Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 24, 2018

Most shorted global equities ahead of earnings

- IRBT most shorted equity reporting this week

- Shorts get stung in Hasbro, await Mattel on Weds

- Crypto-shorts hanging around in Monex

US:

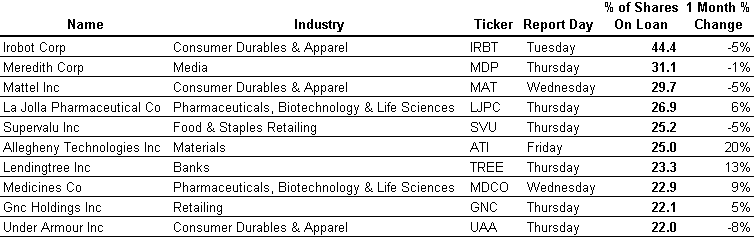

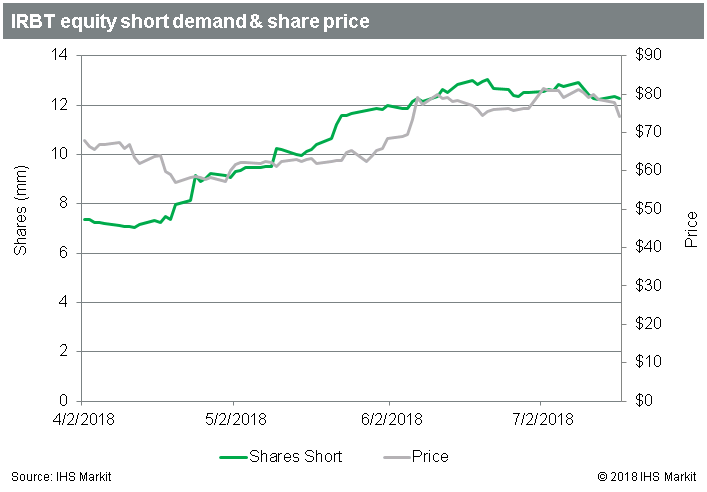

The most shorted US equity reporting earnings this week is iRobot, which has a massive 44% of shares outstanding short. The short demand has declined on the margin, with just over 500k borrowed shares being returned in the last month. With that said, the current 12.2m shares is up 50% from the robotics firm's Q1 earnings report on April 24th.

The IRBT Q1 earnings came in better than expected on top line and earnings, and while the shares initially sold off 3.4%, they've rallied more than 25% since. Consensus EPS for Q2 stands at $0.18 per Factset, and with the shares well off the YTD low and short interest only slightly below 52-wk high, there is clearly a divergence of opinions in the market. The IHS Markit Research Signals Short Squeeze Model is suggesting an elevated risk of a short squeeze, with more than 95% of short positions currently out of the money.

Mattel is third on the list, with 29% of outstanding shares short. Short sellers hoping that the Toys 'R' US hangover would extend to the US toymakers got a jolt on Monday in the form of Hasbro shares surging 12% after substantially beating analyst expectations for Q1 revenues and earnings. Since mid-June the Mattel shorts have trimmed the position by 9m shares, or 3% of shares outstanding, while the shares sold off 9% through the close on Friday, though they recovered nearly 4% of that today.

Europe:

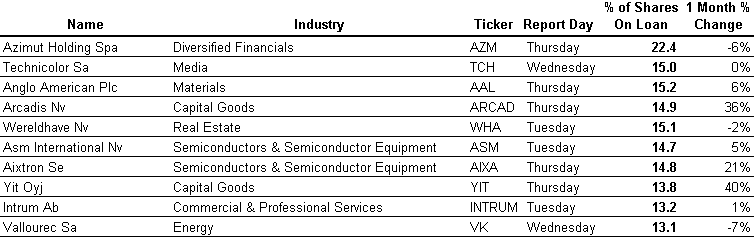

The most shorted European stock reporting earnings this week is Azimut Holding Spa, with 22.4% of outstanding shares short. The share price of the Italian asset management and financial services advisory firm has declined by 18% since they reported Q1 earnings on May 10th. In response, short sellers have increased short positioning 17.6m shares, or 15% of shares outstanding. Short interest peaked in mid-June at 24.3% of shares outstanding and has since declined on the margin while the share price has stabilized in the low teens.

Asia:

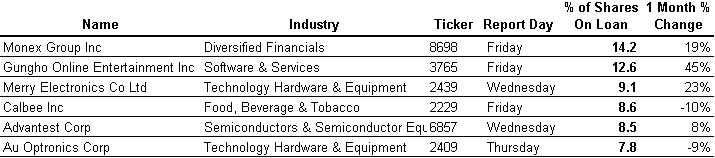

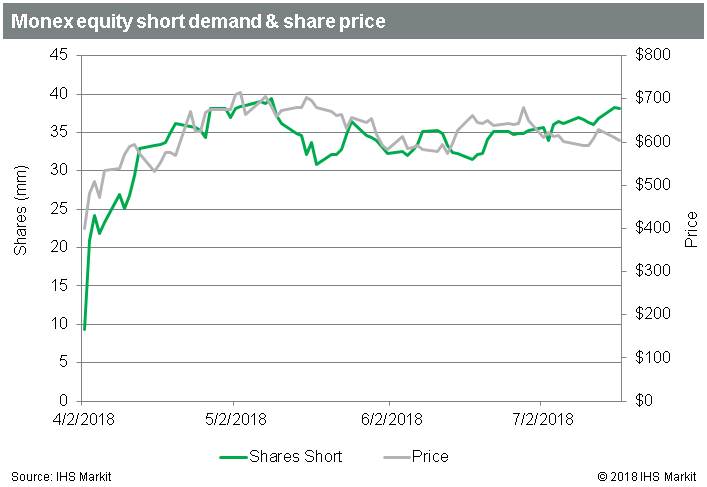

Cryptocurrency firm Monex is the most shorted Asia stock reporting earnings this week, with 14.2% of outstanding shares short. While the share price doubled from April 2nd to May 8th, short sellers increased positions from 3% of shares outstanding to over 14%. Since mid-May, the price has declined by 15%, with short sellers initially covering before bringing the position back above 14% in early July. While shorts may have hoped for a quick win as some of the shine has come off the cryptocurrency space, they've stuck around in Monex despite shares trading up and down in a range since the start of June.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmost-shorted-global-equities-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmost-shorted-global-equities-ahead-of-earnings.html&text=Most+shorted+global+equities+ahead+of+earnings+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmost-shorted-global-equities-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted global equities ahead of earnings | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmost-shorted-global-equities-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+global+equities+ahead+of+earnings+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmost-shorted-global-equities-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}