Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 25, 2018

Lower labor taxes and changes to pension system in Lithuania

- The Lithuanian government has announced plans to further decrease the tax burden on labor by raising non-taxable incomes and lowering social security contributions. As the base pension will now be paid from the state budget, it will be financed through other taxes not only social security contributions. Pensions will not decrease for those who participate in the second pension pillar.

- As no part of social security contributions would be transferred to private pension funds, people participating would contribute 4% (instead of the current 2%) of their average wage. People under 40 years would also be automatically enrolled in private pension funds with the possibility to withdraw immediately.

- The proposed tax changes are not fully financed through the raising of other taxes. However, the changes are still expected to be cost neutral as the government plans to introduce new measures to fight the shadow economy.

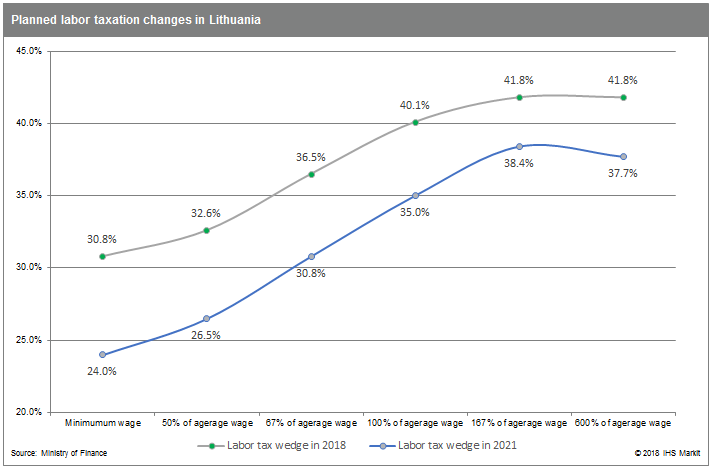

If the changes proposed by the government are approved by Parliament, by 2021, Lithuania would have the lowest labor taxes among the Baltic countries and about 6 percentage points lower than the EU average). As part of the proposed changes average net wage, which stood at EUR660 in 2017, would rise by about EUR50.

The main tax changes include rising non-taxable income threshold, which would be then applied for up to 2.5 times the average wage instead of less than 1.5 currently. The personal income tax for labor income should rise from 15% to 21%, while social security contributions would be at 18.5% for employees and 1.24% for employers. The social security contributions in total are reduced by 2 percentage points as base pensions (which are equal and independent of contributions made) would be financed from state budget instead of social security fund. These changes would gradually reduce the tax wedge for average wages from 40.1% to 35%.

In addition to that, a social security contribution ceiling would be introduced and gradually lowered from 10 average wages to 5 average wages. However, this would be partly offset by higher personal income tax of 25% for income above the ceiling.

The losses from lower labor taxes are expected to be partially financed by expanding the real estate tax base and higher excise tax for tobacco but, these changes would raise less than EUR20 million a year. The costs of around EUR170 million in each of next three years are expected to be financed by lowering the shadow economy. Redesign of pension system should encourage private participation

Now workers have to choose themselves if they want to participate in the second pillar and how much they contribute. They can have only 2% of their social security tax transferred to their pension fund and do not contribute themselves, or in addition to that they can contribute another 2% from their wage and get additional contribution from the state, of 2% of average wage. After the reform, the lowest possible personal contribution would be 4% from wages plus 2% of average wage in the country from state budget. By contributing more than that, employees or employers would be able to reduce their taxable income or profit tax.

Should contributions increase, it would raise the future replacement ratio from 30% to 50% for those who were not contributing themselves, but only had 2% of social security contributions transferred to their private pension fund. The burden for social security fund would be decreased by transferring the basic pension part (which is independent on the contributions made) to state budget, which will be partly financed by higher personal income tax. The individual pension part will be collected through social security contributions as before making the relationship between contributions and future pensions received clearer. As transfers from social security fund to private pension funds through the second pension pillar would be stopped, public pensions would not decrease due to participation in the second pillar as previously. That discouraged some people from participating because they were not sure if they were able to receive as much as they lost in public pensions. Moreover, people under 40 would be automatically enrolled in the private pension fund, chosen by the central bank every few years with the right to withdraw. It would also be possible to stop participation for one year and renew it after that period.

The government also proposes to raise the lowest pensions by about EUR20. Due to indexation of pensions, all pensions are already set to rise by about EUR23 in 2019 and 2020. In total the average pension should rise from EUR255 in 2016 to EUR365 in 2020.

Outlook and implications

Lithuania needed to lower labor taxation, however, the government's unwillingness to finance the change by raising other taxes could raise fiscal sustainability risks. As additional measures to fight the shadow economy are needed, the actual decrease in its level as well as additional gains in tax revenues are uncertain. However, if spending is cut in areas where efficiency can be improved using those funds to reduce labor taxation, these changes will contribute to a stronger economy. Moreover, public finances are currently in good shape as the general government recorded a surplus for a second year in a row and public debt fell below 40% of GDP in 2017.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flower-labor-taxes-and-changes-to-pension-system-in-lithuania.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flower-labor-taxes-and-changes-to-pension-system-in-lithuania.html&text=Lower+labor+taxes+and+changes+to+pension+system+in+Lithuania+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flower-labor-taxes-and-changes-to-pension-system-in-lithuania.html","enabled":true},{"name":"email","url":"?subject=Lower labor taxes and changes to pension system in Lithuania | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flower-labor-taxes-and-changes-to-pension-system-in-lithuania.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Lower+labor+taxes+and+changes+to+pension+system+in+Lithuania+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flower-labor-taxes-and-changes-to-pension-system-in-lithuania.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}