Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 09, 2024

Private sector growth strengthens in South Africa at end of third quarter, as cost pressures cool

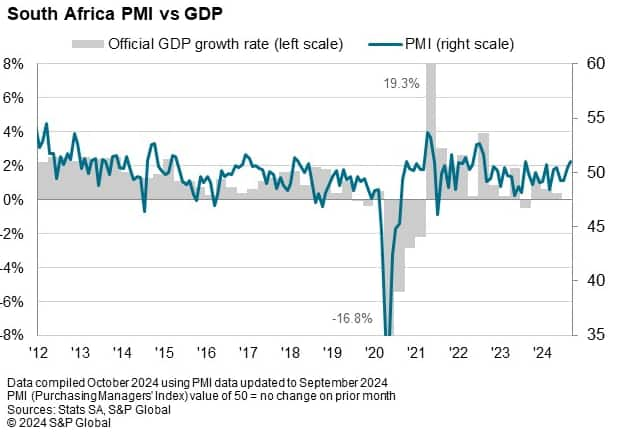

The latest PMI data provided assurance that the South African private sector economy is on the right track, with September seeing growth accelerate to the joint-fastest in over two years. The PMI average for Q3 (50.3) marked the first quarter of improving business conditions since Q4 2022, which is a good indicator of underlying strength in the economy.

Not only did a further improvement in sales give businesses ample reason to increase their output in September, but a marked cooling of input cost inflation also provided hope that macroeconomic trends should become more favourable. The slowdown in price pressures was mainly linked to a surge in the rand against the US dollar, which came amid a sharp US interest rate cut and a stimulus package in China that could boost South African mining exports.

Further positive developments on these fronts could therefore pave the way for cost savings as import prices fall and support a slowing of consumer price inflation. The survey data certainly suggests the latter is already happening, with average selling prices falling for the first time since mid-2020. Price cuts are likely to bolster demand, indicating that the private sector should enjoy a strong end to 2024.

Business activity starts to improve in September

The S&P Global South Africa PMI rose from 50.5 in August to 51.0 in September, and was above the 50.0 neutral threshold for the second month running to signal an improvement in business conditions across the private sector economy. Furthermore, the PMI was at its joint-highest level in over two years (level with August 2023), with 2024 having so far registered only brief and tepid expansions. In fact, the latest findings meant that Q3 2024 marks the first quarter with an average PMI above 50 since Q4 2022.

The recent peak in the PMI coincided with an upturn in private sector business activity in September, the first registered in over a year. Contributors to the PMI survey signalled they had raised activity due to improving customer sales and a more stable economic environment. New work volumes increased for the second consecutive month, which marked the first sustained expansion since mid-2022.

Growth in activity and sales was however focussed on the wholesale and retail sector at the end of the third quarter, where a fall in selling charges helped to strengthen demand. In contrast, the three remaining monitored broad sectors saw total output volumes fall, albeit at broadly milder rates compared to those seen earlier to the year.

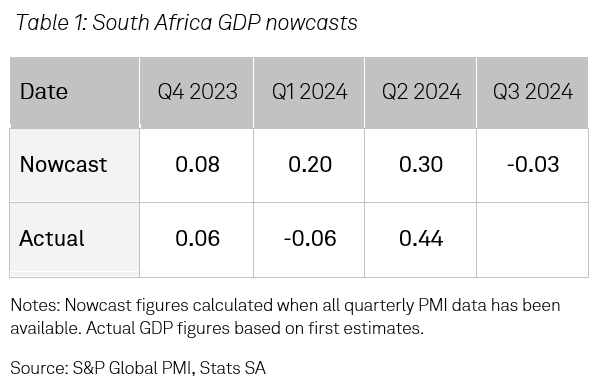

Nowcasting model suggests GDP may stagnate in Q3

One of the key strengths of the PMI is its ability to 'nowcast' key official metrics such as GDP and inflation. This is particularly useful for South Africa where there is a three-month lag time between a reference period and initial estimates of these metrics, as PMI data are released only a few working days after the calendar month surveyed.

Our South Africa nowcasting model combines eight PMI and 13 non-PMI monthly variables to give an estimate of South Africa GDP growth for the respective quarter using the latest available data. A full explanation of the model's methodology can be found in our previous note. When nowcasting GDP growth with the full set of PMI data for that quarter, as well as a handful of non-PMI data points, the model achieved an average error of just 0.14% over the last three quarters.

The latest nowcast, conducted after the release of the September PMI data, indicates that the economy is expected to stagnate in the third quarter of 2024. While this is surprising in the context of the strong PMI figures, a closer analysis shows that only certain parts of the economy are predicted to be a drag, including mining which fell 2.5% in the three months to July, and exports. Other sectors such as services and wholesale & retail are expected to provide a positive effect on GDP.

Selling prices fall as cost pressures ease sharply

The September survey data highlighted a considerable softening of cost pressures at South African firms. Panellists suggested that a strengthening of the rand against the US dollar underlined a cooling of business expenses, mainly through lower import prices. The surge in the rand came as the Federal Reserve cut US interest rates by 50 basis points, which was a greater reduction than the South African Reserve Bank's subsequent decision of a 25 basis point cut. Recent stimulus packages in China also provided some hopes of a boost to South African mining exports, which could help the sector recover from its current malaise.

Consequently, the pace of overall input cost inflation was the slowest recorded in over four years in September, and marginal overall. In fact, barring only three months in the survey history (which began in 2011) where input costs decreased, the latest rise was the joint-weakest on record.

This encouraged firms to put a pause on selling price increases. The seasonally adjusted Output Prices Index dipped just below the 50.0 threshold, showing a fractional decrease in average prices charged for the first time in over four years. By sector, this was driven by services and wholesale & retail, although price hikes in other segments were relatively mild.

The Output Prices Index has tended to be a strong leading indicator of consumer price inflation over its series history, often by up to six months. The latest data therefore suggests that CPI inflation could soften further over the rest of 2024 and into next year, which could support additional interest rate cuts at the Reserve Bank over the coming months. Price reductions are also likely to bolster demand, which should lend a helping hand to business activity in the final quarter.

Business expectations remain strong

Sentiment at South African firms was very positive in September, with expectations towards future activity just a shade weaker than the two-and-a-half year high registered in August. Nearly half of all survey respondents expect output to rise over the next 12 months, much higher than the 2% of respondents who expect a decline. Anecdotal evidence suggested that positive sentiment came from a number of factors, including greater political stability compared to earlier in the year, and a reduction in electricity outages. Stronger market demand was also cited by panellists, as well as hopes that disruption to domestic supply chains from container backlogs at the port of Durban will ease.

David Owen, Economist, S&P Global Market Intelligence

david.owen@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprivate-sector-growth-strengthens-in-south-africa-at-end-of-third-quarter-as-cost-pressures-cool-Oct24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprivate-sector-growth-strengthens-in-south-africa-at-end-of-third-quarter-as-cost-pressures-cool-Oct24.html&text=Private+sector+growth+strengthens+in+South+Africa+at+end+of+third+quarter%2c+as+cost+pressures+cool+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprivate-sector-growth-strengthens-in-south-africa-at-end-of-third-quarter-as-cost-pressures-cool-Oct24.html","enabled":true},{"name":"email","url":"?subject=Private sector growth strengthens in South Africa at end of third quarter, as cost pressures cool | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprivate-sector-growth-strengthens-in-south-africa-at-end-of-third-quarter-as-cost-pressures-cool-Oct24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Private+sector+growth+strengthens+in+South+Africa+at+end+of+third+quarter%2c+as+cost+pressures+cool+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprivate-sector-growth-strengthens-in-south-africa-at-end-of-third-quarter-as-cost-pressures-cool-Oct24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}