Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 21, 2018

UK business outlook gloomiest since 2009 as Brexit worries mount

- IHS Markit's Global Business Outlook survey reveals marked drop in UK business confidence to lowest since the global financial crisis

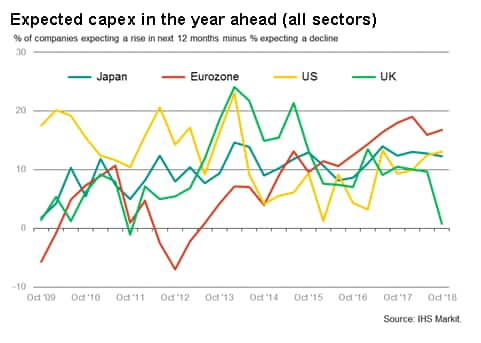

- Business investment intentions lowest since 2009 and weakest of all countries surveyed

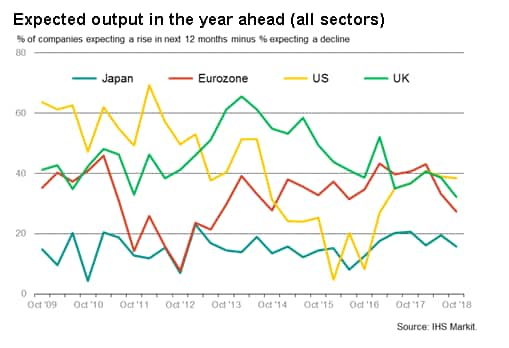

UK business optimism sank to its gloomiest since the height of the global financial crisis, bringing mounting evidence that the economy is struggling under the weight of rising Brexit uncertainty. The disappointing findings, and in particular the weakness of investment intentions, poses downside risks to economic growth in the coming year, especially when viewed alongside a broader global downturn in business optimism.

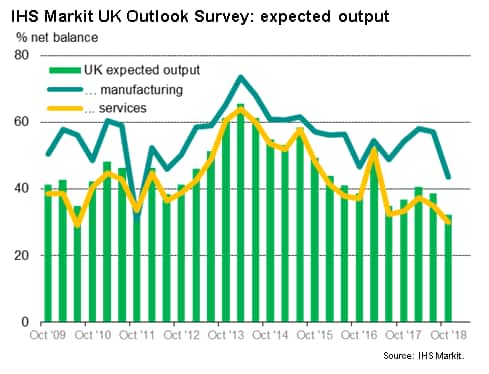

Companies' views on their future business activity levels fell to the lowest since comparable data were first collected in 2009, according to the latest UK Business Outlook Survey from IHS Markit. Profits expectations likewise sank to a new post-crisis low and investment spending plans were the worst of all countries surveyed by a considerable margin.

The UK findings form part of IHS Markit's Global Business Outlook Survey, which painted the gloomiest picture for two years as trade worries and political concerns intensified. Conducted three times per year and based on data collected from 12,000 companies worldwide, this survey asks PMI respondents to report on their plans for the year ahead. Metrics covered include production, capex, hiring and pricing plans, as well as their perceived threats and opportunities in the coming year. Sentiment fell across the board with the exceptions of Brazil and Russia, albeit showing greater resilience in the US. China saw the gloomiest business mood of all countries surveyed.

In the UK, optimism sank to the lowest since early 2009 in manufacturing and its lowest since June 2010 in services.

Weaker fourth quarter and 2019 outlooks

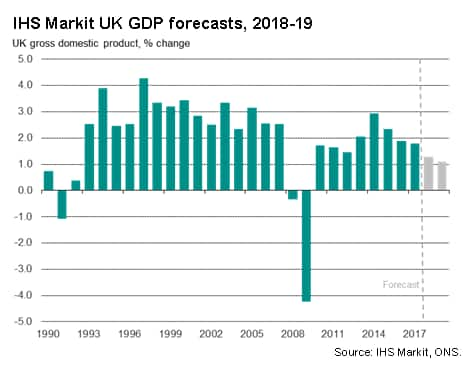

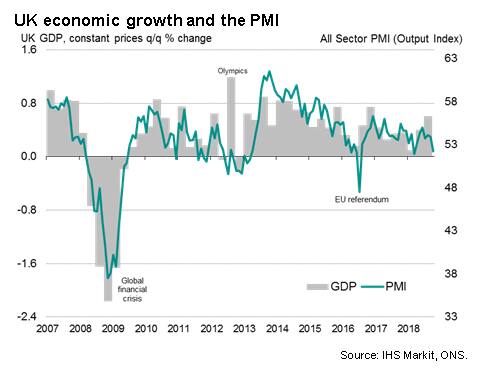

The Outlook Survey represents a natural opinion-based complement to the fact-based PMI surveys, and suggests recent weak UK PMI readings may persist. The latest UK PMI's showed business activity growth already having slowed sharply in October. With the exception of the snow-related disruption seen in March, the increase in output was the weakest since the immediate aftermath of the Brexit vote in July 2016. Historical comparisons with GDP indicate that the October PMI reading is indicative of the economy growing at a quarterly rate of just under 0.2%.

The gloomier sentiment survey also suggests that economic forecast for 2019 may start to get revised lower. While IHS Markit currently forecasts the UK economy to grow 1.1% in 2019, the consensus at the time of writing is for a relatively more upbeat 1.5%.

Investment and hiring hint at risk aversion

One of the most disappointing findings from the survey was a steep drop in planned capital expenditures. The proportion of UK companies expecting to raise their investment spending over the coming year exceeded those expecting a decline by just 1%; the lowest of all countries surveyed. In services, more companies expected to cut investment than expand, albeit only a slim margin. By comparison, no other countries reported negative sentiment about future capex.

Reduced planned capex spending related to both business equipment, plant and machinery, as well as investment on fixed assets, such as buildings. As such, the low investment spending intentions bode ill for future business growth and productivity.

Employment intentions were meanwhile the weakest since the start of 2013, adding to the general picture of cost-cutting amid growing risk aversion.

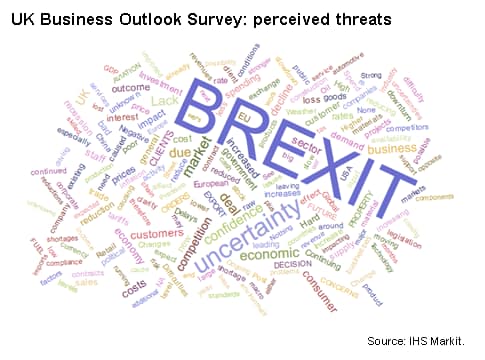

Perceived threats adding to the gloomier outlook included Brexit uncertainty, currency volatility, higher interests rates, a global economic slowdown, trade wars, rising prices, weak consumer spending plus skills and supply shortages.

Further information

Full details of the outlook survey, including historical data for all metrics covered, are available to existing PMI subscribers. For more information contact economics@ihsmarkit.com.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-business-outlook-gloomiest-since-2009-211118.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-business-outlook-gloomiest-since-2009-211118.html&text=UK+business+outlook+gloomiest+since+2009+as+Brexit+worries+mount+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-business-outlook-gloomiest-since-2009-211118.html","enabled":true},{"name":"email","url":"?subject=UK business outlook gloomiest since 2009 as Brexit worries mount | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-business-outlook-gloomiest-since-2009-211118.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+business+outlook+gloomiest+since+2009+as+Brexit+worries+mount+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-business-outlook-gloomiest-since-2009-211118.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}