Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 03, 2020

Daily Global Market Summary - 3 June 2020

Global equity markets and credit indices closed higher again today on optimism from the growing number of re-openings, improving higher frequency data, and continued hopes of additional government stimulus. Benchmark government bonds were lower on the day in the wake of the positive momentum from equities and other risk assets. As with every Thursday since mid-March, tomorrow's US jobless claim report will be closely watched for signs of improvement in the US employment situation in addition to Friday's US non-farm payroll report.

Americas

- US equity markets closed higher today; Russell 2000 +2.4%, DJIA +2.1%, S&P 500 +1.4%, and Nasdaq +0.8%.

- 10yr US govt bonds closed +6bps/0.75% yield and 30yr bonds +6bps/1.55% yield. 10s sold off 9bp between the peak price of the day at 7:30am and the lowest point at 11:00am ET.

- CDX-NAIG closed -3bps/73bps and CDX-NAHY -21bps/461bps.

- Crude oil closed +1.3%/$37.29 per barrel.

- The US labor department, which governs 401(k) retirement accounts, said private equity could be used within the professionally managed funds on offer to savers, such as target date funds which invest in multiple asset classes. The Department of Labor's statement on Wednesday was the result of a request for guidance submitted by Partners Group and Pantheon, two private equity managers. The pair in 2013 launched private equity funds with daily pricing and liquidity that were designed to be slotted into investments in 401(k) plans, but regulatory uncertainty and fear of litigation had limited their appeal until now. (FT)

- Today's 8:30am ET ADP National Employment Report showed nonfarm private- sector employment in the U.S. decreased by 2.76 million jobs in May vs an expected decrease of 8.75 million jobs.

- The seasonally adjusted final IHS Markit US Services Business Activity Index registered 37.5 in May, up from April's record low of 26.7 and slightly higher than the 'flash' figure of 36.9. The rate of reduction in activity softened notably amid some reports of businesses returning to work, but was nonetheless the second-sharpest since data collection began in October 2009. The IHS Markit Composite PMI Output Index posted 37.0 in May, up from April's record-breaking low of 27.0. Although the pace of decline eased, it remained significant and the second fastest since data collection began in October 2009. (IHS Markit Economists Chris Williamson and Siân Jones)

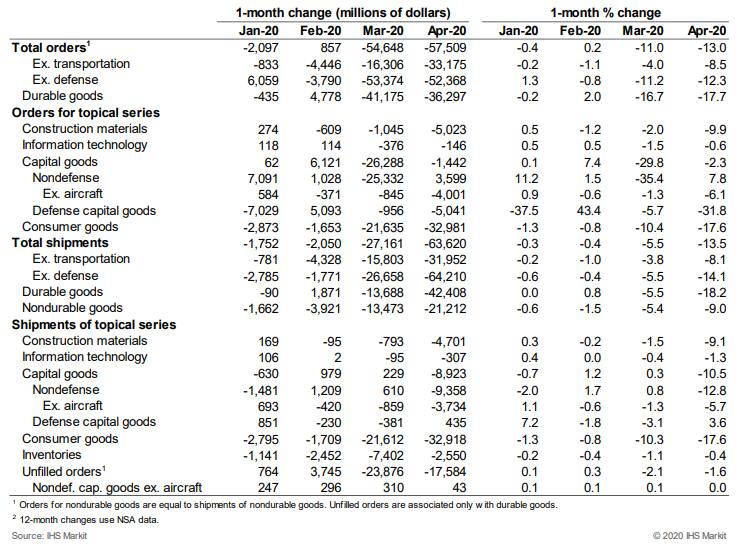

- US manufacturers' orders declined 13.0% in April, while

shipments declined 13.5%. Both were broadly in line with

expectations. Meanwhile, manufacturers' inventories declined 0.4%

in April, less of a decline than we assumed (details in the below

table). (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- The Bank of Canada announced no change to its overnight policy rate of 0.25%. The unprecedented declines in supply and demand lowered first-quarter real GDP in line with the Bank of Canada's projections laid out in the April Monetary Policy Report. Although there is some pullback in the frequency of the large asset-purchase programs announced in March, they will continue well into the recovery. The Bank of Canada will keep the overnight rate at 0.25% for a prolonged period. Canada's first-quarter real GDP decline of 2.1% (not annualized) from the last quarter of 2019 was estimated to be about midway in the Bank of Canada's April forecast monitoring range. The Bank is expecting second-quarter real GDP levels to decline about 10-20% before the economy advances in the third quarter. (IHS Markit Economist Arlene Kish)

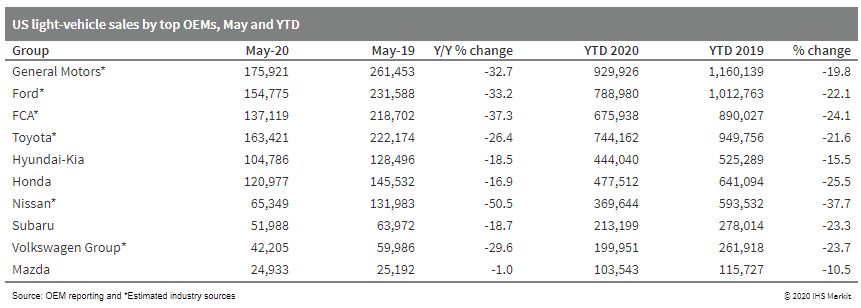

- US light-vehicle sales are estimated to have dropped 30.1% y/y

in May, a less dramatic y/y decline than in April and a

month-on-month improvement. In May, many stay-in-place orders and

restrictions on auto sales were eased, while interest rates

remained low. Although the economic damage brought by the COVID-19

pandemic continues, US automobile sales in May improved from

April's low, as OEMs' incentives, online sales, and "reopening" of

activities - especially at auto dealerships - helped to provide a

cushion against a worst-case scenario. IHS Markit forecasts

full-year 2020 light-vehicle sales of 12.7 million units in the US.

(IHS Markit AutoIntelligence's Stephanie Brinley)

- Brazilian light-vehicle registrations decreased 75.8% year on

year (y/y) in May, according to initial data from the National

Federation of Motor Vehicle Distributors (Federação Nacional da

Distribuição de Veiculos Automotores: Fenabrave). (IHS Markit

AutoIntelligence's Tarun Thakur)

- The federation reported registrations of 56,639 light vehicles last month, compared with 234,147 in May 2019.

- Registrations of medium and heavy commercial vehicles (MHCVs) and buses fell by 50.8% y/y last month; 5,558 MHCVs were sold, compared with 11,293 units in the same month a year earlier.

- The best-selling automaker in the light-vehicle market, General Motors (GM), had a market share of 17.6% in May.

- Regeneron Pharmaceuticals (US) and Intellia Therapeutics (US) have expanded their partnership to give Regeneron the rights to develop up to five additional in vivo CRISPR (clustered regularly interspaced short palindromic repeats)/Cas9-based therapeutic liver targets, including joint development of therapies for hemophilia A and B. Pre-clinical trials demonstrated the targeted in vivo insertion of a factor IX transgene in primates, leading to normal or higher levels of circulating human factor IX, which is typically missing or defective in hemophilia B patients. Under the terms of the new agreement, Regeneron will also have non-exclusive rights to independently develop and commercialize up to 10 ex vivo gene-edited products. (IHS Markit Life Science's Margaret Labban)

- Arkema today announced a long-term partnership with Nutrien, the world's largest integrated fertilizer company, for the supply of anhydrous hydrogen fluoride (AHF) to Arkema's Calvert City, Kentucky, site. The project will secure Arkema's access to AHF, the main raw material used in fluorine chemistry. It supports the company's growth of fluoropolymers in the water treatment, electronics, and batteries segments and offers greater environmental protection than more traditional production processes, the company says. As part of the agreement, Arkema will invest $150 million to build a 40,000-metric tons/year AHF production plant at Nutrien's Aurora, North Carolina, site, scheduled to start up in the first half of 2022. About half the capacity will be used in the production of polymers and fluoro derivatives, and the rest for the production of low-global-warming-potential fluorogases. AHF is used to make products including fluoropolymers and specialty derivatives.

Europe/Middle East/ Africa

- European equity markets rallied significantly for the second consecutive day; Germany +3.9%, Italy +3.5%, France +3.4%, Spain +3.0%, and UK +2.6%.

- 10yr European govt bonds closed lower across the region; France/Spain/Germany +6bps, UK +5bps, and Italy +4bps.

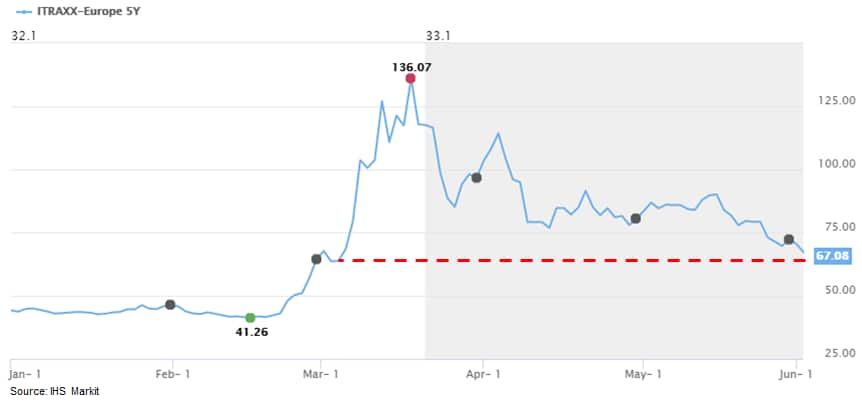

- iTraxx-Europe closed -2bps/65bps and iTraxx-Xover

-12bps/375bps. It's worth noting that iTraxx-Europe closed at its

best level since 4 March:

- Brent Crude closed +0.6%/$39.79 per barrel and was as high as $40.53 per barrel during APAC trading hours.

- Argo AI, an autonomous and artificial intelligence (AI) technology company, has announced the closing of its partnership agreement with Volkswagen (VW) on 1 June. The deal, which was reached in July 2019, includes a USD2.6-billion investment in Argo AI by VW and will open up a presence for Argo AI in Europe. Argo AI and parent company Ford both posted to their company blog sites comments on the VW deal. VW announced on 28 May that its supervisory board had approved the deal, as well as electric vehicle (EV) and commercial vehicle projects and further unnamed projects. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Seasonally adjusted German unemployment increased by another

238,000 in May, following April's jump by 373,000, thus reaching

2.875 million at the end of May. (IHS Markit Economist Timo Klein)

- The Labor Agency has also calculated the effects of the COVID-19 virus, estimating that it alone is responsible for a monthly increase of 197,000 in May after 381,000 in April.

- The combined impact of 578,000 roughly sets back the German unemployment situation to late 2014, or at least to late 2015 when looking at the unemployment rate that now increased from 5.0% in March (close to 40-year lows) to 6.3% in May.

- The Italian government's lockdown measures to contain the

spread of the COVID-19 virus closed parts of the economy during

April, triggering deeper employment losses during the month. (IHS

Markit Economist Raj Badiani)

- Total employment fell by 1.2% month on month (m/m), equivalent to 275,000 jobs, to 24.4 million in April. This had been preceded by a 0.5% m/m drop in March.

- In annual terms, the level of employment was 2.0% lower in April compared with a year earlier.

- Unexpectedly, the unemployment rate dropped to 6.3% in April, the lowest rate since November 2007, and down from 8.0% in March and 9.1% in February.

- According to the Italian National Institute of Statistics (Istituto Nazionale di Statistica: ISTAT), the fall in the unemployment rate in both March and April was because of the rising inactivity rate, with an increasing number of people neither working nor looking for work. ISTAT argued that many laid-off workers stopped looking for jobs during two months of lockdown.

- Indeed, the size of the labor force contracted by 3.0% m/m in April, which implies that 758,000 fewer people were looking for work when compared with March.

- The employment losses were less severe than expected in April and they appeared to be limited by Economy Minister Roberto Gualtieri's move to suspend dismissal procedures from 23 February until mid-August. Gualtieri has pledged repeatedly that "nobody must lose their job because of the coronavirus". However, we suspect that greater job destruction occurred among the self-employed, service-sector workers on temporary contracts, and those in the "grey" economy.

- According to our May update, we anticipated a sharp climb in the unemployment rate in April, helping to lift the average rate to 14.4% in 2020 from 10.0% in 2019. Given the falls in both March and April, we are likely to cut the unemployment rate forecast for 2020 in our June update.

- According to the Austrian Labour Market Service (AMS), there

were 473,300 unemployed people in Austria at the end of May, down

by 49,000 from April and up by 194,000 (69.7%) versus May 2019.

(IHS Markit Economist Timo Klein)

- The annual gap has thus narrowed compared with April (76.3%), but only modestly so.

- The unadjusted unemployment rate declined from 12.8% to 11.5% in May, but part of this is purely seasonal: the gap with the rate a year ago (6.8%) was 4.7 percentage points, down from 5.5 percentage points in April but only matching the gap in March.

- The added information of (seasonally unadjusted) daily data shows that the peak was reached at 533,600 on 13 April, and further declined by 60,000 until the end of May, mostly owing to the full reopening of the retail sector and many services.

- Vacancies, which had exceeded their year-ago level until February, were down by 30% y/y in May (absolute level: 57,597).

- Finally, dependent employment declined by 165,000 (or 4.4%) y/y in May, following annual declines by 200,000 in April and 150,000 in March. The dip by 165,000 in combination with the unemployment increase of 194,000 means that the labour force had fallen by 29,000 y/y (or roughly 0.6%), less severe than in April (-2.0%) but still in sharp contrast to February's increase of 26,000 (0.6%).

- According to the first estimate by the State Secretariat for

Economic Affairs (Secrétariat d'État à l'économie: SECO) of the

Swiss Economics Ministry, the country's real, seasonally and

calendar-adjusted GDP declined by 2.6% quarter on quarter (q/q) in

the first quarter of 2020, following steady moderate growth of

around 0.4% q/q in each of the four quarters of 2019. However, the

interim recession during the second half of 2018 (cumulatively

-0.4%) had already slowed annual growth in 2019 to 1.0% from 2.7%

in 2018. (IHS Markit Economist Timo Klein)

- A closer look at the external sector reveals that exports of goods and services (excluding valuables) increased by 1.1% q/q in the first quarter, following an upwardly revised 0.2% q/q in the fourth quarter of 2019.

- The first-quarter increase was entirely driven by goods (3.4% q/q), while exports of services were weak at -4.4% q/q.

- By contrast, imports of goods and services (excluding valuables) were depressed in both categories - goods posted -1.1%, services -1.2% q/q.

- Goods exports apparently benefited from especially strong deliveries of chemical and pharmaceutical products, most notably to the United States. This hides declining exports in most other industrial sectors.

- With respect to final domestic demand (-2.7% q/q in the aggregate), the declines for investment in equipment (-4.0% q/q) and private consumption (-3.5% q/q) stand out negatively.

- GDP in the first quarter of 2020 dropped roughly to the extent IHS Markit had predicted (-2.4% q/q) and thus we do not see a pressing need to change our forecasts for 2020 and 2021

- The Turkish new light-vehicle market decreased by 2.4% year on

year (y/y) in May to 25,073 units, according to data released by

the Automotive Distributors' Association (Otomotiv Distribütörleri

Derneği: ODD). (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Of this total, passenger vehicle sales were down by 7.6% y/y to 25,073 units during the month, while light commercial vehicle (LCV) sales stood at 7,162 units, up by 21.6% y/y.

- The country's light-vehicle market has now posted a year-to-date (YTD) increase of 20.1% y/y to 183,095 units, comprising 146,528 passenger vehicles, up by 21.7% y/y, and 36,567 LCVs, up by 13.9% y/y.

- In the YTD, C-segment vehicles account for 60.1% of total passenger vehicle sales in Turkey, with sedans being the most preferred vehicle type, accounting for 44.7%.

- In the LCV segment, vans account for 74.0% of total sales in the YTD, followed by light trucks with 12.5%.

- IHS Markit forecasts Turkish light-vehicle sales to decline to 463,000 units in 2020 from 479,061 units sold last year.

Asia-Pacific

- APAC equity markets closed higher across the region; South Korea +2.9%, Australia +1.8%, Hong Kong +1.4%, Japan +1.3%, India +0.8%, and China +0.1%.

- The city authorities of Chinese capital Beijing are considering adding 20,000 new energy vehicle (NEV) license plates for car-less families that intend to make a purchase. According to the draft regulations released by the Beijing Municipal Commission of Transport as part of a public consultation, the extra NEV license-plate quota is planned for this year. The city is drafting a plan to set up a credit system for "car-less families" interested to joining the lottery system by which license plates are allocated. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The China Association of Automobile Manufacturers (CAAM) on 3 June released estimates of new vehicle sales in China in May prior to its monthly briefing. According to a statement posted by the association on its WeChat social media account, it expects new vehicle sales in China to reach 2.136 million units in May, up 3.2% month on month and up 11.7% year on year (y/y). From January to May, new vehicle sales in China are expected by CAAM to reach around 7.9 million units, down by 23.1% y/y. The estimates are based on May's sales reports released by major automotive groups in the country. IHS Markit expects more details to be released by CAAM in the coming week. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Yandex has announced that it will maintain its Detroit, Michigan, operations as a US hub of its autonomous vehicle fleet, reports Automotive News. According to the report, Yandex was one of several companies contracted to provide autonomous vehicle transportation for the reworked 2020 North American International Auto Show, which has been postponed to 2021. Despite the show's cancellation, Yandex will test its autonomous car that it developed with Hyundai Mobis in the area, the report says. Yandex unveiled its fourth-generation of autonomous vehicle based on the 2020 Hyundai Sonata, which features an increased number of cameras from six to nine and in which the radars have been moved, among other efforts, to improve its system. (IHS Markit AutoIntelligence's Stephanie Brinley & Surabhi Rajpal)

- New vehicle sales in Australia fell 35.3% year on year (y/y) during May to 59,894 units, according to data from the Federal Chamber of Automotive Industries (FCAI). Sales of passenger cars shrank 52.1% y/y to 13,836 units, while the sport utility vehicle (SUV) segment posted a decline of 30.0% y/y to 28,652 units during the month. Light commercial vehicle (LCV) sales totaled 14,791 units, down 22.9% y/y, and heavy commercial vehicle (HCV) sales stood at 2,615 units, down 26.5% y/y. According to CarAdvice, Toyota was the leading automaker in May with a 24.2% market share and sales of 14,466 units, followed by Mazda with a 9.5% market share and sales of 5,661 units and Hyundai with a 6.9% market share and sales of 4,109 units. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Facebook's messaging platform WhatsApp and PayPal have invested in ride-hailing company Gojek as part of the Indonesian company's ongoing Series F funding round. Both participants did not disclose the investment size or the stakes that they would receive, reports Reuters. Cameron McLean, market head at PayPal International, said, PayPal's "payment capabilities would be integrated into Gojek's services". WhatsApp, in partnership with Gojek, plans to support the growth of millions of small businesses in Indonesia. This move might strengthen WhatsApp's presence in Indonesia, where it has more than 100 million users. PayPal's investment in Gojek would accelerate digitalization in the country by connecting leading marketplaces and payment networks. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- During May 2020, total imported coal arrivals into India was quite weak and calculated at just 12mt, which is 10.8mt lower than previous year levels. Thermal and metallurgical coal arrivals for the said period calculated at 8.2mt (down 9.7mt y-o-y) and 3.8mt (down 1mt y-o-y), respectively. Despite majority of locations in India not under lockdown, the country is still facing challenges in terms of weak domestic demand from consumption side to difficulty in finding laborer's and workers to restart the factories and also in arranging logistics as majority of truck drivers had abandoned their vehicles and went back to their native places. (IHS Markit Maritime & Trade's Rahul Kapoor and Pranay Shukla)

- Tata Motors announced in a filing to the Bombay Stock Exchange

(BSE) yesterday (2 June) that it has resumed operations at all its

vehicle plants in India, and its Jamshedpur plant received approval

on 27 May. (IHS Markit AutoIntelligence's Isha Sharma)

- The automaker added that around 59% of its passenger vehicle showrooms have restarted operations, and around 90% of suppliers in the commercial vehicle segment have received permissions to restart operations.

- Of this, only 60% of suppliers have been able to start supplies, while 98% of suppliers in the passenger vehicle segment have received permissions and also restarted operations.

- Revealing its plans to improve liquidity, the company stated in the filing that, "As of 31 March 2020, the company had cash and cash equivalent of INR47 billion [USD626.5 million], and undrawn credit facility of INR15 billion.

- To further shore up the liquidity, the company has issued commercial papers of INR35 billion and also raised INR10 billion through non-convertible debentures [NCDs]."

- Indian peanut processors are starting to suffer a financial squeeze after the government decreed the extension of confinement measures until June 30, setting some relief measures to strengthen consumption. The harvest of Java variety is taking place in the state of Gujarat just now, according to the Indian processor and trader PnutKing in its latest market update. Farmers expect a strong crop. Traders and processors are minimizing orders as their stocks are totally replenished due to weak consumption during lockdown. PnutKing reported that many small processors are ready to close for financial reasons. The impact of the damage on the industry will depend on the speed of the recovery in consumption. (IHS Markit Agribusiness' Jose Gutierrez)

- Moody's has downgraded the Maldives' ratings to B3 from B2, and

maintained a Negative outlook. These downgrades come as a result of

the shocks to the tourism sector caused by the COVID-19 virus

pandemic, which in turn will severely weaken the country's fiscal

and external positions, all without sufficient buffers to counter

any resulting deterioration. (IHS Markit Economist Andrew Vogel)

- The coronavirus disease 2019 (COVID-19) virus pandemic has caused a severe shock to the Maldives' tourism sector, which Moody's cites as accounting for 60% of GDP, in addition to being a major source of government revenue and foreign-exchange earnings. Even if tourism activity were to return by late 2020, Moody's still projects an economic contraction of more than 10% for the year.

- This shock will place substantial pressure on government finances and the country's liquidity position. With Moody's expecting a sharp increase in the fiscal deficit through 2022, financing needs will also rise sharply despite the country's limited ability to secure external financing and its weak domestic position.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-june-2020.html&text=Daily+Global+Market+Summary+-+3+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 3 June 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+3+June+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}