Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 24, 2024

Japan's business activity declines while selling price inflation rises in October

Japan's private sector activity shrank for the first time in four months in October, hinting at a softening of the GDP trend at the start of the final quarter of 2024. The latest reduction in business activity was broad-based as services joined manufacturing in contraction.

Muted economic conditions and subdued new order inflows underpinned the latest downturn according to survey respondents, with forward-looking indicators hinting at further weakness in the near-term.

The slowdown in business activity was notably contrasted by an intensification of price pressures, the latter owing to rising costs. Altogether, the mixture of slowing growth and rising inflation poses a dilemma for the Japanese central bank and their current hawkish bias.

Japan's flash PMI signal sharpest contraction of activity in nearly two years

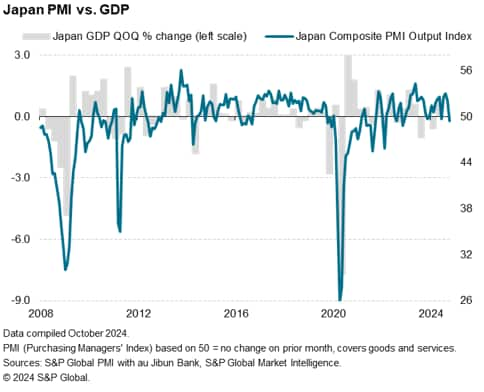

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, fell to 49.4 in October, down from a final reading of 52.0 in September. Falling past the 50.0 neutral mark, the latest reading signalled that Japan's private sector activity contracted at the start of the fourth quarter of the year. While marginal, the latest reduction in activity was the most pronounced since November 2022 and signalled a near-neutral GDP print at the opening month of the quarter.

Broad-based reduction in private sector activity

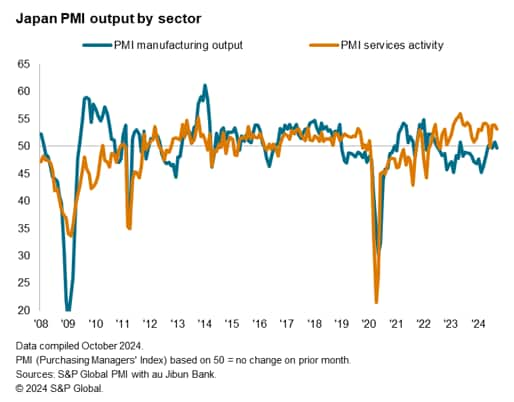

Underpinning the latest downturn in activity was a broad-based reduction in output by sector, with services having followed manufacturing into decline during the latest survey period. Services activity fell for the first time in four months. Moreover, the rate of reduction was the sharpest since February 2022 despite being marginal overall. This was attributed to a softening of demand conditions, notably in terms of overseas-driven (export) business, which led to services new business falling for only the second time in the past two-and-a-half years.

Meanwhile manufacturing output remained in contraction for a second successive month, with the rate of reduction accelerating to a six-month high. A slowdown in goods demand was again observed in October. Export orders notably fell at a pace that was solid and the fastest since March, altogether reflective of the wider trend of deteriorating global goods demand of late.

Forward-looking indicators hint at further weakness to come

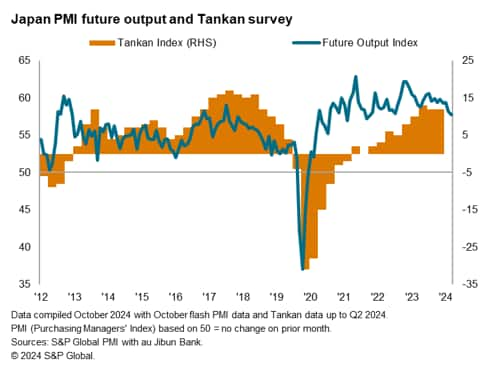

The seasonally adjusted PMI New Orders Index, which typically precedes the trend for the headline output index, indicated that incoming new orders for Japanese manufactured goods and services declined for the first time since June. Moreover, the rate of decline was the sharpest since February 2022, thereby outlining a greater-than-usual reduction in new work. As highlighted above, services new business fell for only the second time since April 2022 while goods new orders dropped at the fastest rate in three months.

Concurrently, optimism about future output fell in October. Confidence about output in the next 12 months lowered for a third straight month to the weakest since August 2020, which was during the initial wave of the pandemic. By sector, confidence levels were at 45- and 30-month lows for services and manufacturing respectively. Furthermore, private sector firms also added new staff at the slowest pace in the ongoing 13-month sequence, reflecting apprehension regarding activity growth.

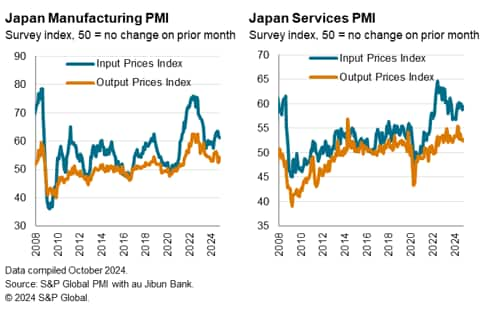

Price pressures intensify in October

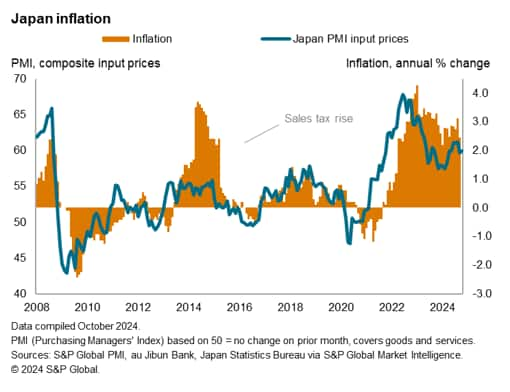

While Japanese private sector activity fell in October, price pressures notably intensified. The rate of selling price inflation climbed for a second successive month as average input costs rose at a faster pace. Survey respondents indicated that rising input material, labour and energy costs underpinned the latest intensification of cost pressures.

By sector, selling price inflation remained steeper within the manufacturing sector when compared with services, though rates of inflation for both sectors were nevertheless above their respective series averages in October.

The latest uptick in cost inflation therefore outlined the likelihood for Japan's inflation to remain at around 2.0% in the coming months. While the latest inflation trend remains supportive of the ongoing hawkish bias for the Bank of Japan (BOJ), the slowdown in private sector activity, underpinned by weakening consumption, provides impetus for the BOJ to further deliberate over their options. This also hints at the likelihood for any moves to be delayed into early 2025.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-business-activity-declines-while-selling-price-inflation-rises-in-october-oct24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-business-activity-declines-while-selling-price-inflation-rises-in-october-oct24.html&text=Japan%27s+business+activity+declines+while+selling+price+inflation+rises+in+October+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-business-activity-declines-while-selling-price-inflation-rises-in-october-oct24.html","enabled":true},{"name":"email","url":"?subject=Japan's business activity declines while selling price inflation rises in October | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-business-activity-declines-while-selling-price-inflation-rises-in-october-oct24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+business+activity+declines+while+selling+price+inflation+rises+in+October+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-business-activity-declines-while-selling-price-inflation-rises-in-october-oct24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}