Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 12, 2024

By Jingyi Pan

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade further deteriorated midway through the third quarter of 2024.

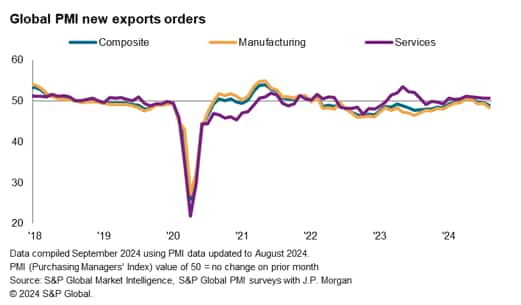

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, posted 48.9 in August, down from 49.6 in July. The latest reading signalled that trade conditions deteriorated for a third successive month and at the fastest pace in eight months.

Excluding improvements in April and May, export orders have fallen continuously since March 2022. While some of the recent trade decline has been linked to disruptions to the supply chains, August data suggest that we are also seeing a deepening of the manufacturing downturn underscored by worsening demand conditions and destocking.

Manufacturing new export orders fell at the fastest pace in the year-to-date in August. In line with the trend in July, where worsening lead times impacted global supply chains and exports, shipping delays were again observed via the Supplier's Delivery Times Index. The pace at which lead times lengthened eased on a global scale in the latest survey period owing to better vendor performance among developed economies, but emerging markets, which are key sources of goods production, broadly indicated that delivery times extended at a more pronounced pace in August. The August PMI data also revealed that renewed destocking by manufacturers affected demand for goods worldwide. Instances in which companies reported lowering their purchasing of inputs increased noticeably, with cost considerations being a key factor. The extension of supply issues, joined by the intensifying of reduction in purchases altogether unpinned the latest downturn in global trade flows.

In contrast, service sector export business further expanded in August, extending the period of expansion that commenced at the start of the year. Moreover, the rate of growth rose for the first time in four months, albeit only slightly.

More detailed sector PMI data further outlined a widening sectoral divergence, with the top four sectors that led the expansion in export business all being service sectors. They are namely the transport, industrial services, non-bank ('other') financials and software services. In contrast, manufacturing sectors mainly ranked towards the bottom, though the worst performers in August also included a services sector - real estate.

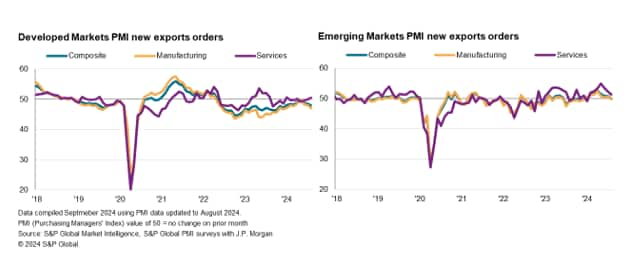

Developed markets continued to lead the downturn in exports in August with the rate of decline accelerating to the fastest since last December. This also extended the period of developed world export contraction that commenced mid-2022. That said, the reduction in exports was limited to the manufacturing sector as service export business rose for the first time since April and at the most pronounced pace in seven months.

Meanwhile emerging markets exports near-stalled in August, falling fractionally for the first time since last December. This was underpinned by a deceleration in services export business growth to the slowest in the current seven-month sequence and a renewed decline in manufacturing exports. The decline in manufacturing exports, the first in the year-to-date, is a notable development given that most manufacturing hubs reside in emerging economies, thereby highlighting that trade conditions have deteriorated at the source.

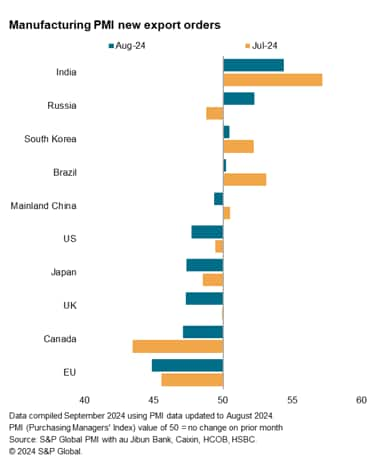

While August's manufacturing PMI data showed that goods trade slowed in both developed and emerging markets, pockets of improvement remained, with four of the top 10 trading economies recording higher goods export orders in August. India retained the lead, but recorded a slower rate of growth in line with the wider manufacturing sector picture for India. Growth in goods export orders was also observed in Russia, South Korea and Brazil, with the latter two seeing only marginal increases in goods orders from abroad.

On the other hand, the EU and Canada remained the worst performers among the top 10 trading economies, with the rates of export decline being especially sharp for the EU. The US, UK and Japan meanwhile recorded more pronounced, though still modest rates of reduction in goods export orders in August.

Finally, mainland China's goods exports fell for the first time in 2024, marking a turn in manufacturing conditions more generally going into the second half of the year. Hopes persist that easing interest rates, especially in developed markets, may help to spur global goods trade into the end of 2024, though questions remain over how much interest rates may be lowered. The extent to which demand in the manufacturing sector can be stimulated by these projected monetary policy moves will be studied closely in upcoming PMI data.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.