Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 30, 2023

By Chris Rogers

After a strong sales performance for washing machines, dishwashers, ovens and more during the pandemic era, the major home appliance manufacturers have faced a tough 12-month period of slowing sales.

Analysis of S&P Capital IQ data shows the sales of six home appliance manufacturing specialists fell by 15% year over year in fourth quarter 2022. In first quarter 2023, the five firms that have reported so far have disclosed a further dip in sales.

The rapid slowdown in sales appears to have caught manufacturers on the back foot. The average inventory-to-sales ratio for the six firms together was 75% in fourth quarter of 2022, according to S&P Capital IQ data. That was down from a peak of 104% in first quarter of 2022 but was still higher than the average for the fourth quarter over the past decade.

Most do not expect a recovery until later in 2023. There's no clear evidence yet of whether there is a shift to just-in-case inventory strategies.

Cutting costs

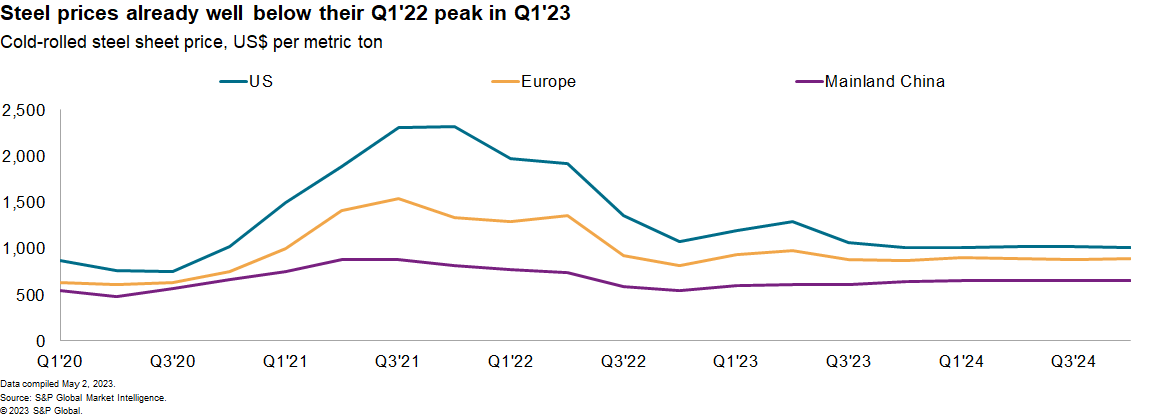

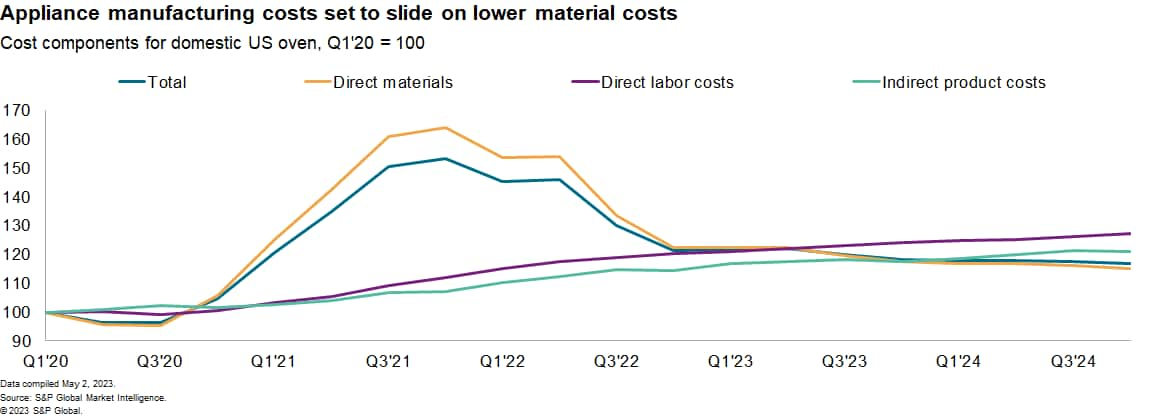

Manufacturers are looking to cut costs by simplifying their products yet cannot escape from volatile commodity markets. Direct materials including steel account for around a quarter of the production cost of domestic ovens, according to S&P Global Market Intelligence estimates. The price of steel has been persistently higher in the US versus markets such as Europe in part due to the impact of tariffs, even though many of the input costs, including electricity, are lower.

The timing of purchases within the supply chain also matters. The drop in the price of steel has already cut production expenses. For example, the cost of producing ovens is already down by 16% in first quarter of 2023 from first quarter of 2022, according to S&P Global Market Intelligence models.

Non-commodity costs are proving stickier. Labor costs have risen by 5% in the past year. Total costs are still expected to be 17% higher in fourth quarter of 2024 than in first quarter of 2020.

To reshore or not to reshore?

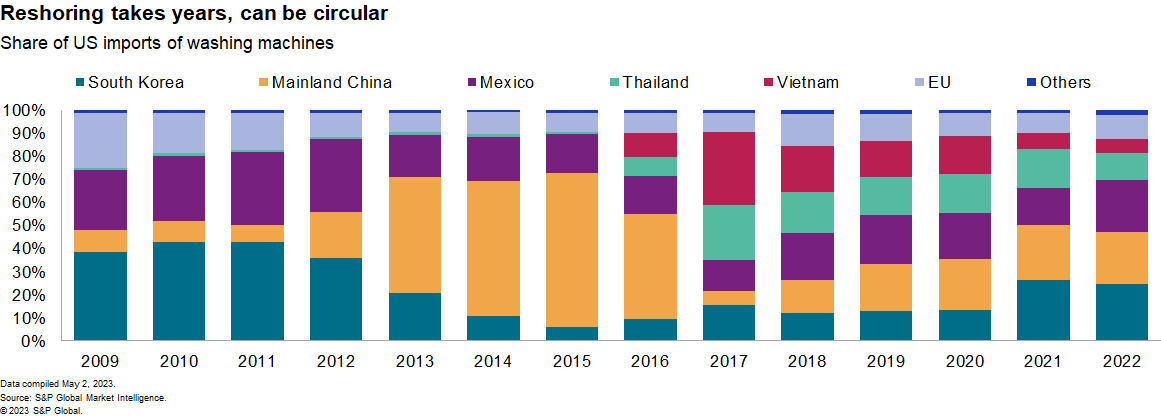

Cost-optimizing strategies for supply chains involve making determinations on the number, scale and location of suppliers. Tariffs have led to a decade-long evolution in US imports of washing machines, such that South Korea, mainland China and Mexico each account for a quarter of imports in 2022.

The shifting US tariffs have not led exporters in the "new" location centers to terminate their operations. Rather they have subsequently moved exports to other target markets while sometimes scaling back operations.

The decision on reshoring production requires a balance of decisions on manufacturing costs, logistics costs and risk considerations. Those considerations shift over time. They can be seen in labor strike risks in Thailand and Vietnam, which have risen based on S&P Global Market Intelligence risk scores. They are still well below Mexico's risk score.

Being close also does not mitigate cargo risks. While not directly comparable, the land cargo risk score for Mexico is well above the ocean risks for Thailand and Vietnam.

Emerging challenge

The widespread use of steel in home appliance manufacturing means that their supply chains are increasingly exposed to environmental regulations such as the European Union's Carbon Border Adjustment Mechanism.

The carbon emissions intensity of the big eight manufacturers varies by over 20% either side of the group average. Firms will have to notify their supply chain emissions from October 2023 even though actual costs will only be incurred later. That gives time to reorient supply chains if necessary.

That may provide a reason to pursue regionalized supply chains for shipments into Asia and the US to be separate for those supplying into Asia and the US separate to Europe.

Want more supply chain content? Sign up for our Supply Chain Essentials newlsetter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.