Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 28, 2024

By Chris Rogers

Learn more about our Supply Chain Console

This report is jointly produced with John Abbott, Principal Research Analyst — Applied Infrastructure & DevOps for 451 Research, a part S&P Global Market Intelligence.

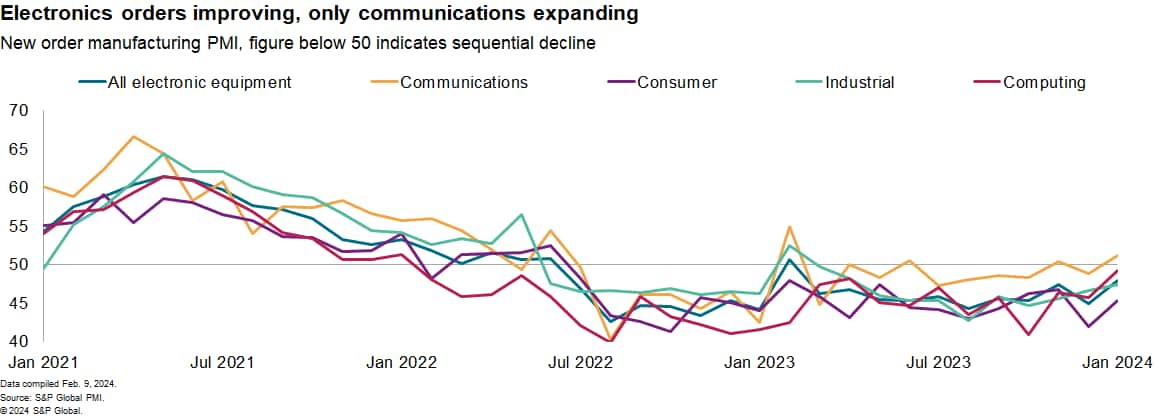

From a top-down perspective, the demand for semiconductors appears weak with electronic equipment manufacturing being in the doldrums. The S&P Global manufacturing Purchasing Managers' Index shows new orders have been in decline for 18 of the past 19 months.

We see some signs of recovery, with the rate of decline falling while new orders for communications equipment are now increasing. That's still a long way from the rate of expansion experienced during the boom in 2021. There are also signs of recovery in exports of semiconductors from leading manufacturing centers in Taiwan and South Korea.

Artificial intelligence moves from learning to inferring

The demand for generative AI has provided a welcome boost to silicon, systems and cloud vendors at a time when sales of generic compute infrastructure has stalled. This market is still early in its development cycle.

The huge demand for GPUs has largely been driven by a small group of forward-looking companies setting up their own foundational platforms, plus a rush of mainland Chinese players buying as many advanced GPUs as they can before further export restrictions come into force. This rush is likely to be followed by something of a lull before most commercial companies are ready to use the models at scale in real, revenue-generating application software. The timing of this depends on the usual sequence of development, testing and previewing before general availability can be achieved.

Training at large scale is the most urgent requirement today, but over time, inference is by far the larger market opportunity, so some of the giant training clusters being set up today will likely be repurposed for inference as that demand picks up — potentially slowing overall infrastructure sales as the glut is digested.

Hyperscalers lead spending boom

Hyperscalers use GPUs in two ways: internally, to pre-train their own large-scale foundation models that their customers can utilize; and outward-facing, for customers to run their own AI models and codes using GPU-powered instances. Increasingly, they are developing their own custom silicon accelerators as a supplement or alternative to GPUs.

Unless performance and efficiency can be exponentially improved, the projected growth in datacenter capacity over the next decade will not be achievable. Such a shift represents a major disruption to the semiconductor industry.

The capital expenditures of four of the hyperscalers which publish relevant data reached $30.8 billion in the fourth quarter of 2023, up by 15% year over year and by 95% compared with the same period of 2019.

Consumer and industrial cycle recovering, slowly

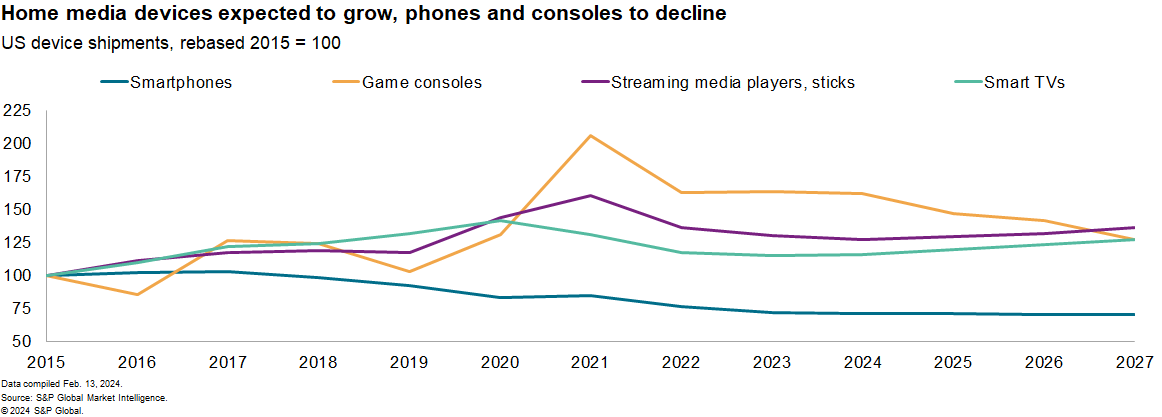

Shipments of consumer devices have pushed the semiconductor sector through a boom-and-bust cycle over the past five years. Over the longer term, the global market for consumer technology and associated platforms is directly tied to the rollout of next-generation connectivity, via fiber and 5G, whose growing maturity in 2024 will further accelerate market development.

New products and applications, many AI-driven and reliant on system-on-chip technology that accelerates AI through an integrated combination of CPU, GPU and neural processing unit (NPU) will continue to emerge. Many PC makers are relying on "AI PCs" being launched later in 2024 to provide a boost to demand.

In the near term, our forecasts show North American shipments of smartphones have been in a steady downturn since 2016, with no recovery expected through 2027. Shipments of home media devices, including videogame consoles, TVs and streaming media jumped by 16% in 2020 and 10% in 2021 before slumping by 17% in 2022 and 2023 combined. Games consoles shipments are expected to decline while stream media and smart TVs are only forecast to grow by 1% to 3% in the next four years.

AI use cases are likely to become a key driver for sales of infrastructure that sits outside of centralized public clouds and datacenters, close to end users, connected machines and sensors. The global mobility industry is experiencing an industry-changing digital transformation — for instance the on and off-car infrastructure required to support the connected car vision, potentially leading to autonomous operation.

These rely heavily on intelligent edge infrastructure deployed, managed and owned by a mix of original equipment makers, industry suppliers, hyperscalers, datacenter providers and 5G service providers. The continuing supply of less-than-leading-edge "legacy" semiconductors and very low power chips with additional embedded intelligence is a vital part of this vision.

Repurposed consumer chips and emerging architectures - RISC-V cores, software-IP and chiplets — must be more rapidly adopted by current embedded processing and microcontroller chip specialists that haven't always been at the forefront of technical innovation.

There's no getting away from the challenge that the industry may have a bright long-term future but has dim immediate prospects. That can be seen tangibly in the middle of the technology supply chain with exports of parts of semiconductors where a recovery has yet to get under way. Trade data for semiconductor components will be a key measure to follow in tracing the recovery of real chip demand.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.