Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 14, 2022

By Elina Gokh

S&P Global Market Intelligence recently collaborated with Coalition Greenwich to better understand trends in credit investing, particularly in the growing alternative credit market. The research team at Coalition Greenwich spoke with decision-makers at more than 40 investment managers and institutional investors to explore how their credit investment mix is changing, and what their key pain points are around technology and portfolio management.

The results highlighted a continued strong interest in leveraged loans and private debt. The upshot of this trend is increased complexity in investment workflows as more investors grapple with inefficiencies typical of these investments.

Investors lack quality information about some investments

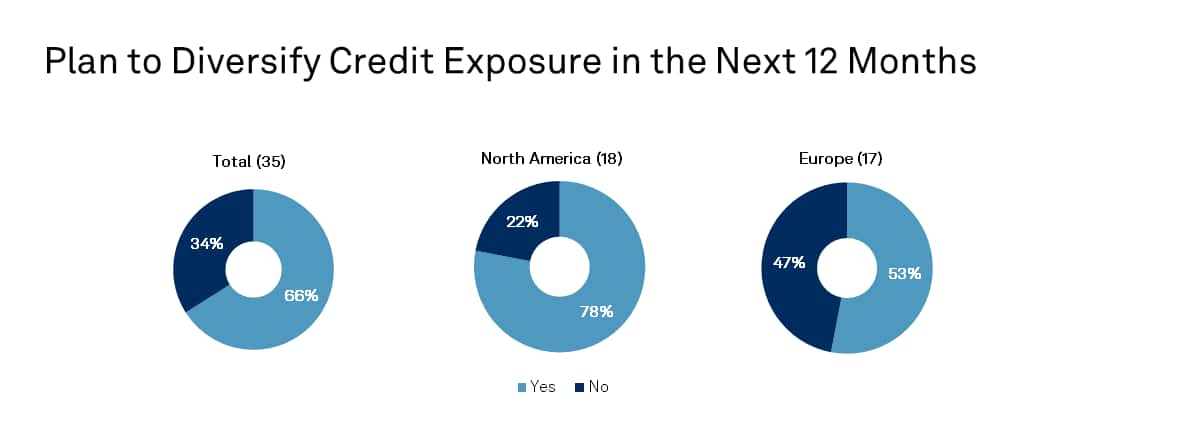

The research reveals that, as fund managers and institutional investors look for returns, more are seeking out senior lending investments across the spectrum of leveraged loans and private debt. Nearly half (46%) of respondents expect to add more private debt to their portfolios. While portfolio managers see many benefits in diversification, it also brings about more operational complexity in monitoring and managing investments.

Lack of good financial data about borrowers is one of the biggest perceived challenges. More than half of the respondents (62%) report that they lack valuable information about their credit investments. Most cobble together data from a variety of sources. The case is especially acute for North American participants, nearly three-quarters (76%) of which report that they lack quality data. Limited access to information creates an incomplete picture that hinders decision-making.

The lack of transparency in loans and private debt is no surprise: this section of the credit market woefully lags behind exchanged-traded markets. Despite the industry's best efforts to streamline and digitize, some credit instruments are still "paper-based." As portfolios become more complex, portfolio managers and traders are seeking more robust solutions that reduce their reliance on manual processes and enable them to manage their data more efficiently.

Complexity highlights the importance of expertise

The complexity of these assets elevates the risks and costs of administering and managing them. Yet, even among the biggest platforms, no single provider excels in every function. The same is true with functionality, with the best solutions for post-trade processing, risk management and trade execution rarely on a single system.

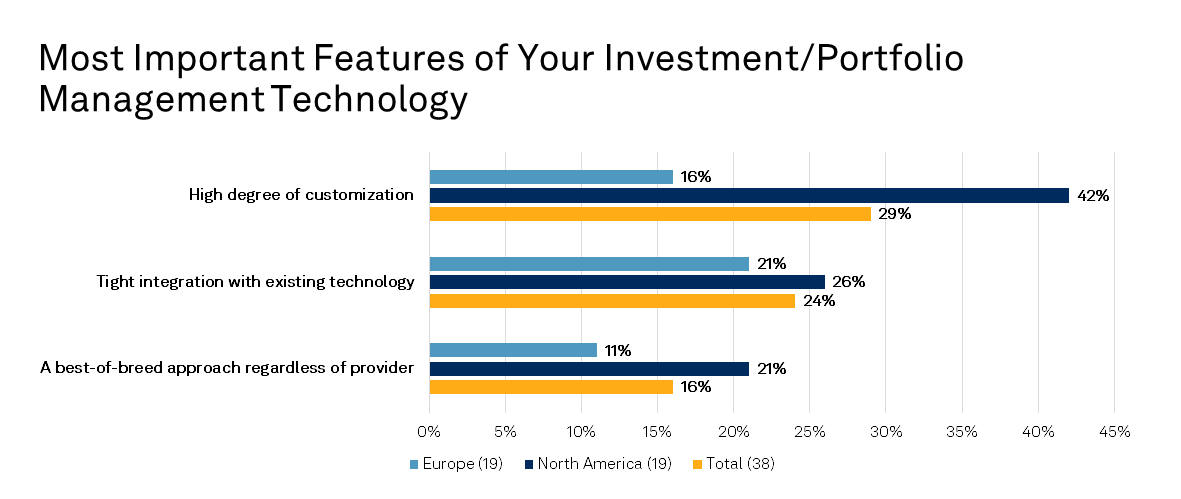

Credit expertise matters more than ever in these complicated markets, as evidenced by the respondents' ranking of a "best of breed approach" among the top three most important features of their investment platform. As the research indicates, one-stop-shop vendor hasn't proved to be a reality. The results further underscore the value of specialists who understand these instruments and are able to customize and integrate relevant data with their existing technology ecosystem.

Solving the markets' tech and behavioral problems

As little as five years ago, many firms thought of cloud-based portfolio management technology as a "non-starter" because of concerns about security, the need to have 'full control', and in some jurisdictions, signatures on paper documents were still being used in settling secondary loan transactions. As more investment flows into different areas of the credit market, we will likely see more positive pressure to build efficient, repeatable processes and toward reducing highly bespoke systems or customizations.

Among the issues that respondents find most frustrating in managing credit are the lack of tech integration and automation with the investment analysis and operations, cited by 29% of respondents, and the difficulty of gathering and normalizing data (26%). There is high demand for further automation; in the words of one interviewee, there is a keen need to "spend less time doing reports and data collection and more time talking to clients." While the respondents were concentrated in portfolio management and trading roles, these themes ring true throughout all stages of the credit investment workflow.

These industry problems require careful thought and tangible, measurable progress to untangle. We have built our business around solving our clients' complex problems through collaborative engagement with industry participants, providers and regulators. We are thrilled to lead in this journey that will undoubtedly continue to inspire the evolution, transparency and efficiency that drives operational alpha and asset class liquidity.

Read the full research

Learn more about the research and download the full results here.

Learn more about our solutions

Our deep knowledge and decades of experience simplify credit investing with integrated, front-to-back technology solutions and managed services affording access to portfolio insights, workflow automation, and deal administration for diversified credit portfolios, CLOs, syndicated and leveraged loans. Our solutions support credit research and analysis, connectivity, trade settlement, asset management and portfolio administration. Learn more about our credit portfolio management solutions.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.