Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 20, 2018

UK households quick to respond to hawkish monetary policy signals

- Majority of households expect interest rates to rise within six months

- Marked increase in proportion of households anticipating a hike compared to January

Survey data indicate that UK households have become increasingly convinced that borrowing costs will rise again in coming months, which could have important implications for consumer spending.

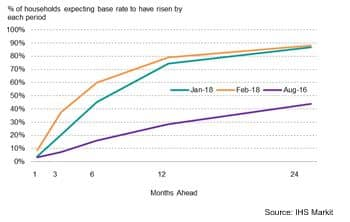

The Bank of England's Monetary Policy Committee tilted to the hawkish side in the most recent February meeting, indicating that rates would need to rise "earlier" and by a "somewhat greater extent" than suggested in the previous quarterly inflation report. According to the latest IHS Markit Household Finance Index, UK households subsequently brought forward their expectations of further tightening, with a clear majority now anticipating a rate rise in the next six months.

Households adjust expectations

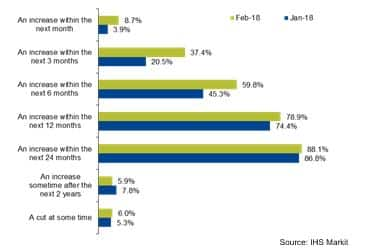

In the wake of the February interest rate decision, markets priced in the possibility of higher interest rates more aggressively, signalling May 2018 as the next likely hike in the tightening cycle. This shift in investor expectations was mirrored by UK households, particularly in their expectations of interest rates over a short horizon. Over one-third of households (37%) foresee a rate rise in the next three months, up from 21% in January. The majority, some 60%, anticipate a hike within six months, up from 45% in January.

Households' views on the next move in Bank of England

base rate

Significantly, three months ahead from the latest survey period brings us to May, which financial markets have priced in as the most likely timing for the next hike in the Bank of England's tightening cycle.

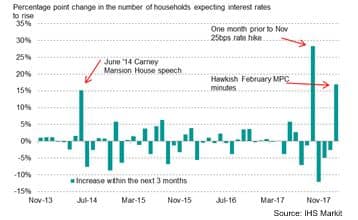

The increase from January to February in the percentage of households anticipating an interest rate rise within a three-month horizon is marked relative to historic shifts in household sentiment. In fact, it is the second-largest since Mark Carney's tenure at the Bank of England began in the summer of 2013. The greatest change occurred in October 2017, a month prior to the first hike in over a decade. Household interest rate expectations have not displayed such a response to policymaker rhetoric since Mark Carney suggested rates were going to rise sooner than markets expected during his Mansion House speech in June 2014.

Consumers expect rates to be hiked

earlier

This feed-through of policymaker rhetoric to household expectations highlights the potential for an instantaneous impact on the real economy, particularly if borrowers alter their consumption behaviour now in anticipation of higher future costs to service their debts.

The road ahead

The focus this coming week will be on average earnings data, due on Wednesday. The MPC suggested in their latest minutes that wage growth should rise further in response to the tightening labour market. Subdued wage numbers could dent expectations of an imminent rate rise. With inflation outpacing wage growth, higher borrowing costs could add a further unwanted squeeze on consumer incomes. At the same time, there have been signs of weaker domestic economic growth, which could derail plans for tighter monetary policy. Deteriorating output trends across the major three business sectors of the UK economy pushed the all-sector PMI into what historically has been dovish territory for the Bank of England.

Cumulative distribution of interest rate

expectations

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-households-quick-respond-hawkish-monetary-policy-signals.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-households-quick-respond-hawkish-monetary-policy-signals.html&text=UK+households+quick+to+respond+to+hawkish+monetary+policy+signals+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-households-quick-respond-hawkish-monetary-policy-signals.html","enabled":true},{"name":"email","url":"?subject=UK households quick to respond to hawkish monetary policy signals | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-households-quick-respond-hawkish-monetary-policy-signals.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+households+quick+to+respond+to+hawkish+monetary+policy+signals+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-households-quick-respond-hawkish-monetary-policy-signals.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}