Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 10, 2022

The policy direction of the European Union (EU) to facilitate investments in renewables, especially hydrogen, and diversify gas supplies and reduce use of fossil fuels is very likely to be maintained and accelerated by Russia's invasion of Ukraine. REPowerEU is the European Commission's proposed strategy on how to achieve these objectives.

The policy, published on 18 May, aims to accelerate the EU's reduction in energy consumption and to focus on alternative forms of energy, including hydrogen and liquefied natural gas (LNG). EU member states agreed in March that the bloc would cut off Russian fossil fuel supplies before 2030, with the European Commission's indicated target to achieve this being 2027.

The Commission's proposals to achieve this follow previous plans to increase the share of renewables in the EU's energy mix, optimize energy savings, and diversify energy supplies. The European Commission now estimates that EUR210 billion in new investments would be needed until 2027 to achieve these REPowerEU targets.

Among the planned initiatives, which should support more vulnerable EU countries, is a voluntary platform for joint purchase of gas, LNG, and hydrogen. Bulgaria, which had its gas supply cut by Russia's Gazprom in April, has already started work on a joint regional framework for gas purchases.

The Commission put forward the establishment of three hydrogen import corridors via the Mediterranean, the North Sea area, and from Ukraine - when conditions allow this. The EU also proposes establishing a Global European Hydrogen Facility, which would facilitate imports of green hydrogen and incentivize decarbonization initiatives in partner countries, encouraging the production of renewable hydrogen in the EU and partner countries.

The Commission's measures also focus on accelerated development of solar and wind technologies, heat pumps and electrolyzers. The EU's executive body also highlights the need to accelerate the provision of permits for renewable projects spanning areas such as wind energy. This initiative appears designed to benefit projects in countries that have a slow or inconsistent regulatory environment such as Romania and Greece.

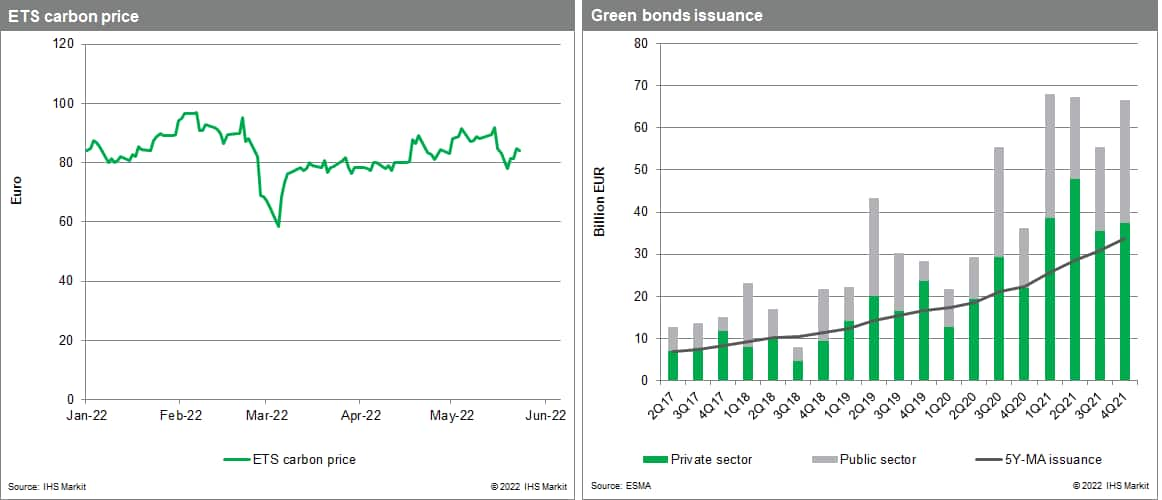

Part of the EU's Innovation Fund would support hydrogen projects via an EU-wide "carbon contracts for difference" scheme and grants. The fund's projected revenues from the auction of emission allowances from the EU's Emissions Trading System (ETS) by 2030 are around EUR38 billion.

On 5 May, 20 companies committed to a tenfold increase of their electrolyzer manufacturing capacities by 2025. The Commission promised a supportive regulatory framework including a legislative proposal for faster award of permits, and collaboration with the European Investment Bank (EIB) to facilitate funding.

The Commission plans to publish guidance on renewable energy and power purchase agreements (PPAs) and a possible guarantee scheme for PPAs relating to the EIB supported PPA-financed renewable energy project in EU member states. The Commission expects to keep its temporary crisis framework for state aid, introduced at the start of the coronavirus disease 2019 (COVID-19) virus pandemic in Europe, "under constant review" in light of the current "geopolitical situation." This strongly suggests that EU state aid rules would not be applied strictly, especially in the energy sector, with the EU more likely to permit state support for policies to diversify energy supplies and deploy more renewables.

The Commission aims to mobilize EUR300 billion (around 1.4% of projected EU GDP in 2022) by 2030 in new investment. A large share of these funds is projected to take the form of loans, or reallocation of grants already earmarked under different EU programs. Member states may be unwilling to request new loans (which would be added to their public debt) given the substantial fiscal shocks already generated by a combination of the pandemic and spillovers from the war in Ukraine.

The private sector is also likely to play a key role in financing the transition. The REPowerEU plan includes measures to encourage member states to use taxation measures to support objectives and remove regulatory barriers to investment. The Commission has also highlighted that it will put forward a flexible instrument to help to mobilize private investment, to be adopted before the end of 2022.

Strong sovereign activity in the Green bond space is also likely to support private issuance. There is evidence that issuance of Green bonds by private firms is highly correlated, with a lag, with issuance of sovereign Green bonds from the same jurisdiction. On this front, the EU expects to issue a total of up to EUR250 billion in Green bonds by 2026 to finance its Next Generation EU program.

There is currently an apparent EU political consensus for accelerating the bloc's energy transition efforts, while public support for investment in renewables and diversification away from Russian fossil fuels also appears strong. Environmental activism and growing public demand will remain important drivers assisting the deployment of renewables and the push to reduce reliance on fossil fuels across the EU. The EU forecasts that the political commitment for the EU's carbon reduction targets and robust demand for "Green" assets from institutional investors will help to offset the negative influence of higher borrowing costs.

Posted 10 June 2022 by Diego Iscaro, Head of Europe and CIS Economics, Insights and Analysis, S&P Global Market Intelligence and

Dijedon Imeri, Senior Analyst, Country Risk, S&P Global Market Intelligence and

Petya Barzilska, Sr. Research Analyst II, Europe & CIS Country Risk, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.