Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 16, 2018

Upgrade of Nigerian sovereign risk rating

We have upgraded Nigeria's sovereign credit risk ratings following the first-quarter review round. Our short-term rating has been improved to 20/100 (equivalent to A on the generic scale, Good Quality) from 30/100 (BBB+, Supportive Credit Fundamentals) previously, and our medium-term rating has been improved to 50/100 (BB-, Ongoing Uncertainty) from 55/100 (B+, High Payments Risk) previously. This upgrade cumulatively reflects Nigeria's positive external balances, sustained by higher crude oil export receipts, and strong external liquidity gains thanks to the Central Bank of Nigeria's (CBN) enhanced foreign-exchange policies, as well as revived investors' appetite for Nigerian corporate and sovereign debt. Higher global crude oil prices have supported Nigeria's post-recession economic recovery through the second half of 2017 and early 2018.

External balances in positive territory

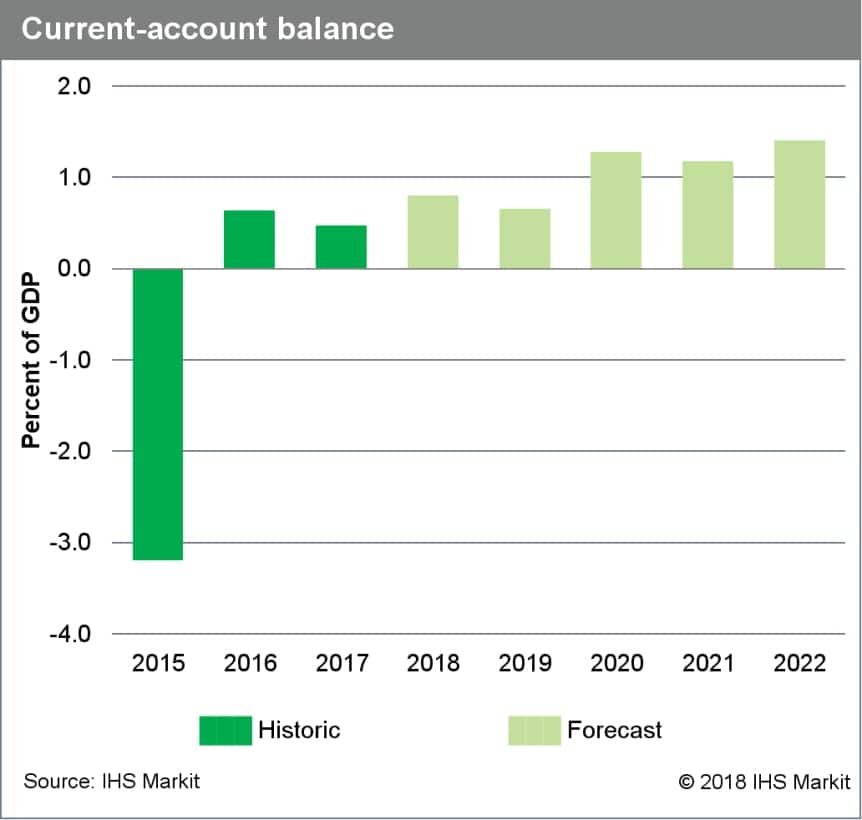

Nigeria's external balances are firmly in positive territory, and we currently expect this trend to continue given prevailing global crude oil prices. The external trade surplus rose in the fourth quarter of 2017 to NGN 1.8 trillion (USD 5 billion), its highest level since swinging away from a deficit of NGN671 billion in the fourth quarter of 2016. Higher crude export receipts, which rose by 9.5% quarter on quarter (q/q) to NGN 3.3 trillion and accounted for 83.2% of total exports, spurred this increase even as oil production fell by 5.9% q/q to 1.9 million barrels per day (b/d) in the fourth quarter of 2017. A decline of 15.1% q/q in the import bill to NGN 2.1 trillion also favored the external trade surplus. Reflecting this, the current account moved deeper into positive territory in 2017. Favorable external balances have considerably eased liquidity pressures according to our assessment of the sovereign's crude external financing requirements, effectively limiting them to external debt service obligations given a marginal short-term external debt burden.

Strong external liquidity gains, foreign-exchange reserves at record highs

Nigeria's gross international reserves are currently at their highest level in four years and stood at USD 47.8 billion as of early May, having broadly risen from a low of around USD 31.75 billion in September 2017. This strong liquidity boost is due to several factors, but especially positive crude oil and gas developments, through recovered production levels plus higher global prices increasing export receipts. Consequently, import cover of foreign reserves has exceeded the equivalent of seven months. We note, however, that this has also been sustained by compressed import demand, as well as the CBN's ongoing management of foreign-exchange demand for selected goods previously imported without strong restrictions on hard-currency access. We expect foreign direct investment to further boost the sovereign's greatly improved external liquidity position.

Sizeable external financial inflows plus surge in capital imports

Nigeria's foreign-exchange liquidity profile has also benefited from sizeable external financial inflows. The government's successful Eurobond issuances on global capital markets totalling USD 2.5 billion in mid-February 2018 closely followed its record 2017 Eurobond streak which yielded USD 4.5 billion. Last year also saw the government's first Diaspora bond secure USD 300 million. Reflecting the resurgent appetite of foreign investors, capital imports rose by 138.7% to USD 12.2 billion in 2017, with portfolio investment (which accounted for 60% of the total) expanding robustly thanks to exceptionally strong growth in money-market instruments. This trend continued in the first quarter of 2018. Although unmet hard-currency demand remains high in the domestic economy, the CBN's foreign-exchange policy enhancements last year were well-received - especially the April 2017 introduction of the special window for investors, exporters, and approved end users to access hard currency for eligible transactions, known as the Nigerian Autonomous Foreign Exchange Fixing (NAFEX) mechanism. Allowing banks to access hard currency via the investors' and exporters' foreign-exchange window in August 2017 triggered a sharper convergence between naira-US dollar exchange rates on the official interbank and parallel markets, and increased confidence in the CBN's policies attracted greater investment inflows.

Outlook and implications

We expect Nigeria's current-account balance to remain in modest surplus generation, largely driven by moderately higher global prices and steady performance in the crude oil and gas sector. The IHS Markit energy team's May 2018 forecast shows the average dated Brent crude oil price as ranging between USD 68 and 77 per barrel in 2018, before a mild decline to USD 65-70 per barrel over 2019-20 based on anticipated global supply and demand drivers. This is comfortably above the government's 2018 draft budget benchmark oil price of USD 45 per barrel, and if attained would bode well for both Nigeria's export receipts and fiscal revenues. Meanwhile, aggregate crude oil production is projected to oscillate around 2 million barrels per day, barring adverse shocks. Security risks in the Niger Delta region still prevail and a new wave of oil and gas output disruptions from attacks on high-profile infrastructure by militant groups remains a viable risk.

Our Stable outlook on both the ratings underscores our view of more broadly balanced risks to Nigeria's sovereign credit profile over the short to medium term, despite prevailing constraints. Macro-financial stabilization has been gradually achieved through remedial policies that have helped to improve foreign-exchange access, attract capital inflows, revive economic growth, temper headline inflation and interest rates, and boost foreign reserves. Nevertheless, risks to macroeconomic stability still linger. Hard-currency shortages and persisting exchange-rate market differentials underscore naira depreciation pressures. Banking-sector weaknesses persist, given operational liquidity constraints, concentrated loan portfolios, and high exposure to the oil and gas sector. Even as external buffers have been strengthened by increased foreign-exchange liquidity, the government has faced criticism for tapping into its Excess Crude Account, bringing it down to USD1.8 billion towards the end of April, from USD 2.3 billion in January. On the fiscal front, budget deficits could widen faster than expected should the government's stimulus agenda be implemented in full force. While Nigeria's external-debt indicators are quite manageable, we note greater recourse to external financing as a medium-term risk if sustained at an accelerated pace.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupgrade-of-nigerian-sovereign-risk-rating.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupgrade-of-nigerian-sovereign-risk-rating.html&text=Upgrade+of+Nigerian+sovereign+risk+rating+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupgrade-of-nigerian-sovereign-risk-rating.html","enabled":true},{"name":"email","url":"?subject=Upgrade of Nigerian sovereign risk rating | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupgrade-of-nigerian-sovereign-risk-rating.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Upgrade+of+Nigerian+sovereign+risk+rating+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupgrade-of-nigerian-sovereign-risk-rating.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}