Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 08, 2020

Latin America mining industry is expected to be the most heavily impacted industrial sector due to country risk after COVID-19

The impact of COVID-19 is being felt across all sectors: in obvious ways for sectors like tourism and retail, and less direct but no less material ways for sectors like mining. When we ran an interim update factoring in the effects of COVID-19 through our Country Risk Investment Model, which looks at the impact of country risk on energy and commodity sectors in financial terms, a few interesting trends came to light.

The impact of COVID-19

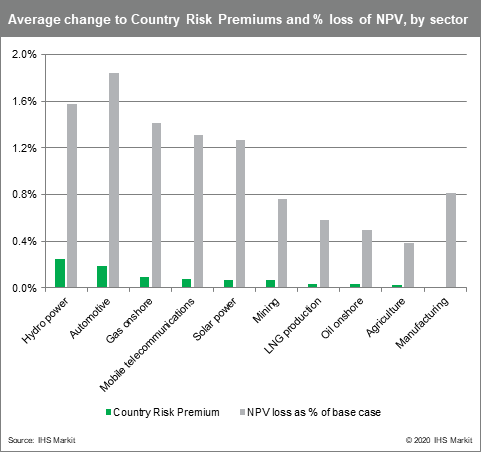

It is no surprise that almost all sectors saw greater projected losses due to country risk. This is particularly true due to the expectation of recessions globally, and the rise in risk of strikes and protests. However, the sectors seeing the largest increase in average Country Risk Premiums (CRP) globally were the Hydro Power, Automotive, and Gas Onshore sectors - 0.24%, 0.19% and 0.10% average rise in the CRP, as compared to an overall average of 0.08% across the ten sectors in our model. These sectors also saw the largest average increase in NPV loss as compared to the base case excluding country risk - 1.58%, 1.84%, and 1.42% as compared to a 1.05% average. This means that these sectors are the most likely to see an increase in costs due the country risk ripples of COVID-19.

The mining sector still at highest risk

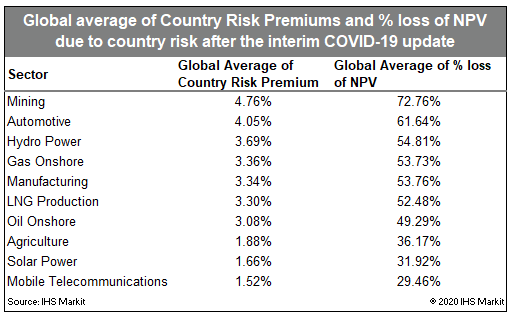

Despite larger rises in other sectors, the sector that continues to have the overall highest average CRP and NPV loss figures is the mining sector. Mining has an average CRP of 4.76% globally, compared to an average of 3.06% across all sectors, and a 72.76% average NPV loss, compared to an overall average of 49.60%. This suggests that mining is the most heavily impacted across all sectors in our Country Risk Investment Model by losses associated with country risk.

With the country risks driving losses in mining - contract risks, strikes and protests, and expropriation - all rising due to COVID-19, we're likely to see these losses play out globally - perhaps nowhere as clearly as in Latin America.

In Latin America, the risks to mining are clear

- Disruption to operations in Brazil likely, with delays to administrative procedures. The government declared mining an "essential" activity, prohibiting local authority restrictions to business operations and transport affecting mining. However, administrative procedures will be delayed as the National Mining Agency has suspended the assessment of concession requests and applications for environmental licences. Even without mandatory measures being imposed, thousands of mining-sector workers have been sent home as a precautionary health measure. Several companies have suspended activities, while mining company Vale has admitted to having difficulty reactivating projects scheduled to begin production in 2020 as COVID-19-virus-related restrictions are slowing down safety and valuation inspections. The mining sector also faces the risk of local authorities asking firms for increased financial contributions to help fund efforts to control the pandemic.

- Union stoppages and legal challenges are likely in Chile's mining sector if stricter sanitary measures are not implemented. Most mining sites in Chile have continued to operate, albeit at a slower pace and with reduced workforce, because of isolation measures. State-owned Codelco, Anglo American, Antofagasta Minerals and Teck Resources have reduced operations or suspended expansion or construction projects, leading to suspensions of contracts with third-party vendors. Unions are demanding increased protection for workers' health through measures such as limiting travel, avoiding crowded spaces, and even halting operations, and threatening with stoppages otherwise. The government is unlikely to order the total suspension of operations because of the importance of the mining sector for Chile's economy, but strike risks are likely to be mitigated by enhanced sanitary measures.

- Mexican government suspended mining operations, and firms are unlikely to receive significant tax relief. The government has declared mining "non-essential", prohibiting miners to operate. Companies such as Grupo México and Newmont are scaling back most operations while others are suspending them completely. Those who do not comply with the suspension face fines or prosecution, but the government is likely to consider some exemptions on a case-by-case basis involving projects that do not have confirmed COVID-19 cases. The government has refused to grant fiscal relief to businesses in Mexico and any change of policy direction in this regard is unlikely to include mining. The Mexican Mining Chamber is requesting the government to allow them to operate.

- Peru's mining law review will be delayed as the government is likely to focus on reactivating the sector after the virus outbreak. Mining companies are allowed to only maintain essential operations during the state of emergency. Projects that have been suspended or slowed down include Anglo American's Quellaveco, Freeport-McMoRan's Cerro Verde, Newmont's Yanacocha, and MMG's Las Bambas. Because of the economic importance of Peru's mining sector, once the pandemic is under control and confinement measures are lifted, the government is likely to implement stimulus measures to reactivate mining activity. This is likely to delay discussions about a new mining law proposed by regional governors, but opposed by the government, that would impose a 10% tax on mining profits, reduce the term of mining concessions from 30 to 12 years, and increase the mining 'canon' (regional tax).

Learn more about our Country Risk Investment Model and how our sector-specific model can improve your investment choices.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flatin-america-mining-industry-most-impacted-COVID19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flatin-america-mining-industry-most-impacted-COVID19.html&text=Latin+America+mining+industry+is+expected+to+be+the+most+heavily+impacted+industrial+sector+due+to+country+risk+after+COVID-19+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flatin-america-mining-industry-most-impacted-COVID19.html","enabled":true},{"name":"email","url":"?subject=Latin America mining industry is expected to be the most heavily impacted industrial sector due to country risk after COVID-19 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flatin-america-mining-industry-most-impacted-COVID19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Latin+America+mining+industry+is+expected+to+be+the+most+heavily+impacted+industrial+sector+due+to+country+risk+after+COVID-19+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flatin-america-mining-industry-most-impacted-COVID19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}