Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Sep 04, 2024

By Matt Chessum

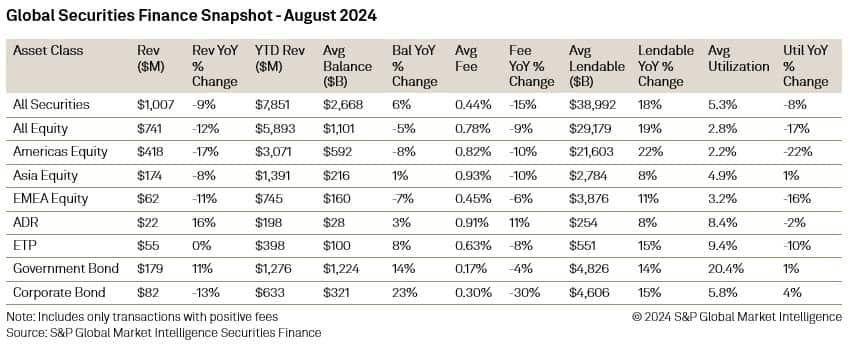

In the securities lending markets, revenues of $1.007B were generated. This represents a 9% decline YoY. Average balances noted a 6% YoY increase across all securities as lendable continued to surge 18% YoY and surpassing $40T for the first time ever on August 27th.

Equity revenues experienced a decline across all regions during the month, decreasing by 12% year-over-year (YoY) across all equities. The most significant YoY decline was observed in Americas equities, which fell by 17%, marking the first instance this year where another region surpassed the YoY decline recorded by EMEA equities, which decreased by 11% YoY. Although a decline was also evident across APAC equity revenues, it was the least severe of all regions, with a reduction of 8% YoY. Average fees were lower YoY across all regions, with fees in the Americas and APAC decreasing by 10%, while EMEA fees fell by 6%. The standout markets across EMEA that helped to raise revenues across the region were France, the UK, and South Africa. Despite an 8% YoY decline, utilization rates increased across all equities during the month, rising to 5.33% from 5.23% in July. Additionally, balances increased by 2% month-over-month (MoM) and by 6% YoY.

In the fixed income markets, government bonds witnessed strong demand during the month which helped to push revenues 11% higher YoY to $179M. This was the highest monthly revenue generated for over two years and was due to a significant increase in balances over the month (+14% YoY and 3% MoM). Average fees also increase during August to 17bps which is the highest level seen since March (18bps).

Corporate bonds also posted their highest revenues of the year so far and their highest monthly revenues since October 2023. Average fees remained constant at 30bps and balances continued to increase, reaching an average of $320.9B. utilization increased as a result to 5.82%, a 2024 high.

August is typically a slower month for global financial markets, but the volatility seen at the beginning of the month showed how quickly investors now react to news flow. A sudden bout of volatility can often lead to increased demand for borrowed securities as investors seek to hedge or capitalize on price movements, resulting in higher borrowing costs. Due to the brief duration of volatility during the month, it appears that utilization increased while fees were slower to respond. Historically, September tends to be a challenging month for stock market performance. Considering the consistent increases observed throughout the year thus far, the securities lending market may have the opportunity to benefit from a shift in this trend.

To find out more, click on the link to download the full report above.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.