Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 09, 2021

Week Ahead Economic Preview: Week of 12 July 2021

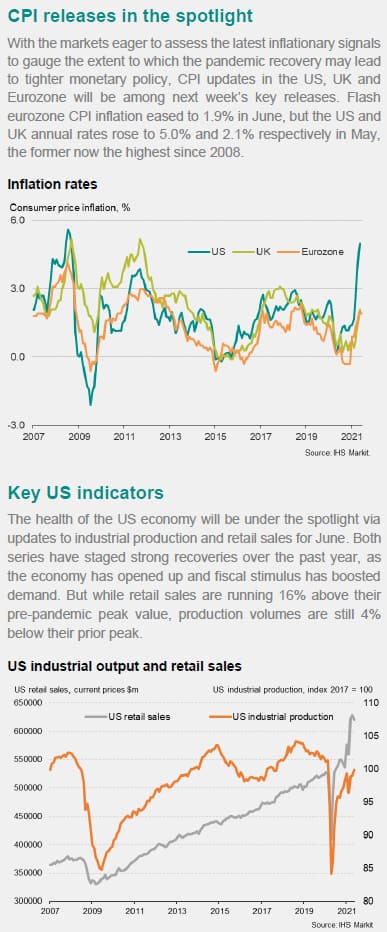

Central bank meetings will be held in Canada, Japan, New Zealand and South Korea in the coming week, which come alongside important inflation updates in the US, UK and the eurozone. We will also see early Q2 GDP readings from China and Singapore, in addition to a barrage of June data releases out of China and the US, notably including retail sales and industrial production.

The week's central bank meetings are expected to bring few surprises, but come at a time of rising uncertainty about renewed COVID-19 lockdowns and the scope for inflation to prove less 'transitory' than might have been anticipated. Although Asia-Pacific central banks such as the RBNZ and BOK have signalled increasing inclinations to raise interest rates in the medium-term, rising COVID-19 cases have led to renewed lockdown measures in many countries and therefore bring a new element of uncertainty to the global outlook. Sharp reductions in PMI survey gauges in many economies, especially in Asia, meant that - although the global economy continued to expand at a strong pace in June - regional divergences have hit record highs and supply shortages have reached unprecedented levels.

News of an ongoing supply shock brings the June inflation data into the spotlight for many economies including the US, the UK and the eurozone.

China's Q2 GDP reading will also be closely scrutinised for the state of expansion in the second quarter, and in particular the extent to which new COVID-19 outbreaks may have subdued growth.

Contact us

PMI commentary: Chris Williamson, Jingyi Pan

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-july-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-july-2021.html&text=Week+Ahead+Economic+Preview%3a+Week+of+12+July+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-july-2021.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 12 July 2021 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-july-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+12+July+2021+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-july-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}