Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 03, 2020

M, not V, shaped factor recovery

Research Signals - May 2020

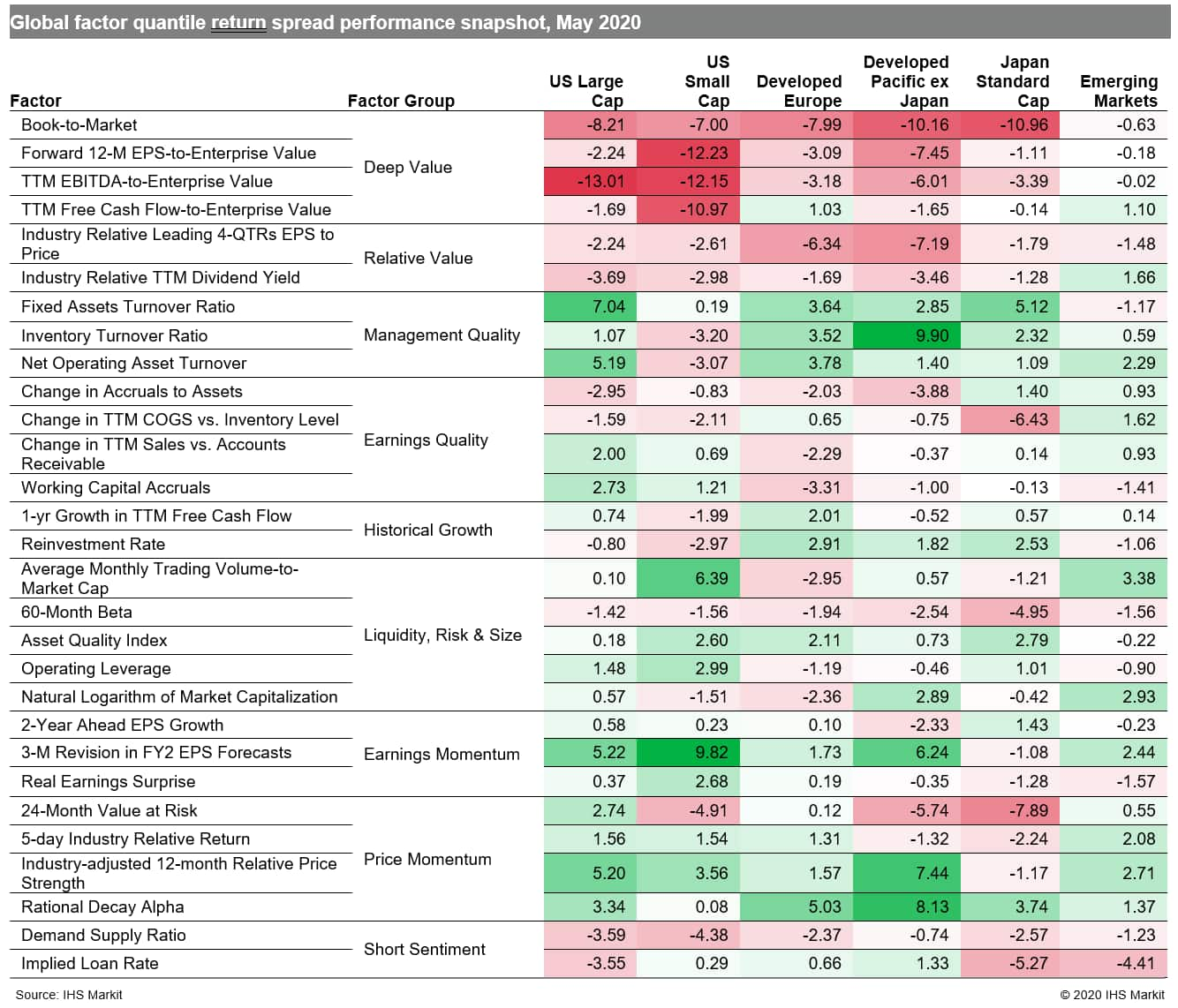

Many letters have been thrown around to describe the anticipated shape of the economic recovery following the COVID-19-induced decline, such as 'V', the most optimistic, 'U', 'W' and 'L', the most pessimistic. Signs that the economic downturn is starting to ease, as seen for example in the slightly softer contraction in J.P.Morgan Global Manufacturing PMI, focus on a second derivative perspective. While the risks and uncertainty remain high on the ultimate shape of the recovery, equity investors took a more positive stance that the worst may be behind us, assigning an 'M' for momentum to their desired trades last month, setting aside a short-lived V(alue)-shaped recovery the prior month, as lockdowns were loosened across many regions (Table 1).

- US: High quality firms, such as those gauged by Fixed Assets Turnover Ratio, joined high momentum names as the top performers among large caps, while small cap investors turned to analyst outlook for guidance from measures such as 3-M Revision in FY2 EPS Forecasts

- Developed Europe: Rational Decay Alpha and Book-to-Market depicted the prevailing theme of momentum factor outperformance at the expense of value, respectively

- Developed Pacific: In markets outside Japan, high risk names continued to outperform throughout the duration of the pandemic, as measured by 24-Month Value at Risk

- Emerging markets: Small caps, captured by Natural Logarithm of Market Capitalization, outperformed alongside high quality and momentum names

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fm-not-v-shaped-factor-recovery.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fm-not-v-shaped-factor-recovery.html&text=M%2c+not+V%2c+shaped+factor+recovery+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fm-not-v-shaped-factor-recovery.html","enabled":true},{"name":"email","url":"?subject=M, not V, shaped factor recovery | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fm-not-v-shaped-factor-recovery.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=M%2c+not+V%2c+shaped+factor+recovery+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fm-not-v-shaped-factor-recovery.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}