Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 06, 2018

Stalling of eurozone productivity stretches to August

- Output per head falls marginally for fifth successive month

- Subdued labour performance in manufacturing offsets growth in services

- Efficiency gains evident in France, losses noted in Germany and Italy

- Italian goods producers note steepest drop in productivity since December 2011

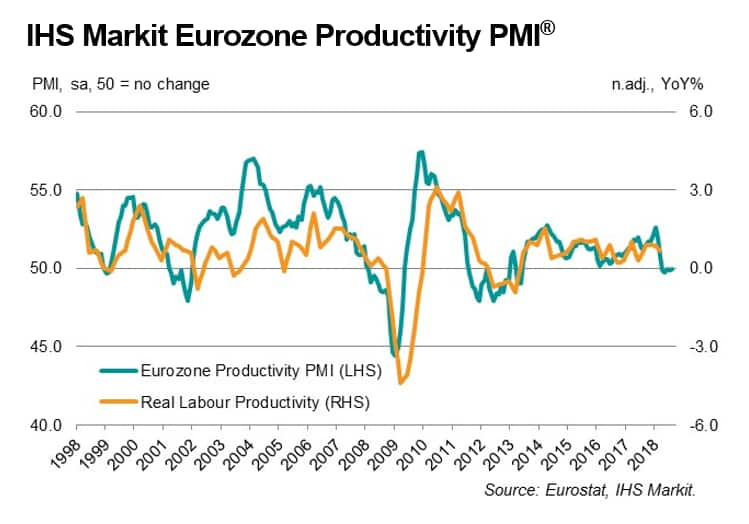

Workforce efficiency in the euro area worsened marginally for the fifth month running in August, as ongoing falls in output per head in the manufacturing industry continued to offset growth in services. Trends varied on a national basis, with productivity in Italy dipping back into contraction and France displaying a renewed upturn. In Germany, the latest decline was the sixth in as many months.

The seasonally adjusted Eurozone Productivity PMI® was little-changed from July's reading of 49.8, at 49.9 in August. This signalled a fifth successive month of efficiency losses, though one that was fractional overall. Manufacturing remained the key source of weakness, registering a sixth straight deterioration in output per head. However, the contraction was only slight and eased from July. Service providers recorded a quicker upturn, but the increase was marginal.

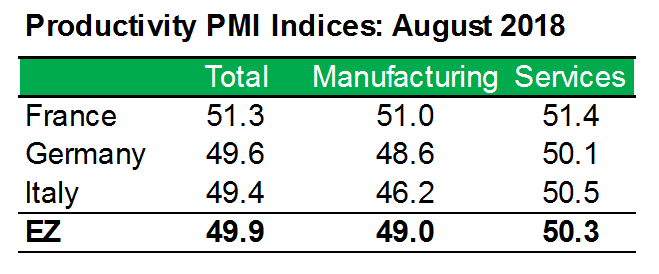

Diverging trends at the national level remained a key theme, with a return to growth of productivity in France contrasting with a renewed decrease in Italy. As has been the case since March, Germany registered a contraction in output per head midway through the third quarter.

The fall in German productivity was slower than in Italy - matching the pace seen in July - and marginal overall. Once again, employment growth outstripped output expansion. A fractional uptick was noted in the service sector, while manufacturers posted reduction for the sixth straight month.

France recorded a broad expansion in productivity, as robust job creation was matched by a strong rise in private sector output. Gains were evident in the manufacturing and service segments. In the latter, the upturn was the fastest since May, albeit mild in the context of historical survey data. The pace of increase among goods producers hit a six-month high, though was also below its long-run average.

Having expanded in each of the previous two months, output per head in Italy decreased in August. The service economy recorded a marginal improvement in workforce efficiency, one that was the slowest in the current three-month sequence of gains. Conversely, goods producers posted a marked fall in productivity, with the downturn the fastest in over six-and-a-half years. Underlying PMI data showed a moderate increase in manufacturing jobs, but a decline in production.

Pollyanna De Lima, Principal Economist, IHS

Markit

Tel: +44-1491-461-075

pollyanna.delima@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstalling-of-eurozone-productivity-stretches-to-august-060918.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstalling-of-eurozone-productivity-stretches-to-august-060918.html&text=Stalling+of+eurozone+productivity+stretches+to+August+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstalling-of-eurozone-productivity-stretches-to-august-060918.html","enabled":true},{"name":"email","url":"?subject=Stalling of eurozone productivity stretches to August | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstalling-of-eurozone-productivity-stretches-to-august-060918.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Stalling+of+eurozone+productivity+stretches+to+August+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstalling-of-eurozone-productivity-stretches-to-august-060918.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}