Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2018

Flash Japan manufacturing PMI signals buoyant start to 2018

- Flash Manufacturing PMI rises to the highest since February 2014

- Output growth accelerates amid further robust gains in new orders and export sales

- Sharp cost increases lead to steepest output price hike in over nine years

- Pressure builds for hawkish monetary policy

Japanese manufacturing firms enjoyed a buoyant start to 2018, reporting the best monthly improvement in business conditions for nearly four years.

Robust demand, both in and out of the country, suggests that growth momentum will remain strong in February. The upturn continued to be accompanied by rising inflationary pressures.

Best month in almost four years

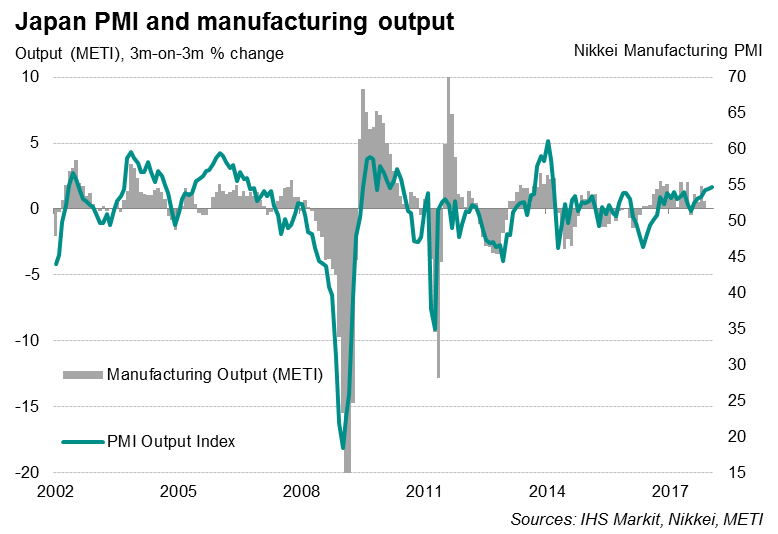

The Nikkei Japan Manufacturing PMI™ rose to 54.4 in January, according to the preliminary ‘flash’ reading, up from 54.0 in December and marking the fastest rate of improvement since February 2014. The headline reading is a composite indicator designed to provide a single-figure snapshot of manufacturing performance.

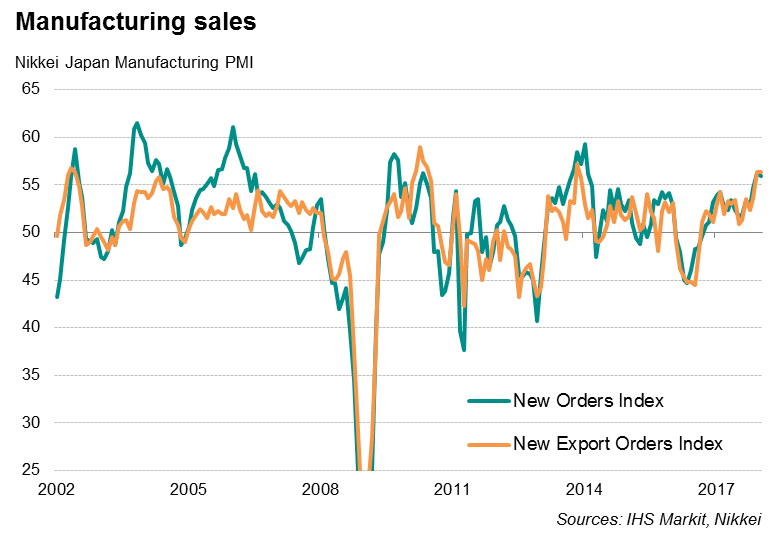

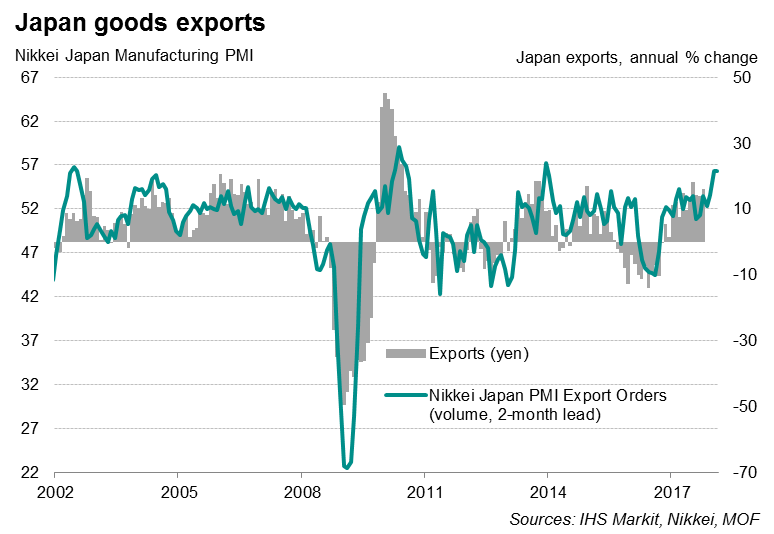

Output growth accelerated to a near four-year high, accompanied by marked increases in both new orders and new export orders, reflecting solid domestic and foreign demand. Although down slightly on December, order book and export growth rates remained among the highest recorded by the survey since 2013-14.

Past surveys showed that sales of intermediate and investment goods were increasing at especially strong rates, underscoring the global technology uptrend that is taking place. IHS Markit’s detailed sector PMI data showed technology equipment being the fastest growing manufacturing sector globally in 2017.

Final figures for Japanese manufacturing (out on February 1st) will provide more clues as to whether the current upturn in technology continues into 2018.

Tighter labour market

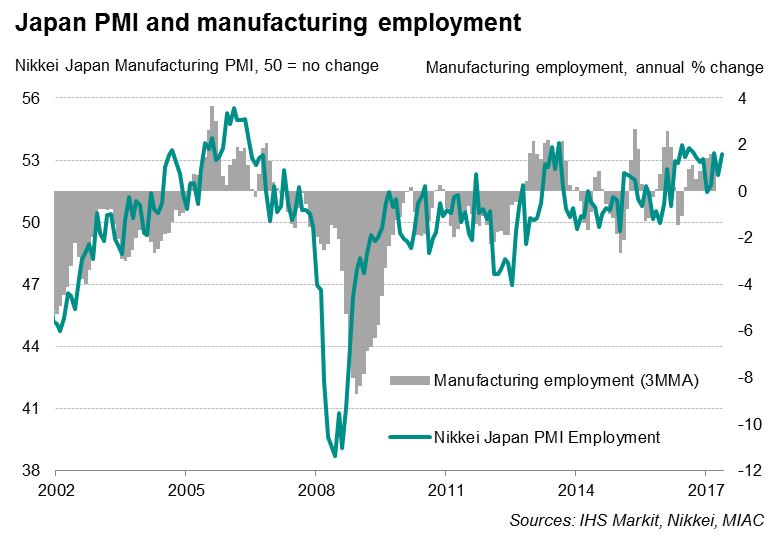

Improving operating conditions and rising backlogs of work encouraged goods producers to continue adding workers to keep pace with higher demand. However, IHS Markit’s latest Business Outlook Survey showed that, while firms maintained solid hiring intentions for the year ahead, there were reports of personnel shortages. Japan’s jobless rate hit a 24-year low in November, and the tight labour market will likely dampen future employment growth as manufacturers find it increasingly difficult to source suitable employees.

Rising cost pressures

Last year’s trend of rising costs in the manufacturing sector extended into 2018, with input price inflation accelerating to the fastest for three years in January. Survey data continued to suggest that a combination of higher global raw material prices and a weaker yen raised import costs.

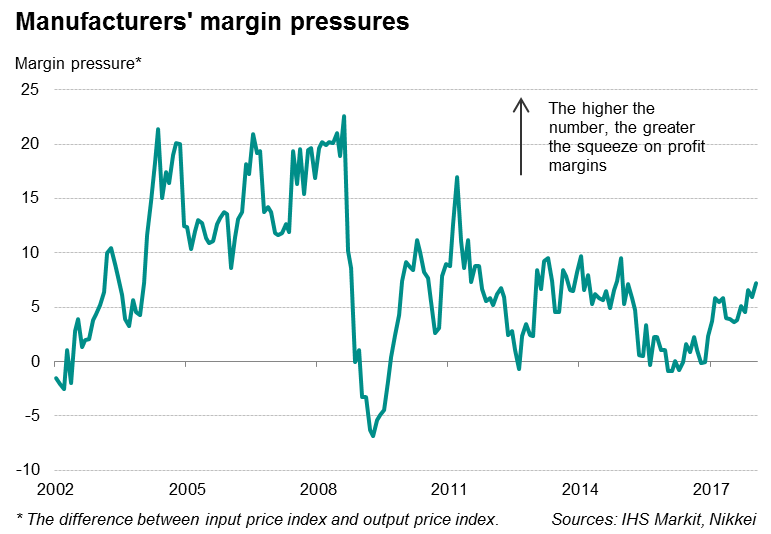

Instead of passing on all of the higher costs to customers, factories continued to absorb the bulk of the rise in input prices, with selling price inflation remaining well below that of input costs. As a result, companies continued to face a squeeze on profitability, with pressure on margins increasing to the greatest since early-2015. However, the ongoing squeeze on companies’ margins will likely alleviate as the economy continues to improve and will eventually feed through to higher consumer inflation. Indeed, the latest rise in factory gate prices was the highest for over nine years.

Monetary policy

The Bank of Japan kept its monetary policy unchanged in January and sought to dampen speculation that it may soon start to join other central banks such as the US Fed, the ECB and Bank of England in taking a more hawkish policy stance. However, the strong start to the year signalled by the PMI will add to expectations that policymaker rhetoric could soon shift towards scaling back monetary stimulus.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-manufacturing-pmi-signals-buoyant-start-to-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-manufacturing-pmi-signals-buoyant-start-to-2018.html&text=Flash+Japan+manufacturing+PMI+signals+buoyant+start+to+2018","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-manufacturing-pmi-signals-buoyant-start-to-2018.html","enabled":true},{"name":"email","url":"?subject=Flash Japan manufacturing PMI signals buoyant start to 2018&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-manufacturing-pmi-signals-buoyant-start-to-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+Japan+manufacturing+PMI+signals+buoyant+start+to+2018 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-manufacturing-pmi-signals-buoyant-start-to-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}