Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 18, 2024

Week Ahead Economic Preview: Week of 21 October 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

BoC meeting and flash October PMI offering early insights

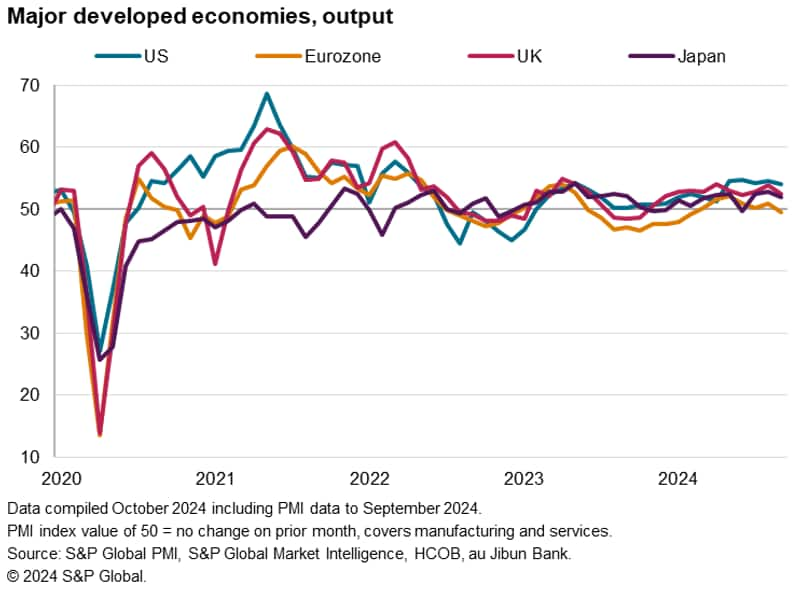

Flash PMI for October is set to offer the first look into fourth quarter economic conditions across major developed economies and provide valuable insights into the interest rate outlooks.

Meanwhile, the Bank of Canada convenes for their October meeting with another rate cut expected while comments from US Fed officials will also be among the central bank highlights in the week.

Additionally, the US releases durable goods orders and existing home sales data in another week filled with company earnings to watch, while eurozone consumer confidence data will be observed amidst flash PMI releases. Tier-1 data updates also include South Korea GDP and inflation data across several Asian economies.

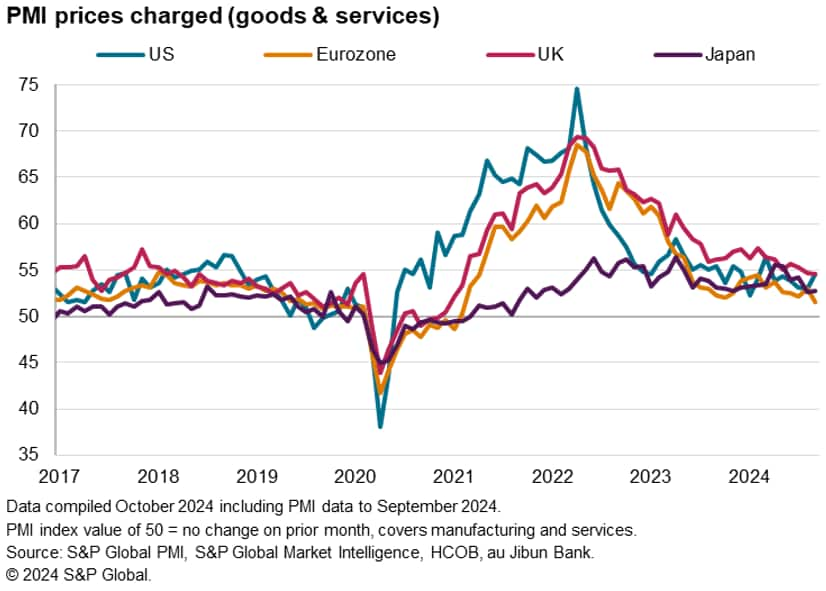

The latest October S&P Global Investment Manager Index survey showed that US equity investors continue to count primarily on central bank policy to support equity returns in the near-term, but remain very much cautious, as seen via the overall risk appetite gauge and also in their defensive sector preferences. As such, we will be looking closely to the incoming October flash PMI data for reassurance that the Fed and other central banks will remain on their rate cut path, particularly given the Fed's data-dependency.

Specifically, PMI selling price inflation will be in focus having remained close to four-year lows globally in September. The interests will be to see US selling price inflation, which precedes the trend for core PCE inflation, to continue indicating that the Fed's preferred gauge will point towards the target 2% level in the coming months and therefore keep interest rates on the decline. This is likewise the case for the eurozone, particularly as PMI output indicators have so far outlined the fact that eurozone economies registered some of the most pronounced contractions around the globe at the end of the third quarter. Further lowering of interest rates post the October European Central Bank (ECB) meeting is widely expected, albeit with some uncertainties regarding timing.

Meanwhile the Bank of Canada (BoC) will be in the spotlight with speculations that a 'jumbo' size rate cut at 50 basis points, could unfold in the upcoming October meeting given current economic conditions.

Finally, besides the series of tier-1 data, general election in Japan will be held on Sunday while the countdown towards the November US presidential election continues.

Key diary events

Monday 21 Oct

China (Mainland) Loan Prime Rate 1Y and 5Y (Oct)

Germany PPI (Sep)

Taiwan Export Orders (Sep)

United Kingdom S&P Global CSI* (Oct)

IMF Meetings (Oct 21-26)

Tuesday 22 Oct

South Korea PPI (Sep)

New Zealand Trade (Sep)

Hong Kong SAR Inflation (Sep)

Canada PPI (Sep)

United States Richmond Fed Manufacturing Index (Oct)

Wednesday 23 Oct

Singapore Inflation (Sep)

Taiwan Industrial Production (Sep)

Taiwan Retail Sales (Sep)

Canada BoC Interest Rate Decision

Eurozone Consumer Confidence (Oct, flash)

United States Existing Home Sales (Sep)

United States Fed Beige Book

Thursday 24 Oct

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

South Korea Business Confidence (Oct)

South Korea GDP (Q3, adv)

Thailand Exports and Imports (Sep)

Malaysia Inflation (Sep)

France Business Confidence (Oct)

Taiwan Unemployment (Sep)

Canada New Housing Starts (Sep)

United States New Home Sales (Sep)

Friday 25 Oct

Japan Tokyo CPI (Oct)

Singapore Unemployment (Q3, prelim)

Singapore Industrial Production (Sep)

Spain Unemployment Rate (Q3)

France Business Confidence (Oct)

Germany Ifo Business Climate

Italy Business Confidence (Oct)

Canada Retail Sales (Aug)

United States Durable Goods Orders (Sep)

United States UoM Sentiment (Oct, final)

Sunday 27 Oct

China (Mainland) Industrial Profits (Sep)

Japan General Elections

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Flash PMI for October

The earliest insights into economic conditions across major developed economies - including the US, UK, Eurozone, Japan and Australia - and also India will be sought with the release of October flash PMI data on Thursday, October 24. Amid lingering uncertainties over the extend and speed in which major central banks would continue lowering rates, both PMI output and price indices will be closely scrutinised. Manufacturing sector conditions will also be in the spotlight, having been the key area of weakness in September globally.

Americas: BoC meeting, Fed speeches, US durable goods orders, existing home sales

The Bank of Canada (BoC) convenes for their October meeting in the fresh week with another rate cut on the table. Slowing growth in Canada, as shown by early PMI indications, calls for the BoC to proceed with lowering rates. This is while inflation remains relatively subdued according to September's S&P Global Canada PMI prices data. At the same time, market expectations have been building for the BoC to cruise faster towards neutral settings for interest rates compared with the Fed, whom we will also be watching closely for comments in the incoming week.

On the data front, US durable goods orders and existing home sales data will be the highlights in the week.

EMEA: Germany Ifo business climate, PPI; Eurozone consumer confidence, France and Italy business confidence

Besides October flash PMI data, a series of economic data will be anticipated including Germany's Ifo business climate survey and PPI readings. Additionally, business confidence data out of France and Italy will join eurozone consumer confidence to provide an early sense of any sentiment changes in the euro area.

APAC: China loan prime rate, New Zealand trade, South Korea GDP, Singapore, Malaysia, Hong Kong SAR inflation

In APAC, October flash PMI data will be due for both Japan and also India, the latter offering a first look into conditions for emerging markets, which expanded at the slowest pace in nearly a year at the end of the third quarter. On the data front, South Korea releases first quarter GDP, while inflation data will be due from Singapore, Malaysia and Hong Kong SAR. Japan's general election will also be held at the end of the week on Sunday.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21st-october-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21st-october-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+21+October+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21st-october-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 21 October 2024 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21st-october-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+21+October+2024+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21st-october-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}