Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Apr 11, 2025

By Matt Chessum

Recent financial market volatility—fuelled by escalating uncertainty surrounding global trade—has had a profound impact on short sellers, flipping fortunes and transforming previously underwater positions into highly profitable trades. The turbulence stems from the Trump administration's trade tariff adjustments, which rattled investor confidence and triggered sharp declines across global stock markets.

The market's reaction has been swift and severe. Equity benchmarks across the world tumbled as investors rushed to reprice risk, factoring in the possibility that the new tariffs could stifle global commerce and potentially push the world economy into recession. This sell-off created a rare environment where short sellers, who had spent months nursing losses in a bullish market, were suddenly in a position of strength.

From Losses to Gains

Short selling—an investment strategy where traders borrow shares to sell them in the hope of buying them back at a lower price—relies heavily on declining markets. When prices rise, short sellers incur paper losses. Over the past year, with equity markets buoyed by resilient corporate earnings and strong consumer demand, short sellers had faced a challenging environment, with the vast majority of trades in the red.

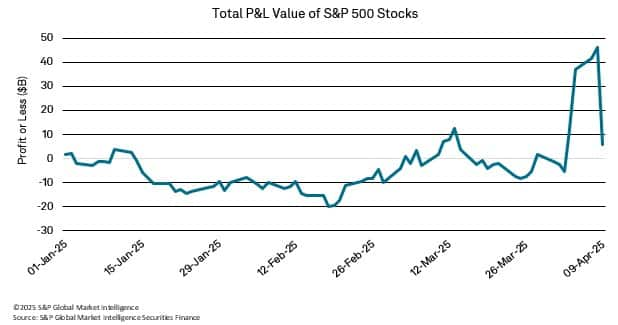

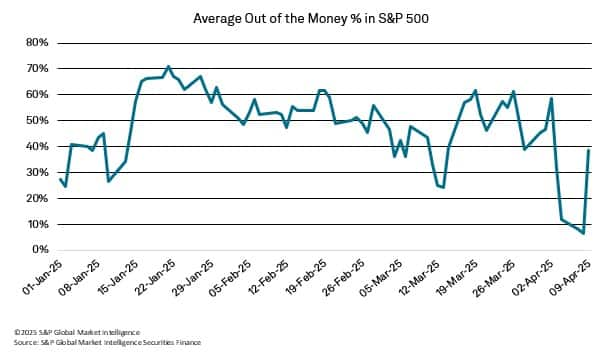

However, the landscape shifted dramatically in early April. Before the tariff announcement, on April 2nd, 59% of all short positions across the S&P500 index were out-the-money, reflecting a market that had largely moved against bearish bets. On that date, aggregate mark-to-market losses for short sellers stood at a staggering $5.4 billion.

Fast forward six days, and the picture was strikingly different. By April 8th, as markets reeled from the announcement and its implications, the short positions across the index that were out-the-money dropped to just 7%, indicating a broad-based decline that worked in their favour. This shift translated into a dramatic swing in paper P&L, with short sellers sitting on unrealized gains of $45.9 billion.

Volatility Cuts Both Ways

Despite the sudden windfall, this profitable environment has not come without risk. Market volatility, while creating opportunity, also introduces considerable uncertainty. Price swings in both directions can quickly erode profits or exacerbate losses. While the immediate aftermath of the tariff announcement saw stocks plunge, intermittent rebounds driven by central bank comments, corporate earnings, or trade negotiation headlines have made it difficult for short sellers to hold onto gains.

Indeed, the gains recorded on April 8th have since moderated as markets bounced off their lows, underscoring the fragile and fast-moving nature of current conditions. For short sellers, timing is everything. Those who closed out positions at the peak of the sell-off may have locked in historic returns. Others who opted to stay in the trade faced shrinking profits as prices partially recovered.

Strategic Shifts and Sector Impacts

The tariff-driven volatility has also compelled short sellers to reassess their strategies. Traditionally defensive sectors such as utilities and consumer staples, once considered poor targets for shorting, have become more attractive as investors rotate away from cyclical stocks exposed to global trade. Technology, industrials, and materials—sectors with significant international revenue exposure—have borne the brunt of the sell-off, becoming high-yield hunting grounds for bearish traders.

Moreover, the rapid repricing of risk has triggered wider discussions about hedging and portfolio construction. Institutional investors, who often use short selling as a hedge against long positions, are increasingly using tactical short exposure not only to protect capital but to generate alpha during periods of heightened uncertainty.

The Road Ahead

As the market digests the full implications of the "Liberation Day" tariffs, the outlook for short sellers remains highly fluid. While recent weeks have been exceptionally favourable for bearish strategies, sustained profitability will depend on the persistence of downward momentum and the absence of meaningful policy reversals.

For now, short sellers are enjoying a moment in the sun. But with market sentiment hanging on every policy statement, economic indicator, and corporate update, the road ahead promises to be anything but smooth.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.