Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 22, 2018

European PMIs and Monetary Policy

- Timing, high frequency of release and non-revision make PMI data an ideal tool for policymakers

- Relationship between PMI and economic activity provides basis for modelling central bank behaviour

- Logit models based on PMI output and price data offer insight into policy-making process

In this short research paper, we showcase how the Purchasing Managers' Index® (PMI®) datasets can be used to help understand and predict changes in European monetary policy decisions.

Using a similar approach to Gerlach (2017), we create a PMI-based 'logit' model using a simple "Taylor rule" approach to assign probabilities to the range of possible European Central Bank (ECB) and Bank of England (BoE) policy-decisions since 1999. [*] We find that the model performs strongly in anticipating rate decisions and highlights the positive role that PMI data play in rate-setting circles. Our research suggests that PMI readings below 52.0 are generally commensurate with lower policy, while reading above 56.0 are consistent with tighter policy. We also find the ECB is more likely to respond to price pressures than the BoE, whose primary policy focus rests on output growth.

Why use the PMI to support policy?

The ability to understand current economic performance in 'near' real-time is an essential component of the monetary policy decision-making process.

By utilising high frequency, non-revised and quickly-released data on economic performance, confidence in the likely direction of the economy can be built. Policymakers can subsequently optimise changes in key macroeconomic management levers such as interest rates.

The PMI data series, now produced by IHS Markit in over 40 countries, meets all the aforementioned characteristics of a desirable economic indicator.

Derived from a questionnaire sent to fixed panels of carefully selected business executives across both manufacturing and service sector industries, the PMI datasets provide monthly information on a wide variety of metrics such as output, new orders, employment, prices and stocks.

Typically conducted in the middle of the month, results from the surveys are also released quickly following the end of the monthly reference period, with data provided on either the first working day (manufacturing) or third working day (services and composite aggregations of both sectors). [*]

Finally, PMI data are rarely revised. Unlike slowly produced official figures such as GDP, numbers for which are subject to notable future reconsideration, PMI historical values are never restated or revised. This feature of the PMI dataset adds an additional layer of confidence for policymakers when making decisions.

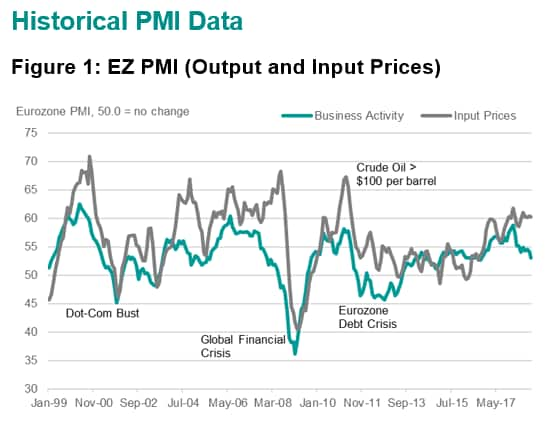

Figure 1 demonstrates how the PMI has captured variations in the euro area business cycle since data were first available in 1999. The bursting of the 'dot-com' bubble saw the PMI drop sharply at the turn of the millennium. The economic upturn that followed ended when Lehman Brothers collapsed, and the sub-prime mortgage crisis ensued. The impact of the eurozone sovereign debt crisis that subsequently escalated is also illustrated by a steep output decline in 2011.

Prices data for the single-currency bloc also highlight the inflationary trends which have been apparent since 1999, particularly between 2008 and 2011, when higher price pressures were driven primarily by the cost of oil.

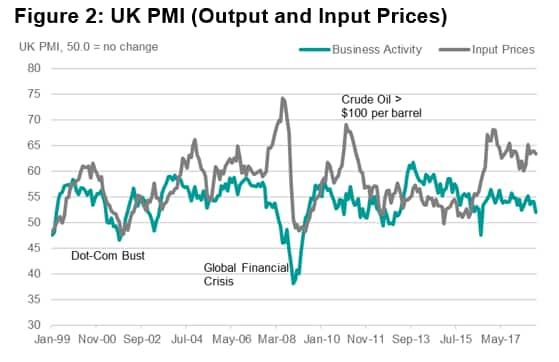

The various economic gyrations over the past two decades are equally apparent in PMI data for the UK, as highlighted by figure 2. Most recently, in the immediate aftermath of the EU referendum in July 2016, the Composite Output PMI dropped to the lowest since 2009, which followed with the Bank of England cutting the base rate in its August meeting. The depreciation of sterling following the Brexit result is also captured by the Input Prices PMI rising steeply throughout late 2016.

PMI Policy Model

We now consider more deeply the question of whether the PMI dataset contains useful information about ECB and BoE rate-setting behaviour by including the data in a simple econometric model.

Our model is based on a multinomial logit specification, which allows probabilities to be assigned to the three central bank policy outcomes of either loosening, tightening or leaving monetary policy unchanged. Note that we treat decisions around "quantitative easing", which came into force following the financial crisis in 2008, as equivalent to an interest rate change.

Based on the assumption that central banks respond to changes in either economic activity or pipeline price developments, we include both the composite PMI output and input price indices as explanatory variables in our models.

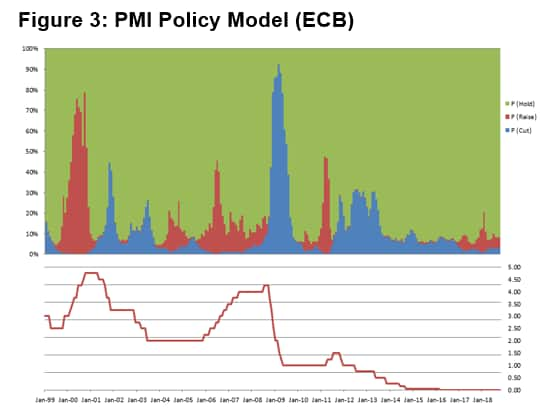

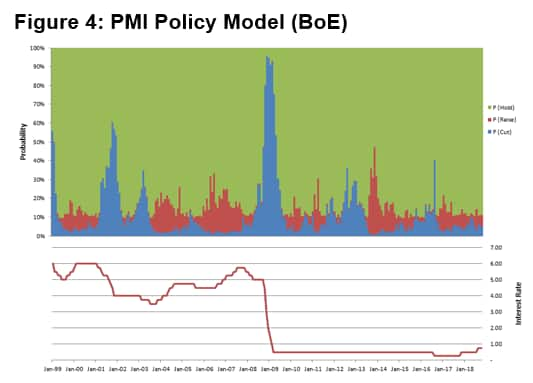

The two figures below show results for both the ECB and BoE since 1999.

For both central banks, the model's implied probabilities of rate decisions have generally coincided with actual rate decisions. Most notably, the rate tightening cycle in the euro area around the turn of the millennium, followed quickly by the loosening in policy during the bursting of the 'dot-com' bubble, is tracked well by the models.

Similarly, during the run-up to the financial crisis, higher probabilities for rate tightening were signalled, before the rapid shift to markedly looser policy after the collapse of Lehman Brothers in September 2008. In the euro area, rate cuts were again the order of the day as the sovereign debt crisis intensified from 2012 onwards.

Indeed, as the PMI Input Prices Index posted levels in the high 60s during the first half of 2011, the model assigned a high probability to the two rate increases that the ECB enacted during this period. The BoE, in contrast, was shown to be much more likely to see through perceived temporary spikes in inflation and hold rates at the then-record low of 0.5%. The BoE appears more driven to loosen policy in response to weak activity data.

PMI Policy Model Results

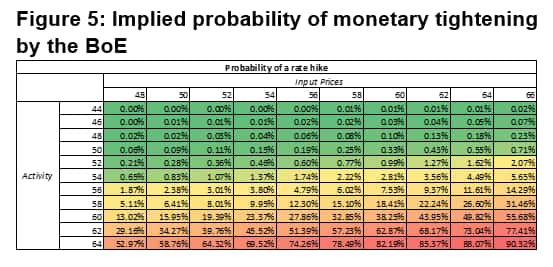

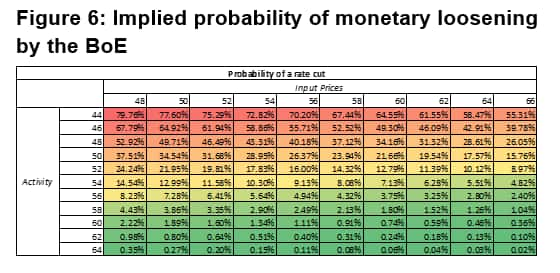

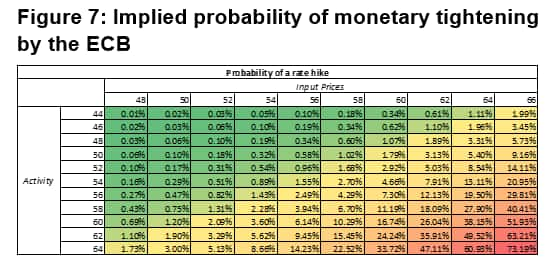

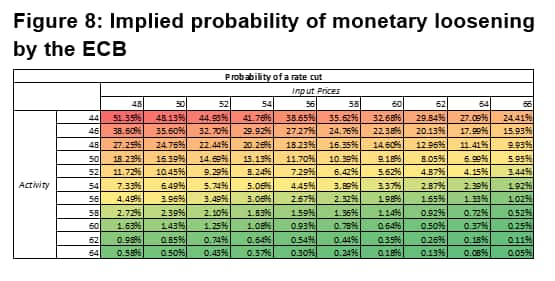

From the model outputs, it is possible to compute a set of matrices detailing implied probabilities of policy changes given values for the composite business activity and input price variables.

If we consider a situation where the UK economy is growing sharply, the implied probability of tightening policy shifts remarkably higher. Holding input prices constant at 58.0 (the long-run average for the UK), a rise in the Output PMI from 60 to 62 induces a 24 percentage point rise in the implied probability of tighter policy to 57% from 33%. Indeed, the largest shifts in the implied probability come when activity growth accelerates. As stronger inflation is generally a lagged response to faster economic expansion, it comes as no surprise that the BoE is likely to be more pro-active when economic momentum picks up.

Similar policymaking behaviour can be seen when the UK economy has entered a downturn. Again, taking the Input Prices PMI at its long-run average (58.0), a faster contraction in activity yields the largest increases in the implied probability. A drop in the Output PMI to 44 from 48 results in the implied probability of additional stimulus rising by around 30 percentage points to 67%.

Overall, the model indicates that economic growth momentum is the key driver behind BoE rate decisions. As can be seen in the above tables, weak activity growth, irrespective of price pressures, is typically associated with high probabilities of stimulus, while the likelihood of tighter policy is greater when economic activity is rising sharply, even when inflationary pressures are weak.

Turning attention to the model results for the ECB, differences from the BoE in monetary policy-setting behaviour are apparent. The model captures the inflation-averse nature of the ECB, which becomes palpable when looking at the extreme variation in the implied probabilities of a rate increase for different values of the Input Prices PMI, holding activity constant.

According to the model, the ECB is four times more likely to tighten policy than the BoE when the Output and Input Prices PMI are at 54 and 66 respectively. Furthermore, when economic activity is expanding sharply (Output PMI at 64) but inflationary pressures are fading (Input Prices PMI at 48), the implied probability of a hike by the ECB is just under 2%, but over 50% in the BoE's case. This further implies the ECB's preference for controlling inflation irrespective of contemporaneous output developments.

For rate-cutting behaviour, some similarities between the ECB and BoE are apparent. Values below 52 for the Output PMI generate the strongest implied probabilities of easing policy. Nonetheless, the inflation-averse bias of the ECB is still clear. Consider a situation where the Output Index is at 48, but the Input Prices Index is at 62. Under such circumstances, the BoE would be more than twice as likely to ease monetary policy than the ECB.

Summary

Our analysis suggests that the probabilities of both ECB and BoE monetary stimulus are generally higher when readings for both the output and input price indices are in the low 50s, with probabilities of looser policy rising sharply as we fall below 50.0 and beyond.

Policy tightening cycles seem more likely to occur when PMI figures hit levels in the mid-to-high 50s. The switchover to rate tightening territory is estimated to be around readings of 56.0. Our results show the BoE is more responsive to changes in economic activity, while the ECB demonstrates a greater reaction to prices.

A "neutral" zone for policy is estimated to exist somewhere between PMI readings of 52.0 and 56.0. Here the probabilities of unchanged policy have tended to be greatest.

PMI data are timely, rarely revised and are closely correlated with underlying economic activity. These features of the PMI datasets subsequently make them an ideal tool for those wishing to understand recent economic developments. This is especially the case in monetary policy circles, given PMI data provide the earliest indication of macroeconomic performance globally.

Based on this observation we subsequently adapted a 'barebones' Taylor rule approach to a simple multinomial logit model to assign probabilities to likely ECB and BoE policy decisions based on the historical relationship between PMI data and actual decisions. Our simple model provides a basic framework for using PMI data in thinking about likely central bank policy movements.

The model could be adapted to include features that cover the extraordinary period following the financial crisis (when central banks were more likely to loosen policy or leave rates unmoved as they hit the zero bound). Economic momentum and the relative position of the economy in the business cycle could also be incorporated. We leave such adaptations for future research.

The results of our analysis are encouraging and provide persuasive evidence that central bankers pay close attention to the monthly PMI results when formulating their policy decisions.

Paul Smith, Economics Director, IHS

Markit

Tel: +44 1491 461 038

Email: paul.smith@ihsmarkit.com

Joseph Hayes, Economist, IHS Markit

Tel: +44 1491 461 006

Email: joseph.hayes@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-pmis-and-monetary-policy-221118.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-pmis-and-monetary-policy-221118.html&text=European+PMIs+and+Monetary+Policy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-pmis-and-monetary-policy-221118.html","enabled":true},{"name":"email","url":"?subject=European PMIs and Monetary Policy | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-pmis-and-monetary-policy-221118.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+PMIs+and+Monetary+Policy+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-pmis-and-monetary-policy-221118.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}