Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ARTICLES & REPORTS — Apr 22, 2024

By Pedro Choi and Stella Lim

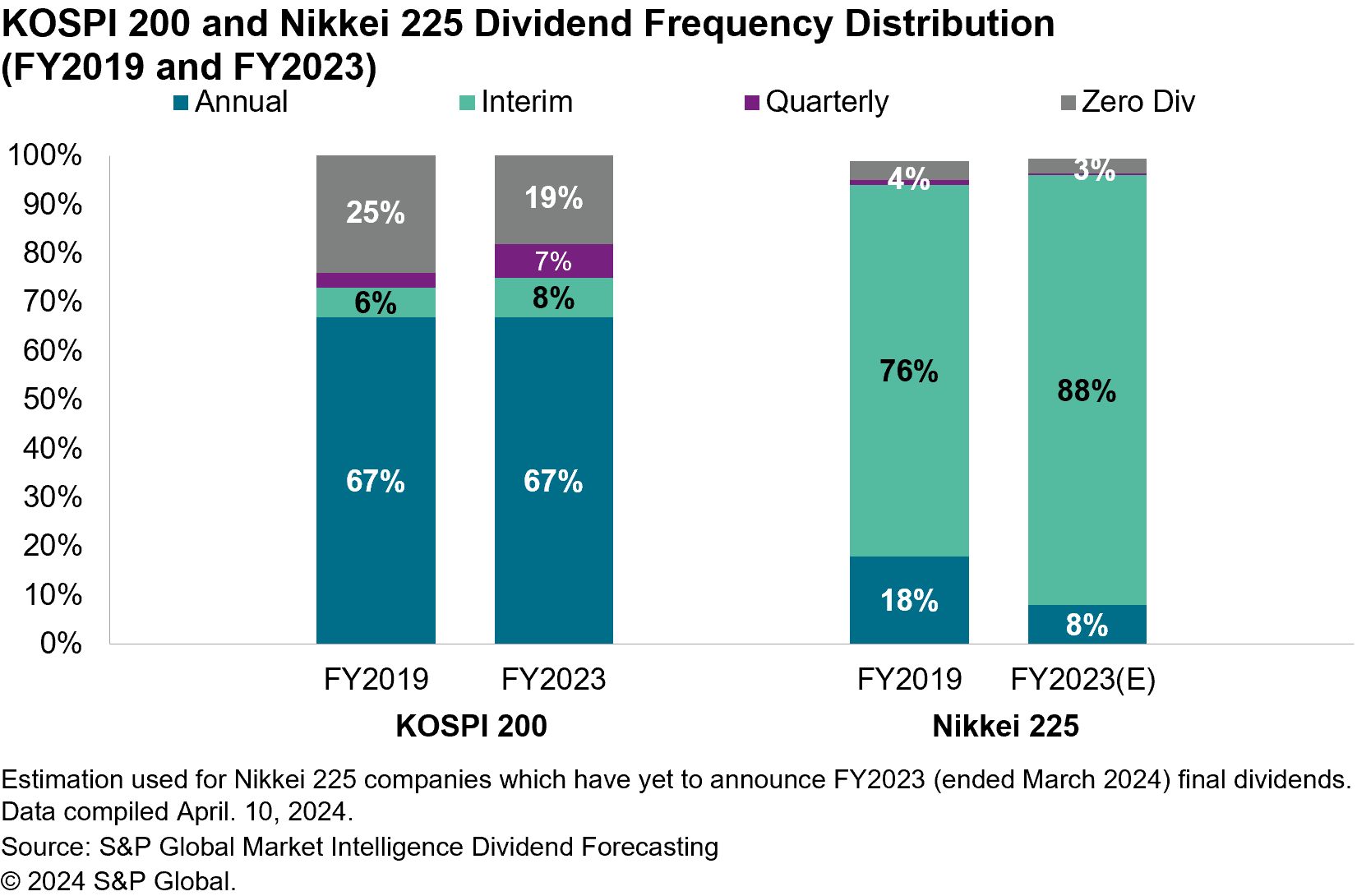

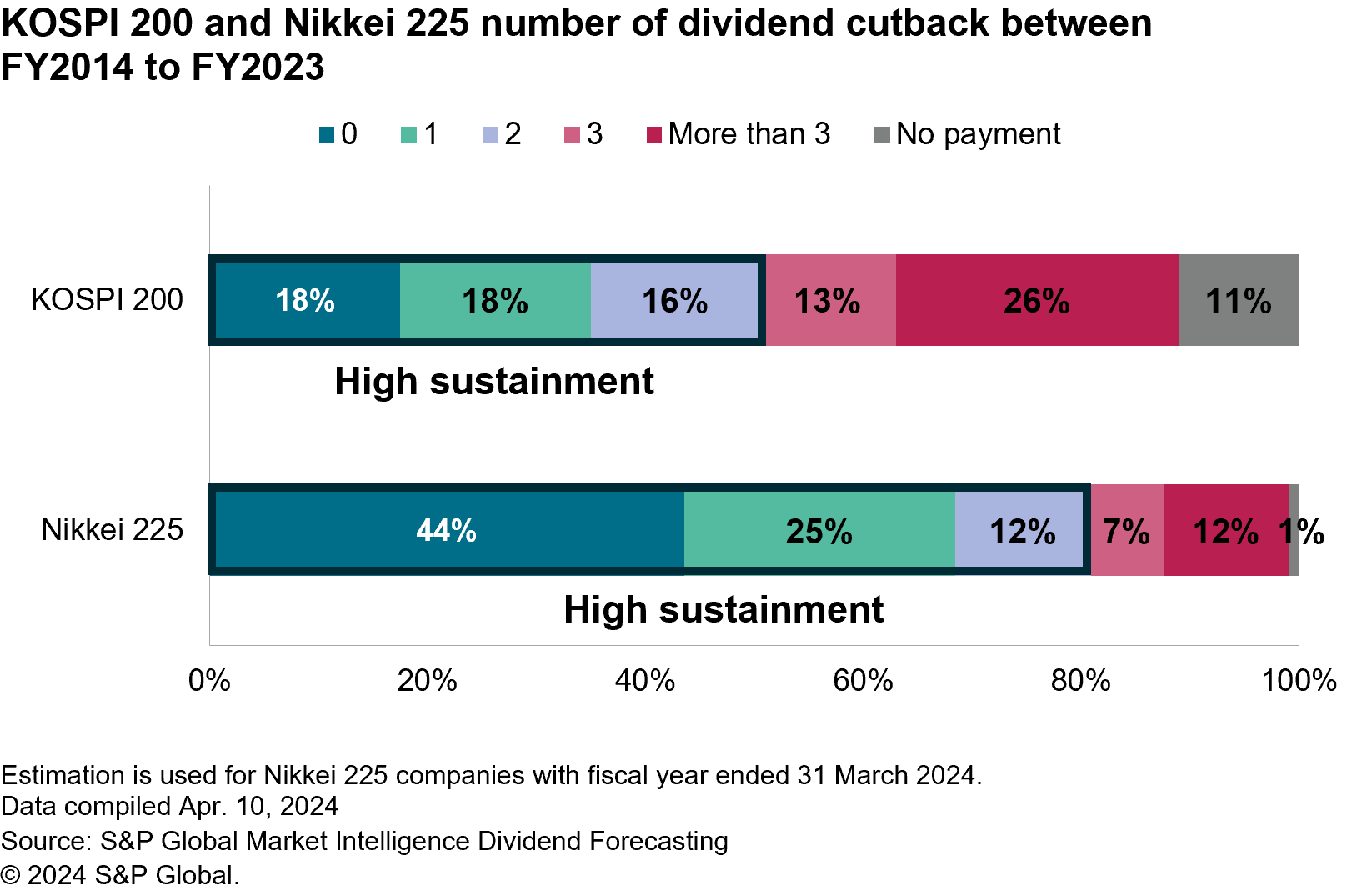

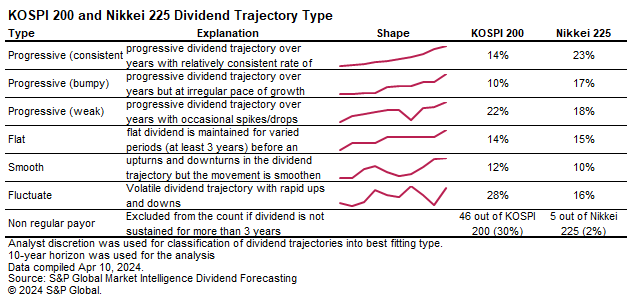

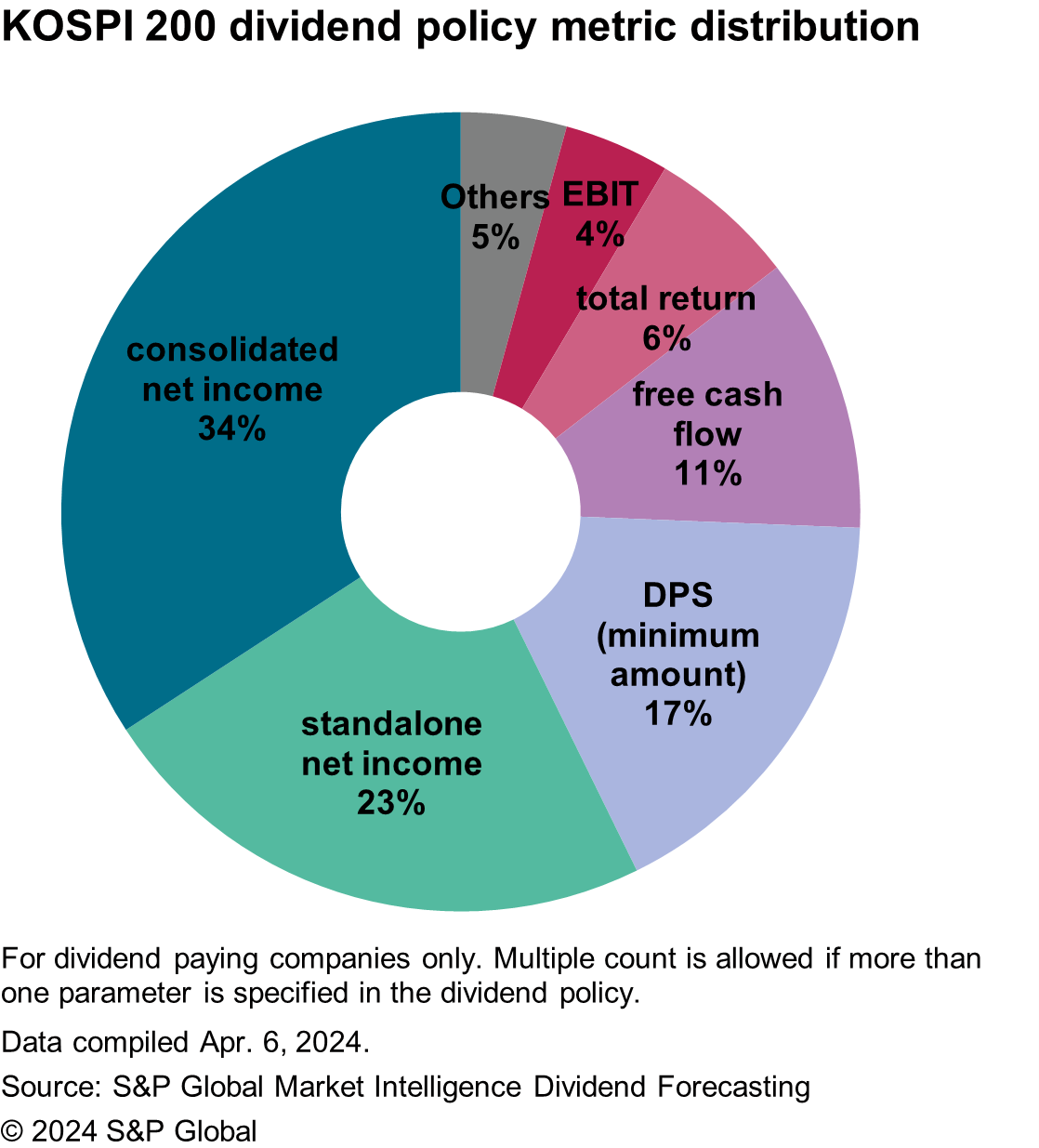

South Korea's Corporate Value-up Program aims to replicate the Tokyo Stock Exchange's Success in 2023 by incentivizing companies to distribute larger dividends. However, a good dividend is not simply larger dividends and KOSPI 200 lags behind Nikkei 225 in various aspects, some of which include:

While pushing for a larger dividend disbursement is necessary, it will take a multifaceted approach for the Value-up Program to truly enhance the attractiveness of South Korean dividends.

On a brighter side, South Korea's economy is expected to be revitalized in 2024 with many top dividend payors' earnings turning around, making it a favorable year to launch the Value-up Program. Our analysis showed that KOSPI 200 is better placed than Nikkei 225 in EPS/DPS, FCF/DPS and leveraged ratios, thus having more room to increase the dividends.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.