Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 27, 2024

By Andrew Harker and Pollyanna De Lima

Companies in the Malaysia, Mexico, Turkey and Vietnam manufacturing PMI® panels were invited to take part in a special reshoring survey in May 2024. Firms offered their insights surrounding the impact of reshoring on order books, their expectations for the year ahead and anticipated challenges. The data were also analysed by detailed sector, region and company workforce size.

In short, the strongest increase in reshoring-related sales (domestic and exports) in the past year was seen in Vietnam, while manufacturers in Mexico and Vietnam were the most bullish about their ability to capitalise on reshoring opportunities over the coming 12 months. In all cases, large firms were most likely to have seen demand improve as a result of reshoring and were most optimistic.

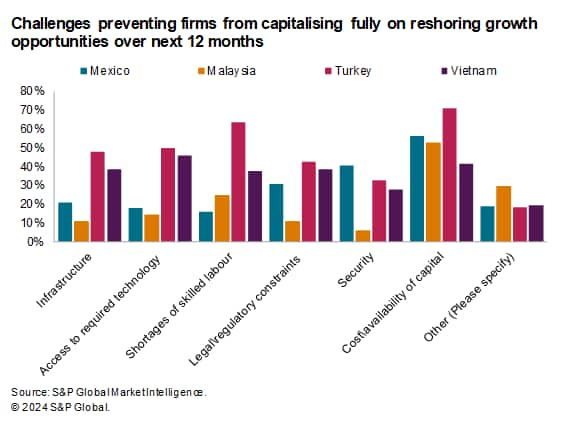

When asked to identify challenges/risks likely to prevent firms from fully capitalising on growth opportunities, manufacturers generally cited the cost/availability of capital as a key obstacle. There were other more specific national issues at play. In Mexico, security was cited as a key hurdle, while in Turkey and Malaysia shortages of skilled labour featured prominently. Vietnamese firms were worried about being able to access the required technology.

Close to two-fifths of manufacturers in Vietnam (37%) signalled that they had seen an improvement in demand over the past 12 months as a result of reshoring, by far the highest of the four countries for which data were collected, where the equivalent figure was around the 20% mark in each case. For Mexico, where this survey was conducted for the second year running, the proportion of companies reporting growth as a result of reshoring was broadly in line with that seen in 2023 (18% in 2024 v 19% in 2023).

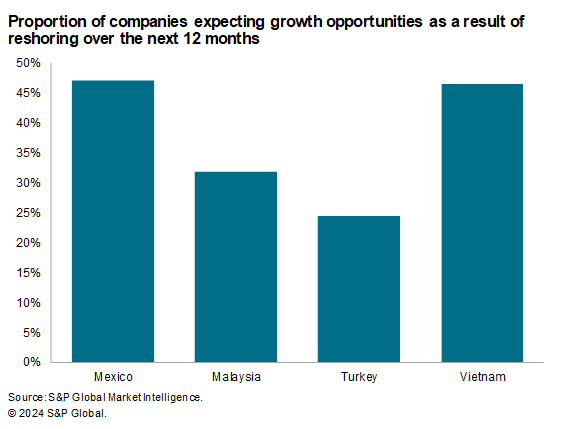

While progress over the past year in Mexico has been less than expected, manufacturers were increasingly optimistic of seeing growth opportunities over the coming year as a result of reshoring. Almost half (47%) of firms in Mexico were optimistic, broadly in line with the figure in Vietnam (46%). Meanwhile, proportions of firms expecting growth linked to reshoring were lower in Malaysia (30%) and Turkey (24%).

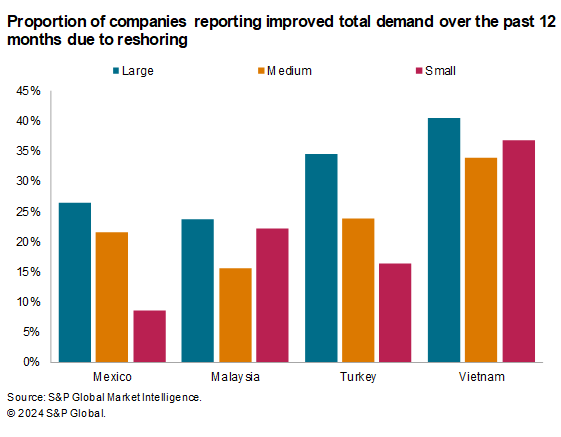

Common across all countries, large manufacturers were more likely to report growth linked to reshoring than small and medium companies. Large firms in Vietnam led the way (40%), just ahead of Turkey (35%). At the other end of the scale, small manufacturers in Mexico were the least likely to report demand improvements due to reshoring, with just 9% of firms responding yes to this question.

Meanwhile, large firms in Mexico were strongly optimistic of gaining from reshoring over the coming year, with close to two-thirds of companies optimistic. This put them just ahead of Vietnam, where 54% of large manufacturers predicted growth over the next 12 months. Again, large firms were more optimistic than SMEs, with the gap particularly stark in Mexico.

When asked to comment on national challenges that might prevent them from fully realising gains from reshoring over the coming year, firms in all four countries highlighted the cost and availability of capital as being one of, if not the most important factor. Leading the way was Turkey, where some 71% of manufacturers indicated that this would pose a challenge, with the equivalent figures just over half in both Mexico and Malaysia.

Turkish manufacturers also widely pointed to shortages of skilled labour as a risk, reported by 64% of firms. In addition, companies also mentioned challenges around inflation and the sourcing of raw materials, particularly imported items.

For Mexico, the second most important national risk was around security (40%), including cargo theft, with other factors including water and power shortages as well as competition from other countries such as Mainland China. International competition was also mentioned by firms in Malaysia and Vietnam.

Vietnam was the only country covered where the cost and availability of capital was not the number one national challenge, although it did come in second place. Here, the top risk was access to required technology, which was reported by 46% of respondents.

In Malaysia, exchange rate fluctuations and labour costs were additional factors cited as potentially providing challenges to benefiting from nearshoring opportunities, while one-quarter of firms also noted the risk of shortages of skilled labour.

Apart from in Mexico, security was not seen as a likely barrier to gains from reshoring elsewhere, with infrastructure also generally coming further down the list of concerns.

---

---

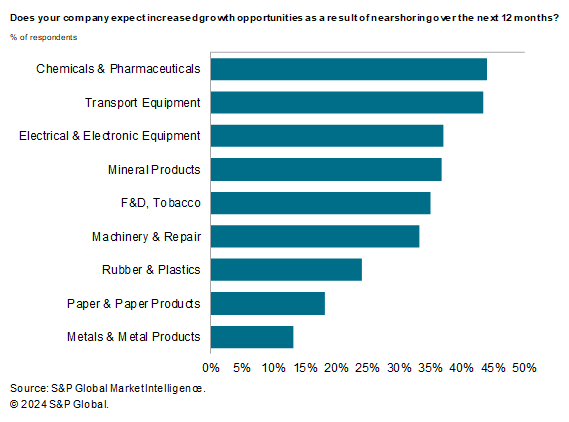

Out of the nine broad areas of the manufacturing industry for which sufficient data were available, Chemicals & Pharmaceuticals achieved the highest position in the rankings for growth opportunities as optimism was signalled by 44% of firms. In second place was Transport Equipment (43%) ― which includes makers of motor vehicles, railway, aircraft and motorcycles. The third spot was shared by Electrical & Electronic Equipment and Mineral Products (both at 37%).

Around 35% of companies in the Food, Beverages & Tobacco segment expect growth opportunities in the year ahead, closely followed by Machinery & Repair (33%). Sentiment was relatively subdued at producers of Metals & Metal Products (13%) and Paper & Paper Products (18%).

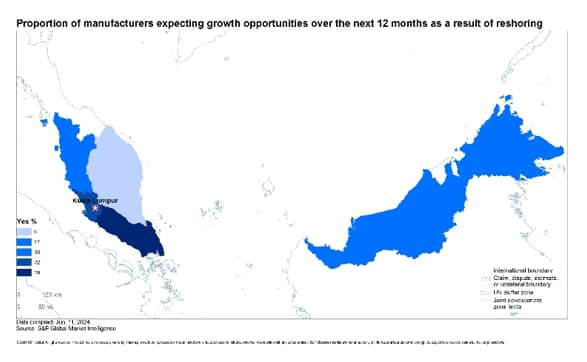

Analysing the data by geographic breakdown, the results highlighted Southern Malaysia as the area with the most upbeat companies regarding reshoring opportunities. Nearly 40% of businesses in Johor, Malacca and Negeri Sembilan indicated positive sentiment. Moreover, looking at whether sales volumes had increased in the past 12 months due to reshoring, close to 30% of firms responded 'Yes'.

The proportion of panellists in the Central (Kuala Lumpur and Selangor) and Northern (Kedah, Penang, Perak and Perlis) areas signalling optimism was broadly similar, with the respective readings at 32% and 30%. When it comes to having already benefited from reshoring in terms of order book volumes, the share of firms reporting growth was equal (17%).

In East Malaysia (Sabah and Sarawak), circa 27% of manufacturers in the PMI panel attributed new order growth in the past 12 months to reshoring. This was higher than the national average of 20%. That said, looking at the outlook ranking scores, the Eastern region came last, with 27% of local businesses expecting reshoring growth opportunities in the year ahead. The sample size for the East Coast (Pahang) was insufficient to generate reliable results.

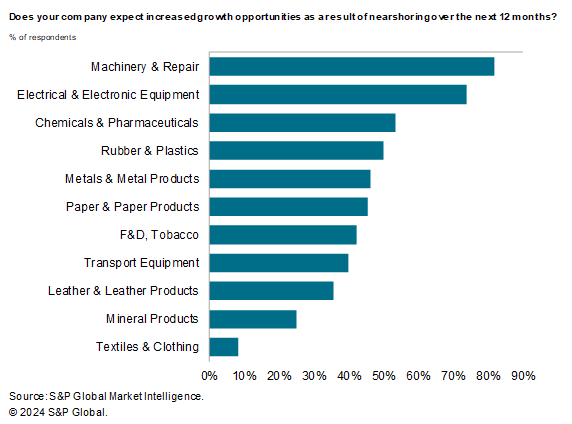

The highest proportion of firms expecting growth opportunities in the year ahead as a result of nearshoring was found in the Machinery & Repair segment (82%). As was the case last year, Electrical & Electronic Equipment came second (74%), followed by Chemicals & Pharmaceuticals (53%). Exactly 40% of companies in the Transport Equipment sector (manufacturers of motor vehicles, railway, aircraft and motorcycles) were upbeat about the outlook for nearshoring, while Textiles & Clothing propped up the rankings (8%).

When it comes to having already benefited from nearshoring trends, the share of firms indicating sales growth over the past 12 months rose in around half of the monitored sub-sectors relative to 2023. Among them were Chemicals & Pharmaceuticals (33%), Mineral Products (25%) and Metals & Metal Products (12%).

The Gulf Coast (Nuevo León, San Luis Potosí, Tamaulipas and Veracruz) saw the largest proportion of companies signalling higher sales in the past 12 months as a result of nearshoring. When assessing potential nearshoring benefits in the coming 12 months, 73% of firms were optimistic.

Around one-in-five panellists in Northern Mexico (Baja California, Baja California Sur, Chihuahua, Coahuila, Durango, Sinaloa and Sonora) indicated that sales rose in the 12 months to May 2024 due to nearshoring, while almost half of all survey participants (46%) foresee nearshoring-related growth opportunities in the year ahead.

Looking at the data for Western Mexico, 42% of firms expect growth. The Central region - which includes Hidalgo, México, Morelos, Puebla, Querétaro and Tlaxcala - came second in the growth opportunities rankings (59%). Meanwhile, 43% of firms in Mexico City were confident that they would benefit from nearshoring in the year ahead. Finally, in East Mexico 53% of companies expect growth opportunities in the year ahead.

Transport Equipment manufacturers have been, and are set to be, the main beneficiaries of reshoring within the manufacturing sector. Some 38% of Transport Equipment firms have seen their demand improve as a result of reshoring, with a similar proportion (35%) expecting increases over the coming year.

Other categories to have seen notable demand growth over the past 12 months due to reshoring included Rubber & Plastics (30%), Paper & Paper Products and Textiles & Clothing (both 25%). At the other end of the scale, the Mineral Products sector (12%) was the least likely to have seen demand improve, just behind Wood & Wood Products (13%) and Chemicals & Pharmaceuticals (14%).

Looking to the prospects for demand over the coming year, the Textiles & Clothing sector came in just behind Transport Equipment as 32% of respondents in the sector predicted increased growth opportunities as a result of reshoring. Around one-third of Rubber & Plastics manufacturers are confident for the coming 12 months, just ahead of the Machinery & Repair category (29%).

Wood & Wood Products firms were the least optimistic for the future, but Mineral Products manufacturers expect to be able to better benefit from reshoring trends over the coming year (19%) versus the situation over the past 12 months (12%).

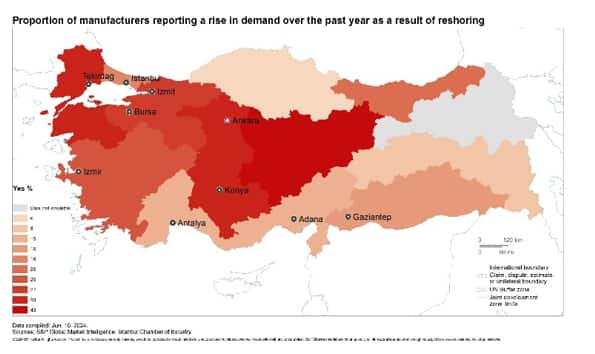

The Central Anatolia region posted the highest proportion of manufacturers reporting an increase in their demand as a result of reshoring over the past 12 months, at 43%. Other areas to outperform the national average were West Anatolia which contains the province of Ankara, and West Marmara (both at 30%). Just behind was East Marmara with 27% of manufacturers there having seen a rise in demand due to reshoring.

Turning to the prospects for the coming year, West Marmara was the top performer as 40% of respondents predicted increased growth opportunities, just ahead of the Central Anatolia region (38%).

Other notable performers included West Anatolia and East Marmara. The West Black Sea (13%) and Central East Anatolia (12%) regions were among the least confident, but the Mediterranean region was also relatively low, scoring just 14%.

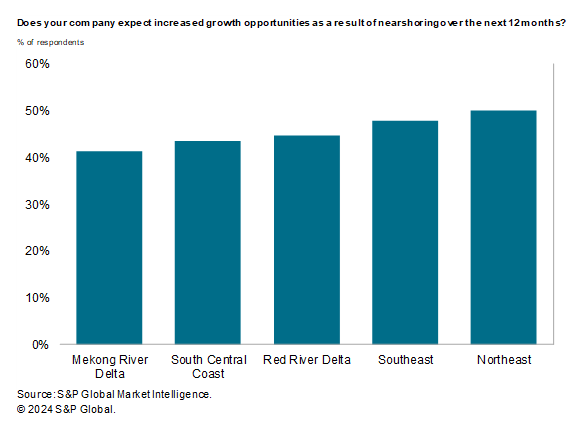

Responses to the special reshoring survey were highly concentrated in the Red River Delta and Southeast regions, which contain the main two Vietnamese cities of Hanoi and Ho Chi Minh City respectively.

Approximately 43% of manufacturers in the Red River Delta region indicated that they had seen an increase in demand as a result of reshoring over the past 12 months. This figure rose to 45% when looking to the future, signalling that firms around the capital Hanoi expect to be able to continue benefiting from reshoring opportunities.

Meanwhile, in the Southeast region (which contains Ho Chi Minh City), just over one-third (36%) of manufacturers have seen an expansion in demand over the past year thanks to reshoring. Firms here, however, were more bullish about the future, with close to half (48%) projecting an improvement over the next 12 months.

Less positive was the picture in the Mekong River Delta, where around one-quarter (24%) of respondents saw demand strengthen as a result of reshoring over the past year, and 41% predict an expansion over the next 12 months.

Looking at the sub-sector performance over the past 12 months, the Machinery & Repair and Transport Equipment categories were the most likely to have seen growth as a result of reshoring, each scoring 54%. Meanwhile, just under half of respondents reported an improvement in demand in the Textiles & Clothing, Metals & Metal Products and Rubber & Plastics sectors.

At the other end of the scale, Chemicals & Pharmaceuticals (21%), Electrical & Electronic Equipment (22%) and Wood & Wood Products (26%) firms were the least likely to report reshoring gains.

Looking to the future, Machinery & Repair companies are extremely confident in their ability to expand based on reshoring opportunities, with some 71% of firms in the sector predicting growth. The reading for Transport Equipment (46%) was below that seen for the question about the past year.

Elsewhere, Rubber & Plastics (59%), Textiles & Clothing (55%) and Metals & Metal Products (54%) were all optimistic in the outlook for reshoring opportunities. Meanwhile, the same categories that have struggled for reshoring-related growth over the past year were the least confident in the potential for improvements in the coming 12 months.

Andrew Harker, Economics Director, S&P Global Market Intelligence

Tel: +44 134 432 8196

Pollyanna De Lima, Principal Economist, S&P Global Market Intelligence

Tel: +44 1491 461 075

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.