Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 21, 2018

Japan Flash PMI signals manufacturing sector on course for best quarter since 2014

- Flash Manufacturing PMI remains among highest seen since 2014, albeit dipping slightly

- Job creation at 11-year peak

- Goods producers raise prices further as cost pressures remain sharp

The Japanese manufacturing upturn continued in February, setting the sector on course for the best quarter since the start of 2014. Forward-looking indicators bode well for the coming months: new orders rose at a solid pace, while business confidence remained upbeat. Meanwhile, job creation hit the highest for 11 years.

Importantly from a policy perspective, manufacturers continued to raise selling prices in response to increased costs, which will be welcome news for the Bank of Japan.

Solid first quarter expected

At 54.0 in February, the Nikkei Japan Manufacturing PMI™ remained at one of the highest levels since early 2014, according to the preliminary ‘flash’ reading, albeit down slightly from 54.8 in January.

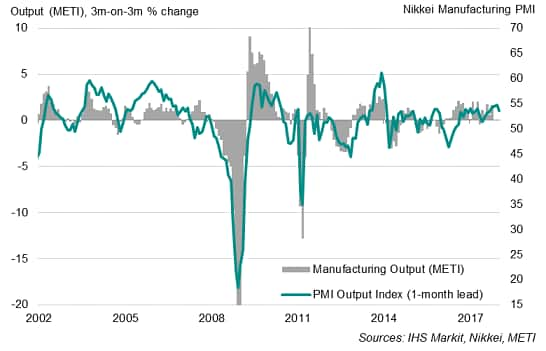

Japan PMI and manufacturing output

The headline PMI is a composite indicator designed to provide a single-figure snapshot of manufacturing sector performance.

The average PMI reading for the first quarter so far is the highest since the opening quarter of 2014, suggesting the manufacturing sector continued to make a solid contribution to economic growth.

The latest survey data also point towards the goods-producing sector building on the robust growth momentum seen throughout last year, with output and employment both growing at solid rates.

Job gains hit 11-year record

A sustained upturn in demand from both domestic and external markets was reported to have encouraged firms to raise staffing numbers, with job creation reaching an 11-year high.

Japan PMI and employment

Despite the expansion of capacity resulting from the recent bout of strong hiring, capacity constraints continued to be reported, as indicated by a further rise in unfinished workloads. The recent backlog accumulation contrasts markedly with the declining levels of outstanding business seen early last year, and underscores the extent to which demand has improved in recent months.

Supply chains also continued to be stretched as a result of strong demand, though weather-related disruptions also played a secondary role. Average delivery times lengthened to an extent not seen since the Tohoku earthquakes in early-2011.

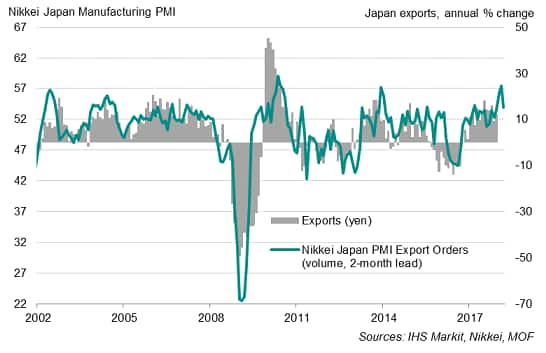

Strong yen could hurt exports

Export order growth slowed from January’s peak but remained solid. February saw the third-strongest monthly rise for a year. The upturn in overseas sales was linked to rising demand from key export markets, including the US and China.

Japan goods exports

The data suggest that, so far, the recent appreciation of the yen has not hurt export growth, though some impact is likely to be seen in coming months as the exchange rate feeds through. The Japanese yen strengthened nearly 4% against the US dollar in the first six weeks of 2018.

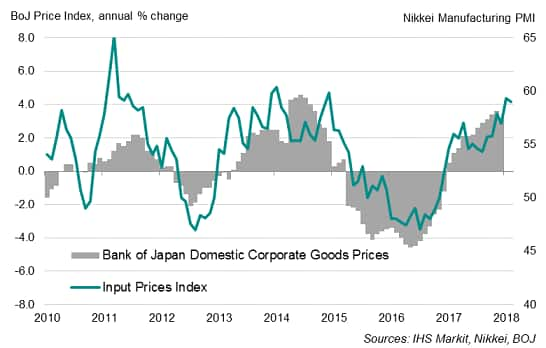

Price constraints

The combination of solid growth of demand and a tightening labour market hints at rising inflationary pressures as we move through the first quarter of 2018. Strong demand was a key factor cited by firms when raising their prices. Average charges for manufactured goods showed a slightly smaller rise than in January, but still recorded one of the largest increases seen over the past three years.

Higher costs also highlighted the need to pass on increased input prices to customers. Average cost burdens rose sharply again in February, with the rate of inflation the second-highest since December 2014. However, the stronger yen could dampen some of the rise in imported inflation in coming months.

Dovish policy stance

Robust manufacturing output growth and rising price pressures will add to expectations for the Bank of Japan to start adopting a hawkish tone. The BOJ left policy unchanged at its January meeting, saying the economy is not yet ready for them to consider tightening monetary conditions. In particular, governor Kuroda highlighted that inflation remains weak. However, this could soon change if the economic data flow continues to improve.

Japan PMI and corporate goods prices

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-signals-manufacturing-sector-2014.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-signals-manufacturing-sector-2014.html&text=Japan+Flash+PMI+signals+manufacturing+sector+on+course+for+best+quarter+since+2014","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-signals-manufacturing-sector-2014.html","enabled":true},{"name":"email","url":"?subject=Japan Flash PMI signals manufacturing sector on course for best quarter since 2014&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-signals-manufacturing-sector-2014.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+Flash+PMI+signals+manufacturing+sector+on+course+for+best+quarter+since+2014 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-signals-manufacturing-sector-2014.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}