Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 07, 2025

US economy ends 2024 on a high as output growth accelerates

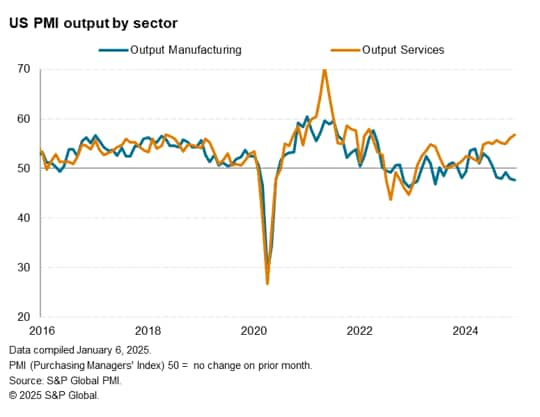

The US economy ended 2024 on a high according to the latest business surveys. Business activity in the vast services economy surged higher in the closing month of 2024 on fuller order books and rising optimism about prospects for the year ahead.

Expectations of faster growth in the new year are based the anticipation of more business-friendly policies from the incoming Trump administration, including favorable tax and regulatory environments alongside protectionism via tariffs.

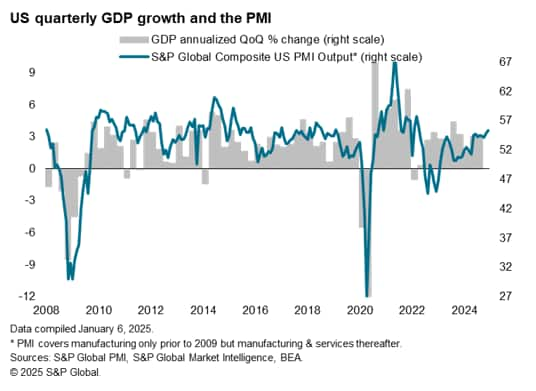

The improved performance of the service sector has more than offset a continued drag on the economy from the manufacturing sector, meaning the survey data point to another robust expansion of the economy in the fourth quarter after the 3.1% GDP growth seen in the third quarter.

The strong service sector PMI reading for December sets the US economy up for a good start to 2025 but, with growth as strong as this, it's understandable that policymakers are taking a more cautious approach to lowering interest rates. However, a key focus in the coming months will be the potential vulnerability of the economy to any major change in the interest rate outlook, especially as financial services activity has been an important engine of growth in late 2024, partly on the anticipation of a further lowering of borrowing costs.

2024 ends on a high

The headline S&P Global Flash US PMI Composite Output Index rose from 54.9 in November to 55.4 in December, coming in below the flash reading of 56.6 but still signaling the fastest expansion of business activity since April 2022.

The PMI has now recorded continual growth since February 2023, with growth kicking higher into the closing months of the year following the Presidential Election.

The solid PMI reading follows news that the US economy grew at a stronger than previously though rate in the third quarter, the annual rate of growth revised up from 2.8% to 3.1%.

Two-speed economy

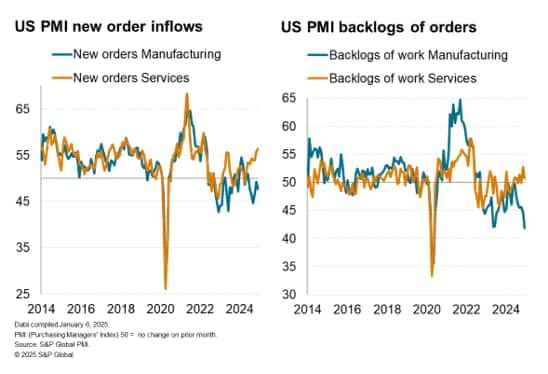

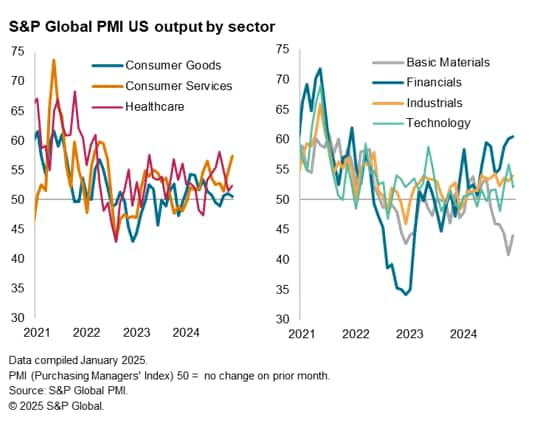

Growth is, however, very uneven. A further jump in service sector activity - which rose in December at a rate not seen since March 2022 - contrasting with a steep fall in manufacturing production. If the pandemic months are excluded, the latest manufacturing downturn was one of the sharpest since the global financial crisis in 2009.

The manufacturing downturn could worsen further, as producers ate into their order book backlogs at a worryingly steep rate by historical standards in December, relying on orders placed in prior months to keep workers busy amid a further reduction in new order inflows.

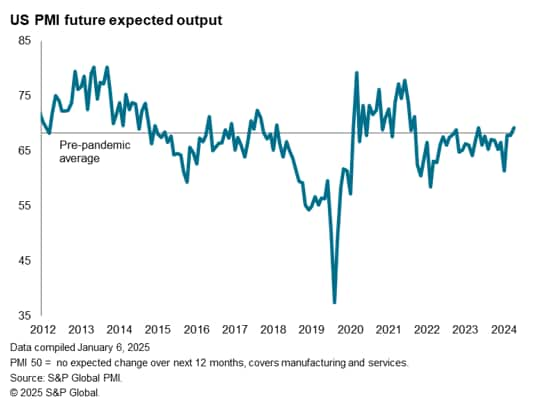

Companies are, however, more upbeat about prospects for the year ahead than they were in the lead up to the Presidential Election. The Republican victory is perceived as heralding a more pro-business environment, especially in relation to regulation and taxation, with an additional spur to US producers from proposed tariffs. Company expectations of output in the year ahead hit the joint highest since May 2022.

However, while sentiment has improved across both manufacturing and services in recent months, the goods-producing sector saw a pull-back in optimism about the year ahead in December amid growing concerns over the potential inflationary impact of tariffs.

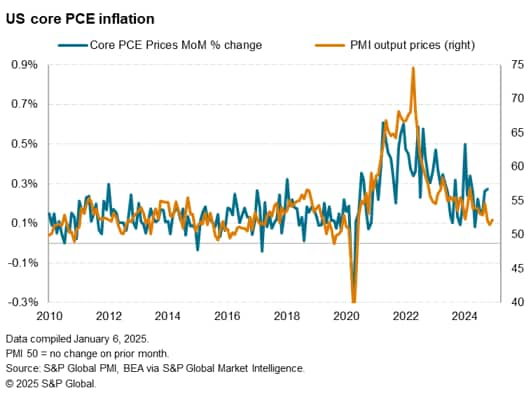

At present, the PMI data indicate subdued price pressures measured overall, consistent with the FOMC's 2% target. However, the December survey showed a marked pick up in average prices paid for raw materials by manufacturers, caused in part by rising imported goods prices.

Looser financial conditions act as a spur to business activity, for now

The possibility of rising inflation is a particular concern given the current drivers of growth of the US economy. A deeper drill-down into the sectoral PMI data showed that the fastest growing part of the US economy in December was again financial services, which have led the expansion in six of the past eight months and headed into the close of 2024 with the fastest rate of growth recorded for three years. The second fastest sector was consumer services.

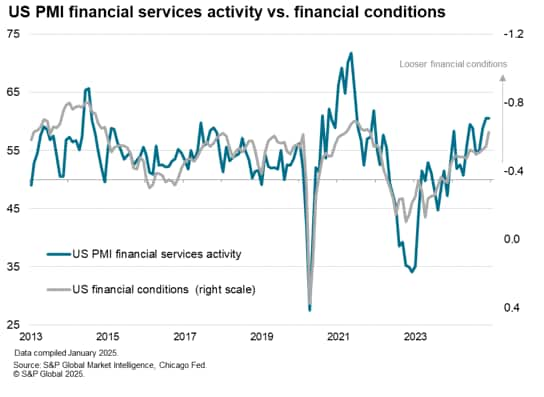

Both financial and consumer services have reported improved output levels partly in response to looser financial conditions. These stronger gains reflect a combination of lower interest rates, rising stock markets and lower consumer inflation rates. The Chicago Fed's index of financial conditions, for example, has signaled a further easing of financial conditions in the closing months of 2024, registering the loosest conditions for just over three years in December. This index has exhibited a close correlation with the S&P Global Financial Services PMI data.

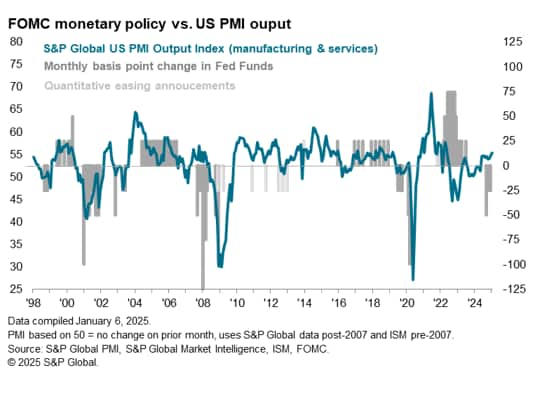

At present, the recent cuts to policy rates by the FOMC have stimulated services activity, but have in fact come at a time when the PMI data suggest that easier monetary conditions were not warranted by the pace of economic growth being signaled. Hence the PMI signal supports the recalibration of expected rate cuts in 2025, down from 100 basis points to the current 50 basis points indicated by the December FOMC meeting projections. If the coming months see some upward pressure on inflation from the imposition of tariffs, the FOMC could be further inclined to tread a cautious path as far as rates are concerned.

Access the latest release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-ends-2024-on-a-high-as-output-growth-accelerates-jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-ends-2024-on-a-high-as-output-growth-accelerates-jan25.html&text=US+economy+ends+2024+on+a+high+as+output+growth+accelerates+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-ends-2024-on-a-high-as-output-growth-accelerates-jan25.html","enabled":true},{"name":"email","url":"?subject=US economy ends 2024 on a high as output growth accelerates | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-ends-2024-on-a-high-as-output-growth-accelerates-jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economy+ends+2024+on+a+high+as+output+growth+accelerates+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-ends-2024-on-a-high-as-output-growth-accelerates-jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}