Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jul 06, 2023

By Matt Chessum

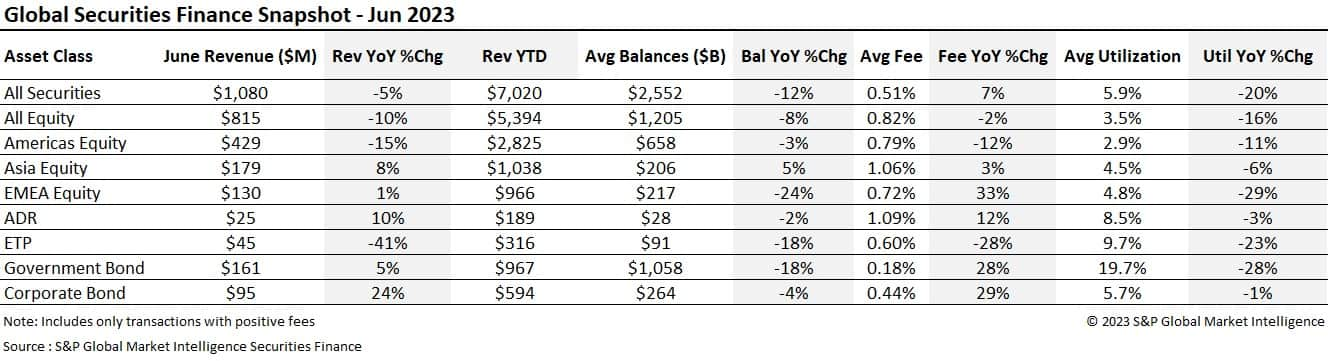

During the month of June securities finance revenues reached $1.080B. Despite surpassing the $1B mark for a sixth successive month, revenues declined 5% YoY and 13% MoM. For the first time this year, during June, revenues declined YoY across Americas equities (-15%) but increased across both Asian (+8%) and European (+1%) equities. Across fixed income assets, strong growth in revenues continued with corporate bond revenues posting an increase of 24% and government bond revenues increasing by 5% YoY. Across all asset classes utilization and average balances generally declined with Asia equities being the only asset class to experience an increase YoY in relation to the value of stock on loan. Average fees remained robust throughout the month increasing across the majority of asset classes. During Q2, revenues generated by all securities reached $3.6B (+7.3% YoY) and during H1, securities finance revenues across all securities reached $7.02B.

During the month of June the NASDAQ closed out its best H1 since 1983 with a 32% increase (which was twice as much as the S&P 500). Over the month, Artificial Intelligence sent the mega cap tech stocks to new highs, and Apple topped a market valuation of $3T as equity markets shugged off warnings of recession and benefited from resilient consumer data. Despite the initial market rally relying upon a handful of stocks, towards the end of the month, a broader allocation towards equities was seen, with the Russell 2000 also making gains. The advent of a new bull market is starting to impact securities finance revenues as the ever increasing one-directional movement in stocks is reducing volatility and directional opportunities for borrowers.

During June, Americas equities generated $429M of revenues, making it the lowest revenue generating month of 2023 so far. Revenues declined 15% when compared YoY and 6% MoM. The decline in revenues was a result of a 10% decline in average fees (MoM) and a 1% decline (MoM) in average balances. Utilization fell below 6% for the first time during 2023 as a result. During the quarter, revenues of $1.4B were generated. This was an increase of 13% YoY but a slight decrease on Q1 ($1.416B).

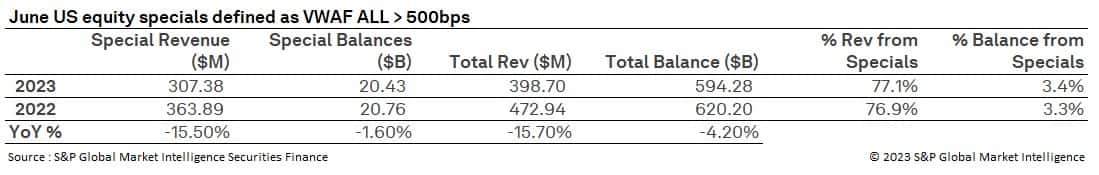

Specials activity across the US declined during June to its lowest level of the year so far with total revenue of $307M. Over the month, specials revenues declined by 8%. The value of specials balances increased by 3% over the month however suggesting that fees were in decline. Specials revenues across the US equity market surpassed $2B during the first half of the year (Q1 $1.015B, Q2 $1.034B) making H1 2023 the highest revenue generating six-month period for US specials since S&P Global Market Intelligence began tracking revenues in 2008. The second highest six month period for US equity specials was seen in 2022 when $1.425B was generated. Specials have generated, on average, 78% of all US equity revenues during the first half of 2023 and 79% of all US equity revenues during Q2.

Across Canada, a similar picture unfolded. Monthly specials revenues declined by 2% over the month from $9M during May to $8.4M during June. Despite this, specials revenues increased 27% YoY. Canadian specials revenues for Q2 were $27.8M and $58.9M for H1 2023.

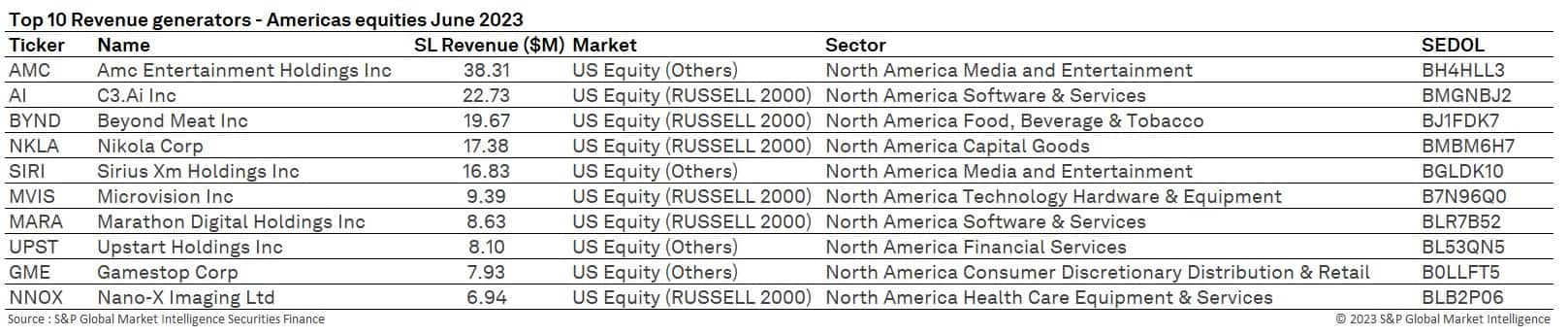

AMC once again retained the top spot for the top US equity revenue generators over the month. Year to date AMC has generated in excess of $450M. June experienced a decline in revenues for the stock as the quantity of shares on loan declined. The software and technology sectors remained well represented across the table, as the NASDAQ produced its best start to the year ever, due to the growing interest in AI. C3.Ai Inc (AI) remained a firm favourite amongst short sellers who were looking to express their belief that the most recent AI inspired rally may start to unwind for some market participants (in the case of C3.Ai Inc reportedly as a result of failings in their proprietary technology in comparison to their competitors). The technology sector also remained popular as it spans the electric vehicle space as well. Microvision Inc (MVIS) is a good example of this. Many technology companies related to the EV space are often valued on future earnings whilst the technology is being fully developed. As this is the case, when valuations hit multiples of a company's earnnings (112.5 times in the case of Microvsion Inc) then negative sentiment can quickly build. Many of the other names in the table remain familiar borrows. Gamestop (GME), the original meme stock, remains a popular borrow, after its shares plunged 18% after firing its chief executive and reporting sales that fell short of estimates ($77M in revenues during H1), as does Beyond Meat Inc (BYND) (H1 revenues $126.6M).

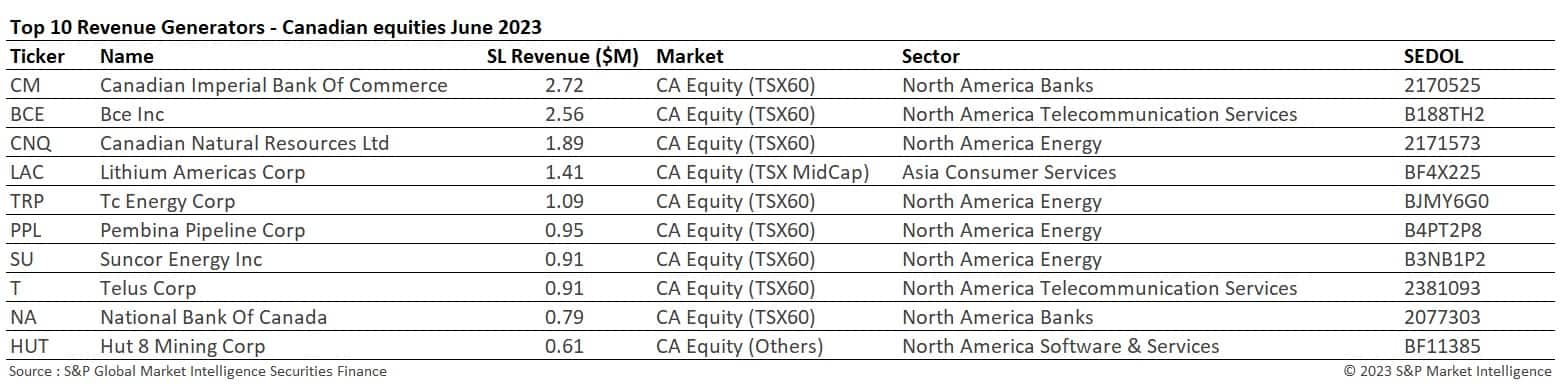

Across Canada the energy sector remained attractive to borrowers. The slower than expected rebound in the Chinese economy has hit energy and material producer share prices as predictions for a strong increase in demand have been reduced. The higher interest rate environment and fears of an impending recession also continue to put pressure on the ability of some companies to pursue their capital spending commitments. Telecommunication services are also well represented across the high revenue earners, as reports of a price war between Canadian telecom providers is lowering share prices as profit margins are squeezed.

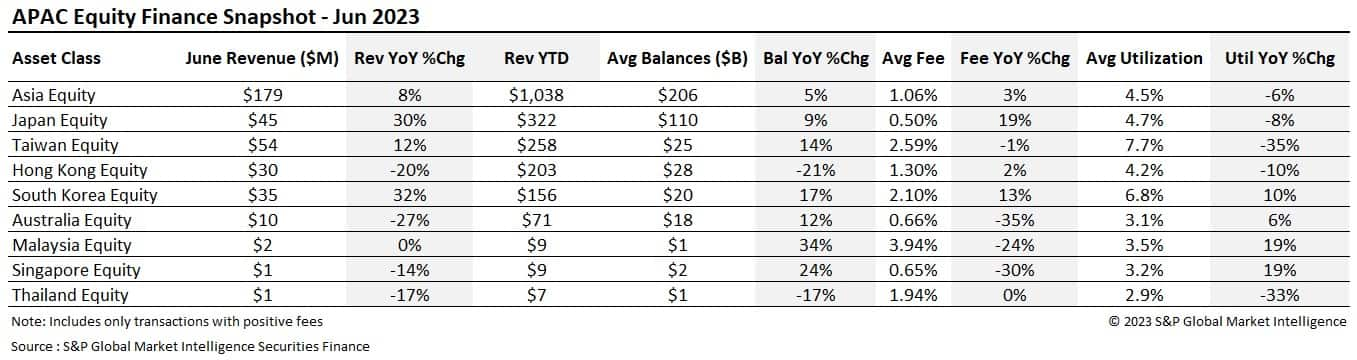

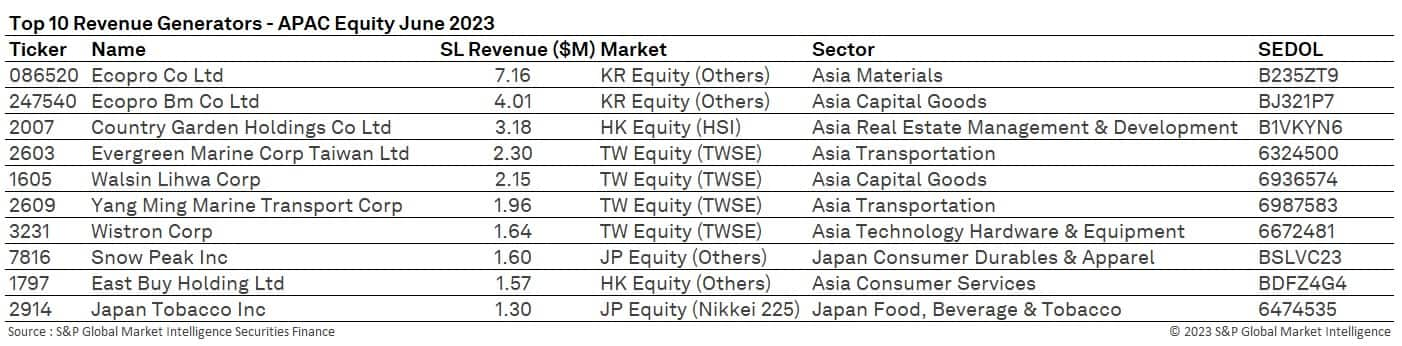

During the month, securities finance revenues of $179M were generated across the APAC region. Revenues increased YoY by 8%. A significant increase in average fees was seen during the month (+7% MoM), making June fees the highest during 2023 so far (106bps). Utilization increased during the month as did on loan balances (+5%). Throughout Q2, APAC equities generated $524.9M which was 4% higher YoY ($504.5M Q2 2022). Average fees were flat over the quarter (YoY) standing at 100bps whilst balances increased 4% (YoY).

In terms of market activity, Taiwan is becoming increasingly important for the region with growing balances and lendable supply. It continued to lead the APAC region generating revenues of $54M over the month. Average balances were higher YoY (+14%) during June whilst average fees (-1% YoY) and utilization (-35%) declined. Taiwanese revenues recovered over the second quarter of the year to match those of Q2 2022, after declining 19.5% YoY during Q1.

Taiwanese stocks featured heavily in the highest revenue generating stocks table over the month. Transportation stocks, Evergreen Marine Corp Taiwan Ltd (2603) and Yang Ming Marine Transport Corp (2609), were popular amongst borrowers. After making very healthy profits during COVID when shipping container space was at a premium the current slowdown seen in the Chinese economy is expected to drive profits lower, making this sector attractive to borrowers.

Revenues in Malaysia were flat during June (YoY) at $2M. Utilization increased significantly, however, (+19%) and average fees remained the most expensive across APAC at 394bps. On the 12th June the Bursa Malaysia amended its criteria for short selling. The daily market capitalization criterion for the preceding 3 months for any stock sold short moved from RM 500 to RM 200 million. This may have an impact upon activity within this market heading into H2.

South Korea experienced an increase in activity throughout the month as revenues increased 32% (YoY) to $35M during June. South Korean Q2 revenues also increased by 10% YoY to $93.1M. Average fees were considerably higher during June reaching 210bps and marking their highest level since March 2022. A further increase in utilization was also seen over the month, reaching 6.79%. An increase in fees and utilization shows that demand for South Korean assets continues to grow. Demand has been building throughout H1 and appears to be gaining momentum.

During the second quarter of 2023 the Japanese stock market performed exceptionally well (+14%). The yield controls in place continued to weaken the Yen against other major currencies, which helped to support Japanese stocks. Despite strong increases in the value of the Nikkei 225, over the quarter, securities lending within Japan continued to produce robust revenues. During the month of June, revenues increased 14% MoM ($45.4M) as both average fees and balances continued to climb. Q2 revenues totalled $149M which is an increase of 32% YoY. Average fees over the quarter were 50bps (+21% Yoy) and balances increased to an average of $116.9B (+9%).

Specials activity within the APAC region generated $87.1M of revenues during the month, making June the best month for specials activity so far. During the month of June, 48% of all revenues were derived from lending stocks at a fee of over 500bps accounting for approximately 6.6% of all on loan balances. Throughout H1 2023, specials have contributed $469.4M of revenues.

When looking at the highest revenue generating stocks for the region, Country Garden Holdings Co Ltd (2007) made a reappearance during the month. Reports in the financial press have been focused upon the slowdown in Chinese economic growth and the knock-on effects that this is having across the Chinese property sector. During the month, the Peoples Bank of China was reportedly finessing plans to roll out several measures aimed at stimulating the country's weakening economy, which could include a large infrastructure spending package and easing rules around real estate investment.

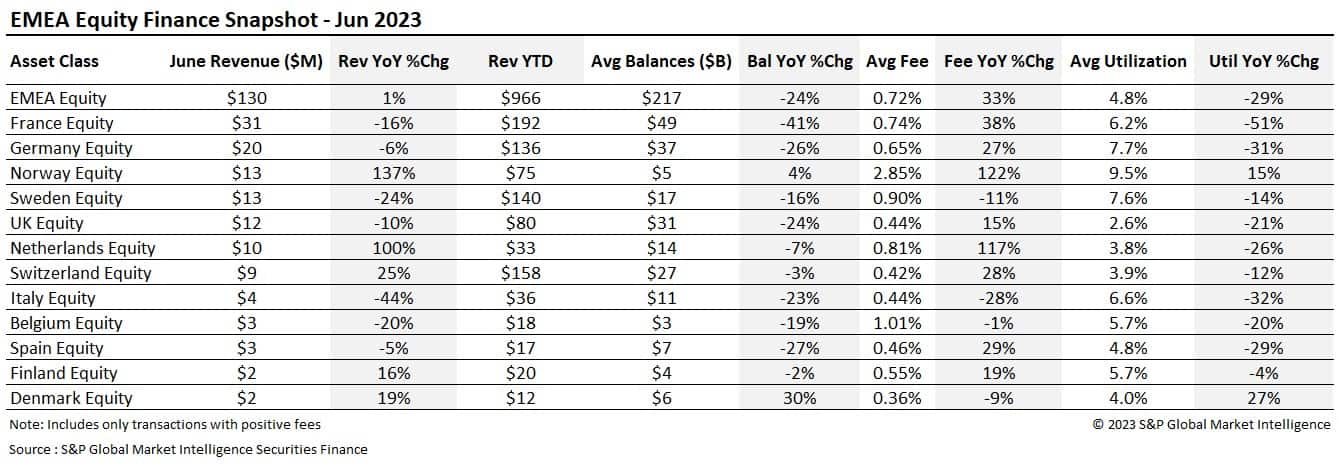

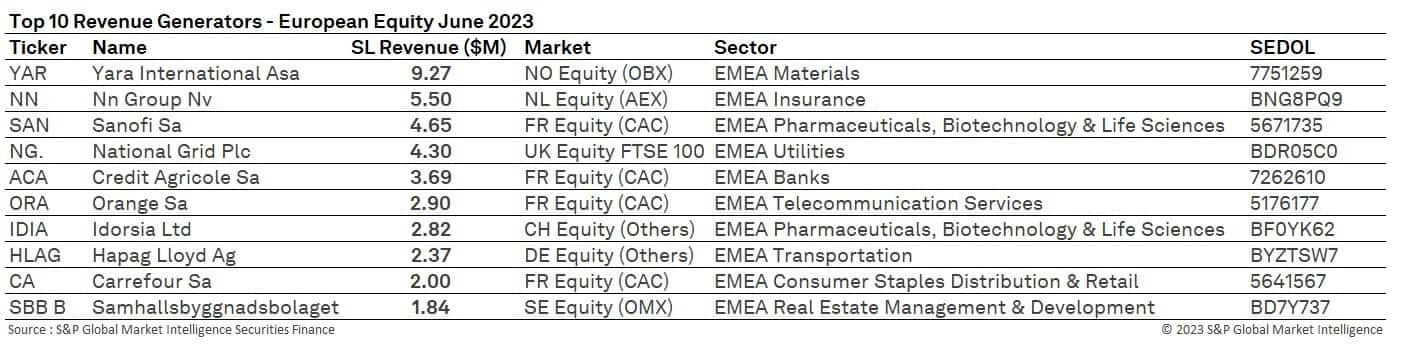

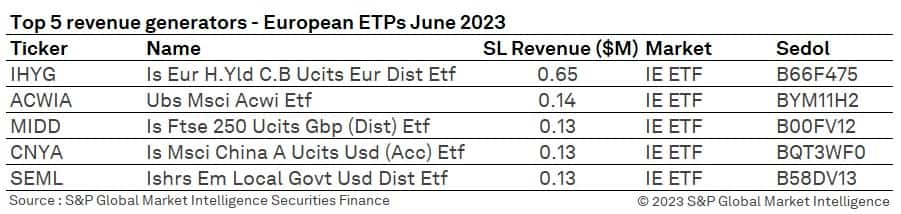

Across Europe, both quarterly and monthly revenues continued to surpass those generated during the same periods during 2022. Monthly revenues hit $130M (+1.4% YoY) and Q2 revenues totalled $590.1M (+2.7% YoY). H1 revenues of $966M were generated (+14% higher than H1 2022). So far during 2023, European markets have benefited from consistently higher average fees (Q1 67bps + 40% YoY, Q2 93bps +22% YoY) which have pushed revenues higher. This increase in fees has been critical for the region as utilization and balances have remained consistently lower (YoY). On average, revenues have been 20% higher during every other month of the year so far. Only during the month of May did revenues dip below those seen in the same point during 2022.

France, Germany, and the Nordics have produced the most consistent revenues during 2023. Despite Swiss revenues falling MoM to $9M during June, over Q2 average revenues ($76.9M) were +53% YoY and average fees (85bps) were 59% higher YoY. Switzerland proved popular amongst borrowers throughout the first semester, generating $158M in revenues compared with $94M during H1 2022. In France and Germany, average fees increased +38% and 27% (YoY) respectively during June and have remained consistently higher over Q2. Despite this, a fall in balances has restrained revenue growth YoY.

$38.2M in specials revenues were generated over June marking the lowest specials revenue generating month of the year so far. Despite this, when looking YTD, $279.4M in specials revenues have been generated, making H1 2023 the second highest since our data collection started (H1 2016 produced $303M). During the month, approximately 29% of the regions revenues were generated from specials activity which accounted for 1.6% of all on loan balances.

Many of the highest revenue generating stocks across Europe continued to be linked with seasonal activity. National Grid was an exception to this. Demand was created by the issuance of a Scrip dividend during the month which pushed both average fees and revenues higher because of the premium offered for cash guaranteed stock.

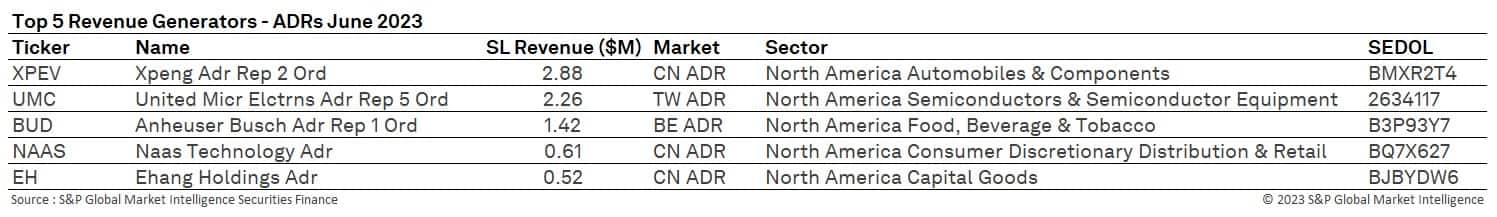

Depositary receipts continued to perform well over the month, but average fees did fall to their lowest level seen since the start of the year (109bps) despite showing a positive gain YoY (+12%). Q2 revenues were 26.7% higher when compared YoY ($86.9M) and Q2 average fees increased 27% YoY (125bps). Over H1, average fees have been consistently higher when compared YoY which has helped revenues to improve.

Over the month, many of the names discussed in previous snapshots remained popular borrows. Naas technology (NAAS) appeared in the table as it entered into a convertible note purchase agreement which increased demand from borrowers who were looking to arbitrage between the equity and the convertible bond. Ehang Holdings (EH) experienced increased demand over the month as investors reportedly started to question the feasibility of the company's ability to turn a profit. This in turn led to a fall in the company's share price over the month.

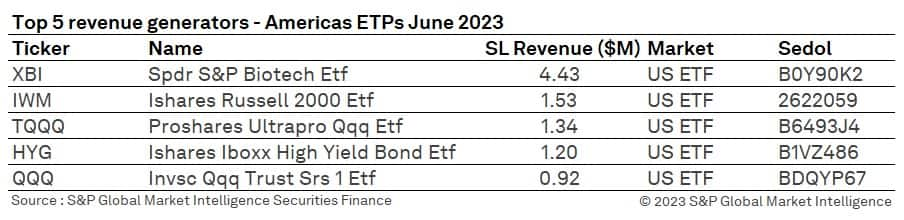

Securities finance revenues continued to decrease during the month when compared YoY (-41% YoY $45M). Revenues also declined 35% over Q2 ($154.7M), increasing the decline of 25% that was experienced during Q1. Average fees have seen a decrease YoY over every month and quarter of the year so far (Q2 -22% YoY, June -27.7% YoY) with average balances declining 17% on average throughout H1. During H1 2023, revenues were on average 30% lower each month when compared with 2022. Many of the drivers that pushed revenues higher during 2022 have eased throughout the year. One example of this can be seen in the demand for the iShares high yield Corporate Bond fund (HYG). HYG was a large contributor to securities finance revenues throughout 2022 as a change in interest rate policy weakened conditions for high yield corporate debt. The opposite has been seen throughout 2023 with strong US data prints leading to the highest inflows into the exchange traded fund since 2020 being experienced during June. The ever-elusive recession (probably the most predicted and talked about ever) and economic resilience is providing confidence to investors looking to receive a greater yield on their investments, pushing prices of the assets higher.

New trends in the ETF market have taken hold over the past few months as the recent hikes in interest rates continue to put the Biotech sector under pressure (funding costs and levels of profitability continue to be questioned). As discussed during the previous snapshot TQQQ, the Proshares Ultrapro QQQ ETF, offers 3x leveraged exposure to moves in the NASDQ 100. Following the indices best half year returns for 40 years, some investors may think it is overpriced, borrow the shares, sell them short and wait patiently for the index to fall before buying them back.

With the conclusion to the US debt ceiling discussion firmly in the rear-view window, government bond markets could once again turn their attention to economic data and the impact that the recent interest rate increases have had upon inflation. The US treasury announced over the month that it was planning on replenishing its cash account to a more "normal" level of circa $600-$700B by year end while simultaneously refinancing the US deficit. The funds are expected to be raised through the issuance of T-bills to the tune of $1T by year end, with the majority of the issuance taking place across the third quarter. This is expected to drain liquidity from the US government bond market and is expected to increase short term funding rates.

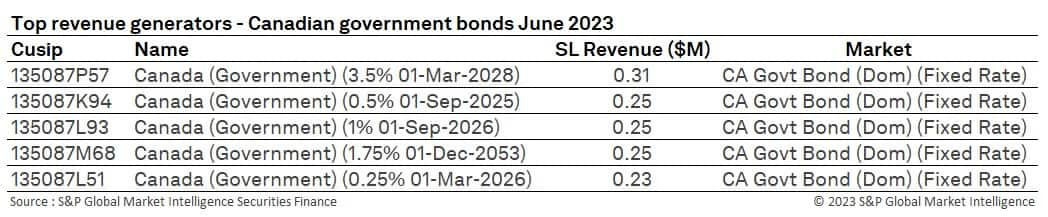

Over the month, the European Central Bank, the Bank of England, the Bank of Canada and the Reserve Bank of Australia all increased interest rates in a pursuit to control stubbornly high consumer price gains. The Fed decided to take a pause (or a skip depending upon what you read) during the month as it looks to assess the impact of previous hikes on economic data as consumer prices rose 4% in May from a year earlier, marking the smallest advances since March 2021.

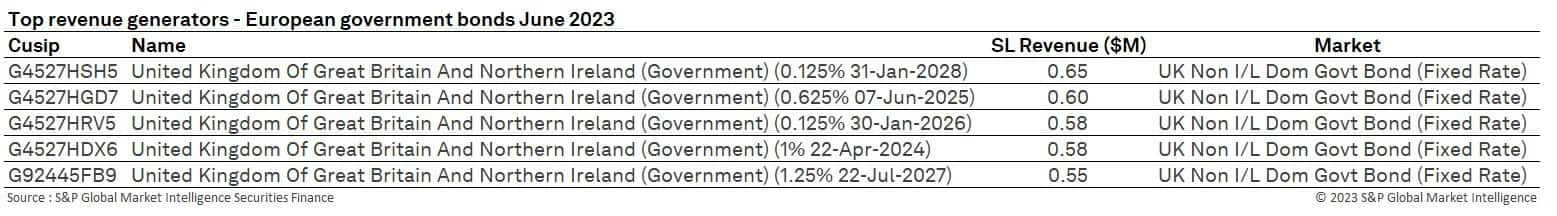

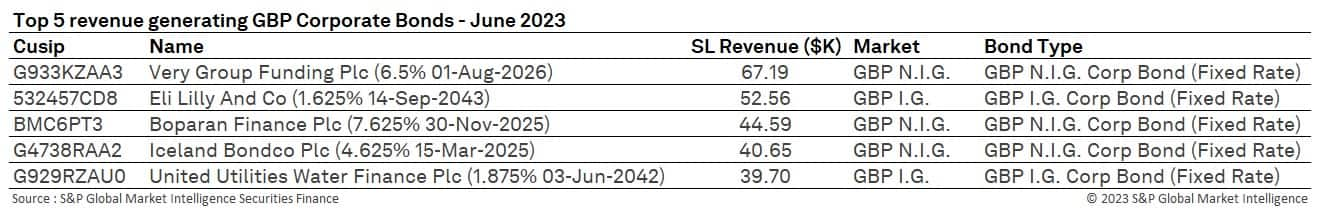

After pausing during May, the Bank of Canada and the Reserve Bank of Australia restated their hawkish outlook on future rate increases and raised interest rates once again. Whilst the Bank of England was one of the first central banks to start raising rates, given the stubbornly high levels of inflation, it is likely to be one of the last to pivot. The BOE increased rates by 50bps over the month and two-year Gilts have now surged to their highest level in 15 years as investors are pricing in a terminal rate in excess of 6%. UK core inflation is now at its highest level since 1992. The ECB increased interest rates to a 22 year high during the month to 3.5%. Market consensus is for one further rise this year, likely taking place during July. The decision reflected ECB concern that inflation will persistently exceed its 2% target for at least the next two years.

As central banks start to approach the peaks of their hiking cycles a natural divergence between geographic regions is taking place. During the month, the Peoples Bank of China and the Bank of Japan remain focused monetary easing though either yield control or lowering borrowing rates. Whilst the Bank of Japan awaits further proof of more sustainable inflation, the PBOC is reportedly changing stance from an economy first mindset to a security first one.

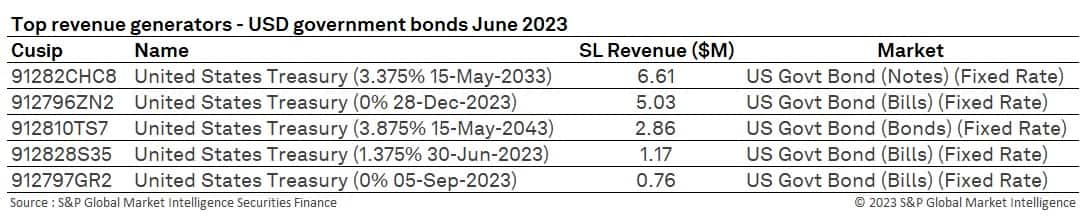

Government bonds continued to perform exceptionally well over the month as a result of the ongoing volatility seen across bond yields. Revenues for June increased 5% YoY ($161M) and 9.3% in comparison to Q2 2022. Despite balances and utilization decreasing over the month, quarter and first half of the year, elevated fees have supported the asset class. Average fees were consistently higher over the half of the year with April seeing the lowest average fee of 17bps (H1 2022 monthly high seen in June at 14bps). Short-dated government bonds have remained popular amongst borrowers as the impact of continued interest rate hikes have affected their prices. This has been a common theme across all regions over the first half of 2023 and remained true throughout June.

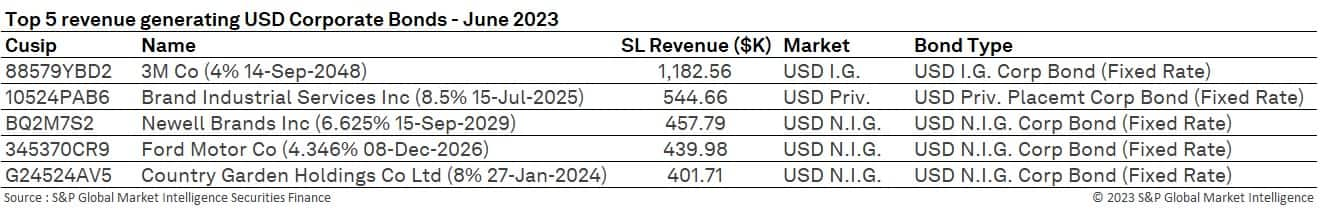

During the month, despite US Treasury yields increasing, yields on US high yield bonds reportedly declined or held steady. This could be a sign that confidence in corporate activity is solid despite the ongoing possibility of an impending recession or sustained period of economic stagnation. A steady rotation from high yield debt into high grade debt was reported on during the month as investors headed for the safe haven of higher rated corporate bonds. The catalyst for this move was a reiteration by Fed chairman Jerome Powell that the Fed has not finished raising rates. Markets reacted to this statement by increasing yields further for US high grade debt, narrowing the risk premium / spread between the two asset classes (high yield bonds are usually less sensitive to yield increases compared to high grade debt with longer duration). The move was therefore seen as an opportunity to lock in some profits before Q2 earnings. Despite this, non-investment grade corporate bonds remained popular borrows throughout the month as interest rates and inflation continued to impact refinancing opportunities. Prices / yields remained sensitive to moves in an ever-increasing interest rate environment and reacted to the Feds warnings of higher rates for longer. This was reflected in higher securities finance revenues YoY, for the sixth successive month.

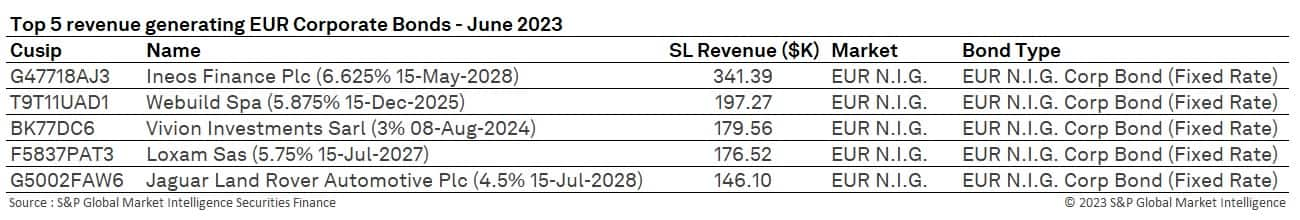

Revenues continued to outperform during June (June +23.6% YoY $95.3M, Q2 $296M +27.8%, H1 +36% $593.8M) and average fees remained elevated in comparison to previous years (Q2 2023 45bps, Q2 2022 33bps, Q2 2021 25bps Q2 2020 21bps). As with other asset classes, balances fell throughout the year and utilization declined. Balances were on average 8% lower over the first half of 2023 when compared with H1 2022 pointing to the development of a more specials focussed market.

Securities finance markets remained resilient throughout June with reasonable revenues seen across the majority of asset classes. A common theme of lower balances, lower utilization but higher fees point to a higher conviction sentiment across the market that's focussed on certain sectors, stocks, or issues of bonds.

Heading into H2, markets will continue to be driven by both inflation and interest rates. The possibility of recession is also expected to grow as central banks continue their hawkish stances. Q2 earnings will be a key driver of market sentiment heading into the second half of the year as consumer demand will remain key to profit generation and growth. Q2 earnings are likely to act as an important barometer for securities finance revenues during H2 as further signs of strong consumer demand is likely to push equity markets ever higher, reducing volatility and directional opportunities.

To understand more about the main drivers of securities finance revenues during the quarter and to share in our thoughts and predictions for H2 and Q3, please join us for our upcoming webinar on 3pm BST / 10 am EST 19th July, 2pm HKT 20th July. Please register HERE.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.