Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 07, 2024

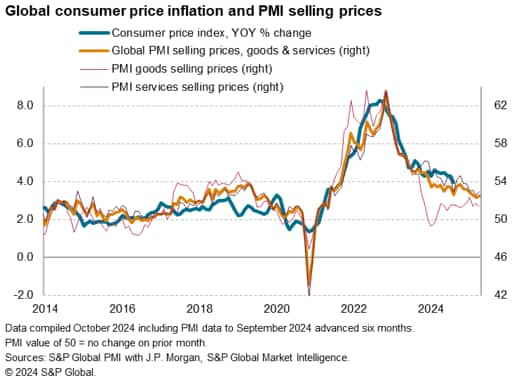

The worldwide PMI surveys showed average prices charged for goods and services rising globally at an increased rate in September. However, the pace remained among the weakest seen over the past four years to suggest that global consumer price inflation remains subdued by recent standards. Regional variances were noteworthy, however. While central bank targets have come into view via the PMI data in the US as well as the UK and eurozone, the former saw an uptick in price growth to serve as a reminder that risks persist in achieving sustainably low inflation.

The latest global PM average prices charged index, at 52.5, was above 52.3 recorded in August. However, August's reading had been the lowest since October 2020, and September's reading was the second-lowest seen over this near-four-year period.

Global inflation was meanwhile estimated at 4.0% in August according to S&P Global Market Intelligence calculations from the latest available national sources, its lowest since September 2021 and following the cooling trend that had been signalled in advance by the PMI. The PMI data - which tend to lead official inflation data by around six months - hint at the rate of increase will moderate closer to 3% in the coming months.

Increased service sector inflation - which has been the main cause of elevated inflation since late-2022 - was the cause of the higher rate of overall selling price inflation in September, though the rise needs to be considered in the context of August's reading having been the lowest since December 2020. Thus, while the rate of services inflation remains above its per-pandemic decade average, it is subdued by recent standards.

Manufacturing selling price inflation meanwhile ticked lower and has now fallen back in line with the pre-pandemic average.

Among the major economies, the US notably reported an increased rate of selling price inflation to the highest since March, driven by increased rates for both goods and services. However, historical comparisons with official rates of inflation, such as core PCE prices, suggest that even the current higher level of the PMI Prices Charged Index is consistent with US inflation remaining close to the FOMC's 2% target, both when compared to annual rates of change and annualised monthly changes in core PCE inflation.

As such, the PMI data support the Fed's shift in focus away from inflation to supporting the labour market, though none the less serves as a reminder that inflation still needs to be watched for a potential uptick.

In the UK, selling price inflation dropped in September to its lowest since February 2021. The further decline brings the PMI prices charged index closer - though still slightly above - the Bank of England's 2% target when compared with official core inflation. Although manufacturing price inflation nudged higher, often linked to supply shortages, services inflation - which has been the main area of elevated inflation in recent months - cooled to a 43-month low in an encouraging sign for the door to be opened for further Bank of England interest rate cuts.

The PMI selling price data meanwhile showed falling inflationary pressures in the eurozone, the index covering charges levied for goods and services dropping to its lowest since February 2021 and down to a level consistent with consumer price inflation falling below the ECB's target. Prices charged for goods fell at the fastest rate for four months and prices levied for services rose at the slowest rate since April 2021.

Elsewhere, the PMI data showed inflationary pressures persisting to a modest but - by historical standards - relatively elevated rate in Japan, while prices fell in mainland China. The latter reflected falls in prices charged for both goods and services, the former dropping at the sharpest rate for six months.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings