Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 03, 2019

Caixin China PMI surveys signal strongest upturn since mid-2018

- At 52.9, Caixin Composite PMI Output Index hits highest for nine months

- First factory job gain seen for six years

- Prices continue to rise

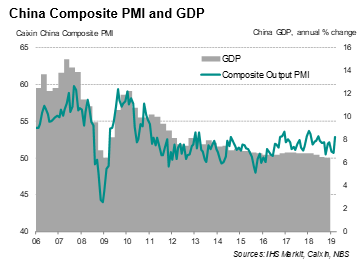

Business conditions across the Chinese economy improved at the fastest rate for nine months during March, according to the latest Caixin PMI surveys, providing evidence to suggest that recent fiscal support measures are beginning to work. The Caixin China Composite PMI (which covers both manufacturing and services), compiled by IHS Markit, indicated the largest increase in output since mid-2014. The 'all-sector' output index rose to 52.9 in March from 50.7 in February.

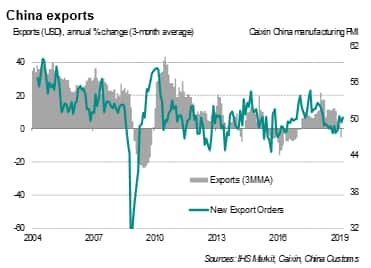

The strongest growth in manufacturing output for seven months was accompanied by a surge in service sector business activity, its fastest gain in just over a year. Manufacturing conditions improved for the first time in four months, supported by firmer demand, including a slight rise in exports.

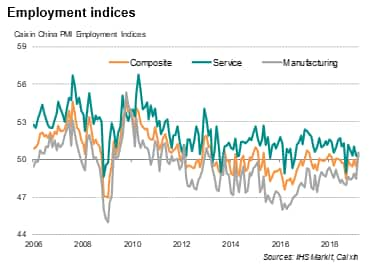

Job growth

The stronger upturn fed through to the labour market. Employment across the two sectors rose for the first time in just over a year. Notably, factory job creation was reported for the first time in six years, joined by a mild rise in staffing levels in the services economy.

Further expansions of business activity and employment look likely in April as overall inflows of new orders increased at the fastest pace since February last year, led by an increasingly solid growth in service-related sales.

Higher prices

Prices continued to rise in March, with price hikes fuelled by strengthening demand, greater wage pressures and higher commodity prices. Average input costs rose steadily, while output charges were raised at the fastest rate for five months.

Fiscal measures support growth

The average PMI reading for the first quarter of 51.5 is the same as in the final quarter of 2018, suggesting that the pace of economic growth is likely to stabilise around the 6.4% annual rate indicated by official GDP for the three months to December.

The upturn takes some pressure off the authorities to roll out more expansionary measures, while also suggesting that some of the implemented fiscal stimulus have started to filter through to the economy. The government has already taken fresh fiscal and monetary policy action to stimulate the economy, such as cutting taxes and banks' reserve requirements, and bringing forward infrastructure projects. Survey data now suggest the measures taken to date are having an impact.

However, much of China's economic stabilisation will also hinge on the progress on a trade deal between China and the US. In any case, Premier Li hinted at further policy measures if necessary.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-china-pmi-surveys-signal-strongest-upturn-since-mid2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-china-pmi-surveys-signal-strongest-upturn-since-mid2018.html&text=Caixin+China+PMI+surveys+signal+strongest+upturn+since+mid-2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-china-pmi-surveys-signal-strongest-upturn-since-mid2018.html","enabled":true},{"name":"email","url":"?subject=Caixin China PMI surveys signal strongest upturn since mid-2018 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-china-pmi-surveys-signal-strongest-upturn-since-mid2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Caixin+China+PMI+surveys+signal+strongest+upturn+since+mid-2018+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-china-pmi-surveys-signal-strongest-upturn-since-mid2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}