Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 22, 2024

By Jingyi Pan

Japan's private sector expansion accelerated in August to the fastest since May 2023, driven by improvements in the service sector alongside renewed modest growth of manufacturing output.

That said, forward-looking indicators hint at growth slowing in the coming months. Manufacturing new orders remained in contraction while overall confidence levels fell to a 19-month low.

Concerns over the outlook and price pressures have meanwhile further led to Japanese private sector firms raising selling prices at a slower pace despite rising input cost inflation.

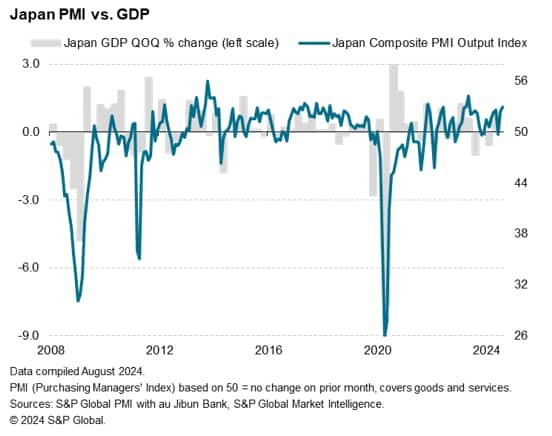

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose to 53.0 in August, up from a final reading of 52.5 in July. This indicated that Japan's private sector activity expanded for a second successive month and at the fastest pace since May 2023. The third-quarter average sits at 52.7 thus far, which is above the 51.5 recorded in the second quarter, where we have seen gross domestic product rising at 0.8% quarterly rate. This suggests that the third quarter expansion is likely to further accelerate based on current PMI indications.

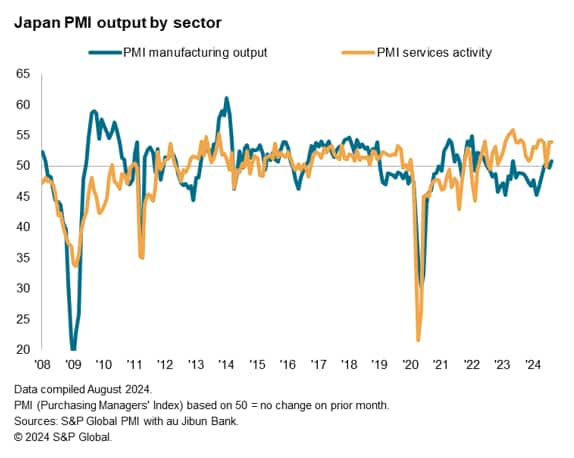

A broad-based expansion in private sector activity across both manufacturing and service sectors was observed in August for the first time since May last year. This was with a renewal of manufacturing production growth following a brief decline in July. While marginal, the latest rise in manufacturing output was the most pronounced since May 2023, and is only the third time that output has risen since mid-2022.

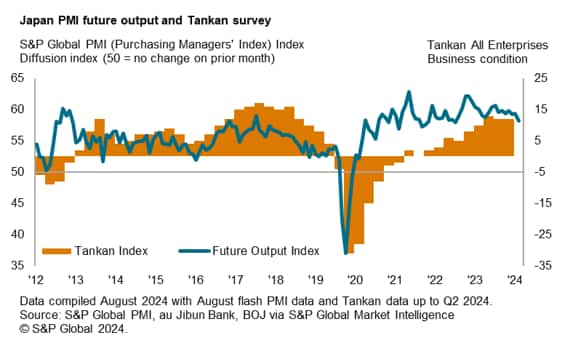

Underpinning the latest rise in Japanese manufacturing production was the expansion of workforce capacity, which enabled firms to work through their existing orders. However, incoming new orders into factories sustained in contraction to signal that demand remained subdued. Notably, trade conditions have yet to improve, with export orders falling at the most pronounced pace in five months. That said, the easing of the pace at which overall new orders declined, and a slight uptick in the PMI Future Output Index (which tracks manufacturers' sentiment about output in the year ahead) offer some hope that the worst may be behind us.

Turning to services, business activity rose at the quickest pace since April. This was with services new business increasing at a rate that was solid and unchanged from July. Export business for service providers also returned to growth in August after falling briefly in July. Improvements in underlying demand conditions and rising tourism demand supported the expansion of services activity according to panellists.

While the overall picture of current activity has shown signs of improvement, future confidence levels declined in the latest survey period. A slight improvement in manufacturing sector confidence was more than offset by falling optimism among service providers. The service sector Future Output Index fell to the lowest in just under two-and-a-half years, as concerns gathered over labour constraints amid an aging population and elevated price pressure according to anecdotal evidence. This brought the overall level of business confidence to the lowest since January 2023.

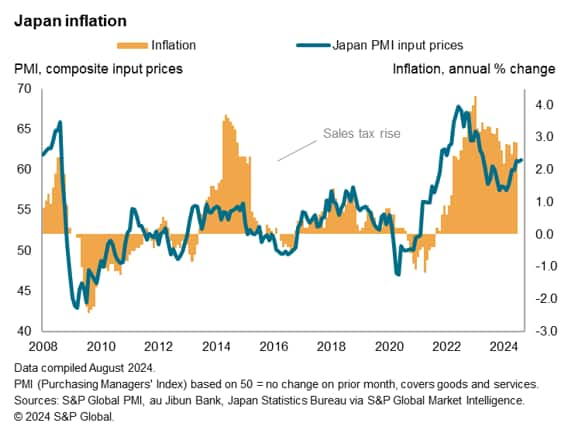

Moreover, concerns over the growth outlook have also led to Japanese private sector firms - across both manufacturing and service sectors - to raise selling prices at a slower pace despite rising cost pressures. This represented a heightening of margin pressures across both sectors, including the outperforming service sector, where demand conditions remained robust.

While Japanese firms have remained more conservative with raising selling prices in August, the sharper increase in costs nevertheless represents a risk for Japan's inflation to heighten. This is given the likelihood that firms may eventually have to share their additional cost burdens with clients by keeping selling prices high.

The prospect of higher inflation would be supportive of the Bank of Japan in raising interest rates again, which has become a topic of discussion amid speculation that the Bank of Japan is due for another move before the end of year. While higher interest rates will be supportive of the yen and help curb import-inflation, the tightening of monetary policy settings may also dampen domestic demand and have a negative impact on exports and domestic spending, thereby providing a risk for the economic outlook into the end of 2024.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.