Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 03, 2019

Japan PMI surveys suggest economy near stagnation amid manufacturing downturn

- March PMI rounds off worst quarter for two-and-half years

- Nikkei Composite Output Index falls to 50.4, drag by steepening production decline

- Economy may struggle to grow in 2019

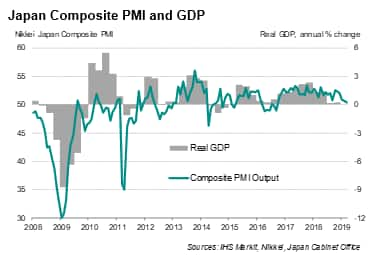

Business activity growth in Japan was subdued during March, recording the slowest expansion for two-and-a-half years amid a steepening manufacturing downturn. The weakness of the surveys suggests that the economy may struggle to grow in 2019.

The Nikkei Composite PMI Output Index slipped from 50.7 in February to 50.4 in March, indicating only marginal growth. March's reading was the lowest since September 2016.

The latest reading is consistent with the Japanese economy near to a flat annual rate of growth.

First quarter growth may disappoint

The subdued survey data imply that economic growth could disappoint in the first quarter. At 50.6, the average PMI reading for the first quarter had been the lowest since the third quarter of 2016 and indicative of the Japanese economy having slowed notably.

The soft start to the year in turn suggests the economy could struggle to grow over the whole of 2019 especially in the face of increasing headwinds from global trade uncertainty and a forthcoming (and twice-deferred) sales tax hike.

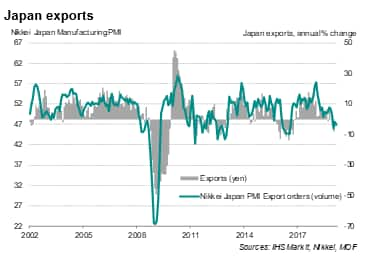

For now, the growth slowdown shows few signs of letting up, not helped by a further decline in Japan's new export business in March, marking the fourth consecutive monthly drop in overseas sales. The export struggle mainly reflects the weakness of manufacturing goods shipments, which is linked to a slowing global demand and the easing of the tech cycle.

The deteriorating export picture contributed to the Japanese manufacturing economy suffering its worst decline in production for 34 months during March, according to the Nikkei PMI data.

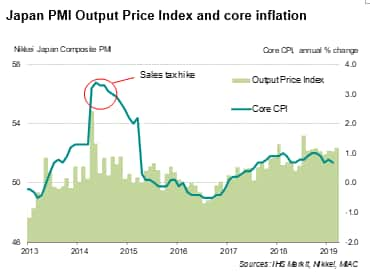

Inflation

Despite softer demand, cost pressures remained solid. Manufacturing input prices continued to rise at a marked rate and above its historical average. Likewise cost inflation in the service sector remained among the strongest seen since the heights of the global financial crisis, in part reflecting higher wages and fuel costs.

Domestic demand

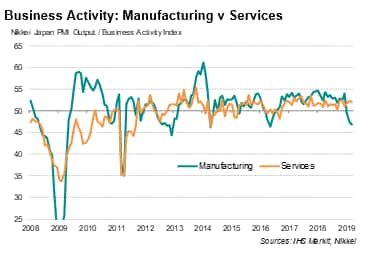

The weakness of external demand was offset by the domestic market. Growth in the service sector, a proxy for domestic consumption, remained well above its long-run series average. Moreover, new business expansion continued to be solid, thereby supporting overall economic activity.

However, there are concerns that a protracted manufacturing downturn would spread to services, which have so far acted as a buffer against the impact of external headwinds. The question now is how long it can remain in this role should the external downturn gain momentum.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-pmi-surveys-suggest-economy-near-stagnation-amid-manufacturing-downturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-pmi-surveys-suggest-economy-near-stagnation-amid-manufacturing-downturn.html&text=Japan+PMI+surveys+suggest+economy+near+stagnation+amid+manufacturing+downturn+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-pmi-surveys-suggest-economy-near-stagnation-amid-manufacturing-downturn.html","enabled":true},{"name":"email","url":"?subject=Japan PMI surveys suggest economy near stagnation amid manufacturing downturn | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-pmi-surveys-suggest-economy-near-stagnation-amid-manufacturing-downturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+PMI+surveys+suggest+economy+near+stagnation+amid+manufacturing+downturn+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-pmi-surveys-suggest-economy-near-stagnation-amid-manufacturing-downturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}