Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 05, 2018

Post-season play

Research Signals - September 2018

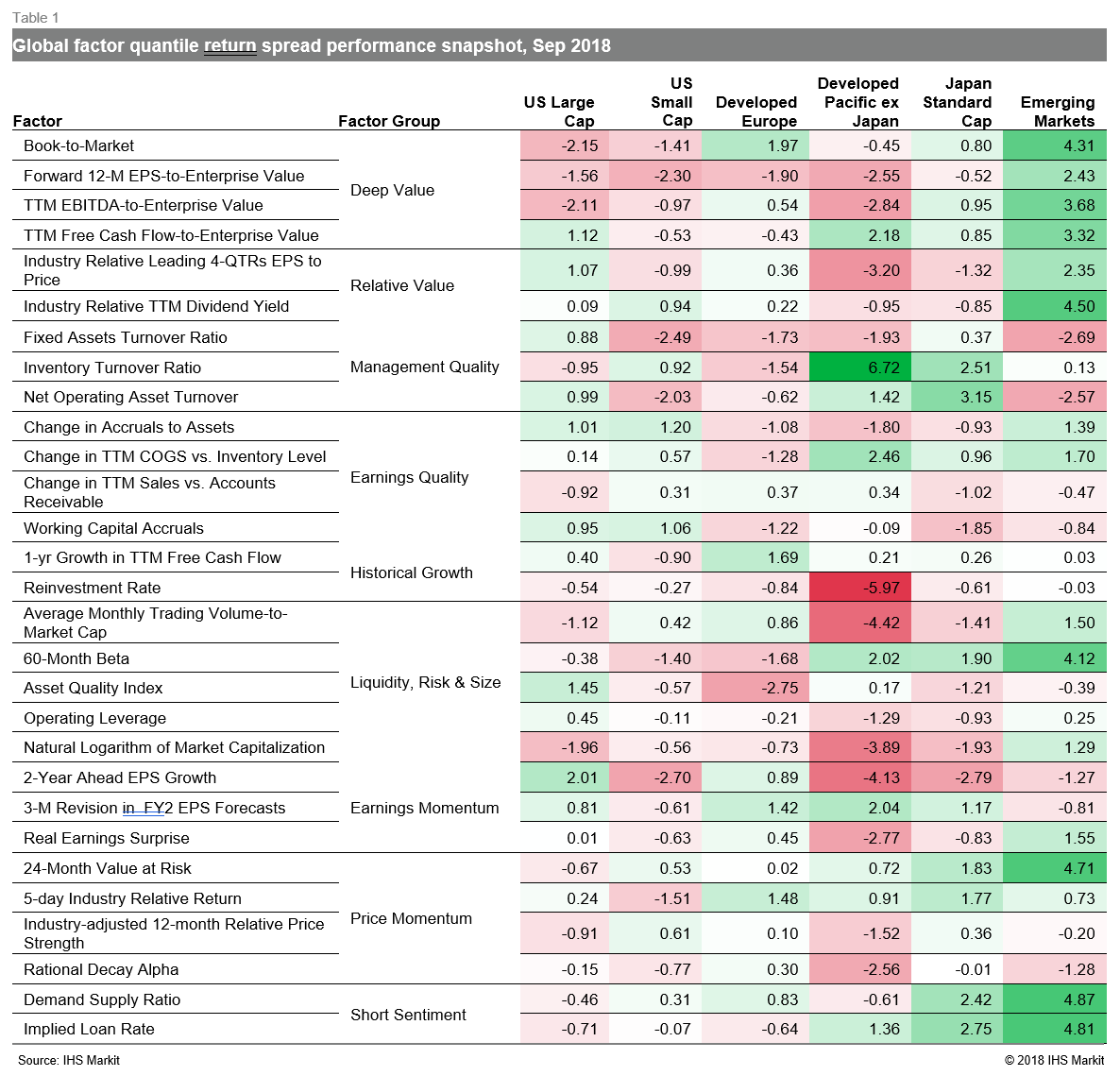

Markets enter the final stretch of the year on the back of lower business optimism globally, according to the J.P.Morgan Global Composite Output Index, which fell to a two-year low in September on especially weak international trade. Factor performance for the month saw an unwinding of the momentum trade in favor of value across many major regional markets (Table 1). Heading into the final quarter of the year, investors hope that trade tariffs and Italian and US politics can follow the lead of the Major League Baseball season as it winds down heading into the home stretch.

- US: The momentum strategy relinquished its winning role and large caps trailed small caps, as confirmed by Rational Decay Alpha and Natural Logarithm of Market Capitalization, respectively

- Developed Europe: Valuation swung from being a strong negative to a positive signal, as demonstrated by Book-to-Market's 7.1 percentage point swing in month-on-month decile spread performance

- Developed Pacific: A bullish Japanese market coincided with outperformance to high momentum names captured by factors such as Industry-adjusted 12-month Relative Price Strength

- Emerging markets: Low valuation and low risk gauged by TTM EBITDA-to-Enterprise Value and 60-Month Beta, respectively, were positive strategies

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpostseason-play.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpostseason-play.html&text=Post-season+play+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpostseason-play.html","enabled":true},{"name":"email","url":"?subject=Post-season play | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpostseason-play.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Post-season+play+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpostseason-play.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}