Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 27, 2022

US economy accelerated prior to Omicron, but renewed weakness apparent

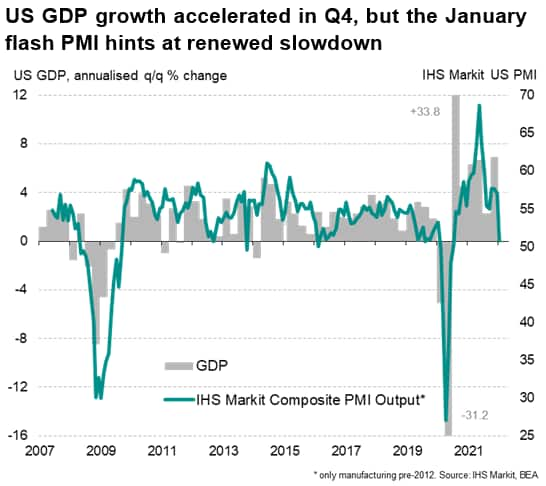

The US economy grew at an impressive pace in the closing quarter of 2021, but a renewed period of weakness is already being signalled at the start of 2022. Growth should pick up again as the Omicron wave fades, but the degree to which growth can accelerate is uncertain given various headwinds to the economy.

Faster GDP growth

US GDP grew in the fourth quarter of 2021 at an annualised rate of 6.9%, up from 2.3% in the third quarter. (That translates into a 1.7% quarter-on-quarter gain after a 0.6% rise in the third quarter). Barring the 33.8% surge seen in the third quarter of 2020 as the economy opened from the initial pandemic lockdowns, this was the fastest rate of expansion since 2000. The strong end to 2021 also closes off the US's best year since 1984 and lifts GDP 3.1% above its level reached just prior to the pandemic.

The upturn was broad-based, with solid expansions of both consumer spending and business investment. Exports and inventories also contributed to the impressive performance.

The expansion was also notable in occurring at a time of persistent COVID-19 concerns and, as the Bureau of Economic Analysis notes, fiscal tightening: "Government assistance payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households all decreased as provisions of several federal programs expired or tapered off."

Renewed weakness

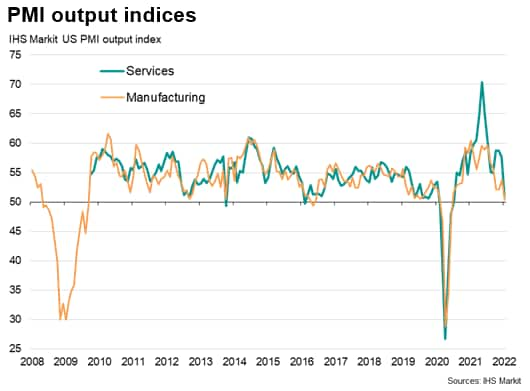

The growth spurt has already faded, however, according to flash PMI survey data from IHS Markit, which slumped lower in January amid the Omicron wave. Sharply rising COVID-19 infections led to a near-stalling of the economy in January according to the survey responses, with rates of expansion close to stagnation in both manufacturing and services.

Early official data on durable goods orders hint at a similar slowdown, with orders down 0.9% in December.

Headwinds

The January weakness of the service sector is of little surprise given record COVID-19 case numbers, but for the same reason is likely to be short-lived. Business activity and consumer spending in the sector should revive as virus case numbers recede in coming weeks.

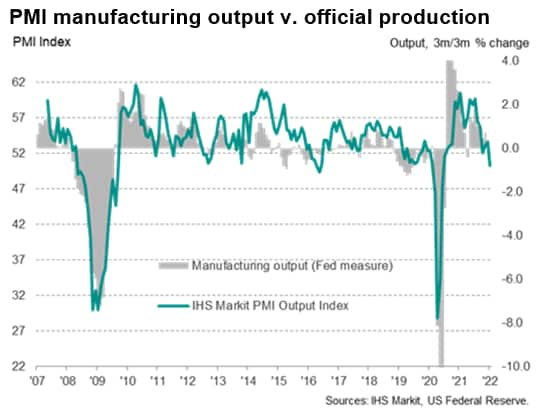

More uncertain is the path of manufacturing, where still-widespread supply shortages and staff availability issues continue to curb production in January, and look set to remain drags for much of the rest of 2022 (see " The Great Supply Chain Disruption: Why it continues in 2022".)

However, coming months could also see additional headwinds, in the form of rising prices and a delayed impact of the tightening of fiscal policy referred to above, as well as rising interest rates. The Federal Reserve is taking an increasingly hawkish stance as to the path of monetary policy tightening for 2022 in the face of a recent surge in inflation, which has accelerated to 7.0%. While signs of policymakers grappling with inflation may help steady nerves about inflation getting out of control, it remains to be seen whether financial markets and personal incomes will be adversely affected. Recent survey data have already indicated than investment professionals have become risk averse in 2022.

PMI data encompassing manufacturing and services activity, the latter covering both consumers and businesses, will shed early light on how the economic growth trend, employment and inflation develops in the face of these headwinds. Click here for more PMI commentary.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-accelerated-prior-to-omicron-but-renewed-weakness-apparent-jan22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-accelerated-prior-to-omicron-but-renewed-weakness-apparent-jan22.html&text=US+economy+accelerated+prior+to+Omicron%2c+but+renewed+weakness+apparent+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-accelerated-prior-to-omicron-but-renewed-weakness-apparent-jan22.html","enabled":true},{"name":"email","url":"?subject=US economy accelerated prior to Omicron, but renewed weakness apparent | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-accelerated-prior-to-omicron-but-renewed-weakness-apparent-jan22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economy+accelerated+prior+to+Omicron%2c+but+renewed+weakness+apparent+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-accelerated-prior-to-omicron-but-renewed-weakness-apparent-jan22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}