Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 02, 2018

Philippines manufacturing growth slows as new taxes curb demand

- Manufacturing PMI drops to 50.8 in February from 51.7 in January, joint-second lowest in survey history

- Firms cut staff numbers

- Inflationary pressures intensify

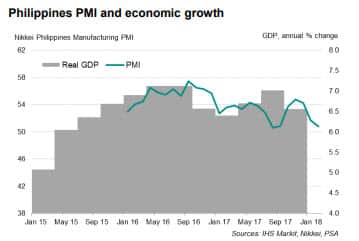

Growth in the Philippines manufacturing economy suffered a further loss of momentum during February, according to the Nikkei PMI surveys, setting the sector on course for its weakest quarterly expansion in the survey’s history.

Tax reforms still limit demand

The headline Nikkei Philippines Manufacturing PMI™ slipped to 50.8, down from 51.7 in January, signalling only a marginal improvement in the health of the sector. The average PMI reading so far for the first quarter is the lowest since the survey began in January 2016. Survey data suggested the new excise taxes, which were implemented at the start of the year, have acted as a brake on demand. While growth in output and new orders picked up from the lows in January, their rates of increase remained well below historical averages. Export sales also weakened further.

The labour market also showed signs of deteriorating. After four months of job gains, staff numbers fell in February, dropping at the steepest pace in the survey history. The persistent lack of capacity pressure, as indicated by declining backlogs of work, was reported to have weighed on hiring.

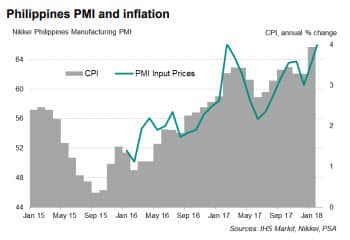

Tighter squeeze on margins

However, of particular concern was a tighter squeeze on profit margins, as inflationary pressures built rapidly to survey-record rates. There were reports of staff layoffs as part of firms’ efforts to reduce costs. Firms continued to blame higher excise tax rates and increased commodity prices, in particular oil, plastics and paper, for the sharp cost increase. A weaker peso also exacerbated the impact of higher import costs.

Monetary policy

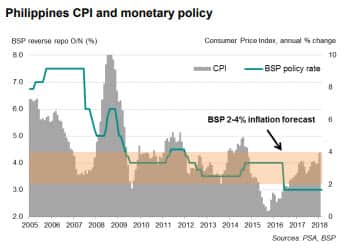

While the influence of tax reforms is expected to fade in coming months, price pressures could still become more entrenched on the back of rising imported inflation, which will add to calls for the Bangko Sentral ng Pilipinas (BSP) to raise interest rates.

At 4%, the official consumer price index hit its highest level for over three years in January, driven up by new excise taxes and increased fuel prices. However, BSP governor Nestor Espenilla commented in a recent policy meeting that, while headline inflation is likely to break above the 2-4% range target in 2018, more evidence of rising core price trends is necessary before deciding to tighten policy.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-manufacturing-growth-slows-as-new-taxes-curb-demand.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-manufacturing-growth-slows-as-new-taxes-curb-demand.html&text=Philippines+manufacturing+growth+slows+as+new+taxes+curb+demand","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-manufacturing-growth-slows-as-new-taxes-curb-demand.html","enabled":true},{"name":"email","url":"?subject=Philippines manufacturing growth slows as new taxes curb demand&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-manufacturing-growth-slows-as-new-taxes-curb-demand.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Philippines+manufacturing+growth+slows+as+new+taxes+curb+demand http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-manufacturing-growth-slows-as-new-taxes-curb-demand.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}