Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 13, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The focus is on monetary policy in the fresh week with central bank meetings in the US, UK and Japan as well as Brazil, South Africa, Turkey, Indonesia and Taiwan. Key inflation updates will meanwhile be watched in the UK and Japan, while US data watchers await retail sales, industrial production and housing market releases.

The September Federal Open Market Committee (FOMC) meeting is expected to be when the US Fed will start lowering rates, though uncertainty persists over how much the Fed will lower rates this year. While the latest S&P Global Investment Manager Index survey outlined increased conviction of monetary policy being a supportive driver for equity returns, investors remained mixed with equal proportions of US equity investors seeing the likelihood for just 50 or 75 basis points worth of cuts in 2024. The earliest S&P Global Flash US PMI data showed that prices may well ease to a level consistent with the FOMC's 2% target, and is therefore supportive of the Fed's endeavour to lower rates, though how the Fed guide expectations at the September meeting will be paramount. Meanwhile, higher-than-expected core CPI has pushed the odds of the September meeting closer to just 25 basis points of cuts.

Over in the UK, monetary policy will also be in the spotlight as the Bank of England (BoE) meets. The BoE is in a group of central banks that has already started lowering rates, but will be proceeding cautiously amid still-elevated service sector inflation. While the BoE may resume cutting rates later in the year, they are widely expected to stand pat in September. Reactions towards inflation data, with the latest August numbers in the UK to be updated just ahead of the monetary policy meeting and expected to show easing inflationary pressures in line with PMI price trends, will be important clues for the monetary policy outlook.

Finally, the Bank of Japan (BoJ), which holds a hawkish bias, will also convene with no imminent changes to interest rates expected. Interest rate differentials have nevertheless been a strong engine behind the USD/JPY decline of late and the BoJ's stance will be key here. This is especially as easing inflationary pressures in August, alluded to by the au Jibun Bank Japan PMI prices data, add to uncertainty regarding the urgency of a BoJ hike.

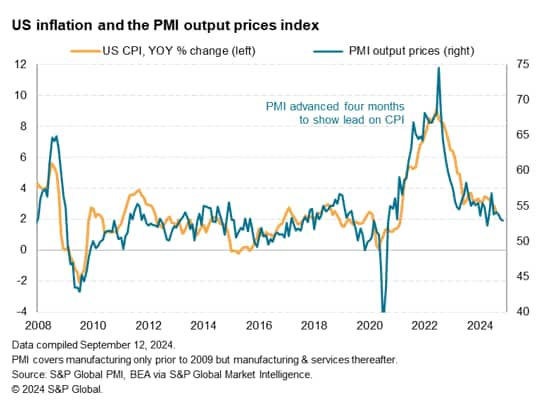

The annual rate of US inflation dropped from 2.9% in July to 2.5% in August, its lowest since February 2021, with a further cooling ahead signalled by the S&P Global PMI.

The softer rate of inflation signalled by the headline consumer price index has followed the trend depicted by the PMI's average selling price index, the latter covering prices charged for both goods and services. This PMI index tends to lead changes in CPI inflation by around four months, and has fallen in August to its second-lowest since June 2020, down to a level historically consistent with inflation running at the Fed's target rate of 2.0%.

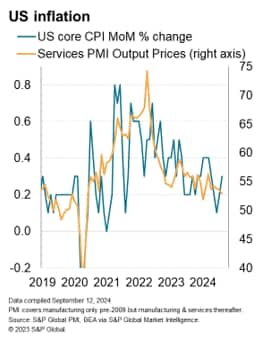

Some of the shine was taken off the good news from the August headline CPI print, as core CPI (excluding food and energy) rose 0.3% on the month, indicating a firming of underlying price pressures and holding the annual rate at 3.2%. However, the services PMI data - which align closely with core price pressures - hint that this core CPI measure should fall back again in the coming months to around 0.2%.

Monday 16 Sep

China (Mainland), Japan, Indonesia, Malaysia, South Korea, Mexico Market Holiday

Italy Inflation (Aug, final)

Eurozone Balance of Trade (Jul)

Italy Balance of Trade (Jul)

United States NY Empire State Manufacturing Index (Sep)

Tuesday 17 Sep

China (Mainland), South Korea, Taiwan Market Holiday

Singapore Non-oil Exports (Aug)

Indonesia Trade (Aug)

Eurozone ZEW Economic Sentiment Index (Sep)

Germany ZEW Economic Sentiment Index (Sep)

Canada Inflation (Aug)

Canada Housing Starts (Aug)

United States Retail Sales (Aug)

United States Industrial Production (Aug)

United States Business Inventories (Jul)

United States NAHB Housing Market Index (Sep)

Wednesday 18 Sep

Hong Kong SAR, South Korea Market Holiday

Japan Trade (Aug)

Japan Machinery Orders (Jul)

United Kingdom Inflation (Aug)

Indonesia BI Interest Rate Decision

South Africa Inflation (Aug)

Eurozone Inflation (Aug, final)

United States Building Permits (Aug, prelim)

United States Housing Starts (Aug, prelim)

United States FOMC Interest Rate Decision

Brazil BCB Interest Rate Decision

Thursday 19 Sep

New Zealand GDP (Q2)

Australia Employment Change (Aug)

Malaysia Trade (Aug)

Norway Norges Bank Interest Rate Decision

Taiwan CBC Interest Rate Decision

Turkey TCMB Interest Rate Decision

United Kingdom BoE Interest Rate Decision

United States Current Account (Q2)

United States Philadelphia Fed Manufacturing Index (Sep)

South Africa SARB Interest Rate Decision

United States Existing Home Sales (Aug)

Friday 20 Sep

Japan CPI (Aug)

China (Mainland) Loan Prime Rate (Sep)

Japan BoJ Interest Rate Decision

United Kingdom Retail Sales (Aug)

Hong Kong SAR Inflation (Aug)

Canada Retail Sales (Jul)

Canada New Housing Price Index (Aug)

Eurozone Consumer Confidence (Sep, flash)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Americas: FOMC and BCB meetings; US retail sales, industrial production, building permits, housing starts data; Canada inflation.

Central bank meetings in the US and Brazil unfold in the fresh week, with the focus on the highly anticipated FOMC meeting in the US. Uncertainty over whether the Fed may lower rates by 25 or 50 basis points (bps) has been widespread, though a higher-than-anticipated core CPI print for August has tilted the dial towards 25 bps. There is some added uncertainty however due to the next Fed meeting coming only after the November 5th Presidential Election. Overall, US equity investors are also mixed regarding whether the Fed will lower rates by 50 or 75 basis points by year-end 2024 according to the latest S&P Global Investment Manager Index survey, and therefore clarity will be sought with the upcoming Fed meeting.

On the data front, we will also see the release of key US activity indicators such as retail sales and industrial production, in addition to building permits and housing starts. Canada releases inflation numbers on Tuesday with early S&P Global Canada PMI data having shown output price inflation intensified in August.

EMEA: BoE, TCMB, SARB meetings; UK, Eurozone inflation data; Germany ZEW index,

The BoE convenes on Thursday with the consensus indicating that the UK central bank may hold off cutting rates further in September before resuming later in the year. This is as service sector inflation remains elevated, though most recent S&P Global UK PMI prices data showed that inflation further lowered in August which we will seek to confirm with official August UK inflation data, released on Wednesday. UK retail sales data will also be published.

Over in the eurozone, final August inflation figures will be released, while the ZEW economic sentiment index for the eurozone and Germany will also be updated.

APAC: BoJ, BI, CBC meetings, China Loan Prime Rate, Japan inflation, trade, New Zealand GDP, Australia employment data

In APAC, central bank meetings take place in Japan, Indonesia and Taiwan, while mainland China's loan prime rates will also be published on Friday. While the BoJ is still mulling a rate hike, Bank Indonesia (BI) is expected to lower rates post the Fed meeting, though neither are likely to shift rates in their September meetings. Inflation data will meanwhile be due from Japan for August. Other key updates include New Zealand Q2 GDP and Australia's August employment report.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.