Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 23, 2019

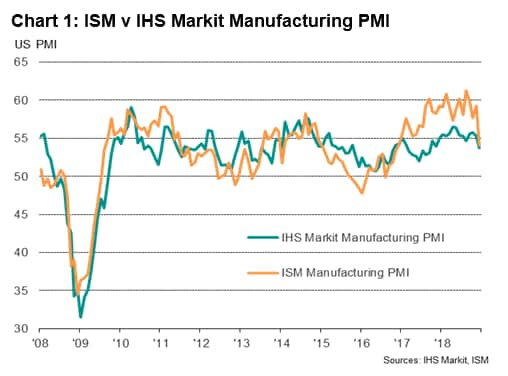

Investigating IHS Markit PMI™ and ISM divergences

- Analysis suggests ISM data overstated manufacturing growth in much of 2017 and 2018, while December plunge appears to be a false signal

- ISM overestimation of growth potentially linked to panel bias towards large companies

- Equity market rally and stronger global growth likely provided boost to ISM data in 2017 and 2018

Official data indicated that factory production rose solidly in December, rounding off a robust fourth quarter. Output jumped 1.1% during the month according to the Fed's data, rounding off a fourth quarter during which production rose 0.6% compared with the third quarter. The fourth quarter expansion was nevertheless below the 0.9% increase registered in the third quarter, hinting at a moderation in the underlying pace of factory growth.

The official data therefore confirmed the picture of robust but moderating growth as shown by earlier IHS Markit Manufacturing PMI™ data, flash results for which will provide insight into January's performance when published this week.

The release of the official data for December also help to clarify recent confusion over differing survey signals: the relatively robust pace of expansion signalled by the IHS Markit survey contrasted with a far more abrupt slowdown indicated by the ISM survey.

With the plunge in the ISM index having sent a misleading signal of the health of the goods-producing sector, we look at the relationship between the two surveys and the official data, and find that the divergences likely reflect a difference in survey panel structure, and specifically a tendency for the ISM data to be more influenced by global economic growth and foreign earnings than the IHS Markit PMI.

To read the full report, please click on the link below.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestigating-pmi-and-ism-divergences-230119.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestigating-pmi-and-ism-divergences-230119.html&text=Investigating+S%26P+Global+PMI%e2%84%a2+and+ISM+divergences+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestigating-pmi-and-ism-divergences-230119.html","enabled":true},{"name":"email","url":"?subject=Investigating S&P Global PMI™ and ISM divergences | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestigating-pmi-and-ism-divergences-230119.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investigating+S%26P+Global+PMI%e2%84%a2+and+ISM+divergences+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestigating-pmi-and-ism-divergences-230119.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}