Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 05, 2018

Nikkei Japan PMI data point to cooling growth in May

- Composite PMI eases to 51.7 in May, down from a six-month high in April

- Growth momentum remains resilient

- Charge inflation continues to lag the rise in input costs

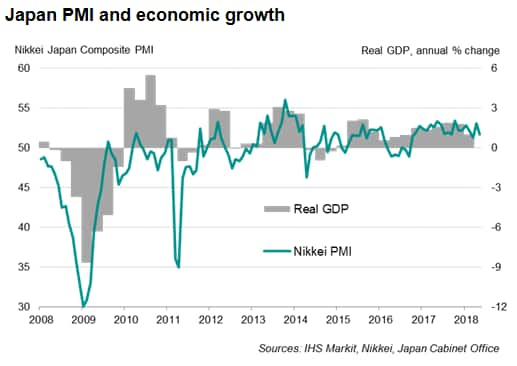

After a solid start to the second quarter, the Japanese economy expanded at a slower rate in May, but nonetheless continued to enjoy a resilient pace of growth. The latest Nikkei PMI added to evidence easing concerns about an economic slowdown after disappointing first quarter GDP figures.

Modest growth in May

The Nikkei Japan Composite PMI™ Output Index fell from a six-month high of 53.1 in April to 51.7 in May, indicating a modest improvement in the level of business activity in the economy.

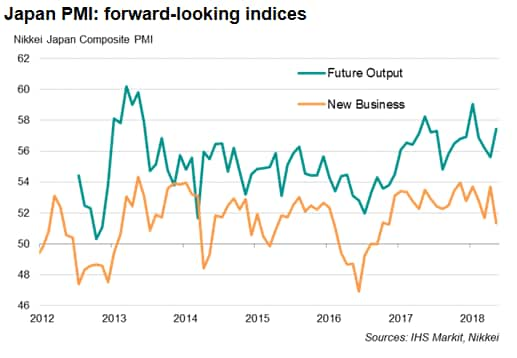

Growth in new business receipts also cooled, which enabled companies to devote more resources to clearing unfinished work. Backlogs of orders across manufacturing and services combined fell for the first time in nearly one-and-a-half years. However, optimism improved, with PMI's gauge of business expectations rising to the highest since January, suggesting further output growth in coming months.

Indeed, the average reading for the composite output index in the second quarter so far (52.4) is slightly above the average in the opening three months of the year, indicating steady growth momentum.

Moreover, the first quarter weakness was possibly exaggerated. The GDP decline stood in contrast with steady expansions indicated by survey data, hinting at an upward revision of the official data later this week (8th June). It is widely expected that growth momentum will improve once the temporary factors - bad weather and higher prices for fresh food and energy - that had weighed on consumption at the start of the year recede.

Outlook

With Japan's economy having expanded for eight consecutive quarters in 2016-2017, some deceleration in economic activity should not come as a surprise. At the present, a very tight labour market and stretched supply chains might limit future growth. Furthermore, an impending sales tax hike and global trade uncertainties are also downside risks to Japanese growth.

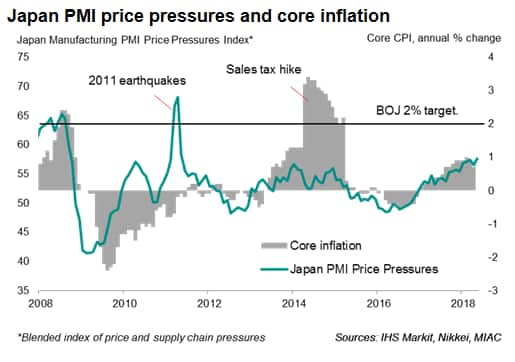

Price pressures

The combined effect of material shortages and input demand pushed cost inflation higher, especially in manufacturing. As global commodity supplies become increasingly tight, vendors struggle to meet demand. May saw delivery times lengthen to the greatest extent since the 2011 earthquakes. Consequently, suppliers raised prices to manage demand.

Overall input cost inflation remained solid, but firms increased selling prices only marginally. In fact, charge inflation was the weakest since July last year, calling into doubt the outlook for reflation.

No hurry for monetary policy changes

Following the removal of the timeline to achieve its inflation target, the Bank of Japan now expects inflation to remain below its 2% goal until FY2020.

While cost pressures are clearly building up in the economy amid higher oil prices and rising wages, firms are quite reluctant to pass on more of the higher costs to customers, thereby frustrating the reflation efforts of the BOJ. As such, the central bank is in no rush to consider tightening monetary policy until the growth recovery takes stronger roots and inflation picks up.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-japan-pmi-data-point-to-cooling-growth-in-may.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-japan-pmi-data-point-to-cooling-growth-in-may.html&text=Nikkei+Japan+PMI+data+point+to+cooling+growth+in+May+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-japan-pmi-data-point-to-cooling-growth-in-may.html","enabled":true},{"name":"email","url":"?subject=Nikkei Japan PMI data point to cooling growth in May | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-japan-pmi-data-point-to-cooling-growth-in-may.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nikkei+Japan+PMI+data+point+to+cooling+growth+in+May+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-japan-pmi-data-point-to-cooling-growth-in-may.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}