Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 01, 2020

Daily Global Market Summary - 1 June 2020

Global equity markets closed higher, with APAC markets performing particularly well. US and European high yield credit indices continue to grind tighter and are hovering near levels last seen in early March. Today's Caixin PMIs for China indicated expansion in May, while the US headline PMI improved a bit versus April but remained well within contraction territory.

Americas

- US equity markets closed higher today; Russell 2000 +0.8%, Nasdaq +0.7%, and DJIA/S&P 500 +0.4%.

- 10yr US govt bonds closed flat/0.66% yield.

- CDX-NAIG closed +1bp/79bps and CDX-NAHY -26bps/516bps.

- Crude oil closed -0.1%/$35.44 per barrel.

- The Congressional Budget Office said it has marked down its 2020-30 forecast for U.S. economic output by a cumulative $15.7 trillion, or 5.3%, relative to its January projections. Adjusted for inflation, the shortfall is estimated at $7.9 trillion, or 3% of cumulative gross domestic product. Most of the gap results from the sharp contraction in economic activity this year, which was unforeseen when the CBO last published its 10-year outlook in January. (WSJ)

- Commodity investors have rushed to profit from a huge glut in the supply of aluminum by buying it up to store and sell for future delivery, reviving memories of the last financial crisis, when millions of tons of the lightweight metal piled up in warehouses. (FT)

- The seasonally adjusted IHS Markit final U.S. Manufacturing

Purchasing Managers' Index (PMI) posted 39.8 in May, up from 36.1

at the start of the second quarter. Although slightly higher than

April's recent low, the latest figure signaled the second-steepest

deterioration in manufacturing operating conditions since April

2009. (IHS Markit Econiomist Chris Williamson)

- New business fell for the third month running. The cancellation and postponement of orders weighed on inflows of new work, according to panel members, with some firms also highlighting a negative impact on client renewals.

- Lower new order volumes led to a further fall in the level of backlogs of work in May amid signs of excess capacity. Despite efforts to adapt using reduced working hours and furloughing staff, firms cut their workforce numbers at the second-quickest rate in over 11 years.

- Output expectations were negative for only the second month since the series began in July 2012, though was not as downbeat as that seen in April.

- Firms and suppliers were placed under greater pressure to reduce prices in May, amid efforts to remain competitive and secure new orders. Input costs and selling prices both fell markedly, with the decline in factory gate charges the sharpest since data collection for the series began in May 2007.

- Total US construction spending fell 2.9% in April from a level

in March that was revised higher. The decline in April was smaller

than expected. (IHS Markit Economists Ben Herzon and Lawrence

Nelson)

- Core construction spending, which bears directly on our GDP tracking, declined 3.5% in April. It, too, was revised higher through March.

- Industry insiders recently reported large declines in activity reflecting a wide array of challenges, including government-ordered cessations of activity, project cancellations, and other disruptions stemming from the COVID-19 pandemic.

- Indeed, payroll employment in the construction industry fell 12.8% in April. A normal historical relationship between construction employment and construction spending would have suggested a 7.6% decline in construction spending; the reported 2.9% decline is four standard deviations above this predicted decline.

- In light of this, we would expect to see downward revisions to April construction data in coming months and further declines in activity going forward.

- Citigroup said financial markets were "way ahead of reality" with tougher times to come, warning corporate clients that they should raise as much money as they could before the pandemic's true cost is factored in by investors. "We definitely feel that the markets are way ahead of reality. We really are telling every client to tap the market if they can because we think the pricing now couldn't get any better," Manolo Falco, investment banking co-head at Citigroup, told the Financial Times. (FT)

- Uber is to introduce a new service that offers rides by the hour with multiple destinations in some US cities, reports Reuters. The new feature allows users to schedule a trip for USD50 per hour for up to seven hours at a time and enter as many as three stops, including the final destination. Beginning on 2 June, hourly bookings will be available in Atlanta, Chicago, Washington, Dallas, Houston, Miami, Orlando, Tampa Bay, Philadelphia, Phoenix, Tacoma, and Seattle. The company plans to extend this service to other US cities in coming weeks. The hourly booking option is already available in several cities in Australia, Africa, Europe, and the Middle East. The aim of the service is to provide for essential trips during the COVID-19 virus pandemic in the United States. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- PTTGC America and Daelim Chemical USA, equal partners in their long-planned PTTDLM petrochemical project in Mead Township, Belmont County, Ohio, have delayed making a final investment decision (FID) on their multi-billion-dollar petrochemical project, originally expected in the middle of 2020. Senior company sources in Bangkok told CW on Monday that the FID is expected to be made either at the end of this year or, more likely, next year and it would take five to six years to complete construction of the facilities. This would take the project's completion date to around 2027-28.

- Altivia Oxide Chemicals (Houston, Texas), an affiliate of Altivia Petrochemicals, today announced that it has acquired KMCO and its associated chemical ethoxylation manufacturing assets at Crosby, Texas. The facilities, located on 160 acres near Houston, include 31 reaction and distillation trains with capacity for ethylene and propylene oxide reactions as well as a broad range of organic reactions including polymerization, neutralization, and condensation. Products include surfactants, lubricant additives, fuel additives, and a variety of ethoxylation- and propoxylation-based intermediates. Its products service the coatings, automotive, fuels and lubricants, and surfactant industries.

- In early May, the minority government of the Liberal Party

announced the Large Employer Emergency Financing Facility (LEEFF),

which would provide bridge financing to large companies in Canada,

including upstream players, hit by the novel COVID-19 virus crisis.

(IHS Markit E&P Terms and Above-Ground Risk's Aliaksandr Chyzh)

- The ruling Liberal Party is likely seeking to leverage the ongoing crisis to accelerate the implementation of its climate-change policies in the oil and gas sector and make government financial assistance more palatable to environmental groups, which remain strongly opposed to any unconditional support for producers amid the oil market crisis.

- The facility will offer loans of at least CAD60 million (USD43 million) to companies with annual revenues over CAD300 million and requires the borrowers to publish annual climate-related financial disclosure reports according to the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD).

- Under the LEEFF's terms, such reports should detail how a company's strategy would contribute to achieving Canada's commitments under the Paris Agreement and the net-zero emissions goal by 2050 - a key climate initiative of the Liberals' governing program.

- In addition, the LEEFF includes restrictions on dividends, share buybacks, and executive compensation, and requires applicants to respect collective bargaining agreements and protect workers' pensions.

- The Brazilian Institute for Geography and Statistics (Instituto

Brasileiro de Geografia e Estatística: IBGE) reported that

seasonally adjusted GDP fell by 1.5% in the first quarter of 2020

compared with October-December 2019 quarter on quarter (q/q). (IHS

Markit Economist Rafael Amiel)

- The economy is now in in a deep recession as most non-essential activities stopped during April and most of May. Production in the all-important automotive sector declined by 99%, almost a complete halt.

- Data for the first quarter of 2020 show that private consumption (down by 2.0% q/q) drove the decline as significant job losses were already recorded in March. Lower interest rates and slightly higher wages did not do much to mitigate the sharp decline in consumption.

- A surprise from the first-quarter report is the sizeable jump in fixed investment (up by 3.5% q/q); this was driven by imports of capital goods, partially offset by sizeable declines in construction and lower production of capital goods by the domestic industry.

- Data for April point to plunging GDP in the second quarter; imports of capitals goods were down by 62% y/y, manufacturing purchasing managers' index (PMI) was at 36 points, while services was at 27 points.

- The outlook for the Brazilian economy is very bleak as for most countries in the world: lockdown measures and social-distancing measures coupled with broken supply chains are damaging production and consumption significantly during the second quarter.

- Colombia's central bank on 29 May voted to cut interest rates from 3.25% to 2.75%; this is the lowest the bank has ever held rates since inflation targeting began in 1999. Very weak demand and falling inflation provide monetary policy space for further cuts in the future. In April, inflation fell to its lowest rate since the middle of 2019, to 3.5%; despite rising food and healthcare costs, a decline in information and communication and transportation costs led to an overall deceleration in inflation. Additionally, inflation expectations are declining as demand weakens, unemployment increases, (reaching 14.6% in April) and productive capacity expands. The central bank states that the Colombian economy could decline by as much as 7%, although it has not published a specific forecast. (IHS Markit Economist Ellie Vorhaben)

Europe/Middle East/ Africa

- European equity markets closed higher across the region; Italy/Spain +1.8%, UK +1.5%, and France +1.4%.

- 10yr European govt bonds closed lower across the region except for Italy -5bps; France/UK +5bps, Germany +4bps, and Spain +1bp.

- iTraxx-Europe closed -2bps/70bps and iTraxx-Xover -17bps/412bps.

- Brent Crude closed +1.3%/$38.32 per barrel.

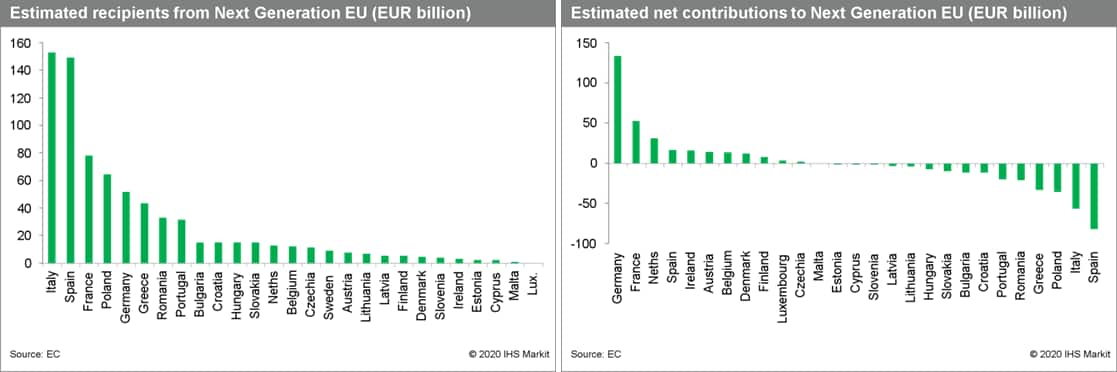

- Recent announcements from the European Commission confirm a

welcome change of approach regarding scale, allocation and funding

but the approval process could be lengthy and challenging. (IHS

Markit Economist Ken Wattret)

- The much-trumpeted additional funding of EUR750 billion is broken down into numerous facilities and purposes. The area of most short-term interest is the new Recovery and Resilience Facility (RRF). This is expected to total EUR560 billion, to be split between grants to EU member states of up to EUR310 billion and loans of up to EUR250 billion.

- Assistance will be available to all EU member states, but will be concentrated on those most affected by the COVID-19 virus crisis and where support is most needed based on a variety of considerations. The European Commission has provided estimates of the net benefit for each member state from the various initiatives, along with their contributions (see first and second charts below).

- The main net recipients would be Italy and Spain, accounting for around 20% each of the total EUR750 billion (see first chart below). They are estimated to receive EUR153 billion and EUR149 billion, respectively, while contributing only around EUR96 billion and EUR67 billion.

- The European Commission will raise money by temporarily lifting its "own resources ceiling" to 2% of EU Gross National Income, using its strong credit rating to borrow EUR750 billion on the financial markets (guaranteed by its member states). This will be repaid over a long period throughout future EU budgets, not before 2028 and by 2058 at the latest.

- The Commission has called for approval by July, which is highly

unlikely with so many different facets to be discussed. The

effective deadline is late 2020 in order to allow sufficient time

for the European and national parliaments to ratify it before 1

January 2021 which is the start date for the EU budget (known as

the Multiannual Financial Framework for 2021-2027).

- The Spanish government is planning support measures for the domestic automotive sector, reports Reuters. Prime Minister Pedro Sanchez told a press conference on Sunday (31 May) that the government plans to agree measures at a forthcoming cabinet meeting designed to improve the domestic industry's competitiveness. He added that this would also include proposals related to tax and labor benefits, as well as ways to boost company liquidity. The planned steps are said to be related to Nissan's announcement that it will close its Barcelona (Spain) vehicle manufacturing facility, as well as component factories at Montcada and Sant Andreu (Spain) by the end of the year. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Finnish economy contracted by 1.1% year on year (y/y) and

0.9% quarter on quarter (q/q) in the first quarter, entering into a

recession, as we expected. The recession looks set to sharply

deepen in the second quarter of 2020, as the impact of the COVID-19

virus is felt in both external and domestic demand. (IHS Markit

Economist Venla Sipilä)

- According to the first, preliminary national accounts results published by Statistics Finland for 2020, the volume of Finland's GDP in the first quarter contracted by 1.1% y/y in calendar-adjusted terms (0.7% adjusted seasonally and for calendar changes), following growth of 0.5% y/y (0.6% y/y adjusted seasonally and for calendar changes) in the fourth quarter of 2019. Seasonally and calendar-adjusted data show a contraction of 0.9% q/q in the first quarter.

- While coming in significantly below the 'flash' estimate - which had suggested calendar adjusted growth of 0.2% y/y, and seasonally adjusted, marginal growth of 0.1% q/q - the latest results confirm that Finland entered into a recession in the first quarter. For now, however, it is still performing better than the European Union on average; according to preliminary Eurostat estimates, total GDP in the EU in the first quarter fell by 2.6% y/y and 3.3% q/q.

- Unsurprisingly, exports of goods and services contracted markedly, with the fall of 8.5% y/y (7.5% y/y in seasonally adjusted terms) caused by a sharp decrease in goods exports. This presents a complete turnaround from the surprising strength still shown in the fourth quarter of 2019.

- Imports also contracted, but by a relatively more moderate pace of around 4% y/y. Goods imports decreased more steeply than service imports.

- Gross fixed capital formation retreated by 1.4% y/y (1.8% seasonally adjusted), thus contracting for the third quarter in a row. Private investments decreased by 3% y/y, while public investments increased by 5% y/y.

- The latest monthly industrial output data suggest that the chemical sector's relative success in the second quarter was partly driven by a surge in demand in March for pharmaceutical industry products, which include cleaning agents and disinfectants. New orders in the chemical industry still managed to grow in March, in contrast to the average fall of 9.3% y/y in manufacturing, the third consecutive monthly y/y fall in orders.

- Turkish GDP increased by 4.5% y/y in the first quarter of 2020

according to data from Turkish Statistical Institute (TurkStat).

Growth in Turkey was resilient compared to the rest of Europe given

the country's delayed actions to implement social distancing and

sustained, expansionary economic policies. Additionally, deep base

effects contributed to the y/y increase, as the third-quarter 2018

lira crisis had reduced the economy significantly in the first

quarter of 2019. (IHS Markit Economist Andrew Birch)

- Economic activity in the second quarter will likely contract sharply. The delayed implementation of anti-pandemic efforts will concentrate the downturn in April and May.

- Leading merchandise trade data for April show that domestic demand has collapsed after the first quarter. After growing by 10.3% y/y in the first quarter, imports plunged by 25.0% y/y in April.

- Leading sentiment indicators further give an indication of the depths to which GDP will be plunging in the second quarter. Although they had begun to dip in March, they plunged in April and only barely began to recover in May. The IHS Markit Purchasing Manager's Index, for example, slipped from 52.4 in February to 48.1 in March, indicating a modest contraction in activity. In April, that indicator dropped all the way to 33.4 in April.

- Similar plunges in confidence were noted in indices measuring consumer, services, retail trade, and construction activity. These indices, updated through May now, showed some recovery, but generally remained deeply pessimistic reflecting sustained, huge losses of activity in May.

- The April trade data also show an acceleration in export losses that will severely undermine demand for production in Turkey. Already having contracted by 18.1% y/y in March, merchandise exports plunged another 41.4% y/y in April as the European-wide lockdown really undermined Turkish exports.

- IHS Markit's Global Construction Outlook (GCO) service's May

interim forecast is expecting Russia to report an 8.3% contraction

in real total construction output in 2020. (IHS Markit Country

Risk's Alex Kokcharov)

- The infrastructure segment will report the sharpest fall (-9.9%) although declines of more than 7% will be experienced by the residential (-7.2%) and the non-residential (-7.6%) segments.

- This significant downturn in the construction sector linked to a sharp overall contraction in the Russian economy in 2020. IHS Markit Economics forecasts 7.3% GDP contraction in Russia in 2020, triggered by the triple shock from collapsed global crude oil demand, a 23% oil production reduction under the OPEC+ deal, and deep declines in private consumption and fixed investment owing to COVID-19 virus-related lockdown.

- A study by the Centre for Strategic Research (CSR), a Russian government-linked think tank, estimated on 27 May that employment in the construction sector is likely to shrink by 9.2% in 2020 to 4.5 million, making some 409,000 construction sector workers unemployed. Many of these workers are likely to be migrant workers from Central Asia, especially Tajikistan, Uzbekistan and Kyrgyzstan. Average monthly wage in the construction sector is expected to fall by 8% to USD546 per month, according to CSR.

- IHS Markit assesses that the sharp contraction in the Russian construction sector is likely to increase the renegotiation of terms and cancelation of contracts, especially for the large-scale projects funded by the government or state-owned firms.

Asia-Pacific

- APAC equity markets closed higher across the region; Hong Kong +3.4%, India +2.7%, China +2.2%, South Korea +1.8%, Australia +1.1%, and Japan +0.8%.

- Didi Chuxing (DiDi) has secured more than USD500 million in investment for its autonomous vehicle (AV) unit in a funding round led by the SoftBank Vision Fund. This funding round marks DiDi's first external investment into its AV division since it became an independent company last year. The capital will be used to invest further in the research and development of AV technology as well as testing, deepen industry cooperation, and accelerate the deployment of AV services. SoftBank, one of the largest investors in DiDi, also has a joint venture (JV) with it, named Didi Mobility Japan, for taxi-hailing services in Japan. DiDi has been working on AV technologies since 2016. DiDi's autonomous technology unit employs more than 200 people in China and the United States and focuses on areas including high-definition (HD) mapping, perception, behavior prediction, and connectivity. (IHS Markit Automotive Mobility's Surabhi Rajpal)

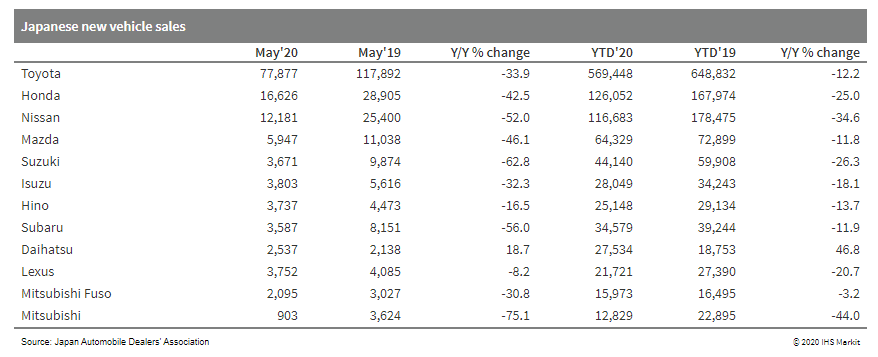

- Japanese sales of mainstream registered vehicles declined by

40.2% year on year (y/y) during May to 147,978, according to data

released by the Japan Automobile Dealers' Association (JADA) today

(1 June). This figure excludes minivehicles, thus covering all

vehicles with engines greater than 660cc, including both passenger

vehicles and commercial vehicles (CVs), sold in Japan. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- Of this total, sales of passenger and compact cars declined 41.8% y/y to 123,781 units in May, while truck sales were down 29.8% y/y to 23,786 units and bus sales fell 50.9% y/y to 411 units.

- In the year to date, sales of mainstream registered vehicles have declined by 18% y/y to 1.184 million units.

- Sales of passenger cars are down 18.6% y/y at 1.016 million units, while truck sales have fallen 14.3% y/y to 163,247 units and bus sales have shrunk 16% y/y to 5,294 units.

- IHS Markit currently forecasts that Japanese light-vehicle

sales will decline by 15.8% y/y in 2020 to around 4.28 million

units.

- Caixin PMI shows signs of improvement in China's manufacturing

conditions, with the headline PMI rising to 50.7 in May vs 49.4 in

April and signaling only a marginal upturn in manufacturing

conditions. (IHS Markit Economist Bernard Aw)

- Demand continued to weaken during May. New order intakes were down for a fourth straight month, although the latest decline was marginal. This hints at the downturn in demand approaching stabilization, as firms increasingly turned towards the domestic market for sales.

- External demand meanwhile remained under pressure. While slowing from April, latest drop in new export orders was still among the steepest recorded since the height of the global financial crisis.

- With falling demand, Chinese manufacturers sought to reduce capacity by cutting workforce numbers further. Overall employment fell for a fifth month in a row during May. However, the rate of decline slowed further since February's record downturn and was only marginal overall.

- The survey data showed that the sharpest fall in employment occurred at producers of intermediate goods (which supply inputs to other manufacturers), followed by those making investment products (such as plant and machinery). Consumer goods manufacturers reported a broadly unchanged level of employment.

- The survey brought signs of further restoration of the supply chains in China. Delivery delays were not reported for the first time in nearly one-and-a-half years during May as the resumption of production continued to help rebuild the distribution network.

- Average cost burdens continued to fall in May, as lower prices for raw materials such as coal, oil, steel and plastics were widely reportedly for driving input prices down. However, there were reports of rising freight costs due to capacity controls linked to global COVID-19 measures.

- China's official manufacturing purchasing managers' index (PMI)

came in at 50.6 in May, down 0.2 point from April and the third

consecutive month above the 50 expansionary threshold. Production

sub-index declined by 0.5 point to 53.2 as the catch-up effect of

small firms' work resumption gradually fades. (IHS Markit Economist

Yating Xu)

- The work resumption rate in small industrial firms has reached 93% as of 18 May, according to the Ministry of Industry and Information Technology (MIIT).

- Demand improved as sub-index of new orders rose 0.7 point to 50.9% and new export orders saw slower contraction compared to April.

- By sector, production PMI expanded in 14 out of the 21 surveyed manufacturing sectors. Food and beverage, auto manufacturing, petroleum processing and special-purpose equipment manufacturing reported stronger growth than a month ago, while manufacturing activities in and foreign trade-related textile timber contracted further.

- China's non-manufacturing PMI rose to 53.6 in April, up 0.4 percentage point from a month ago, with recovery in both construction and services.

- Construction PMI increased by 1.1 percentage point to 59.7, with acceleration in infrastructure investment.

- Service PMI picked up by 0.2 point to 52.3. Among the 21 surveyed service sectors, 15 sectors reported PMI above 50, compared to 14 in April. PMI in transportation, catering and accommodation, telecommunication, and internet services continued to rise while cultural and entertainment remained in contraction.

- The composite output PMI, covering both manufacturing and non-manufacturing sectors, came in at 53.4, unchanged from the previous reading.

- A deeper than expected global economic recession will continue be the main headwind for China's economic recovery in the remainder of this year with exports and related manufacturing bearing the brunt.

- According to a Financial Times (FT) report on 29 May, China's

Central Bank, the People's Bank of China (PBOC) has excluded "clean

utilization of fossil fuels" from a draft list of projects eligible

for upcoming Green Bond financing. (IHS Markit Economist Brian

Lawson)

- PBOC described the adjustment aligning "with international standards".

- Sean Kidney, CEO of interest group Climate Bonds Initiative, described the move as "hugely significant", by excluding so-called clean coal projects from future issuance.

- In 2019, China sold USD31.3 billion of Green Bonds, making it the second-largest country of issuance worldwide, but relatively few international ESG funds supported its sales, citing concerns over application of proceeds, transparency and disclosure standards.

- The FT report claimed that USD24.2 billion of Chinese debt sales described locally as Green were excluded from the global total in 2019 for breaching international standards.

- China's new move highlights growing global pressure from investors against funding carbon-intensive projects, particularly coal development, favoring Green Bond use for renewable energy development.

- The South China Morning Post reported on 31 May that, for 2020

so far, CNY274 billion (USD38.4 billion) worth of perpetual bonds

have been issued by Chinese banks, around five times the comparable

year-to-date volume for perpetual issuance in 2019 according to the

newspaper. (IHS Markit Banking Risk's Angus Lam)

- For 2019 as a whole, CNY569.6 billion (USD79.6 billion) worth of perpetual bonds were issued. In particular, the newspaper reported that several unlisted banks in China have been issuing perpetual bonds, including Bank of Huzhou, which issued CNY1.2 billion worth of perpetual bonds at 4.7% coupon rate at the end of May.

- The China Banking and Insurance Regulatory Commission (CBIRC) also sanctioned the issuance of CNY5 billion worth of perpetual bonds by internet-based MYBank on 20 May.

- Overall, IHS Markit assesses that bond issuance, both of perpetual and conventional debt, is likely to be important for unlisted banks in 2020, given their inability to raise capital through equity sales. Sale of capital instruments (perpetual and subordinated debt) would counterbalance the likely rise of non-performing loans (NPLs), which for city commercial banks, is likely to reduce their capital buffers given their lower bad loan provisioning.

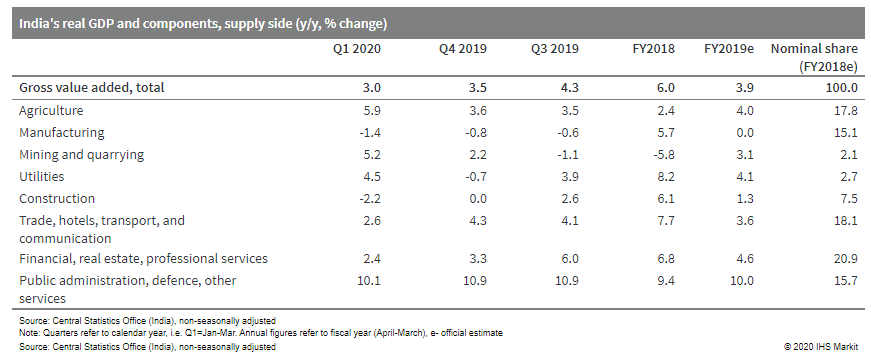

- Indian GDP growth in the January-March quarter of 2020 slowed

to a pace of 3.1% year on year (y/y), compared with a growth rate

of 4.1% y/y in the previous quarter and 5.7% y/y growth in the same

quarter of 2019. (IHS Markit Economist Rajiv Biswas)

- For the 2019-20 FY, Indian demand-side GDP growth moderated to 4.2%, compared with the 6.1% growth registered in FY 2018-19.

- In the January-March quarter of 2020, private consumption expenditure grew at an anemic pace of just 2.7% y/y, while gross fixed capital formation contracted by 6.5% y/y. Imports fell sharply, by 7.0% y/y, owing to weak domestic demand and falling world oil prices.

- The severe and protracted lockdown will badly hit Indian GDP

growth during the April-June quarter of 2020, as private

consumption expenditure has been severely cut down owing to the

lockdown measures, which resulted in the shutdown of most retail

stores except for those selling essential items and also

significant disruption of industrial production in key sectors such

as auto manufacturing.

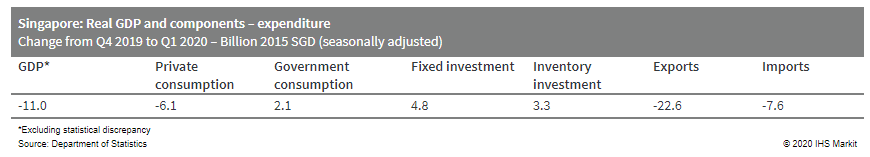

- The negative effect of the COVID-19 virus pandemic caused

Singapore's economy to contract in the first quarter of 2020. GDP

fell at a 4.7% annual rate, its worst performance since the global

financial crisis a decade ago. (IHS Markit Economist Dan Ryan)

- The main cause of the contraction was exports, which decreased because of supply chain interruptions and falling demand overseas. Imports also fell but to a much lesser extent, resulting in a large drop in net external demand.

- Private consumption also fell significantly. This was expected as a result of COVID-19-related lockdowns and closures that affected mainly the service industries.

- Other components of domestic demand actually increased.

Government consumption can be attributed to stimulus spending,

while the rise in fixed investment likely occurred early in the

first quarter and will be followed by a sharp decline.

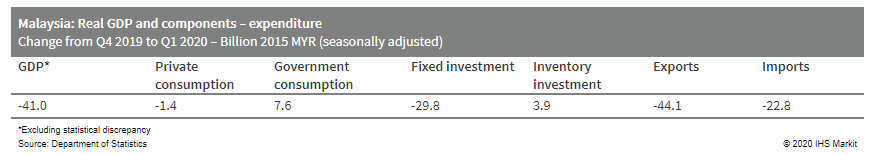

- Malaysia's real GDP fell at a 7.6% annualized rate (actual

-2.0%) quarter on quarter in the first quarter of 2020. This strong

contraction was mostly due to the lockdowns and closures caused by

the COVID-19 virus outbreak. (IHS Markit Economist Dan Ryan)

- Among the components, exports took the biggest hit - a result of falling overseas demand and supply chain interruptions. Fixed investment also fell sharply, as manufacturers cut back on capital investment in anticipation of the worsening economy.

- Private consumption declined only marginally because the full effect of the disease occurred late in the first quarter. Government stimulus also helped moderate the decline in household spending.

- Weakness across all sectors - consumer spending, manufacturing,

and exports - will continue in the near term, causing a contraction

in the second quarter similar to that of the first quarter. This

should put 2020 overall growth at -1.6%. Gradual improvement in the

medium term then yields a 2021 recovery in the mid-3% range.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-june-2020.html&text=Daily+Global+Market+Summary+-+1+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 1 June 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+1+June+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}