Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 27, 2017

The German manufacturing powerhouse must now contend with rising costs

German manufacturing is on quite the run of late but one unintended consequence is rapidly rising costs.

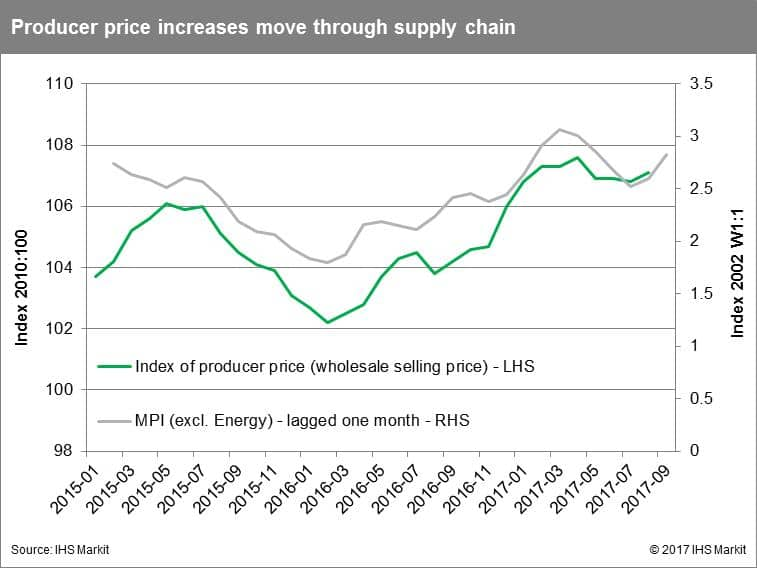

The IHS Markit PMI Manufacturing Flash for September hit a six and a half year high, at 60.6, adding to the strong July reading for Industrial Production which hit 4% y/y, while the Ifo Business Confidence measure was at an all-time high in the same period. However, mixed in with all this general positivity is an area of concern, rising input costs passing rapidly through the supply chain. Indeed, wholesale producer prices increased by 3.2% y/y in August, moving closer to the highs experienced in the first quarter of the year.

Firstly, just what is happening in Germany at the moment that can drive such strong growth at a time of generally modest global expansion?

Germany, clearly, has certain structural advantages. Firstly, being part of a currency bloc which does not appreciate in direct and proportionate response to German export strength, has meant that despite solid growth in output and exports over the last three years, German goods are still competitively priced on a global basis. Secondly, German exports are dominated by the automotive sector, which in turn dominates German output. Indeed, Germany was the world's largest automotive exporter with nearly 22% of the global total in 2016. This dominance has ensured Germany takes advantage of a surge in global demand for autos, with 2016 and 2017 both exceptionally strong.

Alongside these embedded structures, the German economy has benefited from an increasingly strong and active domestic consumption element. Consumer confidence hit a near-16-year high in August, while registered unemployment has been at a post-unification low of 5.7% during May–August. This positivity has contributed to a growth in real consumer spending of around 2.0%, while public consumption growth was an exceptional 3.7% in 2016—partly connected to refugee-related expenses—way above its long-term average of around 1.5%.

One unintended, but significant consequence following such robust growth has been a clear transmission of increased input costs through the supply chain, resulting in growing German producer prices. Indeed, August readings show an increase of 2.6% on an annual basis, with intermediate metal prices gaining 8.6% y/y. Clearly, during a period of sub-par consumption producers will struggle to pass on increased input costs as competition intensifies around protection of market share in a shrinking market. But, with German economic growth strong, producers here are well able to pass cost increases down the supply chain.

So, is this a permanent shift in the German manufacturing environment or a temporary blip for a country enjoying an economic boost when all its stars are aligned?

Our expectations for German economic growth are not as rosy as the current mood may suggest. This year GDP growth will hit 2.3%, before a slip in the growth rate to 2.1% in 2018. Clearly, there are headwinds which will weigh on growth, pulling down export strength and tempering domestic consumption - for what would otherwise be a far stronger showing in the headline figures. As growth rates slip the ability for producers to push cost increases through the supply chain will diminish, pulling back producer price inflation measures.

But, what of input costs – will these continue to rise?

Our expectations are, that commodity prices, in general, are set for a period of decline, with many of the individual commodity price increases seen over the last few months moving beyond levels supported by underlying fundamentals.

Clearly, Germany is benefitting from a number of external factors and the previous slack in the economy is being well utilized as global demand in several areas key to German manufacturing surge. Additionally, the upward shift in domestic consumption, both from the public and private perspective, is boosting internal demand; boosting producer's ability to pass on input cost increases. However, these conditions are unlikely to persist with a number of temporary factors combining to push inflation significantly higher. While the boost these provide may well continue for a number of months, it seems improbable that both the German manufacturing juggernaut can maintain such elevated levels of output for long and that producer price inflation will continue to rise so strongly over the coming months.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-german-manufacturing-powerhouse-must-now-contend-with-rising-costs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-german-manufacturing-powerhouse-must-now-contend-with-rising-costs.html&text=The+German+manufacturing+powerhouse+must+now+contend+with+rising+costs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-german-manufacturing-powerhouse-must-now-contend-with-rising-costs.html","enabled":true},{"name":"email","url":"?subject=The German manufacturing powerhouse must now contend with rising costs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-german-manufacturing-powerhouse-must-now-contend-with-rising-costs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+German+manufacturing+powerhouse+must+now+contend+with+rising+costs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-german-manufacturing-powerhouse-must-now-contend-with-rising-costs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}