Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 17, 2020

Pandemic premiums: Estimating country risk

A key metric informing investment decisions are country risk premiums (CRP): the additional returns a project must generate to cover the risks arising from its particular operating environment. Commonly used sovereign risk indicators are misleading proxies for these risks. Consider, the sovereign ratings of the UK next to uncertainties of its operating environment given Brexit; the structural fiscal deficit of India next to the financial strength of major Indian companies; or the creditworthiness of the Chinese sovereign next to the recent defaults of major state-owned enterprises.

Our Country Risk Investment Model (CRIM) integrates the full spectrum of commercially relevant political, economic, legal, tax, operational, and security risks and models their impact on future cash flows by sector, and by project phase (development, production, and income). This results in a more accurate and actionable forecast of future cash flows allowing for more precise valuation and comparison of potential investments in a single country, across sectors, across a region, and/or around the world.

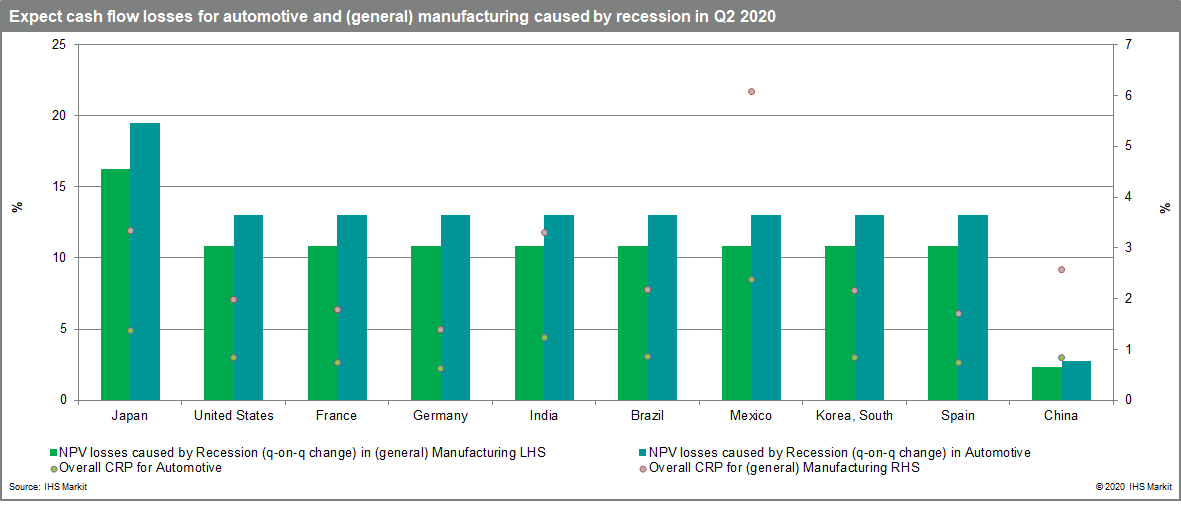

Recession premiums: Automotive and manufacturing

COVID-19 has had a large impact on automobile production, having been affected both on the supply side by national lockdowns and supply chain disruptions, and by the collapse in demand. National recessions around the world were inevitable and drove the greatest expected cash flow losses due to country risk (adjusting the net present value of a hypothetical 25-year for political, economic, legal, tax, operating, and security risks). The losses associated with a reduction in sales caused by economic slowdown is derived from our 'recession' risk score. Positively, CRIM calculated that CRPs recovered strongly overall in Q3 and broadly converged to pre-COVID-19 levels in Q4.

However, automotive revenues were already affected by policy and regulatory risk factors in major markets prior to the COVID-19 pandemic, such as trade disputes between the US and China, finalisation of the United States-Mexico-Canada Agreement, and continued uncertainty around the future trading relationship between the UK and European Union. The impact of COVID-19 was particularly acute for the automotive sector, to which IHS Markit assigns a higher Weighted Average Cost of Capital (WACC) than for general manufacturing given the sector's greater volatility in the global economy, such as the potential for disruption to automotive companies' highly interconnected and dependent 'just in time' supply chains.

Light vehicle production was severely disrupted as major auto plants across Europe shutdown from March-May and vehicle dealers and showrooms remained closed due to the imposition of COVID-19-related restrictions. Consequently, the automotive sector recorded a larger increase in total expected cash flow losses (USD112.9 million over the project's life cycle) than general manufacturing (USD105.6 million) across the top 10 automobile producers in Q2 given the deeper and longer-lasting impact of recessions on this sector.

Country risk fundamentals

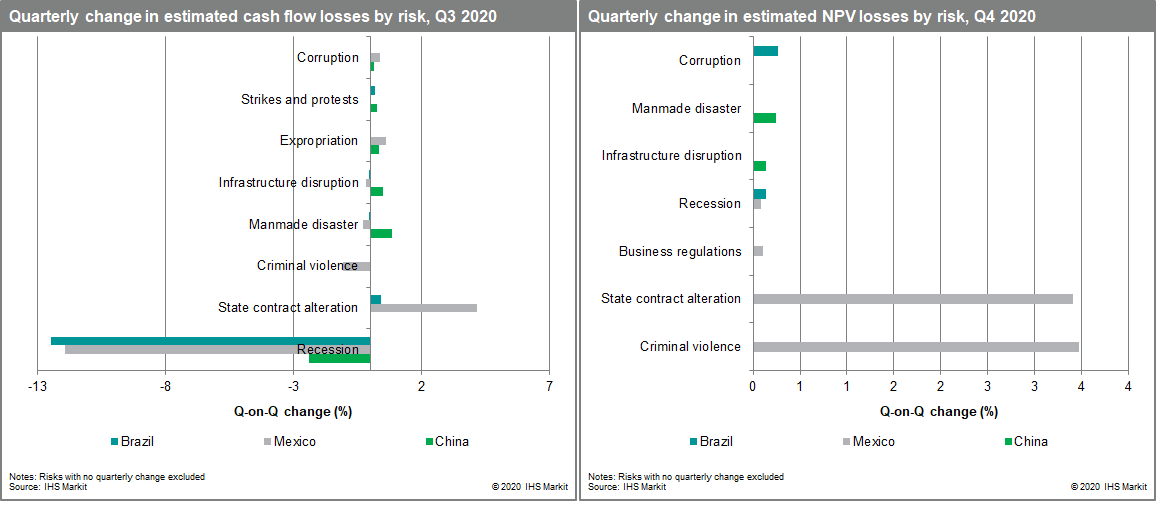

Expected cash flow losses cannot be fully accounted for by a recession-induced reduction in sales. While other automotive producers converged to pre-COVID-19 levels in Q4, Mexico's CRP increased by 1.55% (q-on-q) and 0.88% (q-on-q) for the automotive and manufacturing sectors respectively.

Cash flow losses for Mexico's automotive sector remained elevated into Q4 2020 despite recession-induces losses beginning to subside. This is primarily because President Andrés Manuel López Obrador's support for cancelling electricity and natural resource contracts, advancing contract renegotiations to support state-owned over private companies, and the role of local referenda in forcing contract alterations for projects facing community opposition, have all increased state contract alteration risks. Consequently, estimated losses stemming from contract alteration increased from USD12.79 million in Q3 to USD16.2 million in Q4.

Sovereign misperceptions

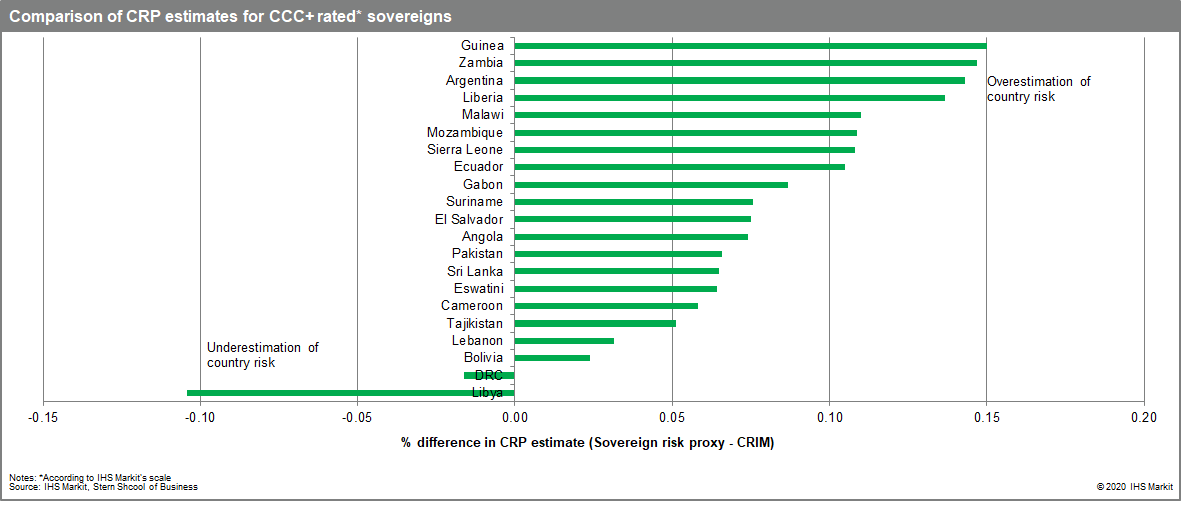

Market-based approaches to calculating country risk tend to miss such commercially significant risks and over-emphasise sovereign default and market volatility. Typical approaches to calculating country risk premiums use government bond and credit default swap spreads, in addition to factoring in equity market volatility. This method is especially problematic in the context of emerging and frontier markets, where credit fundamentals do not necessarily reflect the health of the real economy or the full range of risks that impact project cash flows, such as criminal violence, strikes and protests, and state contract alteration.

Miscalculating country risk in frontier markets

Across the 27 MSCI-classified frontier markets (excluding Benin), using a sovereign risk proxy results in the overestimation of CRPs for 26 countries by 4.24 percentage points on average.

To take one example, a market-based approach undervalues cash flow losses for automobile projects in Mexico by 5.56% compared to the CRP calculated by CRIM. Despite Mexico having a comparatively strong sovereign credit rating (rated at 30 on IHS Markit's scale), this rating does not account for the combined risks of criminal violence, strikes and protests, and state contract alteration - all of which would require a higher estimated return of investment to compensate for any potential cash flow losses.

Download our Country Risk Premium scores and special report to see for yourself.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpandemic-premiums-estimating-country-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpandemic-premiums-estimating-country-risk.html&text=Pandemic+premiums%3a+Estimating+country+risk+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpandemic-premiums-estimating-country-risk.html","enabled":true},{"name":"email","url":"?subject=Pandemic premiums: Estimating country risk | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpandemic-premiums-estimating-country-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Pandemic+premiums%3a+Estimating+country+risk+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpandemic-premiums-estimating-country-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}