Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jan 04, 2023

By Matt Chessum

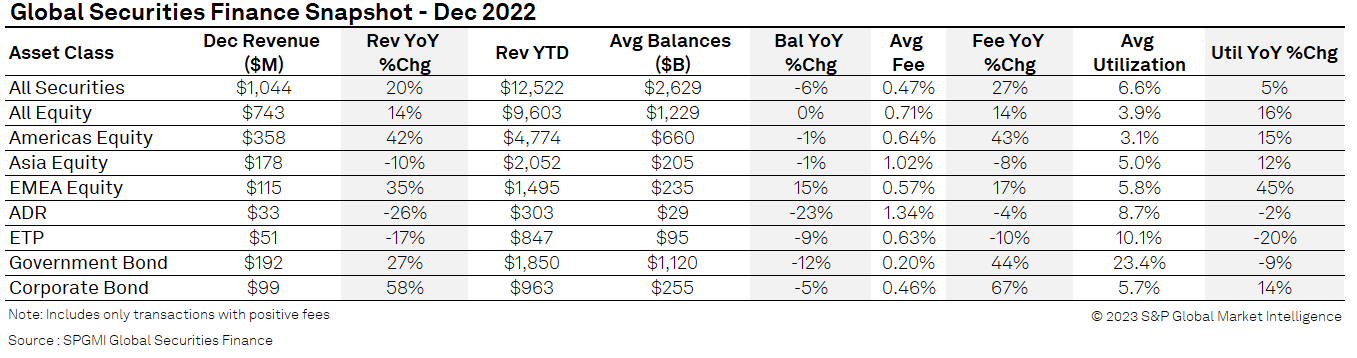

Securities finance revenues finished 2022 on a high, generating $1.044bln during December (+4% when compared with November and +20% YoY). Despite balances being 6% lower YoY (-1%MoM), average fees increased 27% YoY (+0.5% MoM) and average utilization increased 5% YoY (-2% MoM).

Full year revenues for 2022 benefitted from the strong returns that were generated throughout Q4 2022, $3.034bln (+12.1% when compared with 2021). $12.521bln was generated over the course of the year which is an increase of 14.8% on 2021 and 34% on 2020. 2022 was the best year for securities finance revenues since the global financial crisis in 2008 ($13.2bln).

Revenues across most asset classes increased when compared YoY. Both Americas (+42%) and EMEA (+35%) equities saw impressive growth in revenues along with government (+27%) and corporate bonds (+58%). December was a strong month for fixed income assets as both corporate and government bonds had their best performing month of the year during December ($98.64m and $191.88m respectively). ADRs (-26%) experienced a decline, which is a trend that has been witnessed throughout 2022, along with ETPs and Asian equities.

Average fees remained elevated when compared YoY across all asset classes with a strong 27% YoY increase. Average fees were higher for every month of the year when compared with 2021 and the year average was 5bps higher in 2022 when compared with 2021. The 2022 average fee was 45bps (Q1 38bps, Q2 46bps, Q3 48bps Q4 46bps).

As can be expected with the decline in asset valuations during the month, on loan balances declined both MoM (-1%) and YoY (-6%). The only asset class seeing an increase in the value of stock on loan (+15% YoY) was EMEA equities. Average balances for all securities peaked in Q2 in 2022 and fell steadily throughout the year (Q1 $2.91bln, Q2 $2.921bln, Q3 $2.766bln, Q4 $2.63bln).

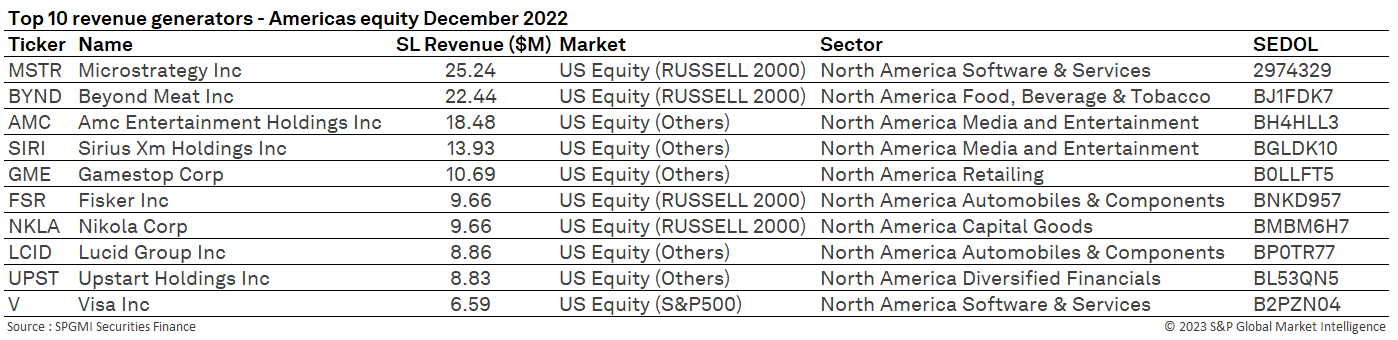

Americas Equity

During a year where the main US indices have shed more value than at any point since the financial crisis in 2008 (DJIA -8.78%, NASDAQ -33.1%, S&P 500 -19.44%) securities finance revenues for the region remained very strong. $4.774bln in revenues was generated over the year with Q4 generating $1.057bln (Q1 $978.59m, Q2 $1.245bln, Q3 $1.492bln). $358m in securities finance revenues were generated during the month of December. This is an increase of 42% when compared YoY and an increase of 2% MoM.

Average fees were 8bps higher (70bps) for 2022 when compared with 2021. This is the highest yearly average since 2020 (81bps). Fees for the asset class rose throughout the year as market valuations declined. The increase in fees is reflective of the increased amount of specials activity that was seen in Americas equites throughout the year.

When December's numbers are compared YoY, growth in revenues (+42%), average fees (+43%) and utilization (+15%) are all very impressive. MoM comparisons are less strong however with only increases seen in average revenues (+1.8%) and average fees (+2.7%). Average utilization decreased over the month (-2%) with average balances remaining flat.

Americas equities continues to be the most important contributor to equity revenues (48% during the month and 38% over the year). The top revenue generating stock of the month was Microstrategy (MSTR). As reported last month, the stock remains under pressure following the fallout from the collapse of crypto exchanges and the prevailing uncertainty experienced in the broader crypto market (Bitcoin -64.21% over 2021). The software sector has increased in attractiveness from short sellers over the last two months of the year and is now one of the most shorted sectors in Americas equities (as reported in the December long /short report). Beyond Meat remains popular amongst borrowers and is one of the top revenue generating stocks of 2022 ($195.265m). Many of the other names seen in the table are well documented from previous snapshots. The EV sector continues to see interest from borrowers as interest rate increases are making car finance more expensive which has the potential to impact demand. Competition also continues to grow as the more traditional automobile makers are looking to make the switch to electric. Fisker Inc (FSR) generated more in borrow revenues throughout December than any other month of the year. The stock generated $73m in revenues over 2022. Lucid Group (LCID), another EV stock, is likely to be the highest revenue generating stock of 2022 ($263.9m) and remains in focus from short sellers. Visa Inc (V) made the top ten during the month and remains a popular borrow (2022 revenues $73.55m).

APAC equity

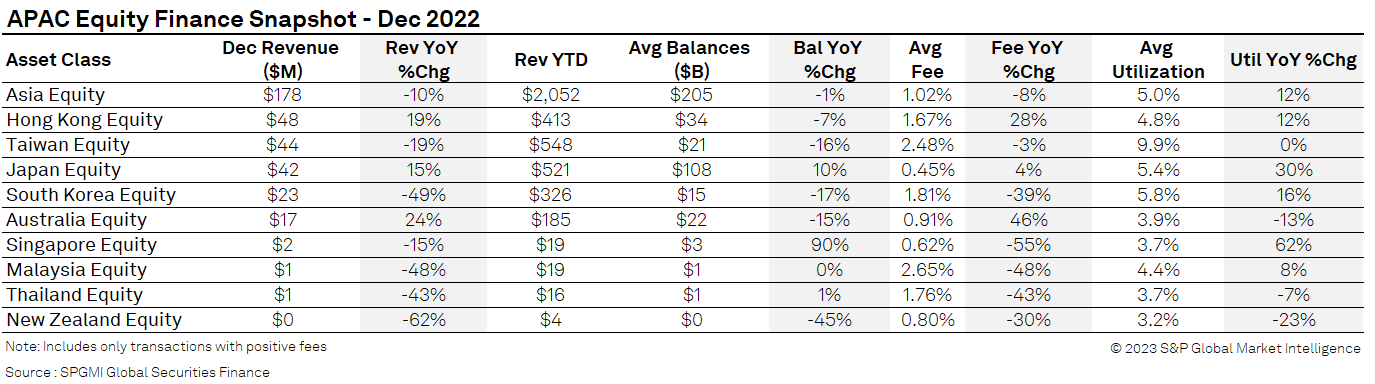

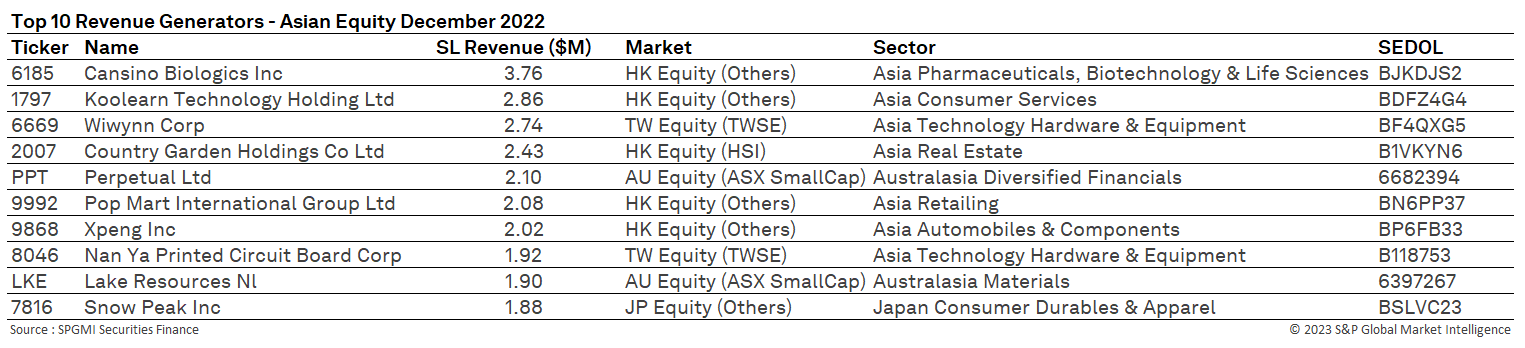

APAC equities generated over $2bln in securities finance revenues throughout 2022 which is a 1.3% increase over 2021. Q4 was the second highest revenue generating quarter of the year (Q1 $534.87bln, Q2 $504.5bln, Q3 $504.6bln, Q4 $507.8bln) and December ($178m) was the third highest revenue generating month of 2022 (March $205.6m and September $179.1m).

During December average revenues (-10%), balances (-1%) and fees (-8%) were all lower when compared YoY. When comparing MoM the inverse was true with revenues increasing 8.4%, balances increasing 4% and average fees increasing 1bps (1%).

Taiwan was the best performing market of the year generating 27% of the regions revenues ($548m). Over the month however, Hong Kong regained the top spot with its highest revenue generating month of the year ($48m). As China announced the end of its zero COVID policy throughout the month of December, the market has benefited from a renewed focus. Half of the top ten highest revenue generating stocks over the month were listed on the HK exchange.

When compared YoY (entire 2022 vs entire 2021) Japan experienced a decline in average revenues of 2.8%. Average fees declined 7% but utilization increased 27% to 6.13%. Japan has traditionally been an important country in the APAC region for securities finance revenues given its size and was the second most important throughout 2022 in relation to full year revenues.

Both Malaysia and South Korea saw decreases in revenues and average fees throughout the month of December. When compared YoY revenues have decreased 70% in Malaysia. Average fees declined 47% YoY and on loan balances decreased by $325m (-42%). Interest in this market has reduced dramatically throughout 2022 despite lendable supply decreasing by 5%. Malaysia continues to be operationally heavy when compared with some of the other markets in the region with permissible borrow lists also having an impact upon activity.

In South Korea the reemergence of short selling bans continued to impact market activity when compared with December 2021. Revenues declined 49% when compared for the month of December on YoY basis, average balances declined 17% YoY and average fees declined 39%. Despite the monthly declines, revenues increased 5.1% on a full year basis for this market as average utilization for the year was significantly higher than during 2021 (5.69% 2022 vs 3.05% 2021). Average utilization was significantly higher for the first six months of 2022 when compared with the first six months of 2021.

Australia continued to shine throughout the month of December with a 24% increase in revenues YoY. December was the second highest revenue generating month of the year for this market. Average fees were 46% higher YoY and have remained close to 100bps throughout the year. Both average revenues and fees increased when compared MoM. Australia has two stocks in the top ten revenue generating names for the region, Lake resources Nl (LKE) and Perpetual (PTT).

As mentioned in the previous month's snapshot, Perpetual continues to be a popular borrow as the company's share price continues to struggle. Active utilization in this name remains high and the company currently has 21% of its outstanding shares on loan.

Within the region real estate stocks such as Country Garden Holdings Co Ltd (2007) remain popular borrows given the fragilities surrounding the Chinese property sector. Retail, EV and consumer durables all remain key sectors for borrowers in this region.

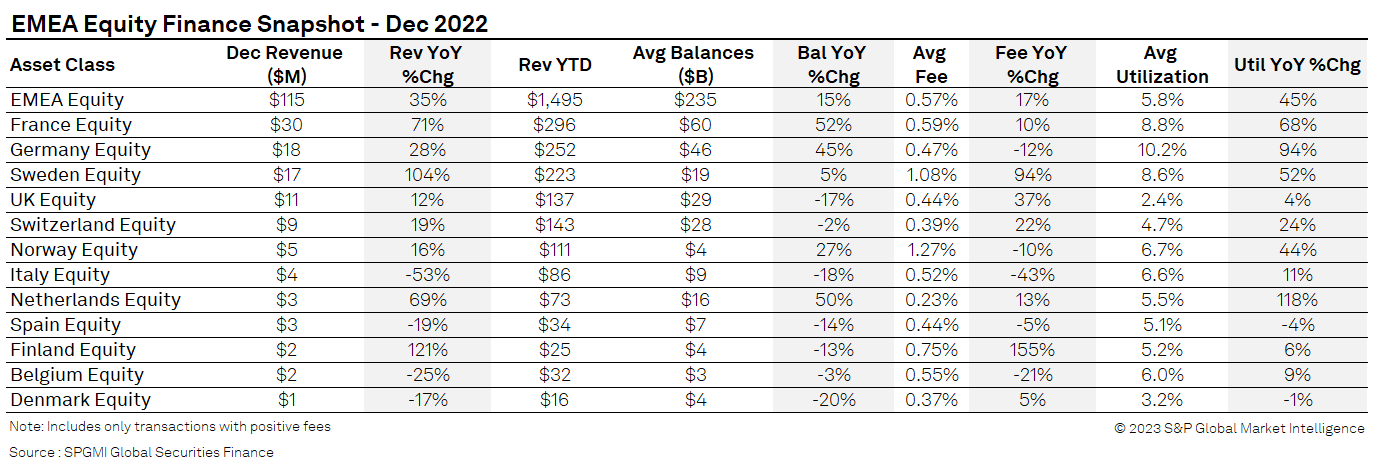

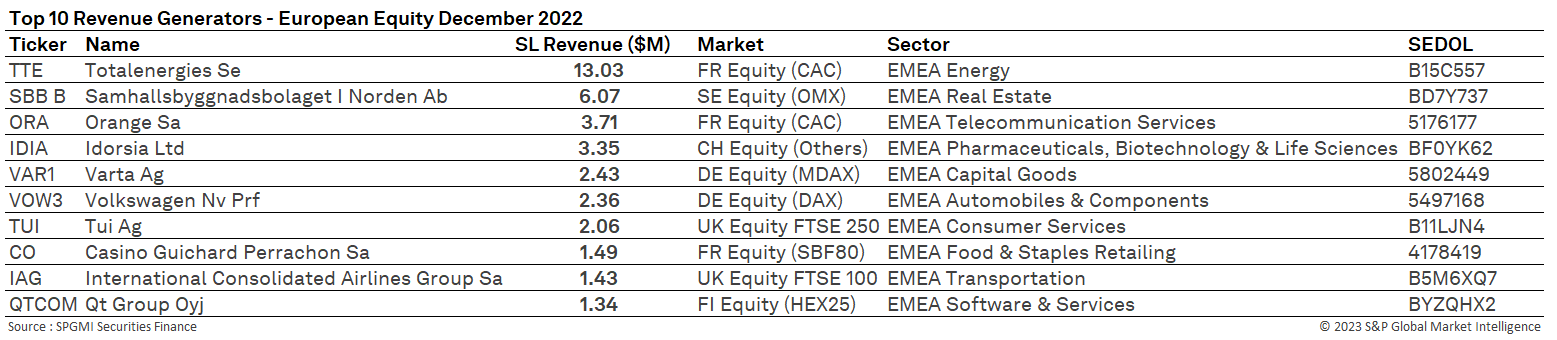

EMEA equity

Securities finance revenues totaled $115m for the month of December for EMEA equity. This is an increase of 35% YoY but a 14.7% decrease when compared MoM. 2022 full revenues for the region totaled $1.495bln. This represents a 1% increase when compared with 2021 despite the region suffering a decline of 24% in lendable assets over the year. Q4 was the second highest revenue generating quarter of the year (Q1 $276.3m, Q2 $574.6m, Q3 $295.8m, Q4 $347.8m). France was the highest revenue generating country of 2022 ($296m). This represents a 34% decrease on 2021 ($447.9m) however.

Sweden continues to generate strong returns for lenders and experienced a 104% increase in revenues when compared YoY. 2022 revenues for Sweden are 35% higher when compared with 2021 ($223.3m). Average fees (1.08%) are 94% higher in this market YoY.

France generated the highest revenues throughout the month. The country benefited from additional revenues generated from an increase in both borrow fee and on loan quantity for Totalenergies (TTE) and Orange (ORA). Both stocks paid a dividend during the month.

Many countries across the continent contributed to the increase in revenues experienced YoY. Germany, the UK, Switzerland, Norway, the Netherlands, and Finland all noted increases YoY when compared with December 2021. Utilization increased across most countries with Germany experiencing a 94% increase. Germany continued to be the most heavily utilized EMEA market across lending pools during the month with 10.2% of all stock on loan.

Many of the top revenue generating borrows will remain familiar to regular snapshot readers. Volkswagen preference shares entered the table during the month. The preference shares are identical to the ordinary shares, but they do not entitle the holder to voting rights. As a result, an arbitrage opportunity has been created between the two lines.

Varta Ag remains a popular borrow and throughout 2022 this stock generated more than $51m in making it the highest revenue generating EMEA equity of 2022. Other top revenue generators throughout the year also appear in the table below these including Samhallsbyggnadsbolaget I Norden Ab (SBB B) which generated more than $22m in revenues and International Airlines Group (IAG) which generated $22m.

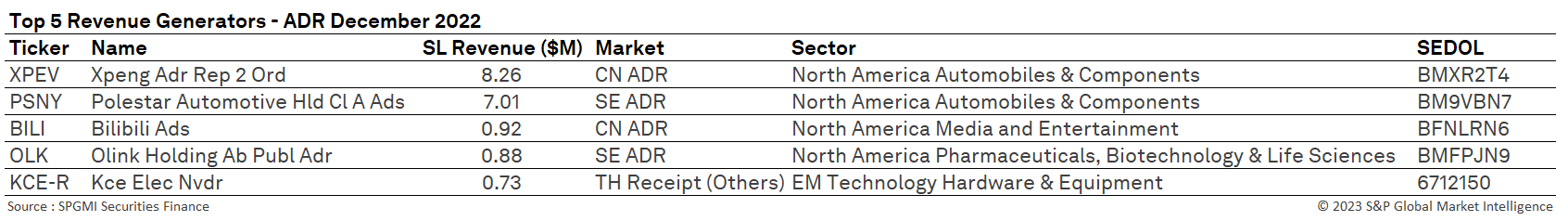

ADRs

ADRs generated $33m in revenues throughout the month of December which represents a decline of 26% when compared YoY. When compared MoM December's revenues are 37% higher than November.

Across the course of 2022 ADRs generated $302.9m in revenues which represents a 43.5% decline when compared with the full revenues of 2021 (Q1 $51.4m, Q2 $68.6, Q3 $103.2m, Q4 $79.7m). ADR securities finance performance has suffered greatly during 2022 due to the ongoing issue between the Chinese and US governments transparency requirements in relation to accounting practices. This issue has led many investors to invest in local lines rather than ADRs. This has had a knock-on effect in the securities lending markets as the number of transactions has declined.

Top ADR borrows remain concentrated in the EV sector with Polestar (PSNY) and Xpeng (XPEV) as the highest revenue generating stocks for the month. Despite reporting record deliveries last month, according to S&P Global Mobility Auto Intelligence, Xpeng remains under pressure from short sellers as the COVID restrictions on factory workers throughout the month of November continued to affect production. Polestar generated more than $45m of revenues during 2022 and continues to demand elevated borrow fees. KCE Electric (KCE-R) is a new name in the list and is a hard to borrow stock that is 94% utilized in the market.

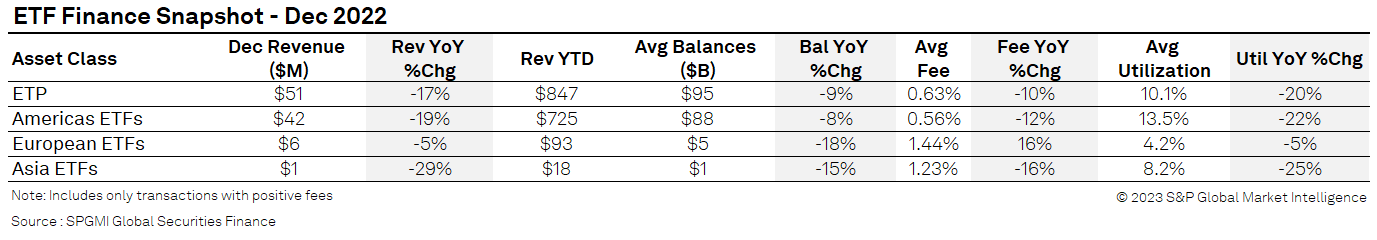

ETPs

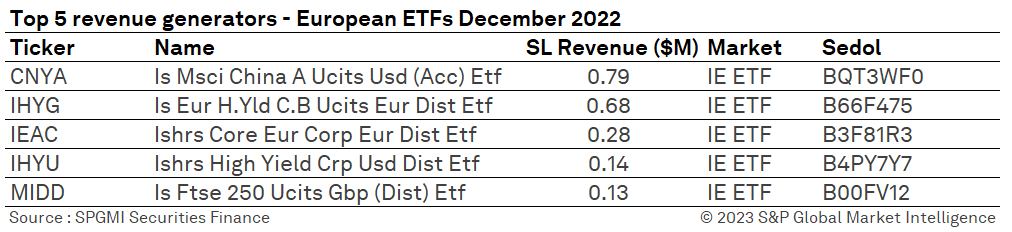

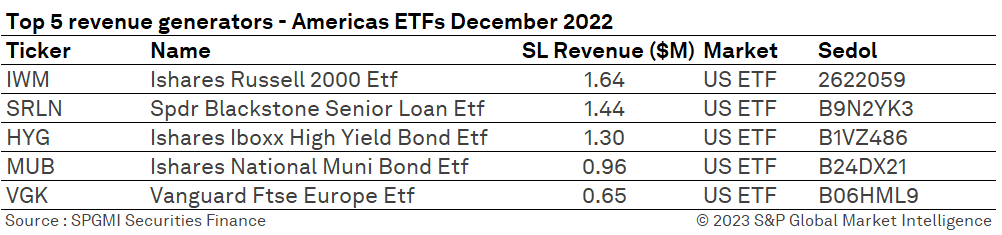

ETPs generated $847m in revenues throughout 2022 (Q1 $215.1m, Q2 $238.1m, Q3 $204m, Q4 $189.6m). This represents a 34% increase when compared to 2021. Americas ETPs continued to dominate these revenue streams - 82% of December's revenues and 86% of the full year revenues. When compared with 2021, revenues generated from Americas ETPs increased 42.5% ($725m 2022 vs $508m, Q1 $183.8m, Q2 $204.8m, Q3 $172m, Q4 $164.3m). European ETPs contributed 11% of the full year revenues and 12% of the monthly revenues. When compared with full year revenues for 2021, European ETPs experienced an increase of 9.3% (Q1 $23.6m, Q2 $24.7m, Q3 $25.4m, Q4 $19.1m).

For the month of December, revenues generated by ETPs declined by 17% both YoY and MoM. On loan balances also declined YoY along with average fees (-10%) and average utilization (-20%). Average fees were down significantly when compared with November (77bps Nov vs 63bps Dec). Significant fee compression was seen across the high yield and corporate bond ETF borrows as inflation figures in both the UK and US were reported lower than expectation. Easing inflation subsequently lowers pressure for further aggressive interest rate hikes which affects the yields / prices of these assets. Speculation in the financial press also alludes to corporate bond fund activity increasing as investors start to see value at current market levels.

Many of the top revenue generating borrows have remained the same throughout 2022. In Europe iShares MSCI China generated the highest revenues. This stock generated $13.9m in securities finance revenues over the course of 2022. Uncertainty in China regarding the zero COVID policy has boosted demand for this stock and increased borrowing fees. High Yield assets continued to dominate the ETP activity in the region.

In the Americas, a similar picture can be seen. Small / mid cap indices and high yield proxies all appear in the top revenue generating names. HYG moved to third place throughout the month as fees reduced given the easing pressures on corporate bonds. Throughout 2022 HYG generated $106m in securities finance revenues for asset owners. December was the lowest revenue generating month for this ETF by a significant margin.

Government Bonds

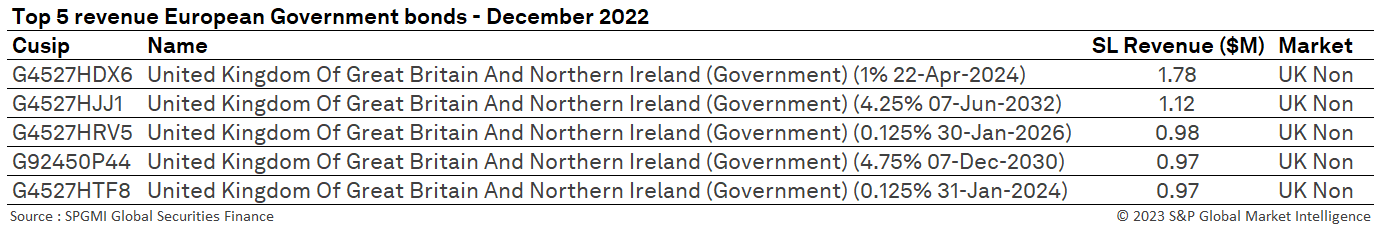

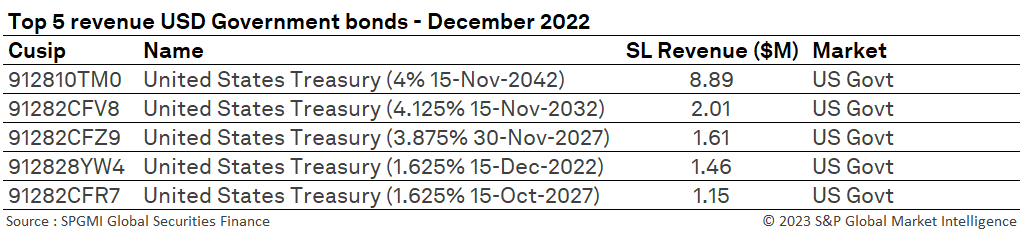

As was expected, government bonds generated more revenues during December than at any other month throughout 2022. The asset class produced $191.8m in revenues throughout December which is an increase of 19% MoM and 27% YoY. Throughout 2022 the asset class generated $1.85bln in revenues (Q1 $420.3m, Q2 $442.8m, Q3 $472.3m, Q4 $514m). Average fees also increased both MoM (+10.8%) and YoY (44%). Fees for government bonds increased throughout 2022 (Q1 13bps, Q2 14bps, Q3 16bps Q4 19bps) making the 2022 average 15bps. This is 19% higher than the 13bps average that was seen in 2021.

Utilization across government bonds was 9% lower YoY at 23.4%. Utilization remained lower throughout most months of 2022 (Q1 25%, Q2 26.48%, Q3 24.7% Q4 23.57%) when compared with 2021, with only June and September posting 1% increases YoY. As the assets have been more expensive to borrow however, revenues have remained higher for every month other than January which saw a decrease of 4.7% YoY (Jan 2022 $138.47m vs Jan 2021 $145.23m).

Demand in both the US and Europe remained strong for short dated government bonds throughout the month. Demand for government bonds is likely to remain driven by inflation, the size of future interest rate hikes and the impact that these changes have on the financial markets and the broader economy. The financial press has reported that they believe that US inflation may have peaked in June 2022, but it is likely to take up to two years for inflation to return to the 2% target. As the decline in inflation is taking place without a subsequent decline in employment there are glimmers of hope that in the US a "softer landing" may be achieved. A less aggressive FED or even a FED pivot in 2023 should prove to be bullish for asset prices (rates products, equities, corporate bonds). The subsequent impacts upon quantitative tightening and the reduction of central bank balance sheets will continue to dictate the amount of liquidity and the subsequent demand to borrow government bonds as we head into 2023.

Corporate Bonds

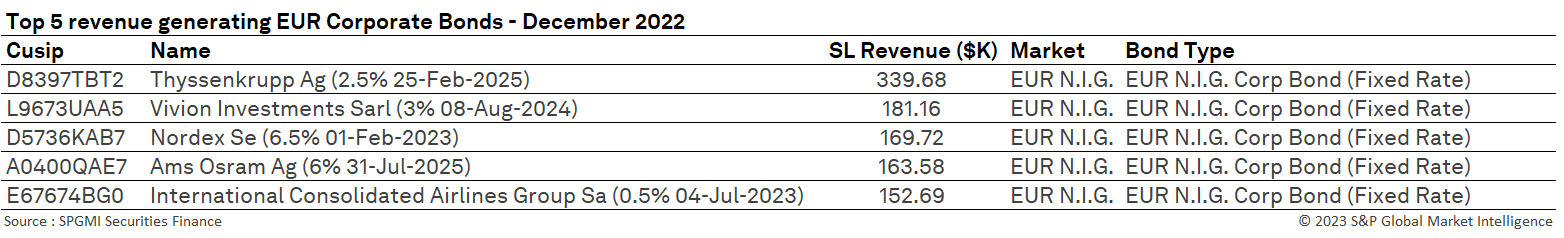

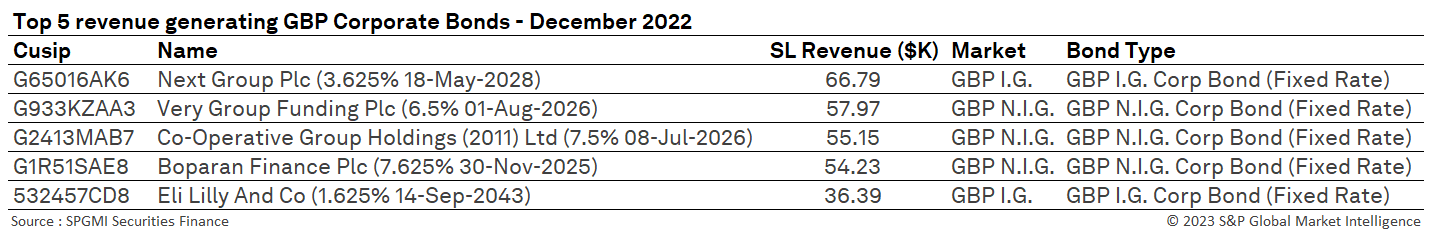

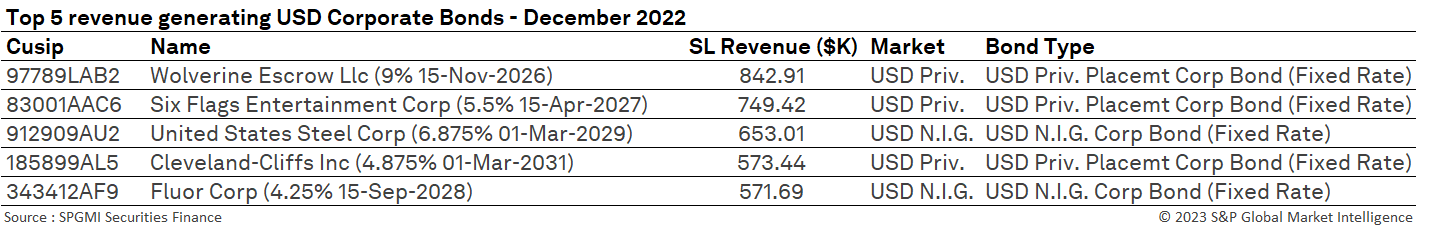

Corporate bonds continued their impressive year, generating $98.64m during December. This was an increase of 58% YoY and 7.7% MoM. Over 2022 this asset class generated $963.1m in securities finance revenues which is the best performance for many years (+82% higher than during 2021). Q4 was the best performing quarter for the asset class, generating $275.8m in revenues (Q1 $204.9m, Q2 $231.6m, Q3 $250.76m).

Average fees for corporate bonds were also significantly higher over both the month (+4%) and the year (+67%). The average fee for corporate bonds increased throughout the year. Average fees for December were 46bps (22bps 2021) and averaged 36bps over the year (22bps 2021) (Q1 29bps, Q2 33bps, Q3 37bps, Q4 43bps).

Corporate bond lending has benefited from a hawkish interest rate environment throughout 2022. As interest rates have increased, asset prices have fallen, providing numerous opportunities for borrows. If inflation rates have started to fall and if interest rate increases slow as a result, then corporate bond borrowing activity could begin to soften. A lot depends upon any looming recessionary periods and whether bonds manage to recover their diversification benefits which have not been present throughout 2022.

Conclusion

The securities finance markets finished 2022 with a bang. December continued the trend experienced throughout the year by generating more than $1bln in revenues over the month. Both Q4 and December revenues pushed 2022 to be one of the highest performing years for market participants. Throughout 2022 the securities finance markets remained well positioned to take advantage of the macro-economic environment and continued to offer liquidity to market participants despite the increased geopolitical risk and structural markets events (such as the Gilt market crash in October). Highlights from 2022 can be seen in corporate and government bond borrowing, US equity specials and ETFs. All these asset classes have outperformed throughout the year pushing revenues higher.

Securities finance remains a key component of any well-functioning financial market and this has been proved throughout 2022. As we move into 2023, securities finance markets will continue to play their role in the broader financial markets. Revenues will be dictated by the economic environment and the impact of interest rates upon both inflation and the health of global economies.

We would like to take this opportunity to thank you for your partnership throughout 2022 and to wish all our readers a very happy new year. We wish you all health and happiness for 2023. For a full round up of 2022 numbers please look out for an invitation to our next webinar which will review the activity seen throughout the year.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.