Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 13, 2024

By Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

The global economic expansion picked up pace in August but the upturn became entirely services-driven as manufacturing output edged into decline. Meanwhile price pressures eased on the back of falling cost inflation, boding well for the lowering of global interest rates in the coming months.

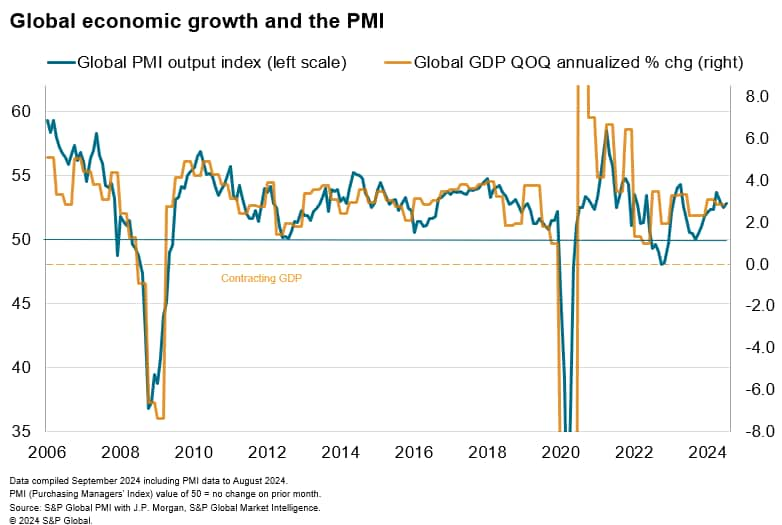

The J.P.Morgan Global PMI Composite Output Index - produced by S&P Global - registered 52.8 in September, up from 52.5 in August. The latest reading marked a first acceleration in growth rate in three months and is broadly indicative of the global economy growing at an annualized rate of 2.9% in August. This compares with an average growth rate of 3.1% in the decade prior to the pandemic.

The latest global economic expansion was uneven, however, with services activity growth accelerating to a three-month high while manufacturing output fell fractionally. Softening demand, underpinned by deteriorating trade conditions and renewed destocking among goods producers, affected manufacturing production midway through the third quarter of 2024. Worryingly, manufacturing downturns have historically tended to lead a worsening performance in the broader services economy. However, improvements in the banking sector - which we have observed in August - also bring hope of a turnaround for the goods producing sector as financial conditions continue to improve.

Crucially, we are widely viewed to be at an inflection point with the Fed set to lower rates from their September meeting and global central banks have generally lowered, or plan to lower interest rates in the months ahead. Further easing of financial conditions is expected to shore up better confidence for businesses in the months ahead, though uncertainty regarding the magnitude of cuts by the Fed and other major central banks remain. August PMI prices data affirmed the easing inflationary pressure picture, and we will continue monitoring this aspect for clues on the path forward.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.