Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 18, 2018

Successful use of 'soft data' in nowcast models will depend on choice of data

- IHS Markit PMI surveys point to modest manufacturing output and economic growth in the first quarter

- Equivalent ISM data have overstated growth in recent months, leading to errors in nowcast models

This time last year, elevated levels of 'soft' data such as the ISM and various consumer confidence surveys meant many nowcasting models overestimated US economic growth. Predictions of annualised GDP growth rates of 4% or above were often seen for the second half of 2017. The reality was considerably weaker, with full-year 2017 growth coming in at 2.3%. Models are again at risk of over predicting in 2018, but the choice of model inputs can mitigate the risks. In particular, IHS Markit's PMI data painted a far more accurate picture of the US manufacturing economy in 2017 than the ISM surveys, and are doing so again in 2018.

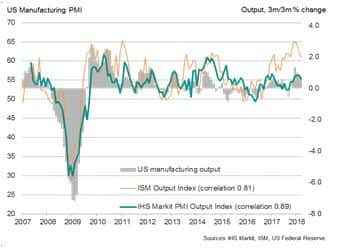

The latest illustration of the strong track record of the IHS Markit data was provided by official manufacturing output data. Federal Reserve statistics showed factory output up just 0.1% in March, leaving output 0.8% higher over the first quarter as a whole. The solid but unspectacular quarterly performance was in line with the signal from the HIS Markit PMI survey's output index, which averaged 55.7 over the first three months of the year; a reading which regression analysis suggests is indicative of a 0.6% quarterly rise in production. In contrast, the 62.5 average reading of the ISM manufacturing output index is indicative of a 1.4% production rise, based on a similar regression analysis.

Charting the official manufacturing production data against the comparable ISM and IHS Markit output indexes clearly highlights the extent to which highly elevated levels of the ISM survey data may be overstating economic growth. In the ISM's own words: "The past relationship between the [ISM's] PMI and the overall economy indicates that the [ISM's] PMI for March (59.3) corresponds to a 4.9% increase in real gross domestic product (GDP) on an annualized basis." Note that the ISM's index in fact averaged 59.7 in the first quarter, so indicating GDP growth in excess of the 4.9% signalled for March alone.

By comparison, IHS Markit's PMI surveys indicate that the economy grew in the first quarter at an annualised rate of approximately 2.5%, or around 1.7% once allowance is made for residual seasonality in the official GDP data. The Cleveland Fed has estimated that first quarter GDP tends to come in around 0.8% weaker than if correctly seasonally adjusted.

US manufacturing output

US manufacturing output excluding autos

Download full article

Chris Williamson, Chief Business Economist, IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsuccessful-use-soft-data-nowcast-models.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsuccessful-use-soft-data-nowcast-models.html&text=Successful+use+of+%27soft+data%27+in+nowcast+models+will+depend+on+choice+of+data+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsuccessful-use-soft-data-nowcast-models.html","enabled":true},{"name":"email","url":"?subject=Successful use of 'soft data' in nowcast models will depend on choice of data | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsuccessful-use-soft-data-nowcast-models.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Successful+use+of+%27soft+data%27+in+nowcast+models+will+depend+on+choice+of+data+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsuccessful-use-soft-data-nowcast-models.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}