Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 05, 2018

Japan off to a solid start in 2018, accompanied by rising inflationary pressures

- Composite PMI rises to 52.8 in January

- PMI signals 0.7-0.8% quarterly GDP growth rate

- Strong gains seen in manufacturing while service sector expansion remains steady

- Input costs rise at fastest rate in over nine years

The Japanese economy continued to enjoy robust growth at the start of 2018, with further signs of rising inflationary pressures. The sustained upturn saw businesses at their most optimistic since the summer of 2013.

Building on solid 2017 momentum

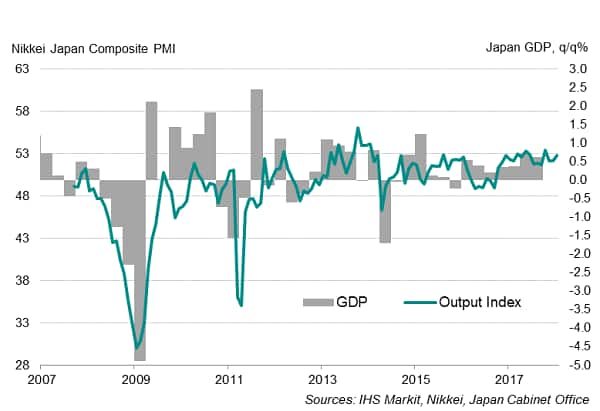

The Nikkei Japan Composite PMI™ Output Index rose to 52.8 in January, from 52.2 in December, signalling another solid improvement in the health of the economy. Historical comparisons suggest the latest reading is consistent with the economy expanding at a quarterly rate of approximately 0.7-0.8%.

Japan PMI and economic growth

Further order book growth – January saw one of the largest increases in new orders seen over the survey history – continued to fuel demand for labour as firms expanded capacity. Employment rose at the fastest pace for seven months.

The improving labour market should feed through to higher consumer spending, which should further boost the economic upturn. Official data showed retail sales growing at the highest annual rate in over two-and-a-half years during December, suggesting that Japanese consumers were feeling more confident at the end of 2017.

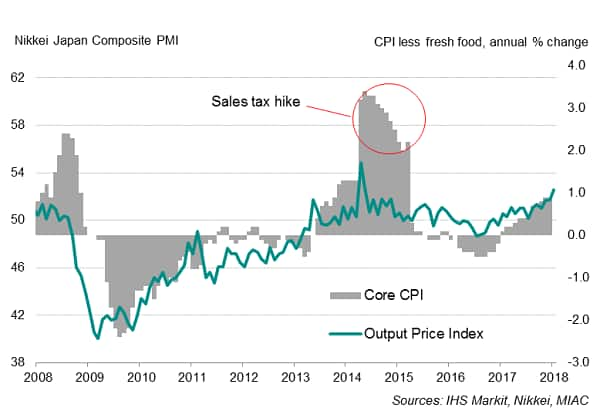

The PMI data show firms’ cost pressures are meanwhile running at their highest for over nine years, in part driven by higher oil prices, which rose 7% during the month. Strong cost increases pushed companies to raise selling prices to the greatest extent since the sales tax hike in 2014, suggesting that headline inflation is expected to move higher into 2018.

Japan PMI and consumer price inflation

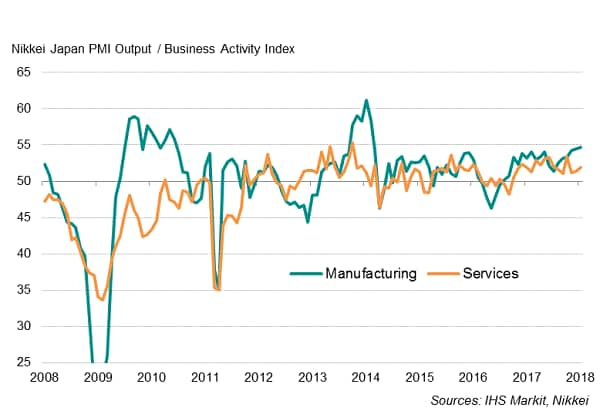

Manufacturing-led upturn

By sector, growth accelerated in both the manufacturing and service sectors during January, though the former continued to enjoy the stronger pace of expansion, buoyed by robust demand in both domestic and foreign markets. The manufacturing industry recorded the best improvement in business conditions in nearly four years. In contrast, service sector activity maintained a more modest rate of increase.

Japan PMI: manufacturing and service sectors

Robust outlook

Forward-looking indicators suggest the current upturn has more room to go. New business growth remained solid while optimism was the highest for over four-and-a-half years.

Such a solid start to the year will add to expectations that the Bank of Japan could soon start to adopt a more hawkish tone, especially given stronger signs of inflationary pressures starting to build.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-solid-start-2018-rising-inflationary.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-solid-start-2018-rising-inflationary.html&text=Japan+off+to+a+solid+start+in+2018%2c+accompanied+by+rising+inflationary+pressures","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-solid-start-2018-rising-inflationary.html","enabled":true},{"name":"email","url":"?subject=Japan off to a solid start in 2018, accompanied by rising inflationary pressures&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-solid-start-2018-rising-inflationary.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+off+to+a+solid+start+in+2018%2c+accompanied+by+rising+inflationary+pressures http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-solid-start-2018-rising-inflationary.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}