Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 02, 2020

Daily Global Market Summary - 2 June 2020

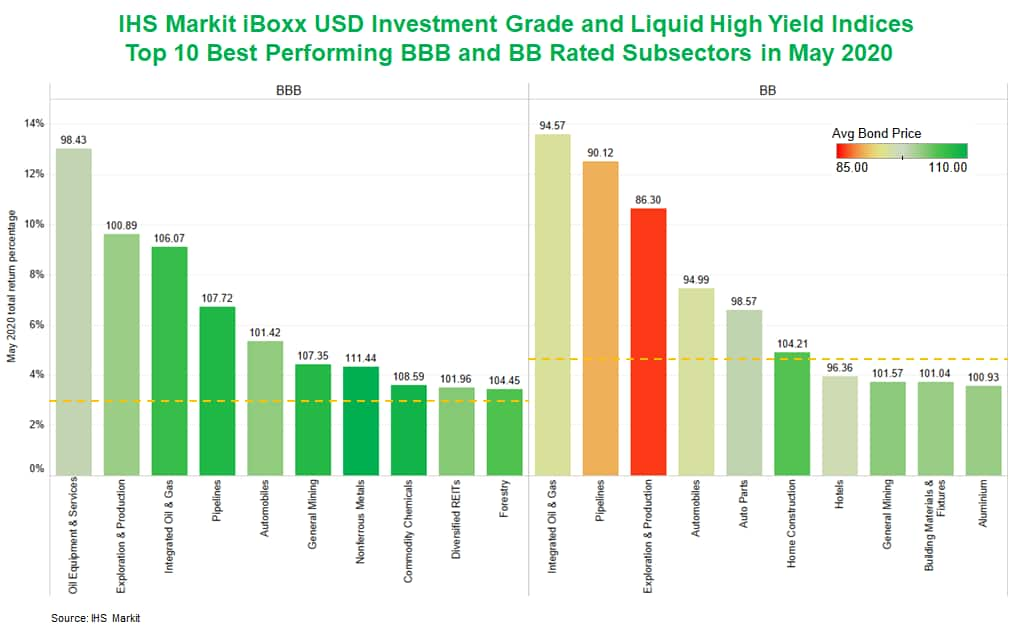

Equity market closed higher across the globe today and credit indices continued to tighten across IG/HY. Oil prices ended the day higher and both Brent and WTI are within striking distance of $40 per barrel, with optimism for the energy sector apparent by the strong performance of US energy debt last month.

Americas

- US equity markets closed higher on the day; DJIA +1.1%, Russell 2000 +0.9%, S&P 500 +0.8%, and Nasdaq +0.6%.

- 10yr US govt bonds closed +3bps/0.69% yield.

- CDX-NAIG closed -3bps/76bps and CDX-NAHY -33bps/483bps.

- Crude oil closed +3.9%/$36.81 per barrel.

- US energy and automotive debt outperformed in May, as indicated

by the month's average total returns across the BBB and BB rated

constituents in the IHS Markit iBoxx USD Investment Grade and

Liquid High Yield Indices. The chart below includes average bond

price by subsector and the yellow dashed line shows the average

total return across the entire rating cohort.

- The percentage of delinquent commercial property loans in the US more than tripled last month, in a sign of a deepening crisis in the $1.3tn market for bonds backed by the mortgages. The 30-day delinquency rate on loans underpinning commercial mortgage-backed securities rose from 2.3% in April to 7.4% in May, according to the data service Trepp. A further 8.6% of mortgages were in that 30-day grace period after missing a payment. (FT)

- The novel COVID-19 pandemic gripping North America caused a

sharp contraction in economic activity and is affecting power

market fundamentals. The extent to which electricity demand and gas

and coal generation are impacted varies by region and depends on

the customer class mix, the timing and stringency of COVID-19

related public health policies, relative fuel prices, and the level

of greenhouse gas free generation. (IHS Markit EnergyView Gas,

Power, Renewables' Samir Nangia)

- Power demand is 4-6% lower in most regions year to date owing to mild first-quarter weather and the COVID-19 pandemic's economic impacts that began in late first quarter.

- Week 21, ending 24 May, suggests that power demand may respond slowly to the easing of commercial and industrial restrictions and that hotter weather can lift demand and make up for lower commercial and industrial load.

- Markets with large shares of industrial load, intense COVID-19 infections, and/or strong public policy responses have shown steep declines in electricity demand.

- Gas generation's year-to-date gains are fading as power demand remains suppressed; coal generation is making up ground in the Electric Reliability Council of Texas (ERCOT) and Southwest Power Pool (SPP).

- The Ohio Power Siting Board has approved the construction of the 20.7 MW Icebreaker project off United States, but with 33 conditions. Conditions include shutting down turbines during nighttime from 1 March to 1 November as a bird and bat risk mitigation measure. According to the project developer, shutting down turbines during nighttime for bulk of the year renders the project economically unviable. Options are being examined to determine if, and how, the project can be progressed. The Icebreaker project, located some 16 km off Cleveland, is planned to comprise six 3.45 MW MHI Vestas turbines. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- Honda, General Motors (GM), and Ford have indicated that they will skip their traditional summer shutdowns at some plants in Canada and the United States, to help make up for lost production related to the coronavirus disease 2019 (COVID-19) pandemic shutdowns, media reports state. According to an Automotive News Canada report, Honda stated, "To provide our dealers with the vehicles they need, all Honda automobile, engine and transmission plants in the U.S. and Canada will run additional scheduled production on June 27 and June 29-30, which had previously been scheduled as downtime." In a separate report, Automotive News cites a GM spokesperson as confirming that most of the automaker's plants will remain open during the weeks of 29 June and 6 July, which had previously been expected to be downtime periods. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Argentine exports of beef, chicken and pork grew by 17% in the

first four months of this year when compared to Jan-April 2020.

While volumes continue to grow however, beef and chicken exporters

will be concerned by recent declines in prices paid by key overseas

customers. Exports of beef, chicken and pork together totaled some

249,223 tons in the Jan-April period - a rise of 36,132 tons on the

same period last year, according to Senasa data. (IHS Markit

Agribusiness' Ana Andrade and Max Green)

- Beef shipments were up 19.5% at 172,000 tons, driven by higher demand from China and Chile, along with the US - a market that only recently opened up to Argentine beef.

- Shipments of chicken meat amounted to 70,251 tons between January and April of this year - an increase of 6% year-on-year. Some 37.5% of the total volume went to China, while other important buyers included South Africa, with 9.4%, Chile, with 8.1% and UAE, with 7.1%.

- However, pork saw the biggest percentage rise - albeit from a lower starting point - with shipments up 176% at 6,684 tons.

- China was again the main destination, buying 61.5% of the total volume, followed by Russia (13.7%), Hong Kong (11.3%) and Angola (5.8%).

- Chile's economic activity monitor declined by the sharpest rate

in over a decade in April. The non-mining sector is being hit

especially hard as services have come to a near-complete halt

during the shutdown measures that have been in place since 22 March

and have been extended to 5 June in some key hotspots, such as the

capital city of Santiago. (IHS Markit Economist Ellie Vorhaben)

- According to data from the Central Bank of Chile (Banco Central de Chile: BCC), the economic activity monitor, a proxy for GDP, declined by 14.1% year on year (y/y) in April; the mining sector contracted by a moderate 0.1%, while the non-mining sector contracted by a sharp 15.5%. Services, retail, construction, and manufacturing declined the most, while education, transportation, restaurants, and entrepreneurial services contracted the sharpest.

- The number of employed individuals has fallen by nearly 770,000 since the beginning of 2020. This led to an unemployment rate of 9% in April, up from a trough of 7% in February 2019. The highest unemployment rates were in the trade, agricultural, and fishing, and industrial manufacturing sectors.

- Chilean copper prices are still roughly 14% below their 2019 year-end average, although in May prices increased to an average of USD2.37 per pound (0.45kg). Copper production has not been heavily affected by the spread of the COVID-19 virus; to date, production levels are down just 2.7% compared with the 2019 average.

- IHS Markit expects the economy to contract by at least 5.1% in 2020 overall. The month of May will almost certainly be equally as bad as, or worse than, April as parts of the country remain under social-distancing and lockdown measures.

- According to Peru's National Institute of Statistics and

Information (Instituto Nacional de Estadística e Informática),

Lima's consumer price index increased by 0.2% month on month during

May. In annual terms, inflation accelerated by 1.8% year on year.

(IHS Markit Economist Claudia Wehbe)

- In a month on month (m/m) comparison, Lima's inflation rate was driven by rising prices in the healthcare category (0.7% m/m) mainly because of higher demand and shortages of some medicines and the food and beverages category (0.6% m/m), which was boosted mainly by price increases in fresh vegetables and a variety of meats that include chicken and meat products.

- Prices of transport and communications category (0.2% m/m) increased in May, although at a slower pace compared with April 2020 prices amid falling gasoline and crude oil prices. Meanwhile, lower prices in domestic liquefied gas pushed electricity and housing rent category (-0.7% m/m) prices downward.

- IHS Markit currently projects inflation at the end of 2020 at slightly above 2.0%, although we are expecting to revise Peru's inflation forecasts during our June forecast round because of signs of deteriorating domestic demand growth amid an economic recession.

Europe/Middle East/ Africa

- European equity markets closed significantly higher across most of the region; Germany +3.8%, Spain +2.6%, Italy +2.4%, France +2.0%, and UK +0.9%.

- 10yr European govt bonds closed higher across the region except for Italy +7bps; Germany/Spain/UK -1bp, and France -2bps.

- iTraxx-Europe closed -4bps/67bps and iTraxx-Xover -25bps/387bps.

- Brent crude closed +3.3%/$39.57 per barrel.

- Qatar Petroleum has signed three separate agreements with DSME,

HHI and SHI to reserve their LNGC construction capacity through

2027 for its future LNGC fleet requirements, including those for

the ongoing expansion projects in the North Field and in the United

States. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- With the agreements, Qatar Petroleum is said to have reserved up to 60% of the global LNGC building capacity through 2027.

- The size of the individual agreements was not disclosed but the concluded agreements for as many as a hundred vessels is understood to amount to USD19.2 billion (KRW23.6 trillion).

- The new vessels will be equipped with the latest generation slow speed dual fuel engines, utilizing LNG as a fuel.

- In April, the company has also reserved Hudong-Zhonghua Shipbuilding's LNGC construction capacity through 2027.

- Qatar is moving ahead with its North Field expansion projects to increase the country's current LNG annual production capacity from 77 million tons to 126 million tons by 2027.

- Despite the extensive job retention scheme, the unemployment

rate is still spiraling up. Indeed, the Office for National

Statistics (ONS) has reported a record rise of 856,500 month on

month (m/m) in unemployment benefit claims, standing at 2.1 million

in April. (IHS Markit Economist Raj Badiani)

- The Chancellor of the Exchequer Rishi Sunak has announced that the Coronavirus Job Retention Scheme (furlough scheme) has been extended for the second time from 1 August to the end of October.

- The scheme allows furloughed employees to receive 80% of their monthly salary up to GBP2,500 (USD3,107) and now covers 8.7 million out of 28 million employees in the United Kingdom. In addition, 1.1 million employers have tapped into the scheme.

- This implies that the scheme will now be operational for eight months at a monthly cost of at least GBP10 billion. The final cost of the scheme could be close to GBP100 billion, or an estimated 5.0% of GDP in 2020. It is a significant contributor to the general government budget deficit widening by a projected 10.4 percentage points to 12.3% of GDP in 2020.

- Italy's passenger car market recorded a fall of 49.6% year on year (y/y) during May, according to the latest data published by the National Association of Foreign Vehicle Makers' Representatives (Unione Nazionale Rappresentanti Autoveicoli Esteri: UNRAE). Demand fell from 197,881 units in May 2019 to 99,711 units. As a result of the steep declines during the past three months, the market's performance in the year to date (YTD) is now down by 50.5% y/y to 451,366 units. Heavier falls came in the Spanish market during May, but it still did better than in April. The latest data published by the Spanish Association of Passenger Car and Truck Manufacturers (Asociación Española de Fabricantes de Automóviles Turismos y Camiones: ANFAC), show that registrations have dropped by 72.7% y/y to 34,337 units. The YTD figures now stand at 257,202 units, a decline of 54.2% y/y. (IHS Markit AutoIntelligence's Ian Fletcher)

- Nissan has announced that it has halted production at its St Petersburg plant from May 29 to June 30 on declining demand in the Russian market as a result of the distancing measures and economic impact resulting from the COVID-19 virus pandemic, according to a Prime-TASS news agency report. The plant only reopened on 18 May after the initial closure in response to the outbreak. Earlier reports said that Nissan planned to reduce the number of employees at the plant in St Petersburg by 25% by August 2020 as around 450 out of 2,000 staff will be laid off. (IHS Markit AutoIntelligence's Tim Urquhart)

- Turkey's three largest state-owned banks - Ziraat, Vakifbank, and Halkbank - announced on Monday (1 June) that they will launch four new low-cost loan packages to aid the recovery from the COVID-19 virus outbreak. Mortgages for first-time home buyers and loans for vehicle purchases, locally manufactured goods, and holiday expenses will all be offered at annual interest rates below prevailing inflation, Daily Sabah reports. Rates on a 15-year mortgage for first-time home buyers will be just 0.64% (around 8% annually) and have a grace period of up to 12 months. A statement released by the banks indicated that they have provided around TRY40 billion (USD5.8 billion) to date in loans to nearly 7 million citizens as part of Turkey's Economic Stability Shield and have allowed customers to delay payments on TRY60-billion worth of loans and credit card debt. (IHS Markit Banking Risk's Alyssa Grzelak)

- Total new vehicle sales in South Africa (as well as Botswana, Lesotho, Namibia, and Swaziland) declined by 68.0% year on year (y/y) to 12,932 units during May, according to figures released by the National Association of Automobile Manufacturers of South Africa (NAAMSA). Sales of passenger cars totalled 9,019 units during May, down by 65.4% y/y, while sales of light commercial vehicles (LCVs), bakkies, and mini-buses declined by 74.8% y/y to 3,073 units. Sales of medium commercial vehicles (MCVs) and heavy commercial vehicles (HCVs) declined by 55.5% y/y and 62.8% y/y to 304 units and 536 units, respectively, last month. Exports stood at 10,819 units, down by 64.1% y/y. South African consumers were already facing difficult conditions with high levels of unemployment, a slowdown in real personal income growth owing to a higher tax burden, a significant electricity deficit, and limited fiscal and monetary policy space to stimulate economic activity. (IHS Markit AutoIntelligence's Nitin Budhiraja)

Asia-Pacific

- APAC equity markets closed higher across the region for a second consecutive day; India +1.6%, Japan +1.2%, Hong Kong/South Korea +1.1%, Australia +0.3%, and China +0.2%.

- According to statistics from financial statements for the first

quarter of 2020 released on 1 June, sales for all of Japan's

industrial sectors, excluding finance and insurance, rose by 1.9%

quarter on quarter (q/q) following a fourth consecutive quarter of

decline, and the year-on-year (y/y) contraction narrowed to 3.5%

from 6.4% in the previous quarter. (IHS Markit Economist Harumi

Taguchi)

- However, ordinary profits fell by 11.6% q/q for a fourth consecutive quarter of decline, and the y/y contraction widened sharply to 32.0%, the steepest y/y contraction since the third quarter of 2009. Ordinary profits decreased for all industry groupings, except for fabricated metal products and business-oriented machinery, and the major contributors to a severe contraction for manufacturing groupings were transport equipment and chemicals.

- Despite sluggish profits and business conditions, investment in plant and equipment (including software) rose by 6.7% q/q, and 4.3% y/y. The unexpectedly solid q/q increase in investment partially reflected the drop-out of negative effects following the consumption tax increase in October 2019 and replacement demand for machinery damaged by natural disasters in the previous quarter.

- A 6.2% y/y rise in non-manufacturing grouping was largely due to increases for the production, transmission, and distribution of electricity, transportation and postal services, and real estate.

- A 0.6% y/y rise for manufacturing industry groupings reflected increases in business-related machinery, electrical machinery, and some other industry groupings, largely offset by drops in transportation machinery and chemical products.

- The strong upswing could be overstated because of fewer responses to the survey (which dropped by nearly 10 percentage points from the average to 61.4%), particularly from small and medium-sized industries, due to difficulties to proceed with accounting under containment measures.

- Tokyo Gas has signed a cooperation agreement with Principle Power, and will invest USD 22 million to fund Principle Power's growth strategy and commercialization of the WindFloat® technology in Japan. The announcement, which creates commercial-scale deployment opportunities for Principle Power's WindFloat® technology in Japan, is expected to strengthen Principle Power's position in the domestic floating offshore wind supply market. Principle Power was recently incorporated in Japan. Tokyo Gas has diversified into power generation over the last few years and has since built a portfolio of renewable energy projects around the world. With a strategic interest in offshore wind, Tokyo Gas hopes to realize commercial scale deployment of floating wind technology through its partnership with Principle Power. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- Mitsubishi Thailand has decided to extend the production suspension at its Laem Chabang I plant until 17 June. The plant will operate on a single shift for the rest of the month. Operations at its Laem Chabang II plant will be suspended from 1 June to 3 June and will be operating on a single shift for the remaining days in June. Meanwhile, production operations at its Laem Chabang III plant will continue only in the day-time shift this month. The automaker also decided that its knocked-down assembly operations will be suspended from 1 June to 7 June. Assembly operations will resume from 8 June to 19 June in a single shift and will be suspended again for the rest of the month. (IHS Markit AutoIntelligence's Jamal Amir)

- According to a notice on the People's Bank of China (PBOC)'s website on 1 June, the central bank has made available CNY400 billion (USD56. billion) to be used as relending purposes. The PBOC will purchase 40% of micro and small loans extended by smaller banks between March and December 2020. The small banks are expected to repurchase these loans after 12 months, and the loans from the central bank will carry 0% interest, but the PBOC will not be taking any credit risk. At the same time, the PBOC is working with the Ministry of Finance to reward small local banks that have extended the moratorium for micro and small loans by rewarding them an equivalent of 1% of the micro and small loan balance. However, no additional information has been provided. (IHS Markit Banking Risk's Angus Lam)

- China announced plans to build Hainan into a free-trade port,

offering favorable tax treatment to facilitate trade and

investment. An unveiled development plan aims to "basically

establish" a free-trade port system by 2025, and make it "more

mature" by 2035. Favorable policies could offer a boost for

Hainan's services investment, yet near-term growth benefits for the

nation as a whole will most likely be limited. China will work to

establish a free-trade port (FTP) in Hainan by 2025, focusing on

trade facilitation and investment liberalization. Tailored laws and

regulations will also be rolled out to promote economic efficiency

while keeping systemic risks under control, according to the

development plan jointly published by the Central Committee of the

Chinese Communist Party (CPC) and the State Council on 1 June. (IHS

Markit Economist Lei Yi)

- "Zero tariffs" will be the key feature for policies related to commodity trade.

- Market access will be significantly widened to facilitate investment. The unveiled plan promised to build an open, transparent, and predictable business environment supported by strengthening intellectual property protection as well as ensuring fairness in competition for all types of market entities.

- Capital account liberalization will be carried out in stages, facilitating cross-border fund flows tailoring to trade and investment needs.

- Favorable tax arrangements will be rolled out gradually to accommodate the development of Hainan FTP.

- Modern industries, including tourism, modern services, and high-tech, will be sectors receiving major policy support. Before 2025, enterprises in these industries registered in Hainan will have their corporate income tax rate exempted for their gains generated from direct overseas investment.

- Changan Ford, Ford's joint venture (JV) with Chongqing Changan Automobile (Changan) is seeking government approval to build a plug-in hybrid model equipped with BYD's batteries, according to a Reuters report citing a document published by the Ministry of Industry and Information Technology (MIIT). It is not clear at this stage whether BYD will supply batteries for Ford's battery electric vehicles (BEVs) in the Chinese market. The US automaker plans to launch at least 30 new models in China by end of 2021, of which 10 will be new energy vehicles. According to information disclosed by MIIT, the Ford Escape PHEV, a plug-in hybrid variant based on the Escape sport utility vehicle (SUV) will feature BYD's battery cells. (IHS Markit AutoIntelligence's Abby Chun Tu)

- BAIC Group has acquired a maximum of 450.8 million shares from Chinese app-based chauffeured car service provider UCAR. This represents a 21.26% stake in UCAR's Hong Kong-listed car rental arm CAR Inc., reports Gasgoo. CAR Inc. stated that this agreement is not legally binding in nature and there is no assurance that a formal agreement will be concluded. In addition, the details of the co-operation between UCAR and BAIC Group are still under negotiation, and the final terms have not been reached, as of the announcement date. BAIC has previously partnered with UCAR to jointly develop custom-built intelligent new energy vehicles (NEVs) for the travel industry. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ratings agency Moody's has downgraded India's long-term foreign

and local currency ratings to Baa3 (or 40 on IHS Markit's numerical

scale) from Baa2, while maintaining a Negative outlook on the

ratings. (IHS Markit Economist Bree Neff)

- The downgrade stems from previously highlighted concerns that India's economic reform agenda has fallen short in boosting the country's economic growth potential for the medium term, and in turn the country's fiscal outlook.

- The agency indicated that the coronavirus disease 2019 (COVID-19) virus pandemic was not the trigger for the downgrade.

- Moody's said that it upgraded India's credit rating in 2017 based on expectations that the reform agenda of Prime Minister Narendra Modi's government would strengthen the country's economic, institutional, and fiscal outlooks. This agenda has fallen short of expectations through weak implementation, and Moody's now expects that real GDP growth will be nearer 6% over the medium term rather than the 8% growth rate that it had previously anticipated in 2017.

- South Korea has released its first-quarter nominal GDP, which

registered KRW1,907 trillion. This equates to about USD1,600

billion, or on a per-capita basis USD31,200 per person. (IHS Markit

Economist Dan Ryan)

- The real growth rate for the first quarter was increased slightly, from -5.5% (quarter-on-quarter annual rate) to -5.0%. The change was mostly due to a smaller decline in the statistical discrepancy.

- Other positive changes to the real components include exports and imports, which both fell substantially but not as much as pre-revision figures, and government consumption, which showed a larger increase than before.

- South Korean automakers posted a 36.3% year-on-year (y/y)

plunge in combined global sales to 423,384 units in May, according

to data released by the five major domestic manufacturers and

reported by the Yonhap News Agency, as compiled by IHS Markit. The

five automakers reported a 9.3% y/y increase in combined domestic

market sales last month to 146,130 units, while their combined

overseas sales nosedived 47.8% y/y to 277,286 units. (IHS Markit

AutoIntelligence's Jamal Amir)

- South Korea's top-selling automaker, Hyundai, posted global sales of 217,510 units in May, down 39.3% y/y. Hyundai's domestic market sales grew by 4.5% y/y to 70,810 units last month, while its overseas sales declined 49.6% y/y to 146,700 units.

- Global sales of Hyundai's affiliate, Kia decreased 32.7% y/y to 160,913 units in May. Kia's domestic sales climbed 19.0% y/y to 51,181 units last month, while its overseas sales fell 44.0% y/y to 109,732 units.

- General Motors (GM) Korea reported a 39.7% y/y decrease in total sales to 24,778 units last month, with domestic sales down 10.9% y/y to 5,993 units and overseas sales down 45.3% y/y to 18,785 units.

- Renault Samsung's sales declined by 16.2% y/y to 11,929 units in May, with domestic sales surging 72.4% y/y to 10,571 units and overseas sales plummeting 83.2% y/y to 1,358 units. The plunge in the automaker's overseas sales was mainly due to the end of production of the Nissan Rogue at Renault Samsung's plant after its contract to produce the model expired in September 2019.

- SsangYong's global sales fell by 31.9% y/y to 8,254 units during May. Last month, the automaker sold 7,575 units in South Korea, down 25.0% y/y, and just 711 units in its overseas markets, a decline of 68.1% y/y.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-june-2020.html&text=Daily+Global+Market+Summary+-+2+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 2 June 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+2+June+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}