Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 05, 2018

Australia PMI surveys signal slower growth and easing price pressures in January

- PMI surveys show slower growth at start of 2018…

- … thanks to weaker rises in both manufacturing and service sector activity

- Employment growth softens

- Inflationary pressures ease

The Australian economy started 2018 in good health, but the latest Commonwealth Bank PMI surveys pointed to slower growth. Inflationary pressures also eased, dampening expectations of tighter monetary policy this year.

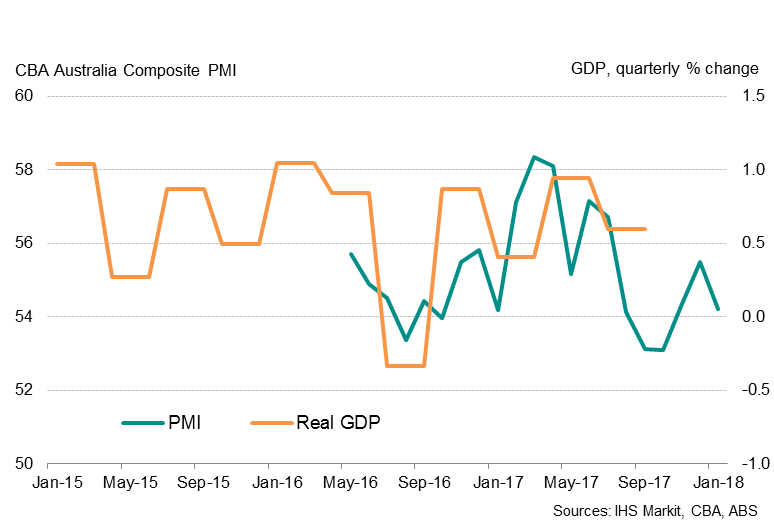

The Commonwealth Bank of Australia Composite PMI™ Output Index slipped from 55.5 in December to 54.2 in January. Output growth eased in response to a slower rise in new business, with order book growth at its weakest since the survey started in May 2016.

Australia PMI and economic growth

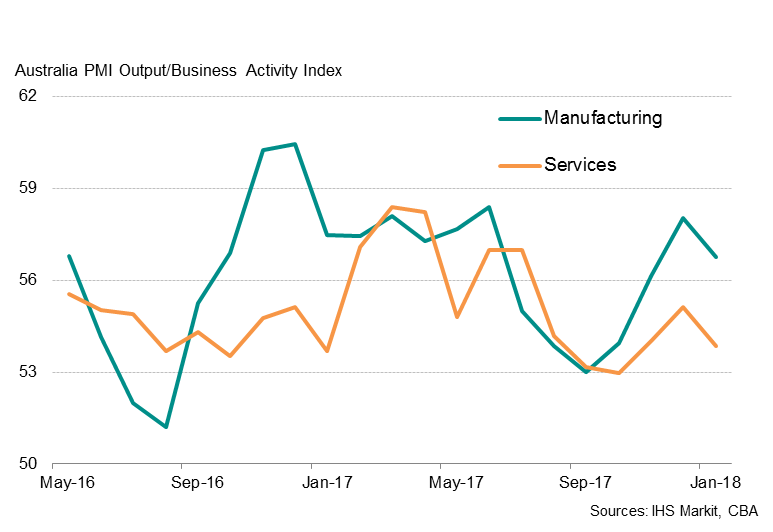

Growth slowed in both the manufacturing and service sectors during the month, though the former continued to enjoy the stronger pace of expansion.

CBA Australia PMI: manufacturing and service sectors

However, the slowdown may prove temporary as business confidence about the year ahead remained elevated, suggesting that companies are, on balance, expecting activity to pick up over the medium term.

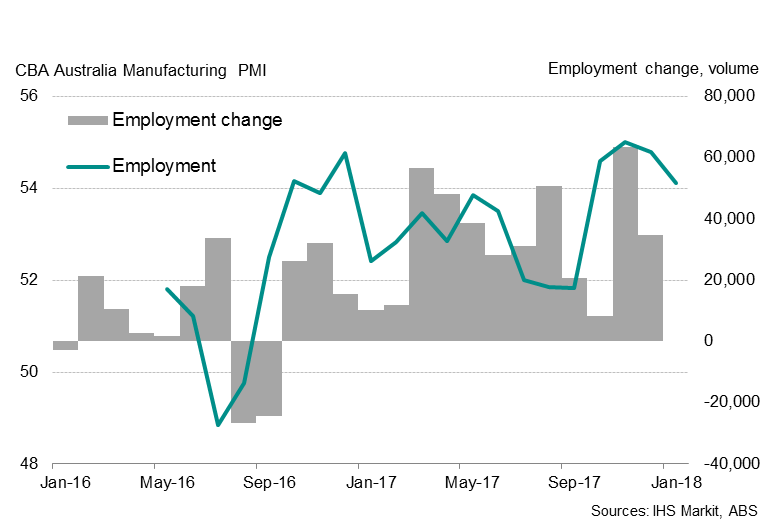

Job creation slows

The slower expansion in turn saw payroll numbers rising at a reduced rate, also a survey low, contrasting with solid gains in recent quarters. The impact was greater in the service sector than manufacturing. Factory jobs growth was down slightly from December, reaching a four-month low but still solid overall, suggesting it is far less likely to see a big drop in the number of new jobs at the start of the year when official employment figures are released. In contrast, service sector jobs growth slipped to the weakest in the survey history.

Australia Manufacturing PMI and employment change

However, the slowdown in employment growth may prove short-lived or at least very limited, as capacity pressures continued to be seen in January. Growth of outstanding business remained above the series average, which should underpin further job creation. Furthermore, companies’ future expectations about business activity levels in a year’s time remained elevated, suggesting companies should remain in hiring mode.

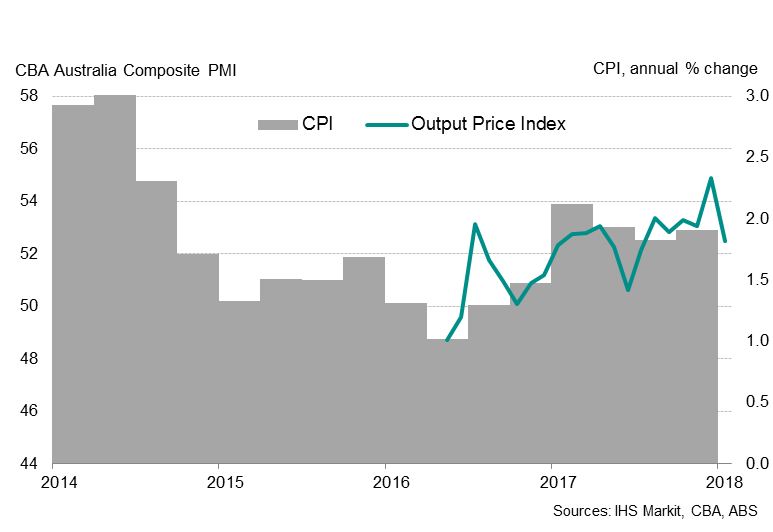

Inflationary pressures ease

While the January survey data showed a further rise in input costs, the rate of increase eased to the lowest in the survey’s 21-month history. In response to slower cost increases, firms raised average prices charged for goods and services at a modest rate, the lowest in six months. Consumer prices rose 1.9% in 2017, remaining below the RBA’s target band of 2-3% for the third consecutive year.

Australia PMI and consumer inflation

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAustralia-PMI-surveys-signal-slower-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAustralia-PMI-surveys-signal-slower-growth.html&text=Australia+PMI+surveys+signal+slower+growth+and+easing+price+pressures+in+January","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAustralia-PMI-surveys-signal-slower-growth.html","enabled":true},{"name":"email","url":"?subject=Australia PMI surveys signal slower growth and easing price pressures in January&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAustralia-PMI-surveys-signal-slower-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australia+PMI+surveys+signal+slower+growth+and+easing+price+pressures+in+January http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAustralia-PMI-surveys-signal-slower-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}