Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 05, 2018

Global auto industry accelerates in April

- Global production growth picks up from March's 21-month low

- Input cost inflation eases to the weakest since last July

- Business confidence at lowest since last September

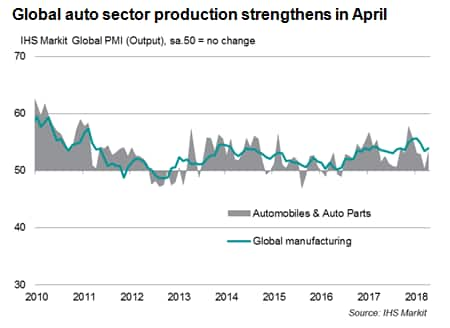

Following marginal growth in March, a solid expansion in output was registered in the global automobile manufacturing sector during April, according to the latest IHS Markit PMI survey data.

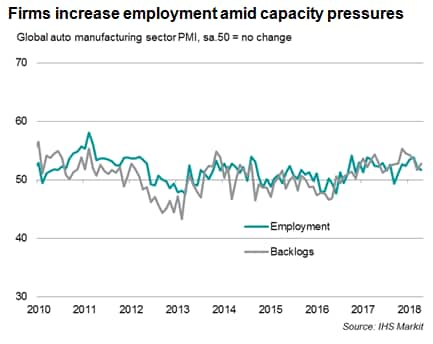

However, despite solid capacity pressures, the rate of employment growth eased to a modest pace, in part reflecting subdued business confidence towards the 12-month outlook in comparison to historical standards.

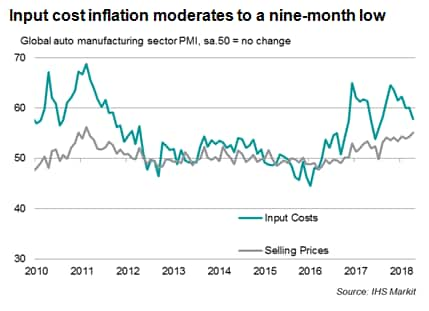

Firms meanwhile felt some respite around rising costs as input price inflation eased to a nine-month low. However, suppliers' delivery times lengthened to the greatest extent since April 2011, suggesting fundamental price pressures remain elevated.

Rising output

The headline IHS Markit Global Automobiles & Auto Parts PMITM rose from March's seven-month low of 51.8 to 53.1 in April. The latest reading indicated the strongest improvement in operating conditions since January. Furthermore, output in the sector has now risen for 22 consecutive months.

Ongoing capacity pressures were again evident as outstanding work (orders not yet completed) accumulated for the twenty-first successive month.

On the downside, the strength of the recent upturn has meant there are signs of bottlenecks present in the global supply chain network. The auto sector PMI Suppliers' Delivery Times Index pointed to the sharpest deterioration in lead times for seven years, as vendors faced delays in delivering raw materials to producers.

Firms continued to expand capacity by raising their staffing levels. However, the rate of recruitment eased for the second month in a row from February's 12-month high.

Cost pressures

Amid a pick-up in oil prices and rising global commodity demand, auto companies continued to face increased costs during April. That said, input price inflation slowed to the weakest in nine months. Average selling prices also rose, in part reflecting efforts to pass costs on to customers to protect profit margins. In a sign of improved pricing power, April saw the strongest growth of selling prices since February 2011.

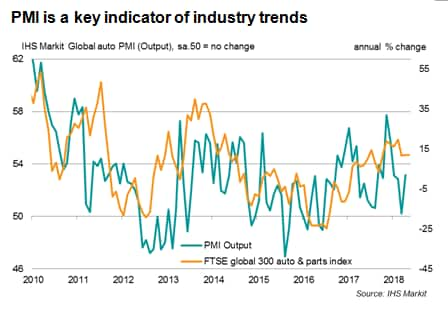

A key threat to the automobile sector is a potential trade war. The probability of this scenario has escalated following the announcement last Thursday that the US will no longer exempt Canada, Mexico and EU from duties on steel and aluminium. Therefore, we need to closely monitor the PMI data, which will provide a clear signal of the underlying trends in the auto industry over the coming months.

May data are scheduled for release on Thursday June 7th.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-auto-industry-accelerates-in-april.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-auto-industry-accelerates-in-april.html&text=Global+auto+industry+accelerates+in+April+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-auto-industry-accelerates-in-april.html","enabled":true},{"name":"email","url":"?subject=Global auto industry accelerates in April | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-auto-industry-accelerates-in-april.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+auto+industry+accelerates+in+April+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-auto-industry-accelerates-in-april.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}