Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 13, 2020

Twenty-six states will raise their minimum wage in 2020

Of the 26 minimum-wage increases across the country in 2020, 18 of them will be due to inflation indexing and cost-of-living adjustments, while the rest are due to legislation. Connecticut, Illinois, Maryland, New Jersey, and New Mexico passed legislation in 2019 to increase their wages in 2020. The other three legislative-increase states—Arkansas, Delaware, and Massachusetts—have been raising their minimum wage in increments as voted upon in previous elections and ballot initiatives.

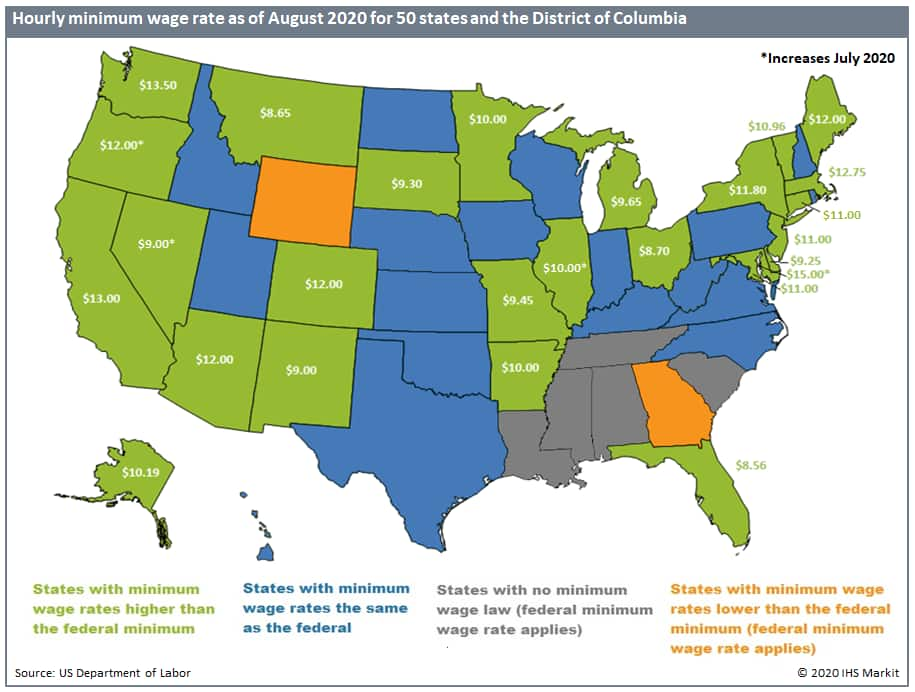

Among the 26 states increasing their minimum wage this year, all did as of 1 January except Illinois, Oregon, the District of Columbia, Nevada, and Connecticut. On 1 January, Illinois increased by $1.00/hour to $9.25/hour and then will increase another $0.75/hour to $10.00/hour in July 2020. In July 2020, Oregon will increase to $12.00/hour from $11.25 in 2019, the District of Columbia will increase by $1.00/hour to $15.00/hour, and Nevada will increase by $0.75/hour to $9.00/hour. In September 2020, Connecticut will increase by $1.00/hour to $12.00/hour. Delaware's minimum wage rate was $8.75/hour for most of 2019 until October, when the wage rate increased to $9.25, where it will remain into 2020.

Among the states making no changes to wages this year, 15 currently have wage rates at the federal minimum of $7.25 an hour. Five others—Alabama, Louisiana, Mississippi, South Carolina, and Tennessee—have no state minimum wage law, and therefore, the federal minimum wage rate applies. In two others, Georgia and Wyoming, the state minimum wage rate is lower than the federal minimum, at $5.15 an hour; thus, the federal minimum wage rate applies to workers there. The remaining states are above the federal minimum and making no changes this year.

By the end of 2020, the highest minimum wage rate will be in the District of Columbia, at $15.00 an hour, followed by the state of Washington, at $13.50 an hour. Seven states will increase wages to $15.00 an hour in the future, as mandated in recent elections. California will be the first, in 2022, followed by Connecticut and Massachusetts in 2023, while Illinois, Maryland, and New Jersey will follow suit in 2024 and beyond.

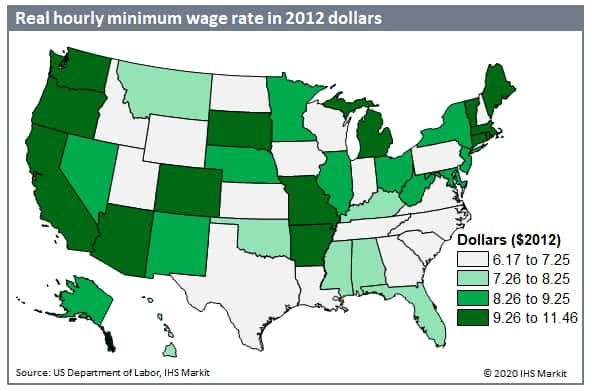

Using the Bureau of Economic Analysis's regional price parity (RPP) index, we can measure a state's minimum wage buying power for 2020 to see how the cost of living in that state compares with the nation. Looking at states' minimum wages in real terms (2012 dollars), the highest minimum wage rate will still be in the District of Columbia ($11.54/hour), followed by Washington ($11.40/hour). Arizona, Maine, and Oregon will round out the top five. There will be 10 states where the minimum wage is $10 or more in real terms, and 34 states will be above the nominal federal minimum of $7.25 an hour. Most of the 21 states that pay the federally mandated minimum wage end up paying less in real terms after RPP adjustments, so the buying power of a salary there is even lower than minimum wage. The exceptions are Mississippi ($7.59/hour), Alabama ($7.51/hour), Kentucky ($7.39/hour), and Oklahoma ($7.32/hour). After cost-of-living adjustments, the minimum wage in these states provides more buying power compared with other states that pay the federal minimum.

Economic impacts of increasing minimum wages

Economic studies ascribe a range of effects (positive and negative) to higher minimum wages. On balance, the impact hinges on whether the benefits of an increase in earnings for a small share of the population is outweighed by a proportional decrease in hours worked and employment in affected sectors. We do know that, for lower-income households, a high proportion of any increase in income will be spent, putting that money back into the local economy through increased consumer spending. Higher minimum wages also increase the cost of labor for businesses that rely on lower-wage workers, such as restaurants, retail stores, and hotels.

Recent research has suggested that higher minimum wages are one of the reasons that lower-wage jobs have seen the strongest wage growth in the past year. On the other hand, the recent tightness of labor markets is also lifting wages. Either way, rising minimum wages are a marker for a state economy with healthy wage growth. An underlying risk, however, is that during another potential economic recession, the inflexibility of a higher minimum wage could exacerbate job losses.

For our forecast going forward, the risk of recession is low and tighter labor markets in states will continue to drive wage growth, potentially for low earners. This would open more room for states, especially those with federal minimum wage rates, to increase their own minimum wages in the future.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftwentysix-states-will-raise-their-minimum-wage-in-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftwentysix-states-will-raise-their-minimum-wage-in-2020.html&text=Twenty-six+states+will+raise+their+minimum+wage+in+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftwentysix-states-will-raise-their-minimum-wage-in-2020.html","enabled":true},{"name":"email","url":"?subject=Twenty-six states will raise their minimum wage in 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftwentysix-states-will-raise-their-minimum-wage-in-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Twenty-six+states+will+raise+their+minimum+wage+in+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftwentysix-states-will-raise-their-minimum-wage-in-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}