Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 05, 2018

UK PMI recovers to five-month high in May, but rebound lacks conviction

- 'All-sector' PMI rises to highest so far this year, but Q2 still set to be second-weakest since Q3 2016

- Employment and new work growth rates unchanged, backlogs fall and future expectations slump lower

- Selling price inflation cools despite rising costs

Business activity rose to the greatest extent recorded so far this year in May, though forward-looking indicators suggest growth could deteriorate again in coming months.

Weak new orders inflows, falling backlogs of work, subdued hiring and dampened business expectations for the year ahead all suggest that the recent rebound in activity after snow-related disruptions earlier in the year could prove short-lived.

Selling price inflation meanwhile continued to cool despite faster growth of costs.

Second quarter growth rebound

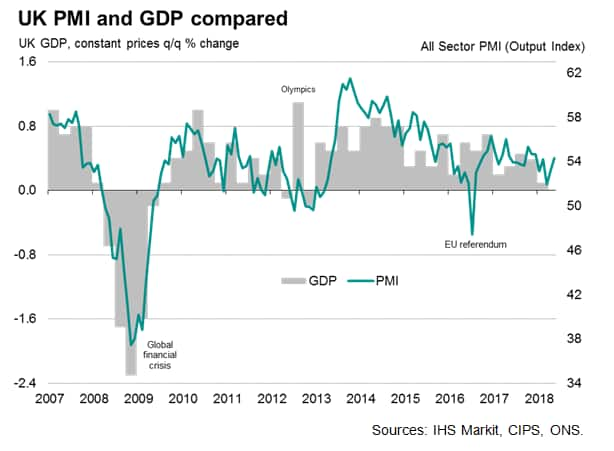

The expansion of business activity signalled by the May IHS Markit/CIPS PMI surveys was the largest since last December. At 54.3, the 'all-sector' output index rose for a second successive month from the weather-related 20-month low seen in March.

At 53.7, the average 'all-sector' PMI reading for the second quarter so far is up from the 53.1 average seen in the first three months of the year, adding to hopes that the economy will rebound from its first quarter soft patch. The average PMI reading for the second quarter so far is historically consistent with GDP rising at a quarterly rate of 0.3-0.4%. However, this would still be the second-weakest quarter since the autumn of 2016. (Note that the PMI had indicated an expansion of 0.3% in the first quarter, hinting that the official GDP estimate of 0.1% may eventually get revised higher).

Weak new order inflows suggest, however, that growth could wane in coming months. New orders grew at an unchanged rate in May, meaning the second quarter is on course for the smallest rise in new business since the third quarter of 2016, when demand slumped in the aftermath of the EU referendum.

Backlogs of orders fell for a second successive month as firms worked through previously received orders. The latest decline in backlogs reflected an especially steep fall in manufacturing.

The drop in unfinished work indicates that existing capacity is more than sufficient to deal with order inflows. Hiring is consequently running at the joint-lowest for 21 months, highlighting the reduced need to build capacity, as well as gloomier expectations of future growth.

Expectations regarding future business activity fell sharply in May, almost entirely reversing April's rise, to run at the second-lowest level since last October.

Manufacturing-led growth

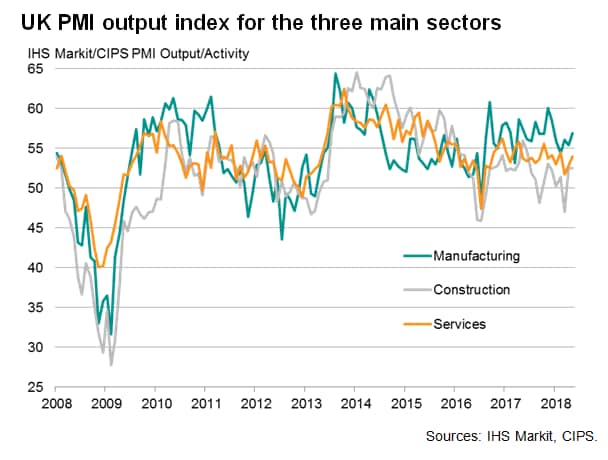

By sector, output growth accelerated in manufacturing and services, but was unchanged in construction. However, while the upturn was once again led by manufacturing, only the service sector saw inflows of new business rise at an increased rate (the fastest for three months). Manufacturing new orders showed the smallest increase for 11 months, while new work in the construction sector fell back into decline.

It was also only the service sector which saw hiring pick up, albeit still only registering the second-weakest jobs gain for 14 months.

All three sectors saw future expectations of growth wane in May.

Selling price inflation cools despite rising costs

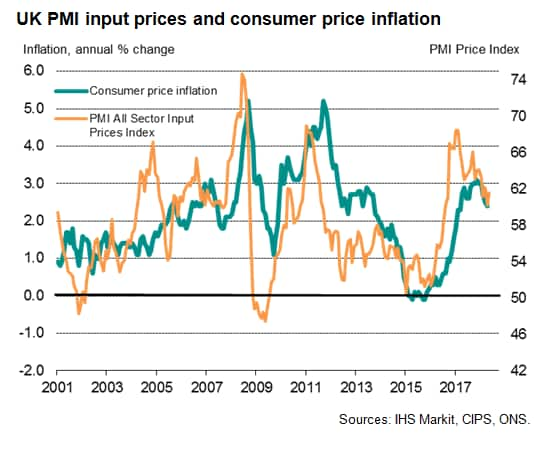

The May surveys meanwhile brought mixed news on prices, with costs rising at an increased rate but average prices charged showing the smallest monthly rise since June of last year.

Input cost inflation accelerated from an already-elevated level in April, linked in part to higher oil prices, though remained below peaks seen at the turn of the year.

In contrast, the rate of inflation of average selling prices for goods and services slowed for a second successive month to an 11-month low, indicating that companies have struggled to pass higher costs on to customers. Many firms reported that weak demand and intense competition limited their pricing power.

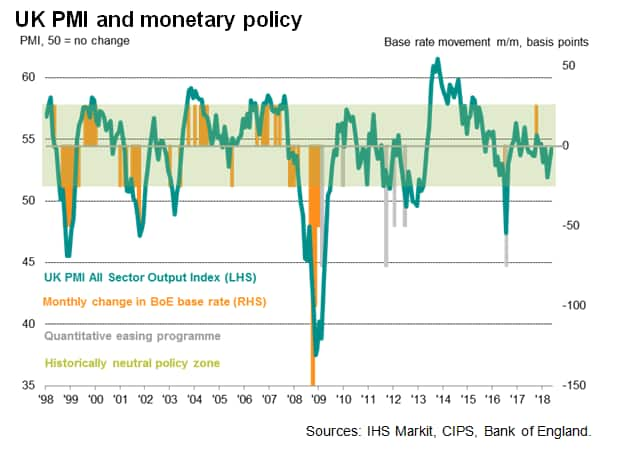

Neutral MPC policy bias, with negative outlook

The rise in May lifts the all-sector PMI out of territory that would normally be associated with a policy easing bias at the Bank of England, but still leaves the surveys significantly below levels that would have in the past encouraged policy makers to hike interest rates. Prior to the last (November) rate hike, which had been the first in a decade, previous interest rates hikes (since 1999) have only occurred when the all-sector PMI has been above 56.5.

Furthermore, with the survey sub-indices pointing to a significant risk of the pace of output growth weakening again in June, it seems likely that the Bank of England's Monetary Policy Committee will err on the side of caution, and await signs of stronger growth and an improved outlook before hiking interest rates, especially with inflation cooling.

However, any MPC members eager to normalise monetary policy may well seize upon the upturn in the PMI as sufficient grounds to tighten policy from the current ultra-accommodative stance.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pmi-recovers-to-fivemonth-high-in-may.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pmi-recovers-to-fivemonth-high-in-may.html&text=UK+PMI+recovers+to+five-month+high+in+May%2c+but+rebound+lacks+conviction+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pmi-recovers-to-fivemonth-high-in-may.html","enabled":true},{"name":"email","url":"?subject=UK PMI recovers to five-month high in May, but rebound lacks conviction | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pmi-recovers-to-fivemonth-high-in-may.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+recovers+to+five-month+high+in+May%2c+but+rebound+lacks+conviction+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pmi-recovers-to-fivemonth-high-in-may.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}