Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 06, 2018

Nikkei Japan PMI signals steady expansion in August, but costs still elevated

- Composite PMI New Orders Index hits four-month high

- Export trend remains weak

- Input price inflation still elevated

Nikkei PMI data indicated that the Japanese economy continued to expand in August, extending the current stretch of growth to nearly two years and the longest in the survey history. However, the upturn remained marred by sharp cost increases.

Steady third quarter growth

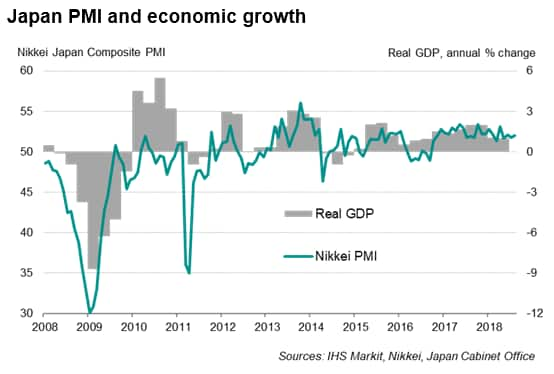

The Nikkei Japan Composite PMI™ Output Index rose slightly from 51.8 in July to 52.0 in August. The average reading for the third quarter so far signals a steady rate of growth of business activity in the economy, commensurate with annual GDP growth of approximately 1%.

Encouraging signs of strengthening client demand were also seen during the month. New business intakes grew at the fastest rate in four months and above the average seen over the first half of the year, easing concerns of weakening demand after a disappointingly soft reading in July.

Sector-wise, the manufacturing economy continued to lead the upturn in business activity, although the expansion of the goods-producing sector appeared to be increasingly driven by domestic markets, with export sales falling over the month.

Export weakness

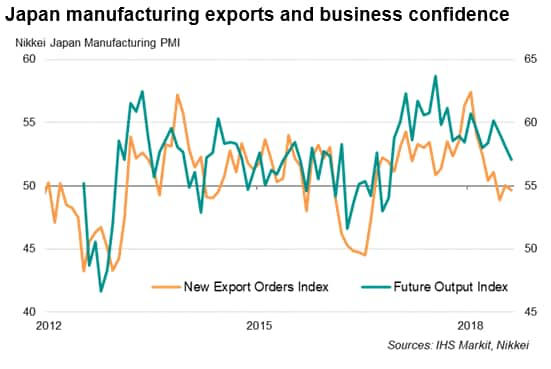

Following a solid start to the year, export growth has faltered dramatically in recent months. There has been no increase in export orders reported in the past three months, partly reflective of weaker global trade conditions, meaning the recent export trend is the worst recorded by the PMI for two years.

Overall expectations towards factory production in the year ahead were the lowest since the fourth quarter of 2016, with anecdotal evidence suggesting that growing trade frictions had weighed on overseas sales.

In addition to trade tensions, an ongoing shortage of inputs, such as electronic components and metals, were often reported to have disrupted manufacturing operations. Delivery times again lengthened markedly in August.

Elevated cost pressures

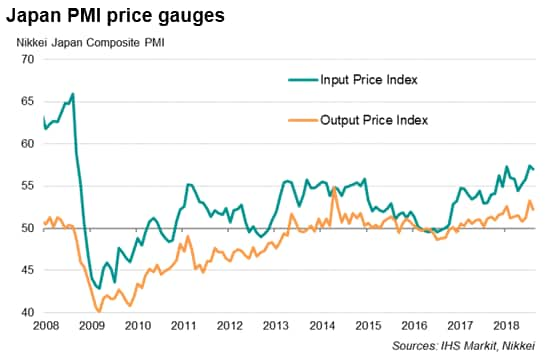

The survey also highlighted how Japanese firms continued to face steep cost pressures midway through the third quarter. August data showed the rate of increase of input costs remaining well above the historical average and among the highest seen for a decade. Increased prices for steel, electronic components, plastics, chemicals and oil were widely cited. While firms managed to pass on some of the costs to customers, the much slower comparative rise in output prices suggest there is still notable pressure on profit margins.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Bernard Aw, Principal Economist, IHS

Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-japan-pmi-signals-steady-expansion-in-august-but-costs-still-elevated.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-japan-pmi-signals-steady-expansion-in-august-but-costs-still-elevated.html&text=Nikkei+Japan+PMI+signals+steady+expansion+in+August%2c+but+costs+still+elevated+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-japan-pmi-signals-steady-expansion-in-august-but-costs-still-elevated.html","enabled":true},{"name":"email","url":"?subject=Nikkei Japan PMI signals steady expansion in August, but costs still elevated | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-japan-pmi-signals-steady-expansion-in-august-but-costs-still-elevated.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nikkei+Japan+PMI+signals+steady+expansion+in+August%2c+but+costs+still+elevated+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-japan-pmi-signals-steady-expansion-in-august-but-costs-still-elevated.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}